Derivatives

衍生品代写 1.A stock price is currently £50. Over each of the next two 6-month periods, it is expected to go up by £10 or down by £10.

1. 衍生品代写

A stock price is currently £50. Over each of the next two 6-month periods, it is expected to go up by £10 or down by £10. The riskfree interest rate is 20% per annum with semi-annual compounding.

(a) [7 marks]

Compute the risk-neutral probabilities and use them to calculate the initial price of a 1-year European call with a strike price of £45. Brieflfly justify this pricing approach.

(b) [6 marks]

Calculate the dynamic replicating strategy for this European call.

(c) [5 marks]

Suppose instead that over each of the next two 6-month periods, the stock price can go up by £10, down by £10, or stay constant. How would you determine the value of the 1-year European call? A qualitative answer will suffiffiffice for this question.

(d) [7 marks]

Suppose 6 months have gone by, the riskfree interest rate is still 20% per annum with semi-annual compounding, and the price of the stock is £60. Over the next 6 months, the stock price can go up by £10, down by £10, or stay constant. A cash-or-nothing digital call option with 6-month maturity, strike price £62 and cash payment £30 trades at £19.09. What is the no-arbitrage price of a European call expiring in 6 months with strike price £55?

2. 衍生品代写

(a) [10 marks]

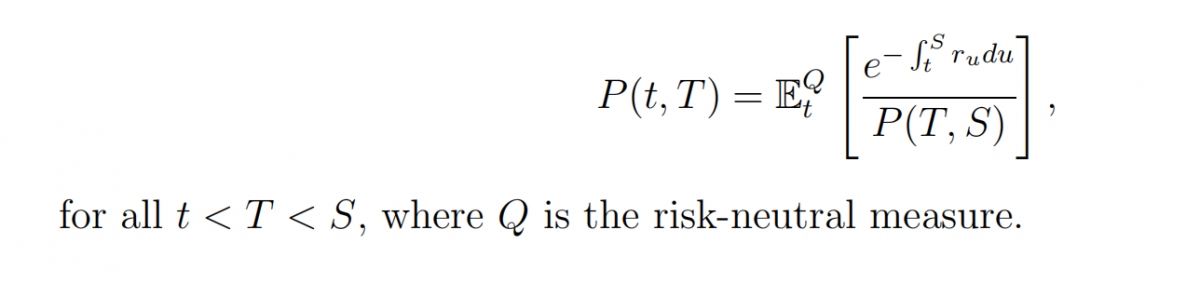

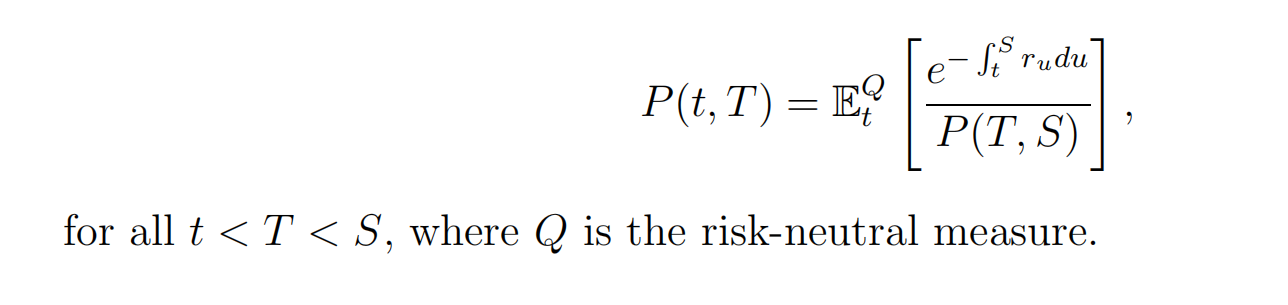

In this question, the instantaneous riskfree rate r follows an arbitrary stochastic process. Let P(t, t’ ) denote the time t price of a zero-coupon bond with maturity at time t’ > t. All bonds have face value £1. Show that

(b) A £100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap, 6-month LIBOR is exchanged for 12% per annum (compounded semiannually). Payment dates are every 6 months and the next payment date is in 4 months. The 6-month LIBOR rate 2 months ago was 9.6% per annum (compounded semi-annually). Today, the yield curve is flflat at 10% per annum with continuous compounding.

What is the value today of the swap from the point of view of the short party (who pays floating and receives fifixed)? Answer this question using both methods:

i. [7 marks] By calculating the values of the flfloating and fifixed rate bonds embedded in the swap.

ii. [8 marks] By valuing the swap as a bundle of FRAs.

更多代写:英国网页代写 midterm代考 英国伯明翰大学Dissertation论文代写 Problem-Solution Essay代写 Harvard Reference代写 数据科学与分析代写