REAL ESTATE INVESTMENT PORTFOLIO

By (Name)

The Name of the Class (Course)

Professor (Tutor)

The Name of the School (University)

The City and State where it is located

The Date

房地产学paper代写 This is an unrealistic assumption since the value of receivables in future cannot be equated to present value.

Introduction: Rental History and Trends in London

There has been a rapid shift to private renting in Britain in the recent past. This is highly attributed to the constraints in the mortgage market as well a decrease in the total deposits for most people reducing their economic ability of home ownership (Baum et al., 2011). Unfortunately, there is an acute shortage of information on rental demands, affordability and the associated investment returns.

It is however notable that there has been a rapid increase in rental stock in the UK by 42% in a period of five years ending 2012. This shift to private renting is expected to accelerate even more to reach 5.9 million rented households by 2016. The private sector is expected to meet this high demand estimated to be around £200 billion. However, this may which may not be actualized given the constraints in accessing funds by small developers who make up most of the population (Savills Research reports, 2012).

译文:

简介:伦敦的租赁历史和趋势

最近,英国迅速转向私人租赁。 这在很大程度上归因于抵押贷款市场的限制以及大多数人的总存款减少,从而降低了他们拥有房屋的经济能力(Baum 等,2011)。 不幸的是,关于租金需求、负担能力和相关投资回报的信息严重缺乏。

然而,值得注意的是,在截至 2012 年的五年期间,英国的租赁存量迅速增加了 42%。这种向私人租赁的转变预计将进一步加速,到 2016 年将达到 590 万个出租家庭。 预计私营部门将满足这一估计约为 2000 亿英镑的高需求。 然而,鉴于占人口大部分的小型开发商在获得资金方面的限制,这可能无法实现(第一太平戴维斯研究报告,2012 年)。

Market and Portfolio Appraisal and Analysis

This paper intends to consider an investment portfolio of buy to rent apartments. The portfolio in consideration takes into account an investment in 1-bedroom, 2-bedroom or 3-bedroom apartments in East London. The affordability, market, returns (rental yield) as well long-term return on investment of all the options will be analyzed in deciding which of the apartments to invest in. These factors are discussed in the following paragraphs as the paper seeks to analyze the London property market with an aim of justifying the viability of the investment choice made as well as its location.

The issues revolving rental affordability in London can only be effectively addressed when the supply of private rented housing relatively meets the demand for houses. This means that there has to be a significant increase in new housing stock. In 2012, it is estimated that £48 billion was paid as rent throughout Britain and this is estimated to increase to roughly £70 billion in the next five years. The supply to meet this high demand is painstakingly challenging since more people are constrained to buy or build their own homes (Hutchison, 1998).

As such, rental income is expected to rise and this seems to persuade investors for long term returns.

The relative investment returns compared to other short-term investments is a factor that is expected to dictate how well the demand-supply deficit will be met. Indeed, the average return on investment across the UK is an average of 5.8%. However, according to Frank Knight index 2013 this increases to 7.7% for larger investments that qualify to secure discounts and other economies of scale. However, the expected growth in investment returns is estimated to be an average of 8.2% in London in the next ten years. The London boroughs in the same period are expected to grow their returns on investment to between 7.3% and 9.1% (Savills Research reports, 2012). 房地产学paper代写

Moving forward, small scale investors are more likely to bring in a balance in the income yield and capital growth prospects. However, it is the large scale investors who are likely to bridge the demand gap for rental houses. This will eventually lead to a favorable system which will have affordable rental housing (Brueggema, 2010). The current trend in rental housing also indicates that more households in rented houses will continue to dwell in rented apartments for longer. It is therefore inevitable that private rentals will also include a large number of family housing.

The imbalance between rental supply and demand has consistently led to an increase in rent. In the next ten years, this increase was projected to be around7.2% in London in 2013 as well as returns though at a lower rate. This has led to a shift in investor perception on residential property. As such, there is need for investors as well as tenants to fully understand the relationship between affordable rent and capital investment alternatives (Geltner et al., 2007).

