Fundamentals of Futures and Options Markets

期货基础代写 Problem 1.8 A stock when it is first issued provides funds for a company. Is the same true of an exchange-traded stock option? Discuss.

Week 1

Derivatives markets: organization, contracts, and participants

Practice Questions

Consolidate

Problem 1.8

A stock when it is first issued provides funds for a company. Is the same true of an exchange-traded stock option? Discuss.

Problem 1.9

Explain why a futures contract can be used for either speculation or hedging.

Problem 1.10

An investor writes a December put option with a strike price of $30. The price of the option is $4. Under what circumstances does the investor make a gain?

Problem 1.11

The Australian Securities Exchange offers a futures contract on 10-year Commonwealth Treasury bonds. Characterise the investors likely to use this contract.

Problem 1.12

A company knows that it is due to receive a certain amount of a foreign currency in four months. What type of option contract is appropriate for hedging?

Problem 1.13

‘Options and futures are zero-sum games.’ What do you think is meant by this statement?

Development 期货基础代写

Problem 1.14

Suppose you own 5,000 shares that are worth $25 each. How can put options be used to provide you with insurance against a decline in the value of your holding over the next four months?

Problem 1.15

A wheat farmer expects to have 100 metric tonnes of Western Australian wheat to sell in three months. The Western Australian wheat futures contract on the Australian Securities Exchange is for the delivery of 20 metric tonnes of wheat. How can the farmer use the contract for hedging? From the farmer’s viewpoint, what are the pros and cons of hedging?

Problem 1.16

Suppose that a March call option on a stock with a strike price of $50 costs $2.50 and is held until March. Under what circumstances will the holder of the option make a gain? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a long position in the option depends on the stock price at the maturity of the option.

Problem 1.17 期货基础代写

Suppose that a June put option on a stock with a strike price of $60 costs $4 and is held until June. Under what circumstances will the holder of the option make a gain? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a short position in the option depends on the stock price at the maturity of the option.

Problem 1.18

It is May and a trader writes a September call option with a strike price of $20. The stock price is $18 and the option price is $2. Describe the investor’s cash flows if the option is held until September and the stock price is $25 at this time.

Problem 1.19

An airline executive has argued: ‘There is no point in our using oil futures. There is just as much chance that the price of oil in the future will be less than the futures price as there is that it will be greater than this price.’ Discuss the executive’s viewpoint.

Problem 1.20

A trader enters into a short forward contract on 100 million yen. The forward exchange rate is $0.0080 per yen. How much does the trader gain or lose if the exchange rate at the end of the contract is: (a) $0.0074 per yen, (b) $0.0091 per yen?

Problem 1.21 期货基础代写

A trader enters into a short greasy wool futures contract when the futures price is 1,170 cents per kg. The contract is for the delivery of 2,000 kgs clean weight. How much does the trader gain or lose if the greasy wool at the end of the contract is: (a) 1,150 cents per kg, (b) 1,190 cents per kg?

Problem 1.22

An Australian company expects to have to pay 1 million Canadian dollars in six months. Explain how the exchange rate risk can be hedged using: (a) a forward contract, (b) an option.

Problem 1.23

It is July 2010. A mining company has just discovered a small deposit of gold. It will take six months to construct the mine. The gold will then be extracted on a more or less continuous basis for one year. Futures contracts on gold are available on the New York Mercantile Exchange. There are delivery months every two months from August 2010 to December 2011. Each contract is for the delivery of 100 ounces. Discuss how the mining company might use futures markets for hedging.

Assignment questions 期货基础代写

Problem 1.24 (Excel file)

Trader A enters into a forward contract to buy gold for $1,000 an ounce in one year. Trader B buys a call option to buy gold for $1,000 an ounce in one year. The cost of the option is $100 an ounce. What is the difference between the positions of the traders? Show the profit per ounce as a function of the price of gold in one year for the two traders.

