JANUARY 2023 AFFILIATE ASSESSMENT

2-HOUR ONLINE EXAMINATION

ECON113: ADVANCED ECONOMICS OF FINANCE

高级金融经济学代考 The word count does not include your fifigures, mathematical formulae, data tables or tables with short amounts of text.

Time allowance

You have 2 hours to complete this examination, plus an Upload Window of 20 minutes. The Upload Window is for uploading, completing the Cover Sheet and correcting any minor mistakes and should not be used for additional writing time.

If you have been granted SoRA extra time and/ or rest breaks, your individual examination duration will be extended pro-rata and you will also have the 20-minute Upload Window added to your indi-vidual duration.

All work must be submitted anonymously in a PDF fifile.

If you miss the submission deadline, you will not be able to submit your work via email or any other channel. If you are unable to submit your work due to technical diffiffifficulties which are substantial and beyond your control, you should apply for a Deferral.

Your work should not exceed 3000 words. 高级金融经济学代考

This includes footnotes and any tables containing large amounts of text. The word count does not include your fifigures, mathematical formulae, data tables or tables with short amounts of text. If your submitted answer exceeds the permitted word count stated, Faculty Word Limit Penalties will apply as follows:

- For work that exceeds the specifified maximum length by less than 10% the mark will be reduced by fifive percentage marks, but the penalized mark will not be reduced below the pass mark and marks already at or below the pass mark will not be reduced.

- For work that exceeds the specifified maximum length by 10% or more the mark will be reduced by ten percentage marks, but the penalized mark will not be reduced below the pass mark and marks already at or below the pass mark will not be reduced.

Answer all questions from Part A, and the question from Part B.

Questions in Part A carry 10 per cent of the total mark each, and the question in Part B carries 50 per cent of the total mark. 高级金融经济学代考

If you have a query about the examination paper, instructions or rubric, you should complete the Examination Paper Query Form embedded into your Exam Answer Sheet. Please note that you will not receive a response during your examination.

By submitting this assessment, you are confifirming that you have not violated UCL’s Assessment Regulations relating to Academic Misconduct contained in Section 9 of Chapter 6 of the Academic Manual.

PART A 高级金融经济学代考

Answer ALL questions from this section. Present all work when computations are required. Each question in this section is designed such that it can be answered with 300 words or less.

A1 Discuss the theoretical and empirical benefifits of using a multi-factor model of the SDF compared to a single factor model in general, and explain why linear multi-factor models are particularly useful when working with equities.

A2 Using the typical convention for forward prices discussed in lecture notes, show what the funda-mental asset pricing equation (FAPE) implies the forward price must satisfy in general. Explainwhat assumption on the underlying asset will determine if additional information is embedded in forward prices relative to spot prices. If forwards have additional information brieflfly explain what is the additional information, or why they do not have any additional information.

A3 The increased awareness of the risks and costs of climate change has led to a surge in demand for fifinancial products to hedge climate risk.

Explain the importance of complete markets in determining the no-arbitrage price of a new option written on a new climate variable, a climate variable that is not yet traded in any way, relative to pricing a new derivative on a traded asset,and how this might explain the lack of such products. 高级金融经济学代考

A4 Describe the role of expected payoffffs, the risk-free rate and risk premium in determining the price, expected return and expected excess return for any asset price if no-arbitrage condition and free portfolio formation hold. Explain why returns are preferred over prices when comparing difffferent assets, and why expected excess returns are a particularly important concept in asset pricing.

A5 An investor makes all of their investment decisions based on the CAPM model, using the aggre-gate stock market index as a proxy for the tangent market portfolio. First, explain how you can use the intuition they have from using CAPM to explain the shortcomings of using the CAPM with stock market as proxy for market return. Second, illustrate two of the consequences of these shortcomings for their investment decisions.

PART B 高级金融经济学代考

Answer ALL the sub-questions from the question below. Each sub-question in this section is designed such that it can be answered with 300 words or less. Remember to present all work and be explicit about all formulas and assumptions used in your answers. Answers without explanations and/or derivations will be given no credit.

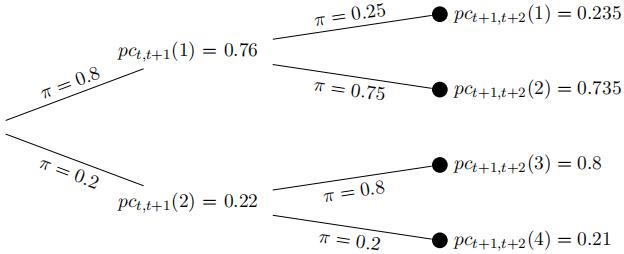

B 1 Consider an economy with three periods (t, t + 1, t + 2), with 2 states (st+1 = 1, 2) in the second period t+ 1 and 4 states (st+2 = 1, 2, 3, 4) in the third period t+ 2. Every agent in this economy can freely trade a complete set of Arrow-Debreu securities. The diagram below shows the evolution of the 1-period Arrow-Debreu (AD) prices consistent with no-arbitrage in this economy.In the diagram below, pct+k,t+k+1(j) denotes the AD price at period t + k for the AD security paying in state j only in period t + k + 1, for k = 0, 1.

(a) Compute the 2-period AD prices and all of the 1-period and 2-period stochastic discount factors (SDFs) and risk-adjusted probabilities consistent with no arbitrage in this economy.

(b) Compute all the spot and forward interest rates consistent with no-arbitrage in this econ-omy.

Explain two equivalent ways you can check if the Expectation Hypothesis holds or not in this economy, and show what they imply.

(c) Show what are the highest and lowest achievable expected returns in this economy consistent with no arbitrage, both 1-period and 2-period returns from the perspective of period t, and brieflfly explain the intuition for your answer.

(d) If the preferences of the representative agent in this economy are given by U (ct , ct+1, ct+2) =Et-P k=0:2 δ ku (ct+k) , with u 0 > 0 and u 00 < 0 and δ > 0, show what can be said about the pattern of aggregate consumption across time and states in this economy if δ = 0.99. 高级金融经济学代考

(e) One asset in this economy, asset A, pays {xA,t+2(1), xA,t+2(2), xA,t+2(3), xA,t+2(4)} ={60, 80, 100, 120} in period t + 2 and nothing in period t + 1. Consider both a put and a call option on asset A, both with a strike price of 90 and expiring in t+2.

i.Show which option (the put or the call above) should achieve a higher 2-period expected excess return in period t, and brieflfly explain the intuition for your answer.

ii.Explain why you can or cannot generate a complete market by trading only in call or put options (with any strike price of your choice) on asset A.

更多代写:英国统计代上网课 ap作弊 英国留学生Assignment代写 英语论文essay代写 宗教paper代写 代写Machine Learning作业