Investimentos

Second Midterm

投资考试代考 Rules:You cannot separate the exam sheets; Explicitly state any assumptions you take, either to numerically solve the problems or

Rules:

- You cannot separate the exam sheets;

- Explicitly state any assumptions you take, either to numerically solve the problems or in the essay questions

Good luck!

Case 1 (3 points)

Answer (briefly and objectively) to only two of the following questions:

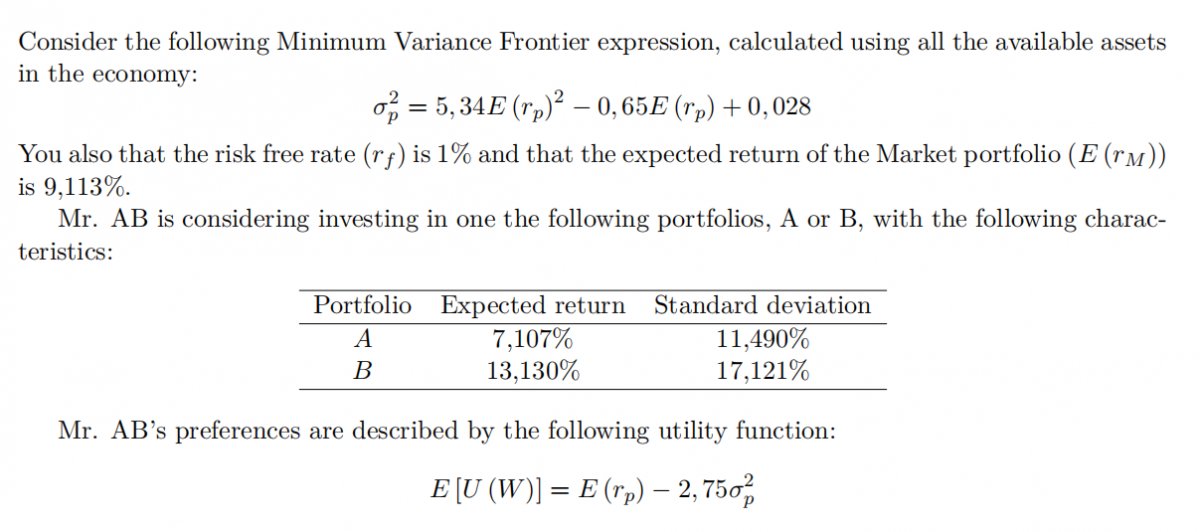

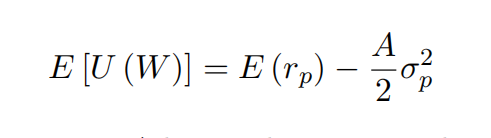

1.[1,5p] Suppose that there is no risk free asset and that investor’s preferences can be adequately represented by the following utility function:

Show that the risk aversion parameter A has to be greater than zero for the optimal portfolio to be on the efficient frontier of the Markowitz model.

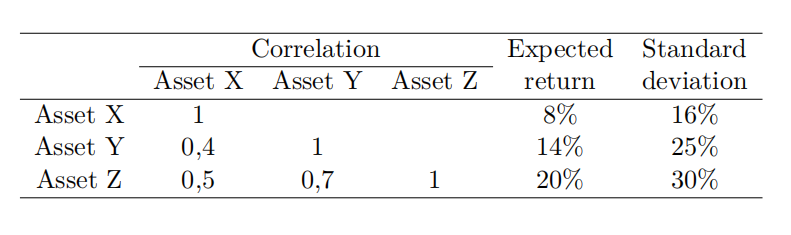

2.[1,5p] Suppose you want to build a frontier portfolio with expected return of 16% using a combination of the three assets described below:

Write down the optimization problem that you would need to solve in order to identify the composition of this frontier portfolio. (Note: you don’t need to actually solve the problem, just write it down.)

3.[1,5p] Prove that, with constant ROE and payout ration p, the growth rate of dividends g is a constant and equal to ROE × (1 − p).

