Course Project for EC350

Marcoeconometrics

Marcoeconometrics代写 The econometric analysis should be implemented by the statistical software R and its integrated development environment (IDE), R studio.

INSTRUCTION: Marcoeconometrics代写

This course project aims to build the ARMA model for the time series of Consumer Price Index of Energy in the United Kingdom and evaluate the forecasting performance of the model.The econometric analysis should be implemented by the statistical software R and its integrated development environment (IDE), R studio.

The project report should be written in the style of academic article, including abstract, introduction,econometric analysis, conclusion, and references (in Harvard style 1 ). For the econometric tasks, you need to report the econometric results from R, and, more importantly,provide the technical description on the methods and the interpretation/discussion on the econometric results.

For example, you should include the following content for the task of ADF test:

- technical description of ADF test;

- R code to conduct the analysis;

- R output (preferred to be nicely formatted tables, rather than the raw screenshot from R studio);

- interpretation and discussions on the results.

The deadline for the course project submission is April 17th, 2021 (12.00 noon). Only electronic submission (PDF file) is required via Blackboard.

DATA:

The file “EI.xls” contains the monthly Consumer Price Index of Energy from Jan 1990 to Dec 2022. The consumption data is seasonally adjusted. The data was obtained from the Federal Reserve Bank of St. Louis (https://fred.stlouisfed.org/series/GBRCPIENGMINMEI). The data webpage also provides more information on the data. The variables that we are interested is log(Pricet) and its growth rate Δ log(Pricet) = log(Pricet) − log (Pricet−1).

ECONOMETRIC TASKS: Marcoeconometrics代写

Before carrying out the following tasks, firstly split the dataset into in-sample period and out-of-sample period. The in-sample period is from Feb 1990 to Feb 2022, and the out-of-sample period is from Mar 2022 to Dec 2022. Note that you will lose the observation in Jan 1990 when you calculate Δ log(Pricet), and thus you need to delete the observation of log(Pricet) in Jan 1990 accordingly.

Important: you should use the data in the in-sample period to perform Tasks a –d2 and then makeforecasting for the out-of-sample period in Task e.

Task a. [Pre-analysis] Provide the data visualisations (time series plot, box plot, histogram, and ACF plot) and the descriptive statistics of log(Pricet) and Δ log(Pricet). What can you spot from various plots? What is the meaning of the descriptive statistics?

1 https://libguides.reading.ac.uk/citing-references/referencingstyles

2 To be clear, only use data between Feb 1990 and Feb 2022 (not the whole dataset) to conduct Tasks a-d.

Task b. [Unit root/stationarity tests] Perform ADF test, PP test, and KPSS test on log(Pricet) and Δ log(Pricet). You can use the setting of a constant/intercept without a trend for the three tests for both log(Pricet) and Δ log(Pricet). You can also use AIC to select the best lag length for the ADF test and use “short” lag length for the PP and KPSS test. Marcoeconometrics代写

Task c. [Model selection] Select the best ARMA(p, q) model for Δ log(Pricet) by AIC.Please set the maximum orders as 5, i.e. p, q ≤ 5.

Task d. [Model diagnostics] Perform model diagnostics for the residuals from the best selected model. To be specific, carry out the time series plot, ACF plot, and Ljung-Box test on the residuals. For the Ljung-Box test, please set the lag lengths as 20, 30, and 50.Comment on the results of the model diagnostics.

Task e. [Forecasting] Choose the best model based on the data in the in-sample period and make forecasting for the out-of-sample period. Plot the predicted values from the best model versus the true values. Calculate the forecasting performance (MSE, MAE, MAPE, and % correct sign) of the best model. Marcoeconometrics代写

Task f. [Cointegration] This is a challenging task. Find one time series of economic data that is cointegrated with log(Pricet) and then perform the Engle-Granger two-steps procedure to show the evidence of cointegration and then further construct the error correction model.

You can use any publicly available online source to download the data. One good data source is the Federal Reserve Bank of St. Louis (https://fred.stlouisfed.org/categories). You need to provide your data source (the link which you download the data) in the report and make some data visualisations for your chosen time series. Important: the cointegration period can be any period, not necessarily between Feb 1990 and Dec 2022. Please do not share your chosen time series with others (Otherwise, plagiarism can be easily detected). Marcoeconometrics代写

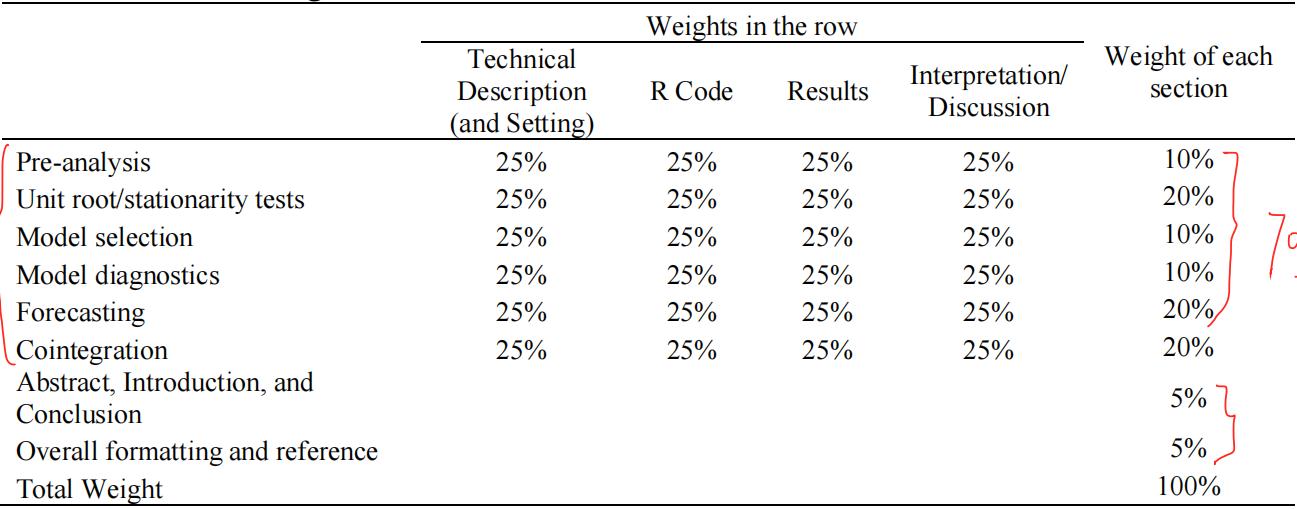

Tips: you need to provide the technical description of the econometric tools, how to choose the setting, R code, econometric result, and interpretation/discussion for each task above. Only providing the result is not adequate. You should insert the relevant R code for different tasks in the related locations of your report, and then attach all of your R code at the end of the report.

Some rules:

- This is an individual project, not a group project. You should do this coursework independently and you should not share your answers with others. All submitted coursework will be checked by the Turnitin. Any case of plagiarism will be reported.

- To respect the fairness to every student, I will make response to queries only related to the clarity issues, and the ‘answer-snooping’ queries should be discouraged.

RUBRICS (Marking Criteria):

更多代写:北美商科Coursework课程作业代写 线上考试 大众传媒网课代修 代写Essay结构 代写留学文书 新西兰商科金融代写