译文:

市场和投资组合评估与分析 房地产学paper代写

本文打算考虑购买出租公寓的投资组合。所考虑的投资组合考虑了在东伦敦的 1 居室、2 居室或 3 居室公寓的投资。在决定投资哪些公寓时,将分析所有选项的可负担性、市场、回报(租金收益率)以及长期投资回报。本文试图分析这些因素时,将在以下段落中讨论这些因素。伦敦房地产市场旨在证明所做出的投资选择及其位置的可行性。

只有当私人出租房屋的供应相对满足房屋需求时,伦敦的租金负担能力问题才能得到有效解决。这意味着新住房存量必须显着增加。 2012 年,英国各地的租金估计为 480 亿英镑,预计在未来五年内将增加到约 700 亿英镑。满足这种高需求的供应是一项艰巨的挑战,因为越来越多的人被迫购买或建造自己的房屋(Hutchison,1998)。

因此,租金收入预计会上升,这似乎可以说服投资者获得长期回报。

与其他短期投资相比,相对投资回报是一个因素,预计将决定满足供需赤字的程度。事实上,英国的平均投资回报率平均为 5.8%。然而,根据 2013 年弗兰克奈特指数,对于有资格获得折扣和其他规模经济的较大投资,这一比例增加到 7.7%。然而,预计未来十年伦敦的投资回报预期将平均增长8.2%。预计同期伦敦行政区的投资回报率将增长至 7.3% 至 9.1%(第一太平戴维斯研究报告,2012 年)。

展望未来,小规模投资者更有可能在收益收益率和资本增长前景之间取得平衡。然而,大型投资者可能会弥合租赁房屋的需求缺口。这最终将导致一个有利的系统,该系统将提供负担得起的出租房屋(Brueggema,2010)。当前出租房屋的趋势也表明,更多出租房屋的家庭将继续在出租公寓中居住更长时间。因此,私人出租不可避免地也会包含大量家庭住房。

租金供求失衡一直导致租金上涨。在接下来的十年中,预计 2013 年伦敦的这一增长将达到 7.2% 左右,但回报率会更低。这导致投资者对住宅物业的看法发生转变。因此,投资者和租户都需要充分了解负担得起的租金与资本投资选择之间的关系(Geltner 等,2007)。

2-Bedroom Apartments versus 1-Bedroom and 3-Bedroom Apartments

Across London, the average rent per bed falls as the number of rooms increase. The average asking rent for a two bedroom apartment in London varies from £9,000 to an extreme of £42,000. The monthly rent for a one bedroom is £533 per bed, £349 per bed for a two bedroom and £293 per bed for a three bedroom. This is another factor that has influenced the choice of investment taken. The gross yield of the different available choices of investment is the main factor that has influenced the option of two bedroom apartments. 房地产学paper代写

On average, one bedroom apartments yield a higher return than two bedroom houses. As the number of beds increases, the gross rental yields reduce. One bedroom apartments have their current gross yield rated at 7.8% across London, two bedroom ones have a yield of 7.2%, three bedroom at 6% while four bedroom ones are rated at 5.1%. As much as one bedroom apartments have a higher return, this alternative means that the only possible tenants of the houses are mainly individuals who are single. Such an inconvenience is not worth risking since it may take some time to get such tenants given the intended location.

Two bedroom apartments on the other hand offer more flexibility for young married couples or singles who can possibly share an apartment. The increasing rent as the number of beds decreases tends to put off tenants. This is due to the fact that for most of the renting generation in London, the rent they pay is about 53% of their earnings.

As such, apartment sharing trend is becoming a common phenomenon in London and hence the two bedroom apartments are more likely to be filled faster than the one bedroom houses.

The risk of unoccupied houses is far reaching given that the borrowed capital needs to be paid back in the first year of completion of the apartments. The three bedroom apartments on the other hand have lower rate of rental yields at 6% which is a difference of 1.2%. Consequently, it is more prudent to invest in two bedroom houses as opposed to one or three bedroom apartments.

