Problem Set Week 10

Purpose

Try to solve the following set of problems related with contents explored in Week 10. Revisit the learning materials made available during Week 10.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Problem set 资产管理周作业代写

Consider an investor that has the following investment roadmap:

- Step 1 effective at beginning of Month 2: construct a 6 stock equal weight portfoliofor a short period of time (one month);

- Step 2 effective at beginning of Month 8: construct a 6 stock equal weight portfoliofor a medium term period of time from month 8 to month 17;

- Step 3 effective at beginning of Month 18: construct a 6 stock equal weight portfoliofor a long term period of time from month 18 to month 34.

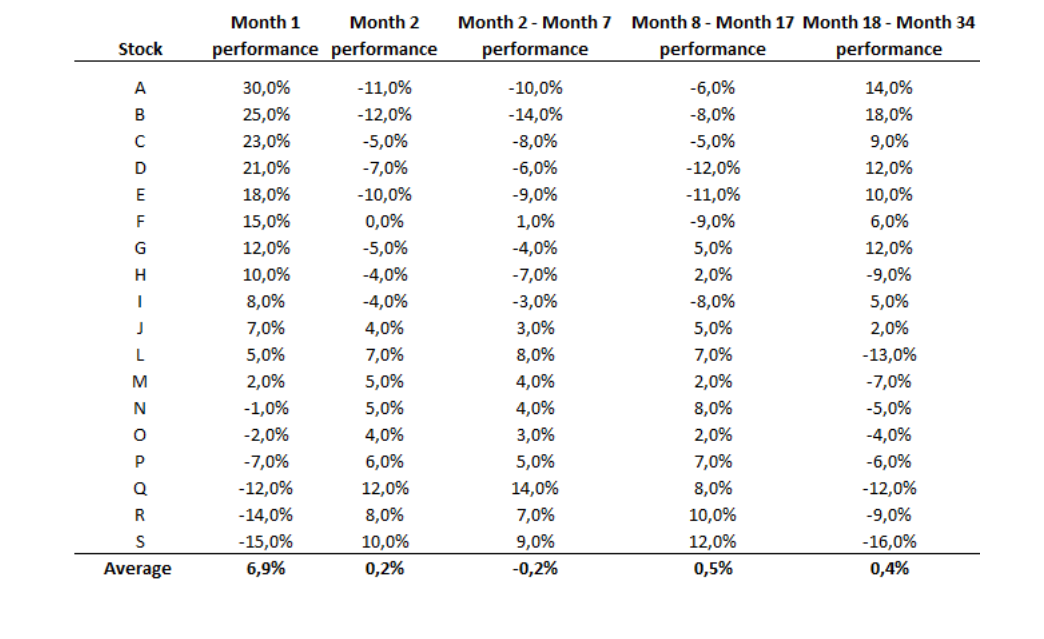

Looking backward, the performance of all stocks available for investment is the following:

-

For step 1:

a)Based on empirical evidence, what is the trading strategy that could work for this investor considering the time period of investment of one month?

b)Considering the available information at the beginning of Month 2, and following the investment strategy proposed in 1.a), what would be the group of 6 stocks chosen?

c)Compute the performance of the portfolio for the relevant period of time and compare with the average market performance.

-

For step 2: 资产管理周作业代写

a)Based on empirical evidence, what is the trading strategy that could work for this investor considering the length of investment time period (month 8 to month 17)?

b)Considering the available information at the beginning of Month 8, and following the investment strategy proposed in 2.a), what would be the group of 6 stocks chosen?

c)Compute the performance of the portfolio for the relevant period of time and compare with the average market performance.

-

For step 3:

a)Based on empirical evidence, what is the trading strategy that could work for this investor considering the length of investment time period (month 18 to month 34)?

b)Considering the available information at the beginning of Month 18, and following the investment strategy proposed in 3.a), what would be the group of 6 stocks chosen?

c)Compute the performance of the portfolio for the relevant period of time and compare with the average market performance.

更多代写:cs澳洲网课作业代写 gmat代考多少钱 英国环境艺术类代考 化学工程论文代写 澳大利亚经济学Midterm代考 资产管理家庭作业代写