Case 2 (6 points) 投资考试代考

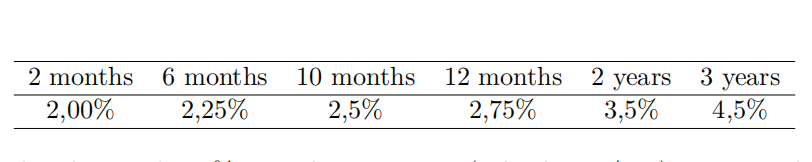

For a settlement date of June 9th, 2015, we know the following annual effective Treasury rates (calendar 30/360):

The treasury bond X, with a 6% annual coupon rate (calendar 30/360), was issued in August 21st, 2011 with a 6 year maturity.

The Treasury Capitalization bond Y, was issued at par on June 9th, 2012, with a 4 year maturity and a 5% semi-annual coupon (calendar 30/360).

1.[1,5p]

Find the Bond X’s fair value, knowing that at the settlement date, it has 288 days of accrued interest.

2.[1p]

Find the Fisher-Weil Duration of Bond X.

3.[1p] 投资考试代考

Find the Fair Value of Bond Y.

4.[1p]

How much should you invest in Bonds X and Y given that you want to build a portfolio with a Fisher-Weil Duration of 1,6 years and invest a total of 5 million Euros? Assume that both Bonds currently trade at their fair value.

5.[1,5p]

Consider the following variable rate Bond, with a Euribor6M +2% semi-annual coupon, BBB rating, with maturity on March 4th, 2016. The issuer offers a 5% redemption premium.

You also know that the risk premium between BBB and Treasury is 5% and that the risk premium between Money Market and Treasury is 1%. The Treasury is less risky than the BBB rating and the Money Market. By March 4th 2015, Euribor6M was 2%. Find this Bond’s fair value, considering that there are 85 days between June 9th and September 4th, 2015 (according to 30/360 calendar).

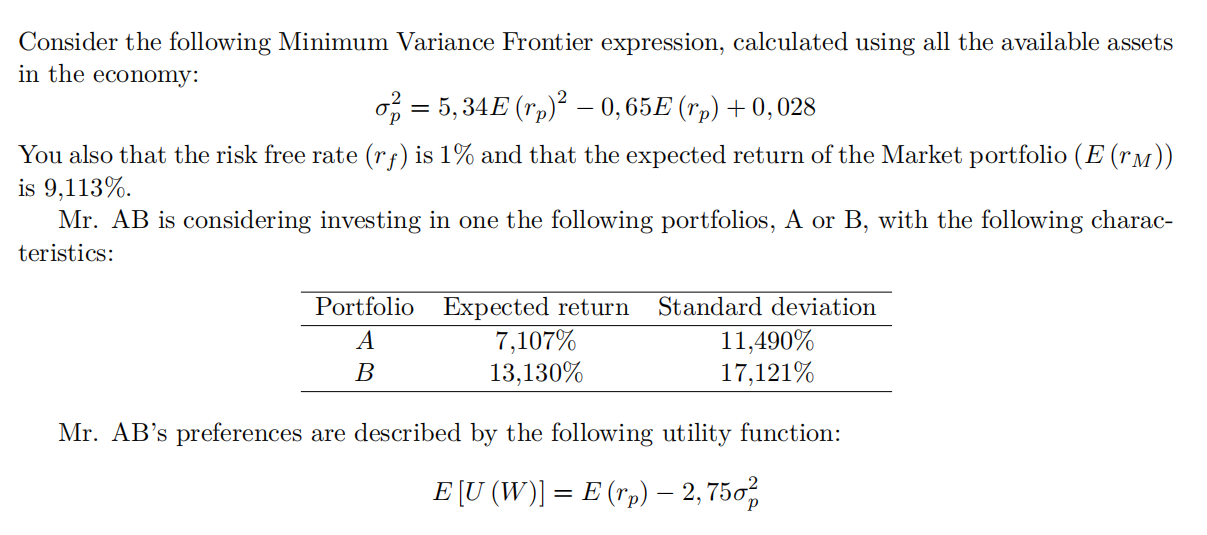

Case 3 (8 points) 投资考试代考

1.[1,5p]

Assuming that you cannot use the risk free asset, check if portfolio A is efficient (this obviously means that portfolio is made up only risky assets).