It is undeniable that there is a substantial difference in terms of gross income between high value markets and low value markets (Dembinski, et al., 2003). The strongest market that yields higher returns is the mainly the smaller units in the low value markets in which tenants are mostly singles and young couples. As such, the decision to invest in two bedroom apartments is enhanced by this fact since higher returns are possible. Another opportunity also arises in buying in these low value markets.

Proximity to the city of London is the main factor that drives the disparities in the rent rates.

Apart from the inability to own homes, it is apparent that another significant driver of this phenomenon is due to relocation due to employment. This accounts for 51% of the rental demand. This is a strategic reason for the target location for the proposed investment hence East London is perfectly suited for such an investment. 房地产学paper代写

The choice of location is East London and specifically in the Stratford city which is strategically placing itself as London’s eastern gateway. In the local authority strategic plan, the city plans to be host to £20,000 new homes as well as £45,000 new jobs in the next ten years. Such development proposals make the area a viable location to invest in with a guarantee of returns in terms of profit as well as capital growth. In addition, the prospective returns in the next ten years is expected to the highest in London at a rate of 8.2% whereas it is expected to be 7.3%-9.1% in the London boroughs including East London (Savills Research reports, 2012).

译文:

两卧室公寓对比一卧室和三卧室公寓 房地产学paper代写

在整个伦敦,每张床的平均租金随着房间数量的增加而下降。伦敦两居室公寓的平均租金从 9,000 英镑到 42,000 英镑不等。一间卧室的月租金为每张床 533 英镑,两间卧室每张床 349 英镑,三卧室每床 293 英镑。这是影响投资选择的另一个因素。不同可用投资选择的总收益率是影响两卧室公寓选择的主要因素。

平均而言,一居室公寓的回报率高于两居室房屋。随着床位数量的增加,总租金收益率下降。一居室公寓目前在伦敦的总收益率为 7.8%,两居室公寓的收益率为 7.2%,三居室公寓的收益率为 6%,而四居室公寓的收益率为 5.1%。尽管一居室公寓的回报更高,但这种替代方案意味着房屋唯一可能的租户主要是单身人士。这种不便不值得冒险,因为根据预期的位置,可能需要一些时间才能找到此类租户。

另一方面,两居室公寓为可能合住公寓的年轻已婚夫妇或单身人士提供了更大的灵活性。随着床位数量的减少而增加的租金往往会使租户望而却步。这是因为对于伦敦的大多数租房一代来说,他们支付的租金约占其收入的 53%。

因此,公寓共享趋势正在成为伦敦的普遍现象,因此两居室公寓比一居室公寓更容易被填满。

由于需要在公寓竣工的第一年偿还借入的资金,因此空置房屋的风险是深远的。另一方面,三居室公寓的租金收益率较低,为 6%,相差 1.2%。因此,与一居室或三居室公寓相比,投资两居室房屋更为谨慎。

不可否认,高价值市场和低价值市场在总收入方面存在显着差异(Dembinski 等,2003)。产生更高回报的最强市场主要是低价值市场中的较小单位,其中租户主要是单身和年轻夫妇。因此,投资两居室公寓的决定因这一事实而得到加强,因为有可能获得更高的回报。在这些低价值市场中购买也出现了另一个机会。

靠近伦敦市是造成租金差异的主要因素。

除了无法拥有房屋外,很明显,这种现象的另一个重要驱动因素是因就业而搬迁。这占租赁需求的51%。这是拟议投资目标位置的战略原因,因此东伦敦非常适合此类投资。

地点的选择是东伦敦,特别是在战略上将自己定位为伦敦东部门户的斯特拉特福市。在地方当局的战略计划中,该市计划在未来十年内建造 20,000 英镑的新房和 45,000 英镑的新工作岗位。此类开发建议使该地区成为一个可行的投资地点,并保证在利润和资本增长方面的回报。此外,未来十年的预期回报率预计最高的是伦敦,为 8.2%,而包括东伦敦在内的伦敦行政区预计为 7.3%-9.1%(第一太平戴维斯研究报告,2012 年)。