Problem 1.25

In March, a US investor instructs a broker to sell one July put option contract on a stock. The stock price is $42 and the strike price is $40. The option price is $3. Explain what the investor has agreed to. Under what circumstances will the trade prove to be profitable? What are the risks?

Problem 1.26

An Australian company knows it will have to pay 3 million euros in three months. The current exchange rate is 1.4500 dollars per euro. Discuss how forward and options contracts can be used by the company to hedge its exposure.

Problem 1.27 (Excel file) 期货基础代写

A stock price is $29. An investor buys one call option contract on the stock with a strike price of $30 and sells a call option contract on the stock with a strike price of $32.50. The market prices of the options are $2.75 and $1.50, respectively. The options have the same maturity date. Describe the investor’s position.

Problem 1.28

The price of gold is currently $800 per ounce. Forward contracts are available to buy or sell gold at $1,000 for delivery in one year. An arbitrageur can borrow money at 10% per annum. What should the arbitrageur do? Assume that the cost of storing gold is zero and that gold provides no income.

Problem 1.29

Discuss how foreign currency options can be used for hedging in the situation described in Example 1.1 so that: (a) ImportCo is guaranteed that its exchange rate will be less than 0.98257, and (b) ExportCo is guaranteed that its exchange rate will be at least 0.98223.

Problem 1.30 期货基础代写

The current price of a stock is $94, and three-month European call options with a strike price of $95 currently sell for $4.70. An investor who feels that the price of the stock will increase is trying to decide between buying 100 shares and buying 2,000 call options (20 contracts). Both strategies involve an investment of $9,400. What advice would you give? How high does the stock price have to rise for the option strategy to be more profitable?

Problem 1.31

On 7 January 2011, an investor owns 1,000 BHP shares. As indicated in Table 1.2, the share price is $44.60 and an April put option with a strike price of $44 costs $1.61. The investor is comparing two alternatives to limit downside risk. The first involves buying one April put option contract with a strike price of $44. The second involves instructing a broker to sell the 1,000 shares as soon as BHP’s price reaches $44. Discuss the advantages and disadvantages of the two strategies.

Problem 1.32

A trader buys a European call option and sells a European put option. The options have the same underlying asset, strike price and maturity. Describe the trader’s position. Under what circumstances does the price of the call equal the price of the put?

Week 2 期货基础代写

Mechanics of Futures Markets

Practice Questions

Consolidate

Problem 2.8

Explain how margins protect investors against the possibility of default.

Problem 2.9

A trader buys two July futures contracts on frozen orange juice. Each contract is for the delivery of 15,000 pounds. The current futures price is 160 cents per pound, the initial margin is $6,000 per contract and the maintenance margin is $4,500 per contract. What price change would lead to a margin call? Under what circumstances could $2,000 be withdrawn from the margin account?

Problem 2.10

Explain the difference between a market-if-touched order and a stop order.

Problem 2.11

Explain what a stop-limit order to sell at 20.30 with a limit of 20.10 means.

Problem 2.12

The forward price on the Swiss franc for delivery in 45 days is quoted as 1.1000. The futures price for a contract that will be delivered in 45 days is 0.9000. Explain these two quotes. Which is more favourable for an investor wanting to sell Swiss francs?

Problem 2.13

An Australian wool exporter expects to receive USD 10 million worth of wool in 30 days. The forward price of the Australian dollar for delivery in 30 days is quoted as 1.0150. The futures price for a contract that will be delivered in 30 days is 0.9950. Explain these two quotes. Which is more favourable for the exporter?

Problem 2.14

Suppose you call your broker and issue instructions to sell one October greasy wool contract. Describe what happens.

Problem 2.15

Identify the three futures contracts in Table 2.2 which have the highest open position/open interest.

Development 期货基础代写

Problem 2.16

The party with a short position in a futures contract sometimes has options as to the precise asset that will be delivered, where delivery will take place, when delivery will take place and so on. Do these options increase or decrease the futures price? Explain your reasoning.

Problem 2.17

What are the most important aspects of the design of a new futures contract?

