Problem Set IV

金融经济学作业代写 Question 1 Assume that The market portfolio is made up with 80% of stocks and 20% of risky corporate bonds The volatility (standard deviation)

Question 1

Assume that

- The market portfolio is made up with 80% of stocks and 20% of risky corporate bonds

- The volatility (standard deviation) of the returns on stocks and bonds are 20% and 10% respectively,

- The correlation between the stocks and bonds is 0.25, and

- The Sharpe ratio of the market portfolio is 0.40

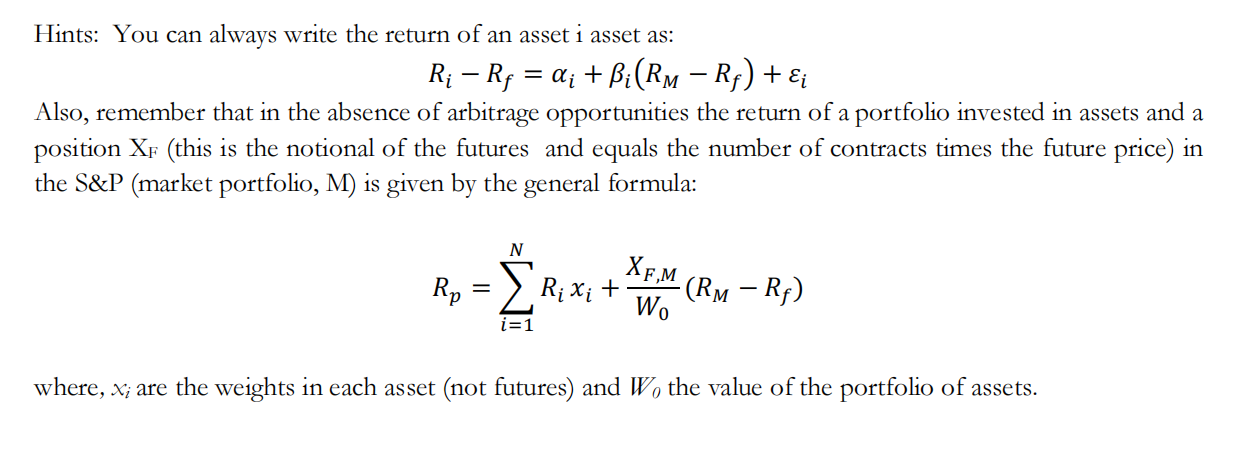

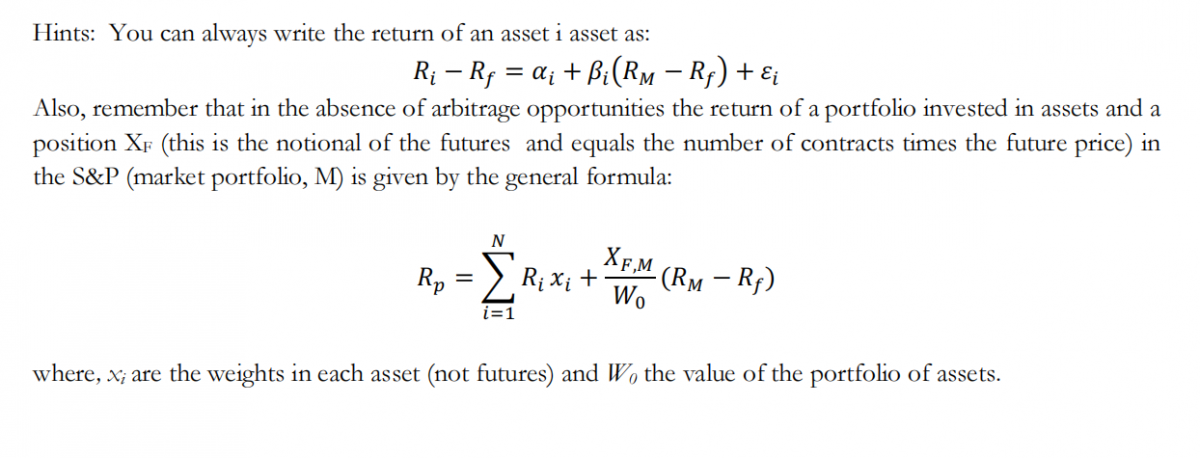

Under the CAPM,

a) Find the betas for stocks βSand bonds βB.

b) Find the expected returns (in excess of risk free rate) on stocks and bonds.

Question 2 金融经济学作业代写

There are two assets, A and B, with normally distributed returns and parameters:

Asset A: ERA = 12%, σA = 30%;

Asset B: ERB = 18%, σB =50%,

and the correlation coefficient between the returns is ρA,B = 0.3.

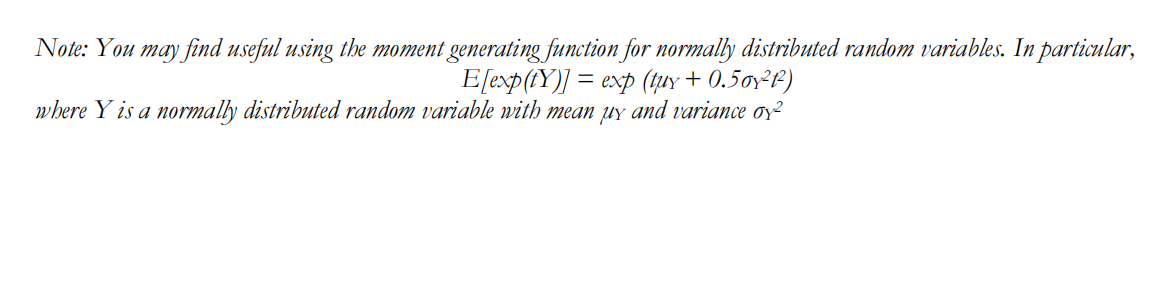

Dave has the following utility function

U(W) = − exp[−αW]

where α is the coefficient of absolute risk aversion and is equal to 4.

a) If A and B are the only assets available, what is Dave’s optimal portfolio if his initial wealth is $1?

b) What is Dave’s optimal portfolio if in addition there is a risk free asset with a return of 6% available?

c) What are the equations representing the capital market line (CML) and the security market line (SML) in part (ii) (assuming all the CAPM assumptions are satisfied)?

Question 3 金融经济学作业代写

Consider the following information on the historical performance of two mutual funds and the market portfolio: 1

| E(Ri) | Var(Ri) | Corr(Ri,RM) | |

| Madrid Fund | 0.08 | 0.0144 | 0.1 |

| Barcelona Fund | 0.05 | 0.01 | -0.1 |

| Market portfolio | 0.06 | 0.012 |

The risk-free interest rate is 1%. Assuming that the CAPM is valid, evaluate the performance of these two funds in the context of this model. Your evaluation should provide a recommendation of funds for:

a) A well-diversified investor

b) An investor who is not well-diversified.

1 Corr(Ri,RM) denotes the correlation of fund i returns with the Market Portfolio returns.

Question 4 金融经济学作业代写

A market neutral portfolio is a zero beta portfolio. Suppose you are the manager of a fund that specializes in oil stocks. Your fund is currently fully invested in oil stocks (call this you oil portfolio). This oil portfolio has a beta of 1.2 and an annual volatility (standard deviation) of 30%. You believe that the stock market is going to perform poorly and want to make you portfolio market neutral by trading S&P 500 index futures (assume the S&P is the market portfolio). What is the volatility of the return on the market-neutral position (which includes you position in oil stocks and futures contracts)?

Assume that the annual return on the S&P 500 index has a volatility of 20%; and ignore margin deposits on the futures position (assume there are none).