Financial Strategy

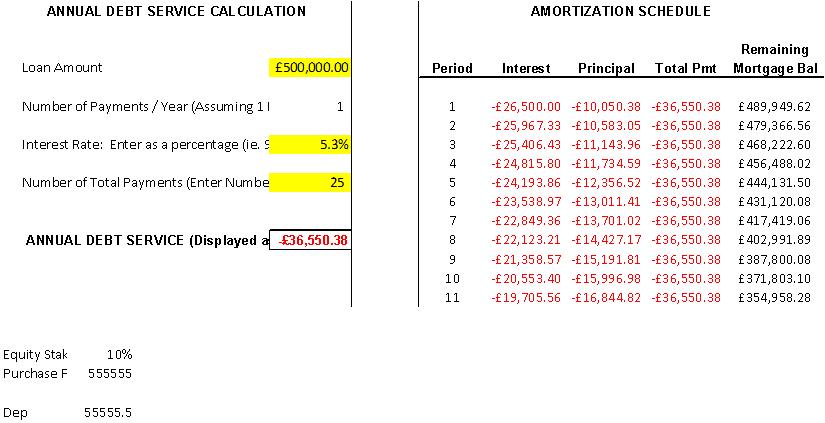

The choice of financing the project depends on a number of factors. These include the degree of risk, the time span to obtain the required funds and the long-term cost of financing (Glynn, 2008). As such, it is important to consider the interest cover that the proposed venture will be required to repay each year. The proposed investment will be funded to a tune of £555,555.

Ten percent of this will be equity capital while the other ninety percent will be funded through borrowed capital. The current rate of mortgage lending is 5.3% to be repaid in a period of 25 years. Given this is a long term investment, the collected rental yields will be the sole source of loan repayment. This has been calculated as £36,550. This is with the assumption that the loan is paid once per year and that the planned flats will be complete in the same year. The other assumption is that the flats will have immediate tenants in the same year which is possible given the location as well as the type of apartments chosen.

The source of funding chosen is cheaper compared to normal loans given their high interest rates.

The long term repayment period of a mortgage allows for more flexibility in funding such a huge project. The planned flats will be five, two bedroom apartments each worth £105,000. The lending institution is expected to oversee the entire construction. The choice of capital value of the each of the apartments is also influenced by the rental yields.

Two bedroom apartments with an average capital value of £100,000 have the highest rental yields at 7.8%. As the capital value rises, the rental yields decrease. For instance, a two bedroom apartment with a capital value of £200,000 has an average rental yield of 4.9% while that with capital value of over £300,000 has a yield of 4.1% or less. As such, the capital value of the apartments greatly influences the expected returns in terms rent yields as well as capital yields. 房地产学paper代写

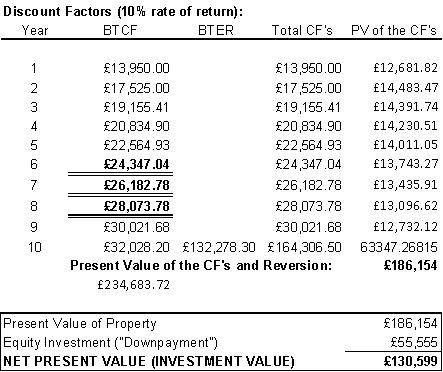

The Net Present Value of a given series of cash flows refers to the total sum of the present values of individual inflows during the lifetime of the proposed investment (Jenkins, 1999). In this case, the proposed investment will be held for the next ten years. As such, the discounted cash flows of the project are used to obtain the net present value of the investment. In this case, each of the projected cash flows is discounted back to present values. The chosen discounting rate for this project will be 10%. However using this method may be misleading especially in the case where the investment yields negative cash flows in later stages.