Problem 2.18

Show that, if the futures price of a commodity is greater than the spot price during the delivery period, then there is an arbitrage opportunity. Does an arbitrage opportunity exist if the futures price is less than the spot price? Explain your answer.

Problem 2.19 期货基础代写

At the end of one day a clearinghouse member is long 100 contracts and the settlement price is $50,000 per contract. The original margin is $2,000 per contract. On the following day the member becomes responsible for clearing an additional 20 long contracts, entered into at a price of $51,000 per contract. The settlement price at the end of this day is $50,200. How much does the member have to add to its margin account with the exchange clearinghouse?

Problem 2.20

On 1 July 2012, a US company enters into a forward contract to buy AUD 1 million with US dollars on 1 January 2013. On 1 September 2012, it enters into a forward contract to sell AUS 1 million on 1 January 2013. Describe the profit or loss the company will make in dollars as a function of the forward exchange rates on 1 July 2012 and 1 September 2012.

Problem 2.21

‘Speculation in futures markets is pure gambling. It is not in the public interest to allow speculators to trade on a futures exchange.’ Discuss this viewpoint.

Problem 2.22

‘When a futures contract is traded on the floor of the exchange, it may be the case that the open interest increases by one, stays the same, or decreases by one.’ Explain this statement.

Problem 2.23

Suppose that on 24 October 2011, a company sells three September 2012 wheat futures contract. It closes out its position on 21 July 2012. The futures price (per tonne) is AUD 305.00 when it enters into the contract, AUD 302.40 when it closes out the position and AUD 303.00 at the end of June 2012. One contract is for the delivery of 200 metric tonnes of wheat. What is the profit? How is it taxed if the company is: (a) a hedger, and (b) a speculator? Assume that the company has a 30 June accounting year end.

Extension

Problem 2.24

What do you think would happen if an exchange started trading a contract in which the quality of the underlying asset was incompletely specified?

Assignment Questions 期货基础代写

Problem 2.25

Trader A enters into futures contracts to buy 1 million euros for 1.3 million Australian dollars in three months. Trader B enters in a forward contract to do the same thing. The exchange rate (Australian dollars per euro) declines sharply during the first two months and then increases for the third month to close at AUD 1.3300. Ignoring daily settlement, what is the total profit of each trader? When the impact of daily settlement is taken into account, which trader has done better?

Problem 2.26

Explain what is meant by open position/open interest. Why does the open position/open interest usually decline during the month preceding the delivery month? On a particular day there are 2,000 trades in a particular futures contract. Of the 2,000 traders on the long side of the market, 1,400 were closing out position and 600 were entering into new positions. Of the 2,000 traders on the short side of the market, 1,200 were closing out position and 800 were entering into new positions. What is the impact of the day’s trading on open position?

Problem 2.27

One orange juice futures contract is on 15 000 pounds of frozen concentrate. Suppose that in September 2011 a company sells a March 2013 orange juice futures contract for 120 cents per pound. In December 2011, the futures price is 140 cents; in December 2012, it is 110 cents; and in February 2013, it is closed out at 125 cents. The company has a December year end. What is the company’s profit or loss on the contract? How is it realised? What is the accounting and tax treatment of the transaction if the company is classified as: (a) a hedger, and (b) a speculator?

Problem 2.28 期货基础代写

A company enters into a short futures contract to sell 5,000 bushels of wheat for 450 cents per bushel. The initial margin is $3,000 and the maintenance margin is $2,000. What price change would lead to a margin call? Under what circumstances could $1,500 be withdrawn from the margin account?

Problem 2.29

Suppose that there are no storage costs for greasy wool and the interest rate for borrowing or lending is 3% per annum. The greasy wool futures contract for December 2012 is quoted at AUD 9.55 per kilogram, while the June 2013 contract is quoted at AUD 9.89 per kilogram. One contract is for delivery of 2,500 kilograms. How could you make money by trading the December 2012 and June 2013 greasy wool futures contracts today?

Problem 2.30

What position is equivalent to a long forward contract to buy an asset at on a certain date and a put option to sell it foron that date?

