ECOM055 – Risk Management For Banking

Problem Set 5

Based on Book Chapter 8 银行业风险管理问题集代写

8.15.

The gamma and vega of a delta-neutral portfolio are 50 per $ per $ and 25 per %, respectively. Estimate what happens to the value of the portfolio when there is a shock to the market causing the underlying asset price to decrease by $3 and its volatility to increase by 4%.

8.16 (Optional, the RMFI software is free; see how you can obtain it on page 773 of the book)

Consider a one-year European call option on a stock when the stock price is $30, the strike price is $30, the risk-free rate is 5%, and the volatility is 25% per annum. Use the RMFI software to calculate the price, delta, gamma, vega, theta, and rho of the option.

Verify that delta is correct by changing the stock price to $30.1 and recomputing the option price. Verify that gamma is correct by recomputing the delta for the situation where the stock price is $30.1. Carry out similar calculations to verify that vega, theta, and rho are correct.

8.17.

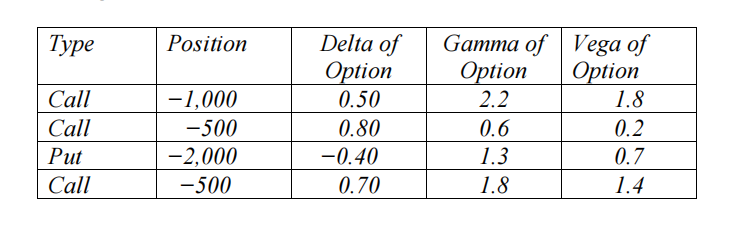

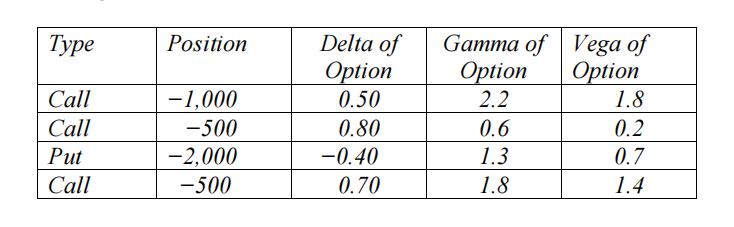

A financial institution has the following portfolio of over-the-counter options on sterling:

A traded option is available with a delta of 0.6, a gamma of 1.5, and a vega of 0.8.

(a) What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral?

(b) What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral?

8.18.

Consider again the situation in Problem 8.17. Suppose that a second traded option with a delta of 0.1, a gamma of 0.5, and a vega of 0.6 is available. How could the portfolio be made delta, gamma, and vega neutral?

8.19. (Optional, the RMFI software is free; see how you can obtain it on page 773 of the book) 银行业风险管理问题集代写

Check the first three rows of Table 8.2 using the RMFI software. Calculate the gamma and theta of the position during the first three weeks, and the change in the value of the position (before the end-of-week rebalancing) during each of these weeks. Check whether equation (8.2) is approximately satisfied. (Note: RMFI software produces a value of theta “per calendar day.” The theta in equation 8.2 is “per year.”)

更多代写:cs澳洲留学生代考 考试作弊后果 英国化学网课代修 波士顿essay代写 澳洲HIS历史代写 银行业风险管理问题代写