译文:

财务策略

项目融资的选择取决于多种因素。其中包括风险程度、获得所需资金的时间跨度以及长期融资成本(Glynn,2008 年)。因此,重要的是要考虑拟议的合资企业每年需要偿还的利息保障。拟议的投资将获得 555,555 英镑的资金。

其中 10% 将是股权资本,而另外 90% 将通过借入资本提供资金。目前按揭贷款利率为 5.3%,分 25 年偿还。鉴于这是一项长期投资,收取的租金收益将成为偿还贷款的唯一来源。这已计算为 36,550 英镑。这是假设贷款每年支付一次,并且计划中的公寓将在同一年完工。另一个假设是公寓将在同一年有直接租户,这是可能的,因为位置和选择的公寓类型是可能的。

鉴于其高利率,与正常贷款相比,所选择的资金来源更便宜。

抵押贷款的长期还款期为如此庞大的项目提供了更大的融资灵活性。计划中的公寓将是五间两居室公寓,每间公寓价值 105,000 英镑。贷款机构预计将监督整个建设。每套公寓的资本价值选择也受到租金收益率的影响。

平均资本价值为 100,000 英镑的两居室公寓的租金收益率最高,为 7.8%。随着资本价值的上升,租金收益率下降。例如,资本价值为 200,000 英镑的两居室公寓的平均租金收益率为 4.9%,而资本价值超过 300,000 英镑的公寓的平均租金收益率为 4.1% 或更低。因此,公寓的资本价值极大地影响了租金收益率和资本收益率的预期回报。

给定系列现金流的净现值是指在拟议投资的整个生命周期内各个流入的现值总和(Jenkins,1999)。在这种情况下,拟议的投资将在未来十年内持有。因此,项目的贴现现金流用于获得投资的净现值。在这种情况下,每个预计现金流量都折现回现值。本项目选择的贴现率为 10%。然而,使用这种方法可能会产生误导,尤其是在投资在后期产生负现金流的情况下。

