Practice Questions for First Midterm Exam- Answers

Prof. Martina Copelman

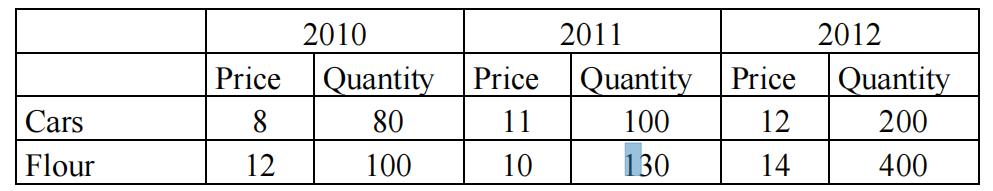

经济学Midterm代考 .Consider the following information and calculate two things, 1) real GDP in 2012 and 2) using the GDP deflator, calculate the inflation rate

Section I: Multiple Choice 经济学Midterm代考

1.Consider the following information and calculate two things, 1) real GDP in 2012 and 2) using the GDP deflator, calculate the inflation rate between 2010 and 2011.

Use 2010 as the base year. Round your calculations to 1 decimal point.

a) 5,760; 1.7%;

b) 1,700; -3%;

c) 8,000; 3%;

d) 6,400; 1.7%;

2.Suppose the economy is currently operating on both the LM curve and the IS curve. Which of the following is true for this economy? 经济学Midterm代考

a) Production equals demand.

b) The quantity supplied of bonds equals the quantity demanded of bonds.

c) The money supply equals money demand.

d) all of the above

3.In terms of the price indices studied in class, which of the following statements is correct? 经济学Midterm代考

a) The Consumer Price Index (CPI) includes a basket of all goods and services produced in an economy during a period of time.

b) The GDP deflator is an index that utilizes a base year (constant) basket of goods as weights.

c) A depreciation of the dollar will produce a larger change in the GDP deflator than in the CPI.

d) The GDP deflator incorporates new products in the basket every period, which means it is better able to reflect changes in consumption patterns.

- Consider an economy where financial markets are in equilibrium. If income increases, but the central bank has an interest rate target at the initial equilibrium, it would have to: 经济学Midterm代考

a) conduct an open market purchase to eliminate the excess supply of money generated by the change in money demand.

b) conduct an open market sale to eliminate the excess supply of money generated by the change in money demand.

c) conduct an open market purchase to eliminate the excess demand for money generated by the change in money demand.

d) conduct an open market sale to eliminate the excess demand for money generated by the change in money demand.

- In the IS-LM model studied in class, when the central bank conducts an open market sale of bonds:

a) The LM curve shifts up decreasing income and raising interest rates.

b) The LM curve shifts down increasing income and lowering interest rates.

c) The IS curve shifts up and right, increasing income and raising interest rates.

d) The IS curve shifts down and left, decreasing income and interest rates.

6.Suppose the price of a one-year bond is $9,600. We know that the face value of the bond is $10,000, what is the interest rate on this bond?

a) 4.17%;

b) 1.41%;

c) 1.04%;

d) 4.17%,

7.Consider an economy with the following behavioral equations for the goods market.

C = 20 + 0.5 Yd T= 10 I = 40 G = 65

What is the equilibrium level of income (Y) and savings (S)? 经济学Midterm代考

a) Y = 245; S = 97.5

b) Y = 240; S = 105

c) Y = 240; S = 95

d) Y = 230; S = 95

8.Consider the IS-LM model for a closed economy.

If the Federal Reserve is considering increasing interest rates, and if the economy were still in a recession, what could the government do to buttress the fall in output?

a) Reduce government transfers.

b) Increase the tax rate.

c) Increase government spending.

d) The government cannot counteract the fall in output.

9.Consider the IS-LM where the investment function is given by I= Ī +b1Y – b2i. During the crisis of 2010 in Europe, the Spanish government decided to increase autonomous taxes and reduce governmentspending. Simultaneously, the central bank decided to implement an open market bond purchase. In the new equilibrium:

a) Consumption will be lower, but investment will be higher.

b) Investment will be higher, but the outcome for consumption will be ambiguous.

c) Both consumption and investment will be lower. 经济学Midterm代考

d) Both outcomes for consumption and investment will be ambiguous.

10.Consider different targets (or objectives) of the central bank. In the IS-LM model, a reduction in government spending will imply:

a) A larger reduction in income if the central bank has an interest rate target versus a money supply target.

b) A smaller reduction in income if the central bank has an interest rate target versus a money supply target.

c) It will have no effect on income independently of the target of the central bank, given that the economy is operating under the liquidity trap.

d) An equal reduction in income independently of the target of the central bank

11.In the U.S. during the crisis of 2007-2009, GDP was well below potential.

Additionally,nominal interest rates were almost zero percent. In order to stimulate demand and increase GDP, the appropriate policy would be:

a) Expansionary fiscal policy.

b) Expansionary fiscal policy and contractionary monetary policy.

c) Expansionary monetary policy.

d) Contractionary fiscal policy and expansionary monetary policy.

12.In the IS-LM model, a decline in autonomous consumption (C0) will cause ________, in the demand for goods and services and _______in financial markets; therefore, the equilibrium interest rate will

a) a fall; an excess supply of money; fall. 经济学Midterm代考

b) an increase; an excess demand for money; fall.

c) an increase; an excess demand for money; increase.

d) a fall, an excess supply of money; increase.

13.Consider the model for financial markets studied in class that is initially in equilibrium for a certain amount of nominal money supply,

M, and nominal money demand, Md. If the price level increases, then:

a) Real money supply falls and real money demand falls.

b) Real money supply falls and nominal money demand stays constant.

c) Real money supply falls and nominal money demand increases

d) Real money supply increases and real money demand falls.

