Name:

Instructor:

Course:

Date:

财务管理论文代写 The company’s market value of equity stock increased by more than four times its valuation during the second year.

A Three Year Balance Sheet Analysis For Royal Airline Company 财务管理论文代写

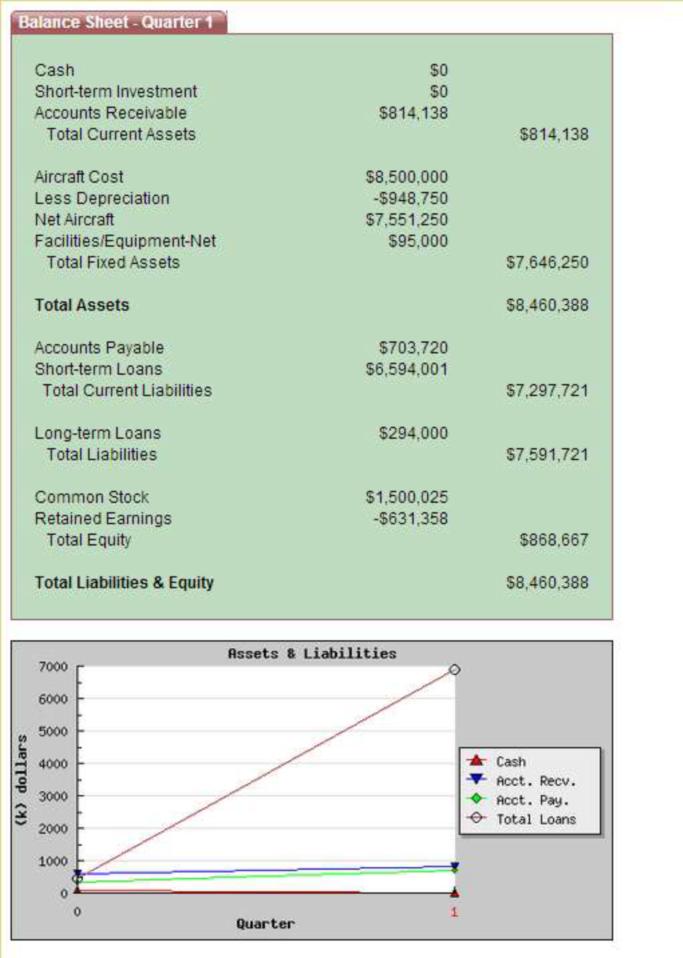

QUARTER 1 BALANCE SHEET

YEAR 1

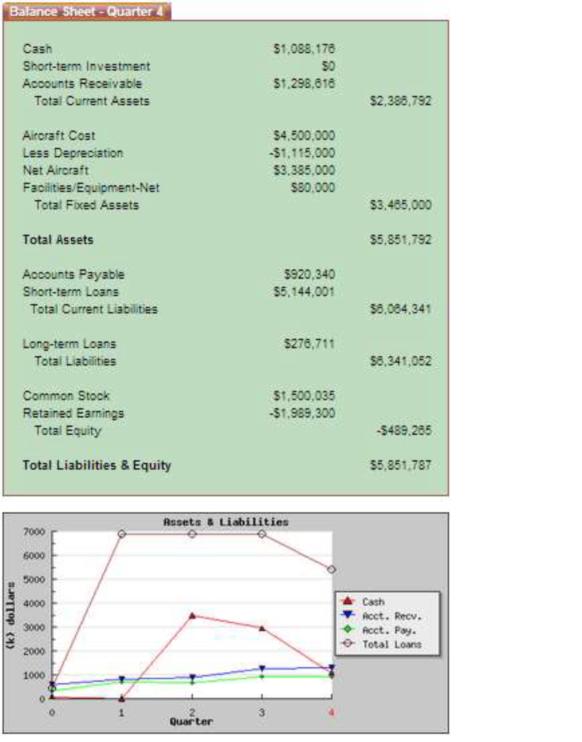

Balance is a very important financial tool that indicated the financial position of Royal Airline Company in terms of how the company generates its resources and finances. Royal Airline Company started operating during the first quarter of the accounting year with no cash at hand. Over the same period, the company’s total current assets amounted to $814,138 with its total Fixed Assets valued at $7,646,250, thus representing $8,460,388 as the total value of the company’s assets. By the end of the year (Quarter 4), Royal Airline’s asset strength significantly dropped to $5,851,791 representing 30.83% drop in total assets. However, the company’s value of current assets increased to $2,386,972 while the fixed assets dropped to $3,465,000 following depreciation on fixed assets.