Evaluation 房地产学paper代写

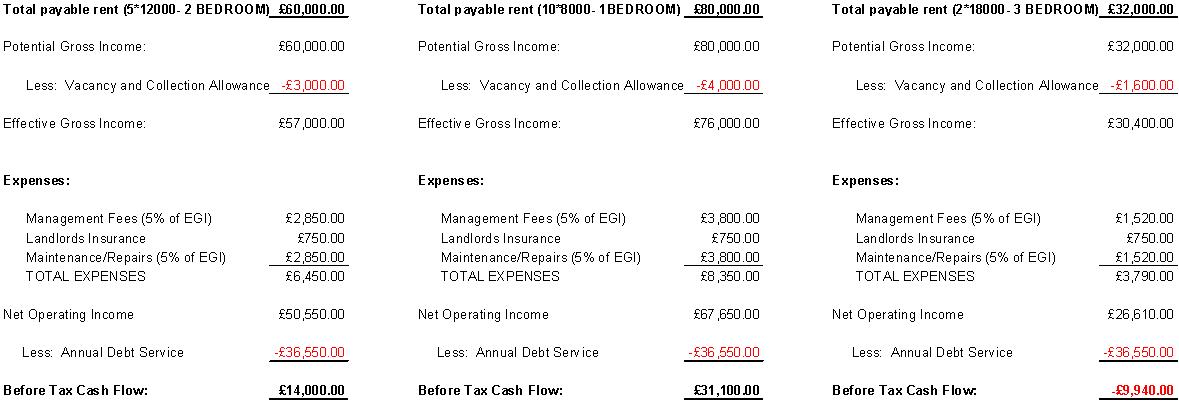

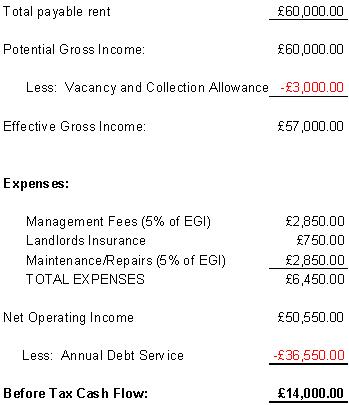

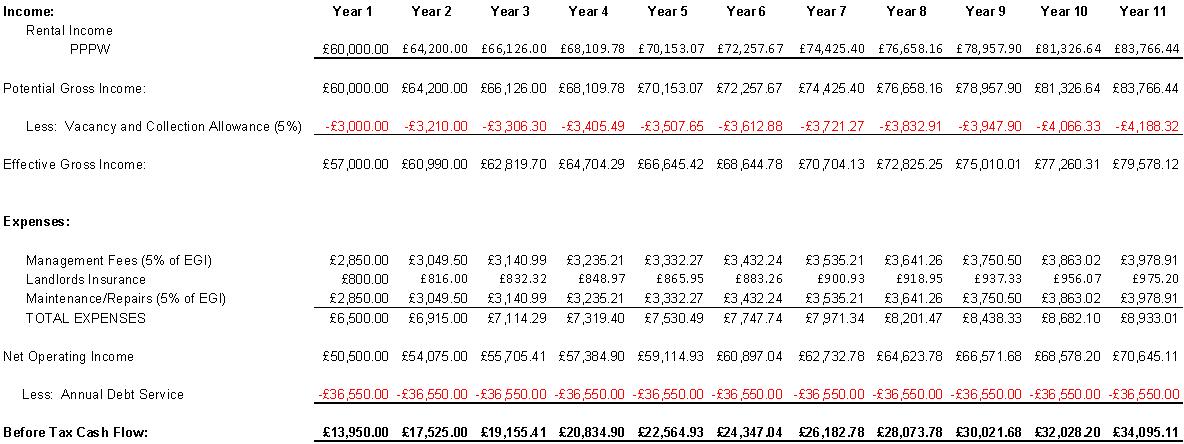

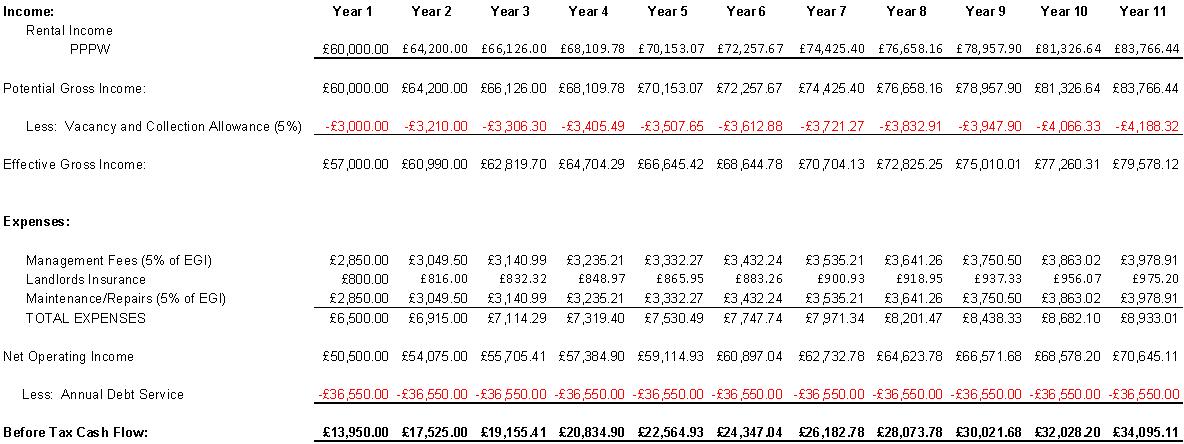

The excel sheets calculated indicate the investment returns of the considered three options. The mortgage debt amount is expected to be the same since the capital available is constrained to £555,555. Consequently, the repayment amounts will be equal regardless of the option chosen. In evaluating the proposed investment, the annual debt repayment is at a rate of 5.3%. The chosen rate is the prevailing average market rate in most financial institutions for buy to let mortgages. This requires the 5 apartments to be rented at an annual rent of £12,000. This translates to £1000 per calendar month. This is the average rent in the proposed location. From the rent collected, an annual repayment of £36,550 will be paid as debt recovery. This has been spread over a period of ten years.

