Homework 2

金融课业代写 1.In this problem, you are asked to build a Hull-White lattice model. Thezero-coupon bond prices for maturities up to 30 years, are given in bond.txt

1. 金融课业代写

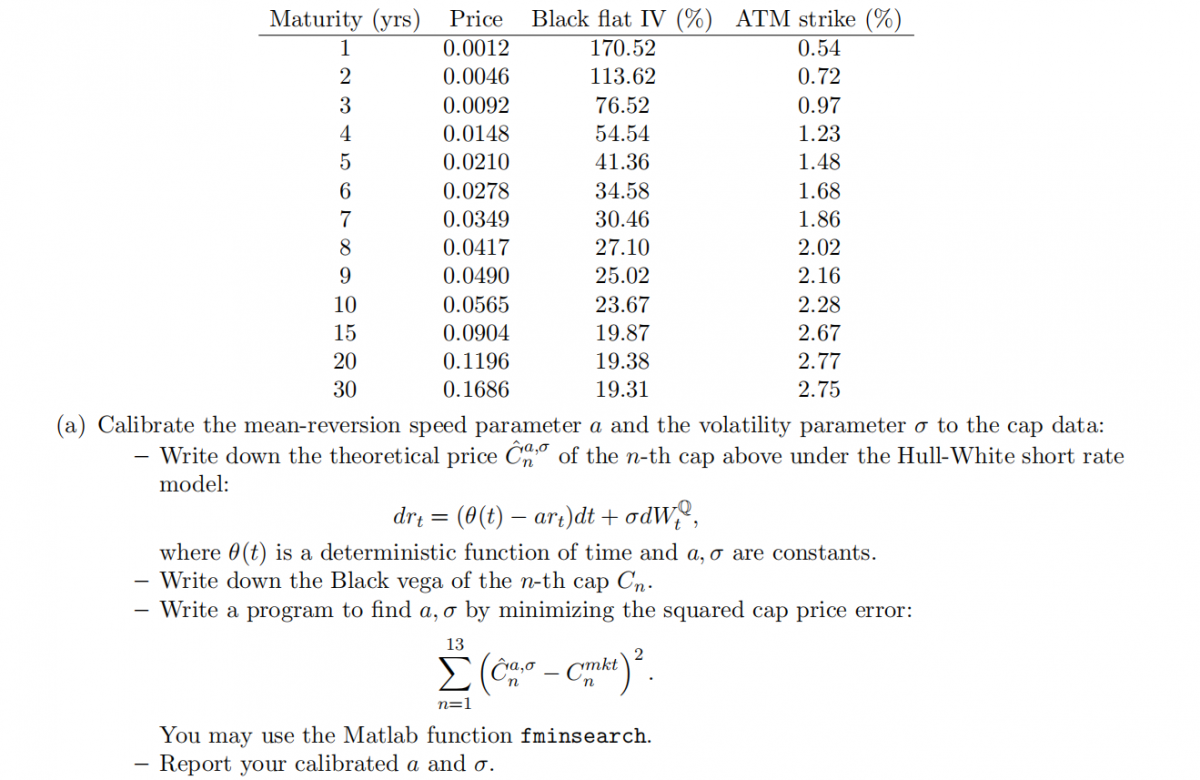

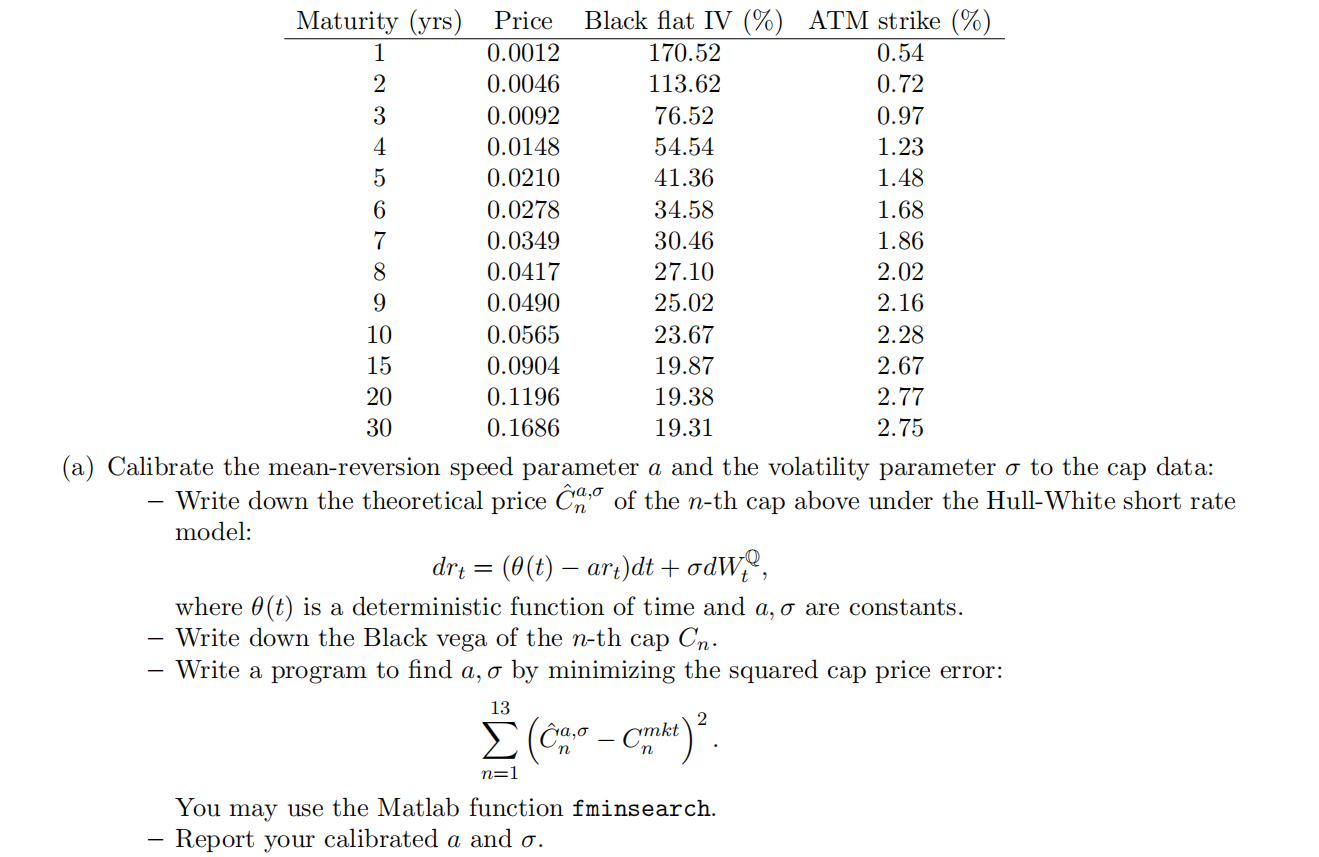

In this problem, you are asked to build a Hull-White lattice model. Thezero-coupon bond prices for maturities up to 30 years, are given in bond.txt, where the k-th entry is p(0, 0.5k), k = 1,…, 60. The cap quotes (with first reset date T0= 0.5 years and semi-annual payments) are given below:

(b) For ∆t = 0.5 years, calculate the Hull-White choice of ∆r and J.

(c) Taking ∆t, ∆r, J from part (b), fit the mean short rate αm = α(m∆t) = Erm∆t to the provided bond price data. Plot αm for m = 0,…, 59.

(d) Using the calibrated Hull-White model, find the cost (on a notional principal of 100) of a prepayment option (an option that gives the holder the possibility of early loan repayment) after 5 years on a 13 year fixed rate loan where the rate is 5% payable annually.

2. 金融课业代写

Consider the Black-Scholes model with parameters r = 0.05, σ = 0.25, S0= 20. Consider a put option with strike price K = 33 and maturity T = 0.5. In thisproblem we are interested in estimating the option vega at time 0.

(a) Compute the exact vega at time 0 using the Black-Scholes formula.

(b) Consider the forward difference estimator where we simulate the two payoffs (for the two volatilities) independently. Suppose N = 10000 is the sample size. Design and implement a numerical experiment to find the optimal value of h (the bandwidth) which minimizes the MSE. Show your results graphically. 金融课业代写

(c) Estimate the vega using the pathwise derivative approach. Report the 95% confidence interval you get with N = 10000 samples.

(d) Estimate the vega using the likelihood ratio method. Report the 95% confidence interval you get with N = 10000 samples.

(e) Compare the confidence intervals in parts (c) and (d) with that of the forward difference estimator in part (b). Which of the methods is the best in this case?

For each method, derive and show the relevant formulas.

更多代写:多伦多cs网课代修 托福助考 英国会计代考推荐 理科essay作业代写 美国eco report代写 代写summary