14.Which of the following is FALSE? 经济学Midterm代考

a) The value of a house built in 2013 and re-sold in 2014 is counted in GDP in 2014.

b) The value of a pound of Colombian coffee sold in Starbucks is not counted in GDP.

c) The value of a painting by Renoir sold in an auction in 2012 is not counted in 2012 GDP.

d) The value of 20 feet of cotton cloth used for curtains sold on amazon is not counted in GDP

15.In the model of the goods market, an increase in the tax rate (t), would _____ the multiplier. This means that an increase in autonomous investment of 100, would ____ equilibrium output (Y) by ____:

a) Increase; increase; 100

b) Decrease; decrease; more than 100

c) Decrease; increase; more than 100

d) Increase; decrease; less than 100

e) None of the above

16.Consider a closed economy given by the following equations: C=200 + .5(Y-T), T=80 + .1Y,I=300, G= 400.

Equilibrium output in this economy is approximately_____. Furthermore, if policy makers want to increase equilibrium output by 250, they would have to _______:

a) Y= 2161; increase G to 450.4

b) Y= 1563.6; increase I to 137.5

c) Y=1980; decrease T to 56.3

d) Y=2032; increase C to 301.6

17.In the model for financial markets, an increase in the money supply with everything else constant, would lead to:

a) A decrease in interest rates, an increase in the price of bonds, and an increase in output. 经济学Midterm代考

b) A decrease in interest rates and the price of bonds, and an increase in output

c) An increase in interest rates, a decrease in the price of bonds, and a decrease in output

d) An increase in interest rates and the price of bonds, and a decrease in output.

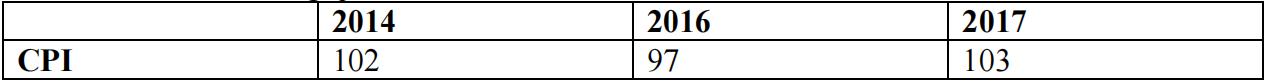

18.Suppose data for an economy for 2015 shows that a basket of goods cost $125. Suppose that 2015 is chosen as a base year.

You are also given the following information to be used to answer the following questions:

What is the cost of that same basket in 2014 and in 2016? What is the inflation rate between 2014 and 2015?

a) Cost of basket in: 2014=$127.5, 2016= $128.8, p 2015 = 2%

b) Cost of basket in: 2014=$122.6, 2016= $121.3, p 2015 = 3%

c) Cost of basket in: 2014=$127.5, 2016= $121.3, p 2015 = -1.96%

d) Cost of basket in: 2014=$122.6, 2016= $127.5, p 2015 = –5%

19.Suppose that you have the following data for a particular economy: the marginal propensity to save (s1) is 0.25, I=200 + 0.1Y- 50i, G=500, autonomous consumption (?̅) is 600,autonomous taxes (?$) are 200 and i= 0.05. What would be the approximate change in equilibrium output if simultaneously government spending increased by 100 and taxes increased by 100? 经济学Midterm代考

a) Y would increase by 166.75

b) Y would decrease by 500.25

c) Y would increase by 667

d) Y would not change

20.Consider an economy operating at the zero-lower bound. Using the IS-LM model, what would be the more effective policy to increase consumption? 经济学Midterm代考

a) for the central bank to buy bonds in the open market.

b) For the central bank to sell bonds in the open market.

c) For the government to increase spending on infrastructure

d) For the government to increase the tax rate to lower the budget deficit.

e) None of the above

21.In the model for financial markets, suppose that at the current interest rate, there is an excess demand for money. Given this information, we know that:

a) Production equals demand

b) The price of bonds will tend to increase 经济学Midterm代考

c) The goods market is also in equilibrium

d) The supply of bonds also equals the demand for bonds

e) The price of bonds will tend to fall

22.Which of the following is a liability for the central bank?

a) Checkable deposits

b) Savings accounts

c) Currency

d) Bonds

e) Loans

23.When the central bank decides to implement expansionary monetary policy, the following will occur:

a) A leftward shift in the money demand curve and a rightward shift in the money supply curve

b) A rightward shift in the money demand curve and a leftward shift in the money supply curve

c) A leftward shift in the money demand curve and a leftward shift in the money supply curve

d) A rightward shift in the money demand curve and a rightward shift in the money supply curve 经济学Midterm代考

e) None of the above

24.A liquidity trap is most likely to occur if:

a) The real interest rate is negative

b) Individuals prefer to hold only money and no bonds

c) Inflation is zero

d) Inflation is constant

e) Inflation is rising

25.If the goods market is in equilibrium, we know with certainty that:

a) Private savings equals investment

b) Government spending equals taxes

c) The budget surplus is zero

d) National savings equals investment

e) None of the above

Section II: Numerical Problem 经济学Midterm代考

- Consider the following IS-LM model for a closed economy.

C= 100 + 0.5 YD Md = 0.11Y – 1,200i

T= 500 + .1Y i = 20% (that is 0.2)

I= 2,000 – 1,500 i G = 500.

a) Calculate the equilibrium level of output (Y).

b) Calculate the money supply for this economy (M).

c) If the money supply increases by $90. What is the new level of equilibrium income and interest rate? Graph this situation in the IS-LM model.

d) Graphically demonstrate what the government would have to do to keep income constant at the initial equilibrium level in a). Explain what type of policies the government could carry out to achieve such a result. What should happen to the interest rate in this scenario?

更多代写:html程序代写 edu网课考试代考 Essay代写网站 essay代寫价格 北美留学论文代写 Econometrics作业代写