译文:

皇家航空公司三年资产负债表分析 财务管理论文代写

余额是一个非常重要的财务工具,它表明皇家航空公司在公司如何产生资源和财务方面的财务状况。 皇家航空公司在会计年度第一季度开始运营,手头没有现金。 同期,公司流动资产总额为 814,138 美元,固定资产总额为 7,646,250 美元,相当于公司资产总值 8,460,388 美元。 到年底(第 4 季度),皇家航空公司的资产实力大幅下降至 5,851,791 美元,总资产下降 30.83%。 然而,公司的流动资产价值增加到 2,386,972 美元,而固定资产在固定资产折旧后下降到 3,465,000 美元。

In terms of the liabilities and equity, Royal Airline Company commenced its operations with current liability amounting to $7,297,721 and $294,000 in long-term loans.

The firm’s equity was valued at $868,667. Over the accounting year to the fourth quarter, the company’s total liability dropped from $7,591,721 to $6,341,052 representing 16.47% fall in the total liability. 财务管理论文代写

The long-term loans of the company also dropped as Royal Airline repaid part of the long-term loans acquired during the first quarter. However, the company’s value for common stock remain unchanged at $1,500,035 over the first four quarters as the firm maintained its common stock position without adding or repayment. The working capital (C.A-C.L) of the Royal Airline declined over the first year of operation. By the end of the fourth quarter, the equity value of Royal was negative, and indication that the firm’s equity prices fell below the par-value, hence the negative value of equity.

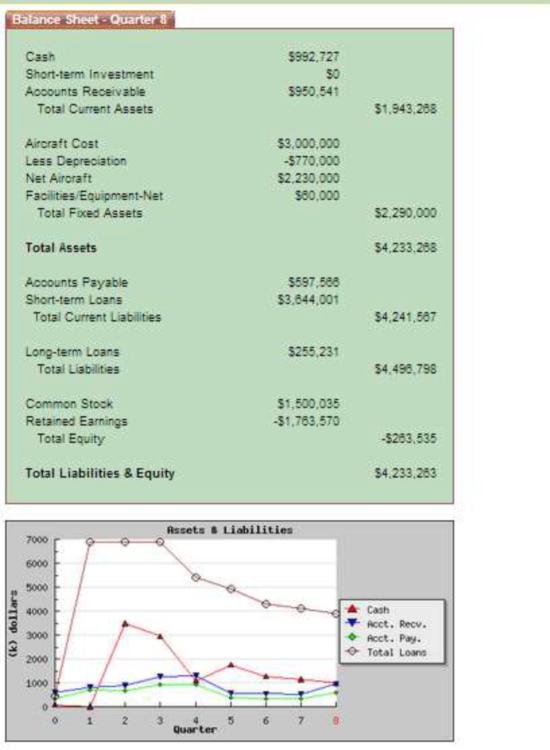

BALANCE SHEET FOR YEAR 2 (QUARTER 8)

During the second year, Royal Airline’s current ratio (which is the measure of the liquidity position of the firm) increased from 0.4:1 to 0.5:1 in year 2. This was attributed to the increased in the firm’s liquid cash position and other liquid assets. However, since the current liabilities exceeded the current assets, the company is therefore not in a position to meet its short-term financial obligations when they fall due during the first two years of its operation. 财务管理论文代写

The value of the fixed assets further went down because of the accumulated depreciation on the fixed assets. The company settled part of its current liabilities during the second year, hence the $1,822,774 drop. The value of the firm (its equities) further decreased because the share prices of the firm’s equity dropped below the par value of the firm’s shares. However, the firm’s quick ratio increased to 0.23 from 0.18 that was posted in year 1, notably these ratios are below the recommended value that should exceed 1.00.

