ECOM055 – Risk Management For Banking

Problem Set 2

2.16.

Explain the moral hazard problems with deposit insurance. How can they be overcome?

2.17.

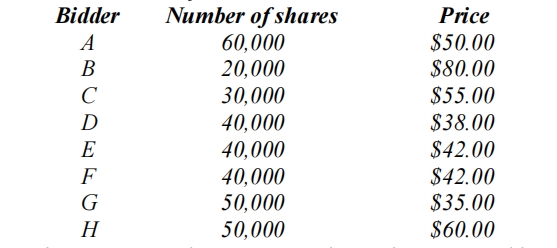

The bidders in a Dutch auction are as follows:

The number of shares being auctioned is 210,000. What is the price paid by investors? How many shares does each investor receive?

2.18.

An investment bank has been asked to underwrite an issue of 10 million shares by a company. It is trying to decide between a firm commitment where it buys the shares for $10 per share and a best efforts arrangement where it charges a fee of 20 cents for each share sold. Explain the pros and cons of the two alternatives.

3.16. 银行业风险管理代写

Use Table 3.1 to calculate the minimum premium an insurance company should charge for a $5 million three-year term life insurance contract issued to a man aged 60. Assume that the premium is paid at the beginning of each year and death always takes place halfway through a year. The risk-free interest rate is 6% per annum (with semiannual compounding).

Table 3.1

| Male | Female | |||||

| Probability | Probability | |||||

| Age | of Death | Survival | Life | of Death | Survival | Life |

| (Years) | within 1 Year | Probability | Expectancy | within 1 Year | Probability | Expectancy |

| 0 | 0.006519 | 1.00000 | 76.28 | 0.005377 | 1.00000 | 81.05 |

| 1 | 0.000462 | 0.99348 | 75.78 | 0.000379 | 0.99462 | 80.49 |

| 2 | 0.000291 | 0.99302 | 74.82 | 0.000221 | 0.99425 | 79.52 |

| 3 | 0.000209 | 0.99273 | 73.84 | 0.000162 | 0.99403 | 78.54 |

| … | … | … | … | … | … | … |

| 30 | 0.001467 | 0.97519 | 47.82 | 0.000664 | 0.98635 | 52.01 |

| 31 | 0.001505 | 0.97376 | 46.89 | 0.000705 | 0.98569 | 51.04 |

| 32 | 0.001541 | 0.97230 | 45.96 | 0.000748 | 0.98500 | 50.08 |

| 33 | 0.001573 | 0.97080 | 45.03 | 0.000794 | 0.98426 | 49.11 |

| … | … | … | … | … | … | … |

| 40 | 0.002092 | 0.95908 | 38.53 | 0.001287 | 0.97753 | 42.43 |

| 41 | 0.002240 | 0.95708 | 37.61 | 0.001393 | 0.97627 | 41.48 |

| 42 | 0.002418 | 0.95493 | 36.70 | 0.001517 | 0.97491 | 40.54 |

| 43 | 0.002629 | 0.95262 | 35.78 | 0.001662 | 0.97343 | 39.60 |

| … | … | … | … | … | … | … |

| 50 | 0.005038 | 0.92940 | 29.58 | 0.003182 | 0.95829 | 33.16 |

| 51 | 0.005520 | 0.92472 | 28.73 | 0.003473 | 0.95524 | 32.27 |

| 52 | 0.006036 | 0.91961 | 27.89 | 0.003767 | 0.95193 | 31.38 |

| 53 | 0.006587 | 0.91406 | 27.05 | 0.004058 | 0.94834 | 30.49 |

| … | … | … | … | … | … | … |

| 60 | 0.011197 | 0.86112 | 21.48 | 0.006545 | 0.91526 | 24.46 |

| 61 | 0.012009 | 0.85147 | 20.72 | 0.007034 | 0.90927 | 23.62 |

| 62 | 0.012867 | 0.84125 | 19.97 | 0.007607 | 0.90287 | 22.78 |

| 63 | 0.013772 | 0.83042 | 19.22 | 0.008281 | 0.89600 | 21.95 |

| … | … | … | … | … | … | … |

| 70 | 0.023528 | 0.73461 | 14.24 | 0.015728 | 0.82864 | 16.43 |

| 71 | 0.025693 | 0.71732 | 13.57 | 0.017338 | 0.81561 | 15.68 |

| 72 | 0.028041 | 0.69889 | 12.92 | 0.019108 | 0.80147 | 14.95 |

| 73 | 0.030567 | 0.67930 | 12.27 | 0.021041 | 0.78616 | 14.23 |

| … | … | … | … | … | … | … |

| 80 | 0.059403 | 0.50629 | 8.20 | 0.043289 | 0.63880 | 9.64 |

| 81 | 0.065873 | 0.47621 | 7.68 | 0.048356 | 0.61114 | 9.05 |

| 82 | 0.073082 | 0.44484 | 7.19 | 0.054041 | 0.58159 | 8.48 |

| 83 | 0.081070 | 0.41233 | 6.72 | 0.060384 | 0.55016 | 7.94 |

| … | … | … | … | … | … | … |

| 90 | 0.167291 | 0.17735 | 4.03 | 0.132206 | 0.29104 | 4.80 |

| 91 | 0.184520 | 0.14768 | 3.74 | 0.147092 | 0.25257 | 4.45 |

| 92 | 0.202954 | 0.12043 | 3.47 | 0.163154 | 0.21542 | 4.13 |

| 93 | 0.222555 | 0.09599 | 3.23 | 0.180371 | 0.18027 | 3.84 |

3.19. 银行业风险管理代写

Suppose that in a certain defined benefit pension plan

(a) Employees work for 45 years earning wages that increase at a real rate of 2%.

(b) They retire with a pension equal to 70% of their final salary. This pension increases at the rate of inflation minus 1%.

(c) The pension is received for 18 years.

(d) The pension fund’s income is invested in bonds which earn the inflation rate plus 1.5%.

Estimate the percentage of an employee’s salary that must be contributed to the pension plan if it is to remain solvent. (Hint: Do all calculations in real rather than nominal dollars.)

4.15.

An investor buys 100 shares in a mutual fund on January 1, 2018, for $50 each. The fund earns dividends of $2 and $3 per share during 2018 and 2019. These are reinvested in the fund. The fund’s realized capital gains in 2018 and 2019 are $5 per share and $3 per share,respectively.

The investor sells the shares in the fund during 2020 for $59 per share. Explain how the investor is taxed.

4.17. 银行业风险管理代写

A fund of funds divides its money between five hedge funds that earn –5%, 1%, 10%, 15%, and 20% before fees in a particular year. The fund of funds charges 1 plus 10% and the hedge funds charge 2 plus 20%. The hedge funds’ incentive fees are calculated on the return after management fees. The fund of funds incentive fee is calculated on the net (after management fees and incentive fees) average return of the hedge funds in which it invests and after its own management fee has been subtracted. What is the overall return on the investments? How is it divided among the fund of funds, the hedge funds, and investors in the fund of funds?

4.18.

A hedge fund charges 2 plus 20%. A pension fund invests in the hedge fund. Plot the return to the pension fund as a function of the return to the hedge fund.

更多代写:cs澳洲留学生代管网课 代考英文 英国化学网课代做 北美英语论文代写 澳大利亚经济学网课代考 资产管理周作业代写