Week 3 期货基础代写

Hedging Strategies Using Futures

Practice Questions

Consolidate

Problem 3.8

In the Chicago Board of Trade’s corn futures contract, the following delivery months are available: March, May, July, September and December. State the contract that should be used for hedging when the expiration of the hedge is in:

a) June

b) July

c) January

Problem 3.9

Does a perfect hedge always succeed in locking in the current spot price of an asset for a future transaction? Explain your answer.

Problem 3.10

Explain why a short hedger’s position improves when the basis strengthens unexpectedly and worsens when the basis weakens unexpectedly.

Problem 3.11

‘If there is no basis risk, the minimum variance hedge ratio is always 1.0.’ Is thstatement true? Explain your answer.

Problem 3.12

‘For an asset where futures prices are usually less than spot prices, long hedges are likely to be particularly attractive.’ Explain this statement.

Problem 3.13

‘If the minimum-variance hedge ratio is calculated as 1.0, the hedge must be perfect.’ Is this statement true? Explain your answer.

Development 期货基础代写

Problem 3.14

Suppose that in Example 3.4 the company decides to use a hedge ratio of 0.8. How does the decision affect the way in which the hedge is implemented and the result?

Problem 3.15

The standard deviation of monthly changes in the spot price of Western Australian wheat is (in AUD per metric tonne) 1.2. The standard deviation of monthly changes in the futures price of Western Australian wheat for the closest contract is 1.4. The correlation between the futures price changes and the spot price changes is 0.7. It is now 15 October. A flour mill is committed to purchasing 5,000 metric tonnes of Western Australian wheat on 5 January. The flour mill wants to use the January Western Australian wheat futures contracts to hedge its risk. Each contract is for the delivery of 20 metric tonnes of wheat. What strategy should the flour mill follow?

Problem 3.16 期货基础代写

On 1 July, an investor holds 50,000 shares of a certain stock. The market price is AUD 30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September ASX/SPI 200 futures contract. The index is currently 4,000 and one contract is for delivery of AUD 25 times the index. The beta of the stock is 1.3. What strategy should the investor follow? Under what circumstances will it be profitable?

Problem 3.17

Suppose that in Table 3.5 the company decides to use a hedge ratio of 1.5. How does the decision affect the way the hedge is implemented and the result?

Problem 3.18

A futures contract is used for hedging. Explain why the daily settlement of the contract can give rise to cash flow problems.

Problem 3.19

The expected return on the S&P/ASX 200 stock market index is 12% and the risk-free rate is 5%. What is the expected return on the investment with a beta of: (a) 0.2, (b) 0.5, and (c) 1.4?

Extension 期货基础代写

Problem 3.20

Imagine you are the treasurer of a Japanese company exporting electronic equipment to the United States. Discuss how you would design a foreign exchange hedging strategy and the arguments you would use to sell the strategy to your fellow executives.

Problem 3.21

It is 1 September. An Australian wool farmer expects to sell 20,000 kilograms of greasy wool on 25 September. The October futures price for greasy wool is currently AUD 220 per kilogram. The contract size is 2,500 kilograms of greasy wool. Design a hedging strategy for this farmer using the October futures contract. Using the concept of basis risk determine the outcome of the hedging strategy if the spot price on 25 September is AUD 225 per kilogram and the futures price is AUD 235 per kilogram.

Problem 3.22

It is 1 November. An Australian clothing manufacturer needs to purchase 20,000 kilograms of greasy wool on 18 November. The December futures price for greasy wool is currently AUD 215 per kilogram. The contract size is 2,500 kilograms of greasy wool. Design a hedging strategy for this manufacturer using the December futures contract. Using the concept of basis risk determine the outcome of the hedging strategy if the spot price on 25 September is AUD 200 per kilogram and the futures price is AUD 205 per kilogram.