译文:

就负债和权益而言,皇家航空公司开始运营时的当前负债为 7,297,721 美元和 294,000 美元的长期贷款。

该公司的股权价值为 868,667 美元。在截至第四季度的会计年度中,公司的总负债从 7,591,721 美元降至 6,341,052 美元,总负债下降了 16.47%。

由于皇家航空公司偿还了第一季度获得的部分长期贷款,该公司的长期贷款也有所下降。然而,该公司前四个季度的普通股价值保持不变,为 1,500,035 美元,因为该公司维持其普通股头寸,没有增加或偿还。皇家航空公司的营运资金 (C.A-C.L) 在运营的第一年有所下降。到第四季度末,Royal 的股权价值为负,表明该公司的股价低于面值,因此股权为负值。

第 2 年(第 8 季度)资产负债表

在第二年,皇家航空公司的流动比率(衡量公司流动性状况的指标)在第二年从 0.4:1 增加到 0.5:1。资产。但是,由于流动负债超过了流动资产,因此公司无法在其运营的前两年到期时履行其短期财务义务。

由于固定资产累计折旧,固定资产价值进一步下降。该公司在第二年清偿了部分流动负债,因此下降了 1,822,774 美元。由于公司股权的股价低于公司股票的面值,公司(其股权)的价值进一步下降。然而,该公司的速动比率从第一年公布的 0.18 增加到 0.23,特别是这些比率低于应超过 1.00 的建议值。

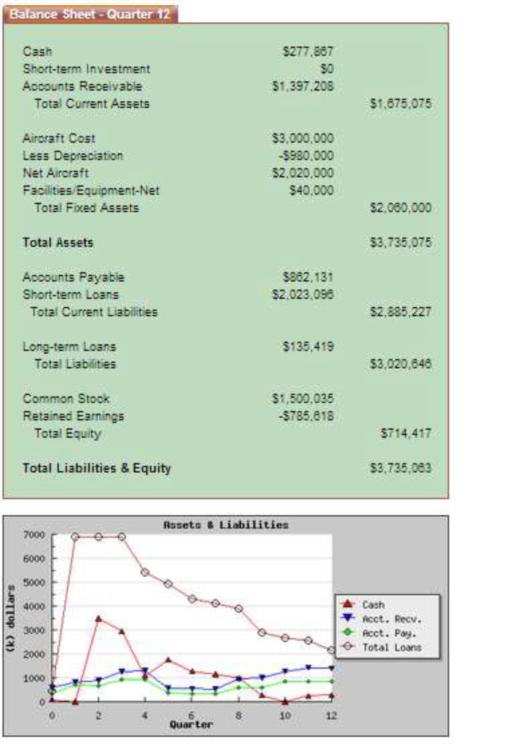

YEAR 3 (Quarter 12) BALANCE SHEET 财务管理论文代写

During Year 3, the company’s financial position further weakened with the total value of assets falling to $3,735,075 while the firms value for liabilities also declining to $3,020,646. However, like in the previous two years, the debt value of the firm remained unchanged at $1,500,035 as no debts were redeemed by the company. The company’s market value of equity stock increased by more than four times its valuation during the second year. This was because the company issued more equity share to finance the acquisition of the new aircraft value purchased at $3,000,000 in the third year. The retained earnings, like in the past two years, remained negative, and indication of lower profitability index. Royal Airline’s current ratio (current assets/current liabilities) increased from 0.5:1 to 0.6:1 in the third yeas, an indication of an improved ability of the company to settle its short-term financial obligations.

译文:

第 3 年(第 12 季度)资产负债表

在第 3 年,公司的财务状况进一步恶化,资产总价值下降至 3,735,075 美元,而公司负债价值也下降至 3,020,646 美元。 然而,与前两年一样,由于公司没有偿还任何债务,公司的债务价值保持不变,为 1,500,035 美元。 第二年,该公司股票的市值增长了其估值的四倍多。 这是因为该公司发行了更多股权,以资助在第三年以 3,000,000 美元购买的新飞机。 与过去两年一样,留存收益仍然为负,表明盈利指数较低。 皇家航空公司的流动比率(流动资产/流动负债)在第三年从 0.5:1 增加到 0.6:1,表明公司解决短期财务义务的能力有所提高。

