Problem Set Week 9

Purpose

Try to solve the following set of problems related with contents explored in Week 9. Revisit the learning materials made available during Week 9.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Exercise 1 资产管理家庭作业代写

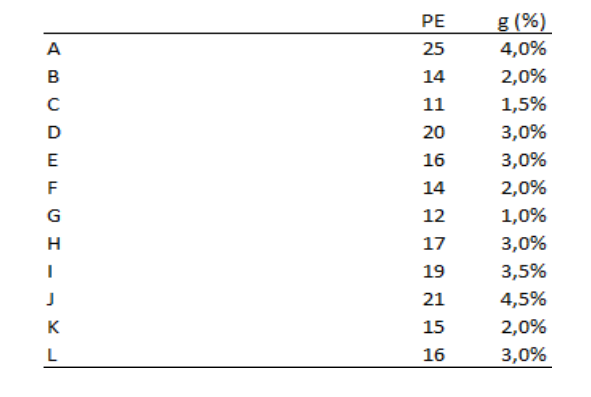

Consider a growth investor that is a “passive screener” following the PEG criteria. Assume this investor only acquires six stocks. Consider the following information about a group of stocks the investor is screening:

where PE represents the current Price Earnings ratio at which each stock is trading and “g” represents the expected growth rate of earnings per share.

a.

Which group of stocks will this “growth” investor choose to invest?

b.

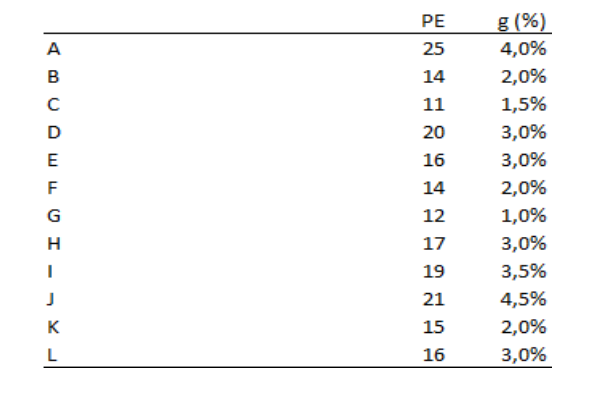

Assume that the investor invests in the group of stocks selected in 1a) for a period of 6 months. The portfolio is equal-weighted. After the six month period you have the following information for each stock:

b.1) What is the 6 month return of the growth investor portfolio?

b.2) Imagine this investor follows a PEG criteria but with the opposite order criteria, i.e., not the one you expect a “growth” investor to follow. What would be the group of stocks chosen and the 6-month performance of the corresponding equal weight portfolio?

b.3) Are results obtained in b.1) and b.2) consistent with empirical evidence?

b.4) What is the rational for buying stocks with low PEG ratio?

c.

Consider the 6-month return standard deviations reported in the previous table for each of the stocks.

c.1) What is the average standard deviation of returns for stocks belonging to the low PEG and high PEG portfolios obtained in question b)?

c.2) Comparing these two standard deviations, is their relative dimension consistent with results in empirical evidence?

c.3) Is it possible to calculate the standard deviation of the low PEG and high PEG portfolios obtained in question b)?

Exercise 2 资产管理家庭作业代写

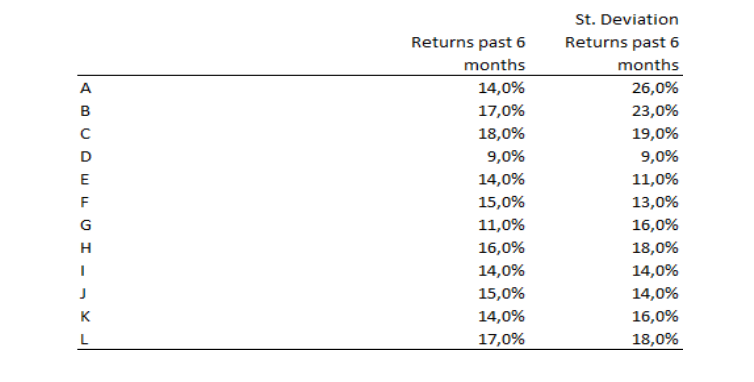

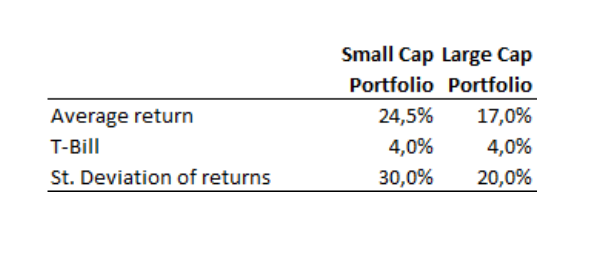

Consider the following information with respect to a Large Cap portfolio and a Small Cap Portfolio:

a. Computethe Sharpe ratio for each portfolio.

b. Considering exclusively this risk-return information, in case you had to choose one of the two portfolios, what would be your choice?

c. Additionally, you have the information that transaction costs of the Small Cap Portfolio and the Large Cap Portfolio were 2.5% and 0.8% respectively.

c.1) Recalculate the Sharpe ratio after adjusting returns for those transaction costs.

c.2) Would your investment decision in b) change?

c.3) Is the relevance of transaction costs for trading Small Caps in this example consistent with empirical evidence? Give one suggestion for the small cap investor in order to dilute the transaction costs.