Assignment Questions 期货基础代写

Problem 3.23

A company wishes to hedge its exposure to a new fuel whose price changes have a 0.6 correlation with gasoline futures price changes. The company will lose USD 1 million for each 1 cent increase in the price per gallon of the new fuel over the next three months. The new fuel’s price change has a standard deviation that is 50% greater than price changes in gasoline futures prices. If gasoline futures are used to hedge the exposure what should the hedge ratio be? What is the company’s exposure measured in gallons of the new fuel? What position, measured in gallons, should the company take in gasoline futures? How many gasoline futures contracts should be traded?

Problem 3.24

A portfolio manager has maintained an actively managed portfolio with a beta of 0.2. During the last year the risk-free rate was 5% and equities performed very badly providing a return of −30%. The portfolio manager produced a return of −10% and claims that in the circumstances it was good. Discuss this claim.

Problem 3.25

It is 16 July. A US company has a portfolio of stocks worth USD 100 million. The beta of the portfolio is 1.2. The company would like to use the Chicago Mercantile Exchange (CME) December futures contract on the S&P 500 to change the beta of the portfolio to 0.5 during the period 16 July to 16 November. The index futures price is 1,000 and each contract is on USD 250 times the index.

a) What position should the company take?

b) Suppose that the company changes its mind and decides to increase the beta of the portfolio from 1.2 to 1.5. What position in futures contracts should it take?

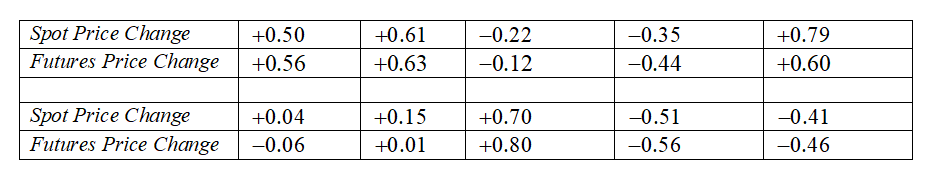

Problem 3.26 (Excel file)

The following table gives data on monthly changes in the spot price and the futures price for a certain commodity. Use the data to calculate a minimum variance hedge ratio.

Problem 3.27 (Excel file)

It is now October 2012. A company anticipates that it will purchase 1 million pounds of copper in each of February 2013, August 2013, February 2014 and August 2014. The company has decided to use the futures contracts traded in the COMEX division of the CME Group to hedge its risk. One contract is for the delivery of 25,000 pounds of copper. The initial margin is USD 2,000 per contract and the maintenance margin is USD 1,500 per contract. The company’s policy is to hedge 80% of its exposure. Contracts with maturities up to 13 months into the future are considered to have sufficient liquidity to meet the company’s needs. Devise a hedging strategy for the company. (Do not make the ‘tailing’ adjustment described in Section 3.4.)

Problem 3.28 期货基础代写

A fund manager has a portfolio worth USD contracts on the 50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures S&P 500 to hedge the risk. The current level of the index is 1250, one contract is on USD 250 times the index, the risk-free rate is 6% per annum and the dividend yield on the index is 3% per annum. The current three-month futures price is 1259.

a) What position should the fund manager take to eliminate all exposure to the market over the next two months?

b) Calculate the effect of your strategy on the fund manager’s returns if the level of the market in two months is 1,000, 1,100, 1,200, 1,300 and 1,400. Assume that the one-month futures price is 0.25% higher than the index level at this time.

| Index now | 1250 | 1250 | 1250 | 1250 | 1250 |

| Index Level in Two Months | 1000 | 1100 | 1200 | 1300 | 1400 |

| Return on Index in Two Months | -0.20 | -0.12 | -0.04 | 0.04 | 0.12 |

| Return on Index incl divs | -0.195 | -0.115 | -0.035 | 0.045 | 0.125 |

| Excess Return on Index | -0.205 | -0.125 | -0.045 | 0.035 | 0.115 |

| Excess Return on Portfolio | -0.178 | -0.109 | -0.039 | 0.030 | 0.100 |

| Return on Portfolio | -0.168 | -0.099 | -0.029 | 0.040 | 0.110 |

| Portfolio Gain | -8,417,500 | -4,937,500 | -1,457,500 | 2,022,500 | 5,502,500 |