INCOME STATEMENT ANALYSIS 财务管理论文代写

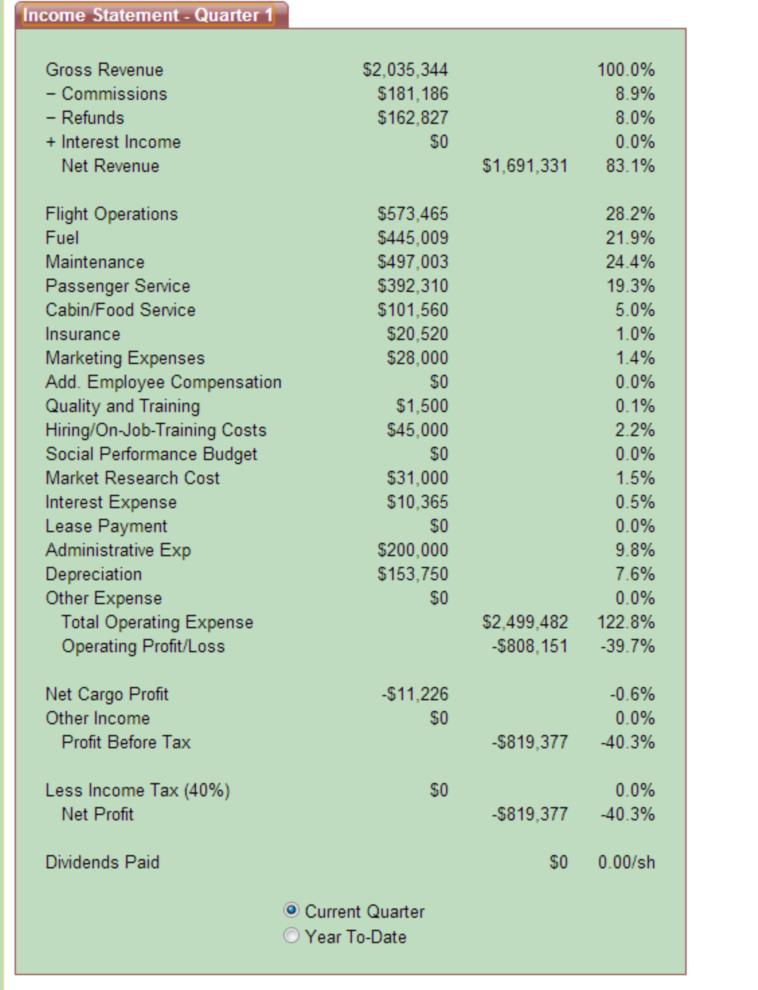

YEAR 1

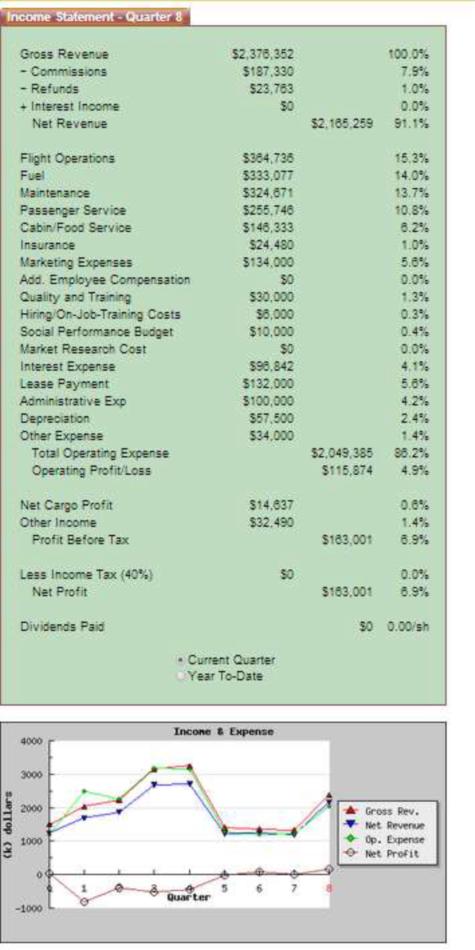

YEAR 2 FINANCIAL STATEMENT

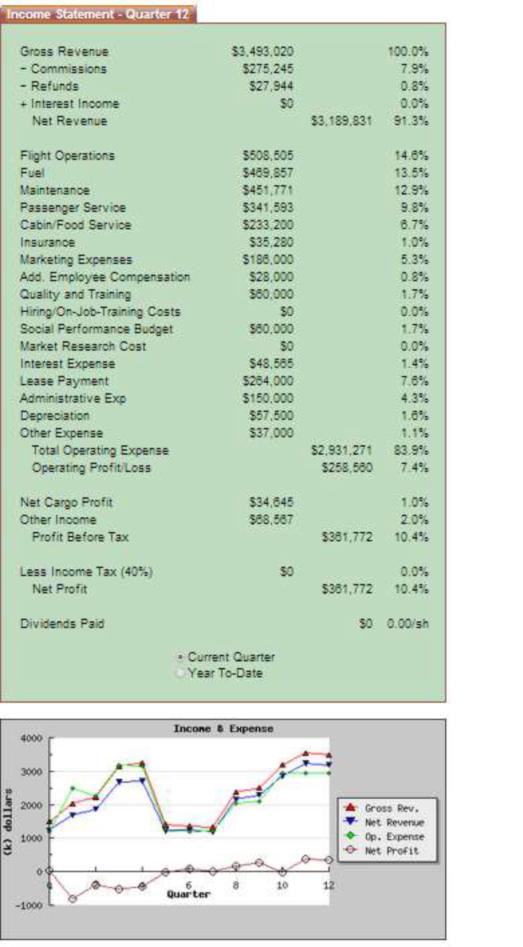

YEAR 3 FINANCIAL INCOME STATEMENT

Income statement of the firm measures the ability of the firm to convert the resources into revenue and other income generating activities. It also an indication of the profitability index of the firm through maximization of the shareholders wealth and value of the firm.

译文:

损益表分析 财务管理论文代写

第一年

第 2 年财务报表

第 3 年财务损益表

公司的损益表衡量公司将资源转化为收入和其他创收活动的能力。 它还通过最大化股东财富和公司价值来指示公司的盈利能力指数。

A Three-Year Income Statement Analysis

The income statement of Royal Airline Company showed that the company reported an increasing profitability index in the subsequent years after incurring losses of $819,377 representing 40.3%. During the second year, Royal Airline profitability increased as evidenced by the 6.9% after tax profit (valued at $163,001). The company’s after tax profitability index further increased 10.4% ($361,1772) in the third year. During the first year, the operating expenses of Royal Airline Company accounted to 122.8% of the total revenue generated over the same period, hence the operating loss. The company’s improved profitability performance in the second and third year was attributed to the growth in the firm’s net revenue of $2,165,259 and $3,189,831. 财务管理论文代写

