ECOM137 China and Global Financial Markets

Problem Set 5

China Construction Bank (CCB) and Chicago Mercantile Exchange and Chicago Board of Trade (CME Group) signed an agreement in London in October 2015 to enable the physical delivery of offshore renminbi (RMB) futures and options contracts outside China for the first time. This means British and European-based traders of RMB future and options contracts can settle their trade in Europe, instead of setting up a bank account in HK to do that.

The Chinese RMB/USD Futures Quotes are in contracts of 1 million RMB

- APR 2019: $0.14751

- MAY 2019: $0.14744

- JUN 2019: $0.14736

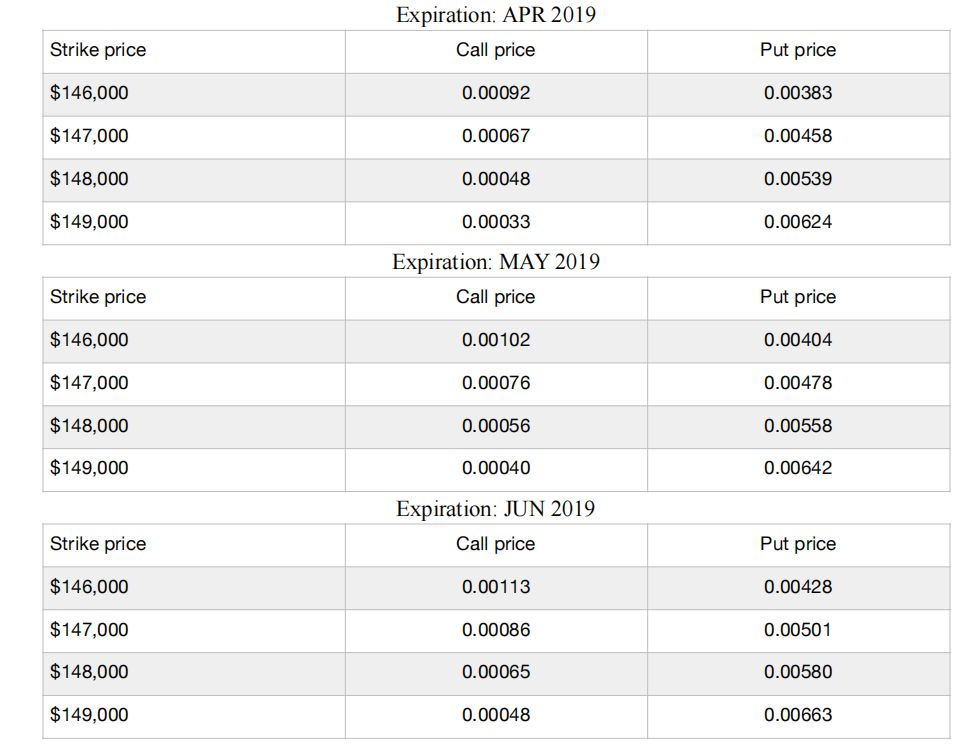

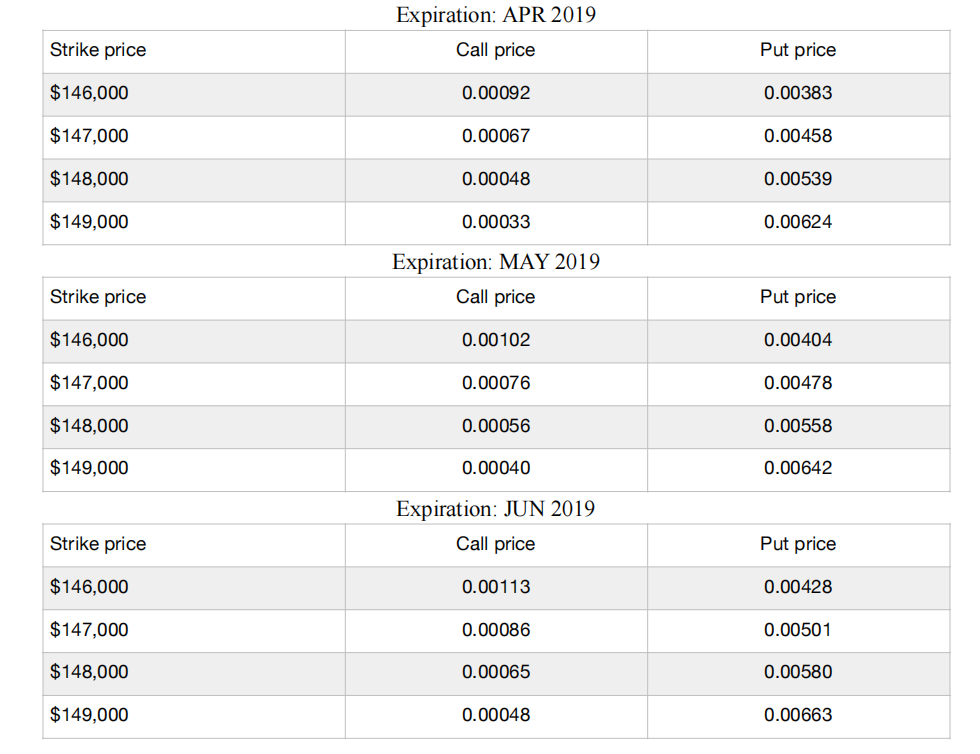

The Chinese RMB/USD Options Quotes are in contracts of 1 million RMB. The premium is quoted in USD per 1 RMB. These are European options, meaning that they give the owner the right, but not the obligation to buy or sell the underlying asset at the strike price on the expiration date.

Note how the premium quotes changing according to the type of contracts. 金融市场课业代写

- Why does the premium of a call option decrease in its strike price, given a fixed expiration date?

- Why does the premium of a put option increase in its strike price, given a fixed expiration date?

- American options are usually priced higher than comparative European options. Why?

Suppose you work for a London-based Multinational Corporation, which exports to China. It’s February today and you expect to receive RMB 5 million from your Chinese client in three months’ time. You would like hedge against the short-run devaluation of RMB.

- Suppose you hedge using the futures contracts offered by CME. Which quote should you use? How much USD does using the futures contracts guarantee you?

- Suppose you hedge using the options contracts offered by CME. You want to guarantee at least an income of $712,500. Do you need call options or put options? Which specific option should you use?

- What are the differences between hedging using futures contracts and hedging using options contracts?