| Futures Now | 1259 | 1259 | 1259 | 1259 | 1259 |

| Futures in Two Months | 1002.50 | 1102.75 | 1203.00 | 1303.25 | 1403.50 |

| Gain on Futures | 8,849,250 | 5,390,625 | 1,932,000 | -1,526,625 | -4,985,250 |

| Net Gain on Portfolio | 431,750 | 453,125 | 474,500 | 495,875 | 517,250 |

Week 4 期货基础代写

Determination of Forward and Futures Prices

Practice Questions

Consolidate

Problem 5.8

Is the futures price of a stock index greater than or less than the expected future value of the index? Explain your answer.

Problem 5.9

The risk-free rate of interest is 7% per annum with continuous compounding and the dividend yield on a stock index is 3.2% per annum. The current value of the index is 150. What is the six-month futures price?

Problem 5.10

The risk-free rate of interest is 6% per annum with continuous compounding and the dividend yield on NAB is 2% per annum. The current value of the NAB share is AUD 26. What is the three-month futures price?

Problem 5.11

Estimate the difference between short-term interest rates in Japan and the United States on 13 January 2012, from the information in Table 5.4.

Problem 5.12

It is sometimes argued that a forward exchange rate is an unbiased predictor of future exchange rates. Under what circumstances is this so?

Development 期货基础代写

Problem 5.13

A one-year long forward contract on a non-dividend-paying stock is entered into when the stock price is AUD 40 and the risk-free rate of interest is 10% per annum with continuous compounding. What are the forward price and the initial value of the forward contract? Six months later, the price of the stock is AUD 45 and the risk-free interest rate is still 10%. What are the forward price and the value of the forward contract?

Problem 5.14

Assume that the risk-free interest rate is 9% per annum with continuous compounding and that the dividend yield on a stock index varies throughout the year. In February, May, August and November, dividends are paid at a rate of 5% per annum. In other months, dividends are paid at a rate of 2% per annum. Suppose that the value of the index on 31 July is 1,300. What is the futures price for a contract deliverable on 31 December of the same year?

Problem 5.15

Suppose that the risk-free interest rate is 10% per annum with continuous compounding and that the dividend yield on a stock index is 4% per annum. The index is standing at 400, and the futures price for a contract deliverable in four months is 405. What arbitrage opportunities does this create?

Problem 5.16 期货基础代写

The two-month interest rates in Australia and the United States are 4.5% and 1% per annum, respectively, with continuous compounding. The spot price of the US dollar per Australian dollar is 0.9850. The futures price for a contract deliverable in two months is 0.9900. What arbitrage opportunities does this create?

Problem 5.17

The current price of silver is USD 15 per ounce. The storage costs are USD 0.24 per ounce per year payable quarterly in advance. Assuming that interest rates are 10% per annum for all maturities, calculate the futures price of silver for delivery in nine months.

Problem 5.18

The current price of Australian greasy wool is AUD 220 per kilogram. The storage costs are AUD 10 per kilogram per year payable semi-annually in advance. Assuming that interest rates are 6% per annum for all maturities, calculate the futures price of Australian greasy wool for delivery in six months.