Although the operating expanses of also increased in year 2 & 3 following the acquisition of new planes, the percentage increase in revenues were more than those of expenses, hence the profitability growth. At this trend, it is expected that the company will post better profitability performance in the coming years. However, this would be determined by the ability of the financial management team to reduce on the rising operating expenses. Over the three years, the Royal Airline Company did not declare dividends on its stocks and debts. To breakeven in the coming years, Royal Airline is obliged to cut on its operating costs and expenses in order to earn more profit that is sufficient to compensate the firm’s common stock investors in the form of dividends.

译文:

三年损益表分析

皇家航空公司的损益表显示,该公司在蒙受 819,377 美元的亏损后,在随后几年的盈利指数不断上升,占 40.3%。第二年,皇家航空公司的盈利能力增加了,税后利润增长了 6.9%(价值 163,001 美元)。该公司的税后盈利能力指数在第三年进一步增长了 10.4%(361,1772 美元)。第一年,皇家航空公司的经营费用占同期总收入的122.8%,因此出现经营亏损。公司在第二年和第三年的盈利表现改善归因于公司净收入分别增长 2,165,259 美元和 3,189,831 美元。

虽然在购买新飞机后第 2 年和第 3 年的运营费用也有所增加,但收入的增长幅度大于费用的增长幅度,因此盈利能力有所增长。在此趋势下,预计公司在未来几年将有更好的盈利表现。然而,这将取决于财务管理团队减少不断上升的运营费用的能力。三年来,皇家航空公司没有宣布其股票和债务的股息。为了在未来几年实现收支平衡,皇家航空公司有义务削减其运营成本和费用,以赚取更多的利润,足以以股息的形式补偿公司的普通股投资者。