2.[1p]

If you found A not to be efficient, find the highest possible gain in expected return possible, using risky assets only, for the same risk level of portfolio A. If you found A to be efficient, find the lowest possible expected return, for the same risk level of portfolio A. (Note: If you didn’t answer part 1, make an assumption over the efficiency of portfolio A).

3.[0,5p]

Show whether it is possible that portfolio B is made up exclusively of risky assets.

4.[1p] 投资考试代考

Find the expected return and standard deviation of the optimal portfolio, among those exclusively composed by risky assets, given Mr. AB’s preferences.

5.[1p]

Consider that you are now able to include the risk free asset in your investment choices. Assuming the CAPM holds and that the market is in equilibrium, find the expected return, standard deviation and the composition of Mr. AB’s optimal portfolio

6.[0,75p]

Consider that, you are only able to take a long position in the risk free asset, i.e., you are allowed to lend but not borrow at the risk free rate. In this situation, there is no longer A single market portfolio, that would correspond to the tangency portfolio, as the CAPM assumptions would not hold anymore. Let’s anyway consider that the Market Portfolio will still be the tangency portfolio, as before. In light of this, determine the expected return and the standard deviation of the Mr. AB’s optimal portfolio.

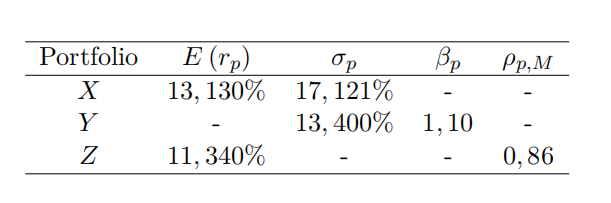

7.[2,25p]

Considering that the CAPM holds, that the market is in equilibrium (i.e., all assets have a zero Jensen’s alpha), consider the following portfolios:

(a) [0,75p] Analyze the efficiency of each of these portfolio, according to the CAPM.

(b) [0,75p] Determine the Total, Systematic and Specific risk (expressed as standard deviations) of all three portfolios, and identify those that are completely diversified

(c) [0,75p] Determine the Sharpe and Treynor ratios for all three portfolios.

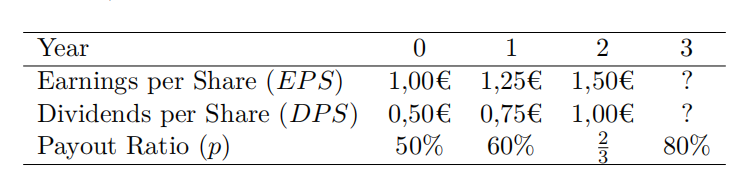

Case 4 (3 points) 投资考试代考

We present below the data for Madeup Inc., (year 0 data corresponds to actual values, years 1, 2 and 3 correspond to projections):

The risk free rate is 3%, the market risk premium is 6% and the beta for the stock is 1,5.

From year 3 onwards, the firm will have a constant growth rate, a constant 80% payout ratio and constant 15% Return on Equity.

The stock currently trades at 13,95€/14,05€ (Bid/Ask).

1.[1,5p]

What is the stock’s fair value, immediately after the last dividend was paid (i.e., exactly one year from receiving year 1’s dividend)? What is your trading recommendation?

2.[0,75p] 投资考试代考

Consider now that from year 3 onwards there will be zero earnings and dividend growth. Determine the stock’s fair value and, consequently, what is the implied Present Value of Growth Opportunities implied in the mid market price.

3.[0,75p]

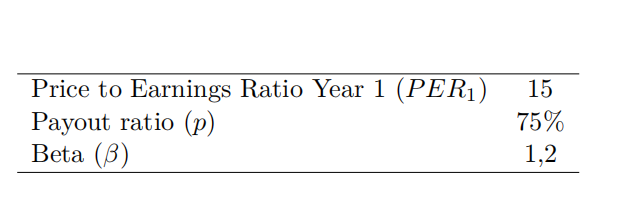

Consider the following information on the average industry values for Madeup Inc’s industry:

How do you compare Madeup with the industry and, with that in mind, would you keep the trading decision formulated in part 1? Explain.

更多代写:计算机台湾台湾网课代修 GRE代考 英国生物学labreport代考 商业essay论文代写 市场营销论文代写 英国学术代写