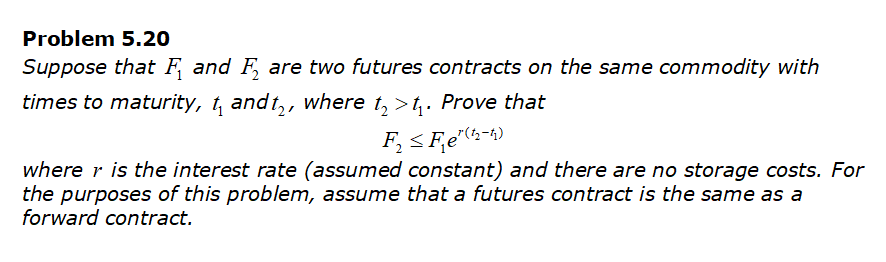

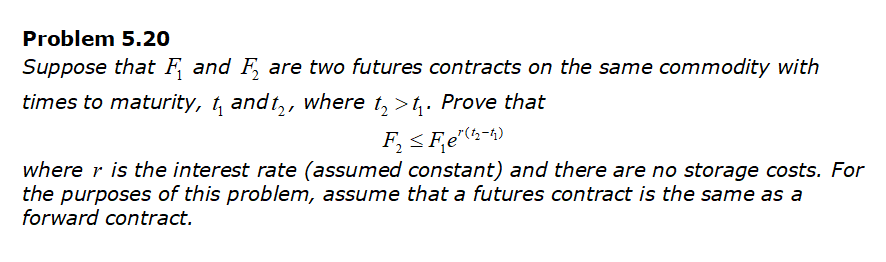

Problem 5.19 (Excel file)

Suppose that the two-year interest rates in Australia and the United States are 5.6% and 0.5% per annum, respectively, and the spot exchange rate between the Australian dollar (AUD) and the US dollar (USD) is 1.0300 USD per one unit of AUD. Determine the theoretical forward exchange rate from the perspective of an Australian investor wanting to purchase USD in two years’ time

Problem 5.21

When a known future cash outflow in a foreign currency is hedged by a company using a forward contract, there is no foreign exchange risk. When it is hedged using futures contracts, the daily settlement process does leave the company exposed to some risk. Explain the nature of this risk. In particular, consider whether the company is better off using a futures contract or a forward contract when:

a) The value of the foreign currency falls rapidly during the life of the contract.

b) The value of the foreign currency rises rapidly during the life of the contract.

c) The value of the foreign currency first rises and then falls back to its initial value.

d) The value of the foreign currency first falls and then rises back to its initial value.

Assume that the forward price equals the futures price.

Problem 5.22

Show that the growth rate in an index futures price equals the excess return of the portfolio underlying the index over the risk-free rate. Assume that the risk-free interest rate and the dividend yield are constant.

Extension 期货基础代写

Problem 5.23

Show that equation (5.3) is true by considering an investment in the asset combined with a short position in a futures contract. Assume that all income from the asset is reinvested in the asset. Use an argument similar to that in footnotes 2 and 4 and explain in detail what an arbitrageur would do if equation (5.3) did not hold.

Problem 5.24

Explain carefully what is meant by the expected price of a commodity on a particular future date. Suppose that the futures price of crude oil declines with the maturity of the contract at the rate of 2% per year. Assume that speculators tend to be short crude oil futures and hedgers tended to be long crude oil futures. What does the Keynes and Hicks argument imply about the expected future price of oil?

Problem 5.25

The Value Line index is designed to reflect changes in the value of a portfolio of over 1,600 equally weighted stocks. Prior to 9 March 1988, the change in the index from one day to the next was calculated as the geometric average of the changes in the prices of the stocks underlying the index. In these circumstances, does equation (5.8) correctly relate the futures price of the index to its cash price? If not, does the equation overstate or understate the futures price?

Assignment Questions 期货基础代写

Problem 5.26

An index is 1,200. The three-month risk-free rate is 3% per annum and the dividend yield over the next three months is 1.2% per annum. The six-month risk-free rate is 3.5% per annum and the dividend yield over the next six months is 1% per annum. Estimate the futures price of the index for three-month and six-month contracts. All interest rates and dividend yields are continuously compounded.

Problem 5.27

The current USD/euro exchange rate is 1.4000 dollar per euro. The six-month forward exchange rate is 1.3950. The six-month USD interest rate is 1% per annum continuously compounded. Estimate the six-month euro interest rate.

Problem 5.28

The spot price of oil is USD 80 per barrel and the cost of storing a barrel of oil for one year is USD 3, payable at the end of the year. The risk-free interest rate is 5% per annum, continuously compounded. What is an upper bound for the one-year futures price of oil?

