Investment Analysis

投资分析考试代写 1) MEAN VARIANCE UTILITY I: You are a risk-averse investor with mean variance utility and are given the following information about 3 assets:

READ THIS CAREFULLY:

You are not allowed to work with others while taking the exam.

This test is a combination of short answer and Excel-based questions and is worth 100 points total. Each question tells you how many points it’s worth.

Short Answer Problems: Type your answers on the test sheet Word document. Don’t write everything you know about the topic. Just answer the question directly and accurately. Insert your text and use as much space as you need.

Excel Problems: Do these problems in an Excel file. Use a separate tab for each question. Put your answers on the Word document test sheet. If they are correct, you’ll get full credit. If not, I will look at your Excel file and see if I can give you partial credit. Note: Write all of your numerical answers to at least three decimal points.

Submission: Submit your Excel file and Word file using the Link provided in the Final Exam folder.

Open Book Test: You may use any materials from class you wish (e.g., lecture notes, slides, your group’s problem solving solutions, etc.). For this test you are also allowed to use problem-solving solutions I’ve posted. You are not allowed to use any materials from the internet or from any other sources.

Good luck!

SHORT ANSWER QUESTIONS (70 points total) 投资分析考试代写

1) Mean Variance Utility I:

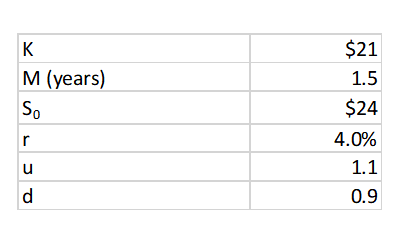

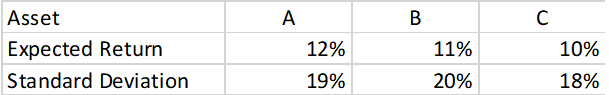

You are a risk-averse investor with mean variance utility and are given the following information about 3 assets: (12 points)

You may only hold one of the assets.

a) If you had to choose between holding asset A and B, what additional information would you need to make the decision?

b) If you had to choose between holding asset A and C, what additional information would you need to make the decision?

c) If you had to choose between holding asset B and C, what additional information would you need to make the decision?

2) Mean Variance Utility II:

Suppose you are given that the expected excess return on the market portfolio is -5% (negative 5%), the standard deviation of the market portfolio is 20% and the risk free rate is 1%. You have mean variance utility with A = 4. Short sales of the market portfolio are not allowed. How much of the market portfolio and how much of the risk-free asset would you hold? (12 points)

3) Optimal Risky Portfolio: 投资分析考试代写

We learned that a risk-averse mean-variance investor will always choose the portfolio on the efficient frontier with the highest Sharpe ratio as her optimal risky portfolio. If the investor is risk averse, why doesn’t she choose the global minimum variance portfolio instead? You must explain your answer using the concept of a Capital Allocation Line (CAL). (12 points)

4) Perfect Negative Correlation:

You hold a portfolio of Normal Company and Contrary Company stock. Whatever Normal Company does, Contrary Company does the opposite, so the returns on their stocks are perfectly negatively correlated (r = -1). Your portfolio is 2/3 Normal Company and 1/3 Contrary Company. (12 points)

a) Suppose you estimate that σNormal= 15% and σContrary= 15%. Can you estimate the CAPM expected return of your portfolio with this information? If not, what additional information would you need to estimate the CAPM expected return on this portfolio?

b) Suppose instead, you estimate that σNormal= 10% and σContrary= 20%. Can you estimate the CAPM expected return of your portfolio with this information? If not, what additional information would you need to estimate the CAPM expected return on this portfolio?

5) Bond Pricing: 投资分析考试代写

You just bought a 10-year coupon bond with an annual coupon of 5%. You paid par for the bond ($100 price). You just found out that the same company is issuing another bond with the same maturity and coupon, but this bond gives you the right to sell the bond back to the company for par at any time between 3 years from now and 10 years from now. Would this bond be priced above par or below par? Would its yield to maturity be greater or less than the bond you just purchased. You must explain your answer. (11 points)

6) Binomial Trees:

When we studied binomial trees we calculated the risk neutral probability p. I explained that it is not the probability of an “up” move in the real world. Why then do we call it a probability? Explain in detail using words and not formulas. (11 points)

EXCEL-BASED QUESTIONS (30 points total) 投资分析考试代写

7) Butterfly Spread Strategy:

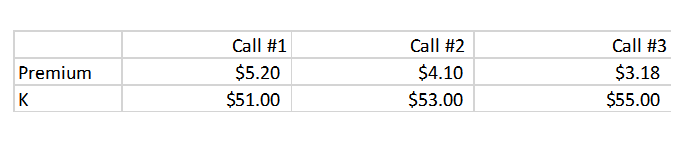

In a butterfly spread, the investor is long one call option with strike K1, short 2 call options with strike K2 and long one call option with strike K3. The strikes are set such that K1 < K2 < K3. (15 points)

a) You are given the following data

Graph the payoff and net profit of the entire position as a function of ST. Please paste the graph into this document. What is the total premium to take on the position? Do you pay it or receive it?

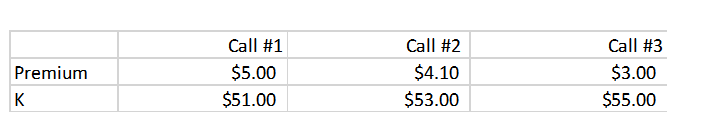

b) Suppose instead you are given this data with changed premiums.

Repeat part a). Do you see anything unrealistic about these premiums? If so, why? (Note: you only get credit for answering the question).

8) Three Step Binomial Tree:

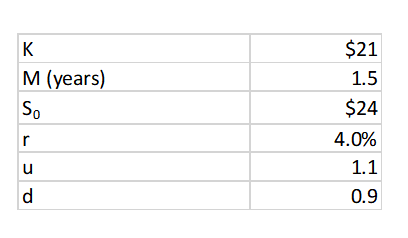

Create a three-step tree given the following data on a European call option with no dividends on the underlying stock. Your step size should be .5 years. (15 points)

What is p, the risk-neutral probability? What is the call premium?

更多代写:留学生Matlab代写 雅思代考 英国传播学论文代写 北美Essay代写收费 伯明翰大学论文代写 西南田纳西社区学院代写