Problem 5.29

A stock is expected to pay a dividend of AUD 1 per share in two months and in five months. The stock price is AUD 50 and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a six-month forward contract on the stock.

a) What are the forward price and the initial value of the forward contract?

b) Three months later, the price of the stock is AUD 48 and the risk-free rate of interest is still 8% per annum. What are the forward price and the value of the short position in the forward contract?

Week 5 期货基础代写

Swaps

Practice Questions

Consolidate

Problem 7.8

Explain why a bank is subject to credit risk when it enters into two offsetting swap contracts.

Problem 7.9

Companies X and Y have been offered the following rates per annum on a $5 million 10-year investment:

| Fixed rate | Floating rate | |

| Company x: | 8.0% | BBSW |

| Company y: | 8.8% | BBSW |

Company X requires a fixed-rate investment and company Y requires a floating-rate investment. Design a swap that will net a bank, acting as intermediary, 0.2% per annum and will appear equally attractive to X and Y.

Problem 7.10

A financial institution has entered into an interest rate swap with company X. Under the terms of the swap, it receives 10% per annum and pays six-month BBSW on a principal of $10 million for five years. Payments are made every six months. Suppose that company X defaults on the sixth payment date (end of year 3) when the interest rate (with semi-annual compounding) is 8% per annum for all maturities. What is the loss to the financial institution? Assume that six-month BBSW was 9% per annum halfway through year 3.

Development 期货基础代写

Problem 7.11

A financial institution has entered into a 10-year currency swap with company Y. Under the terms of the swap, the financial institution receives interest at 3% per annum in Swiss francs and pays interest at 8% per annum in Australian dollars. Interest payments are exchanged once a year. The principal amounts are 7 million dollars and 10 million francs. Suppose that company Y declares bankruptcy at the end of year 6, when the exchange rate is $0.80 per franc. What is the cost to the financial institution? Assume that, at the end of year 6, the interest rate is 3% per annum in Swiss francs and 8% per annum in Australian dollars for all maturities. All interest rates are quoted with annual compounding.

Problem 7.12

Companies A and B face the following interest rates (adjusted for the differential impact of taxes):

| A | B | |

| Australian dollars (Floating rate): | BBSW + 0.5% | BBSW + 1.0% |

| Canadian dollars (Fixed rate): | 5.0% | 6.5% |

Assume that A wants to borrow Australian dollars at a floating rate of interest and B wants to borrow Canadian dollars at a fixed rate of interest. A financial institution is planning to arrange a swap and requires a 50-basis-point spread. If the swap is to appear equally attractive to A and B, what rates of interest will A and B end up paying?

Problem 7.13

After it hedges its foreign exchange risk using forward contracts, is the financial institution’s average spread in Figure 7.11 likely to be greater than or less than 20 basis points? Explain your answer.

Problem 7.14

‘Companies with high credit risks are the ones that cannot access fixed-rate markets directly. They are the companies that are most likely to be paying fixed and receiving floating in an interest rate swap.’ Assume that this statement is true. Do you think it increases or decreases the risk of a financial institution’s swap portfolio? Assume that companies are most likely to default when interest rates are high.

Extension 期货基础代写

Problem 7.15

Why is the expected loss from a default on a swap less than the expected loss from the default on a loan with the same principal?

Problem 7.16

A bank finds that its assets are not matched with its liabilities. It is taking floating-rate deposits and making fixed-rate loans. How can swaps be used to offset the risk?

Problem 7.17

Explain how you would value a swap that is the exchange of a floating rate in one currency for a fixed rate in another currency.

Problem 7.18

The BBSW zero curve is flat at 5% (continuously compounded) out to 1.5 years. Swap rates for 2- and 3-year semi-annual pay swaps are 5.4% and 5.6%, respectively. Estimate the BBSW zero rates for maturities of 2.0, 2.5 and 3.0 years. (Assume that the 2.5-year swap rate is the average of the 2- and 3-year swap rates.)