As at the tenth year, the outstanding debt is expected to be £371,803. The annual expected gross income is therefore expected to total to £60,000. The vacancy collection allowance has been set at 2%. Other deductions including management fees (5% of expected gross income), landlord’s insurance and maintenance fees (5% of expected gross income) will all add up to a total of £9,450. This leaves the investment with total cash inflows of £14,000.

The expected increase in rent over the ten year period is expected to be 7%.

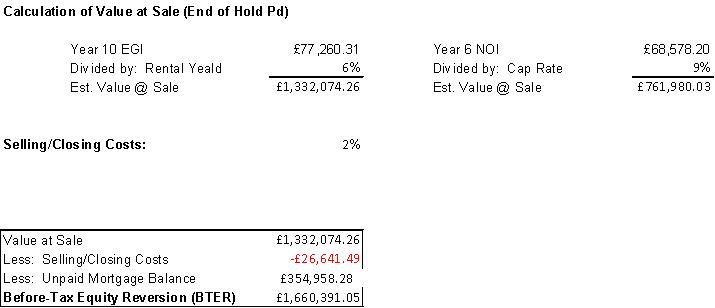

The rental yield has been set at 8% for this investment while the capital rate is 9% as at the end of the holding period. As such, the estimated value at the end of the holding period will be £965,753 and £761,980 respectively. The equity reversion method at this rate values the investment at £1,301,397 having deducted the unpaid mortgage balance as at the end of the holding period. The net present value method on the other hand gives a total of £186,154 as the present value of the expected cash flows as at the end of the holding period. The net present of the investment on deducting the initial down payment is £130,599. 房地产学paper代写

In comparison, the one bedroom apartments have a higher annual yield in terms of rental yields as compared to the proposed two bedroom apartments due to the higher cost of one bed compared to more beds. However, it is imperative to consider how fast the apartments are likely to be rented. Given the limitations with the one bedroom apartments, it may take some time to have all the apartments filled hence it may not be financially prudent given that the apartments are expected to service the mortgage borrowed. Three bedroom apartments on the other hand have a lower annual yield which will take even more to recover the borrowed capital. Two bedroom apartments are therefore the best choice strategically and financially.

译文:

评估 房地产学paper代写

计算出的 Excel 表格显示了所考虑的三个选项的投资回报。由于可用资本限制为 555,555 英镑,因此预计抵押贷款债务金额将相同。因此,无论选择何种选项,还款金额都是相等的。在评估拟议投资时,每年的债务偿还率为 5.3%。所选择的利率是大多数金融机构购买抵押贷款的现行平均市场利率。这要求以 12,000 英镑的年租金出租 5 套公寓。这相当于每个日历月 1000 英镑。这是拟建地点的平均租金。从收取的租金中,每年将偿还 36,550 英镑作为债务追偿。这已经传播了十年。

截至第十年,未偿债务预计为 371,803 英镑。因此,年度预期总收入预计将达到 60,000 英镑。空置征收津贴定为2%。其他扣除项目包括管理费(预期总收入的 5%)、房东的保险费和维护费(预期总收入的 5%)合计总计 9,450 英镑。这使投资的总现金流入为 14,000 英镑。

十年期间租金的预期增长预计为 7%。

该投资的租金收益率定为 8%,而持有期结束时的资本率为 9%。因此,持有期结束时的估计价值将分别为 965,753 英镑和 761,980 英镑。以该利率计算的权益回归方法将投资估值为 1,301,397 英镑,扣除持有期结束时的未付抵押贷款余额。另一方面,净现值法给出总计 186,154 英镑作为持有期结束时预期现金流量的现值。扣除初始首付的投资净现值为 130,599 英镑。

相比之下,与拟议的两居室公寓相比,一居室公寓的年租金收益率更高,因为一张床的成本高于更多床的成本。但是,必须考虑公寓出租的速度。鉴于一居室公寓的局限性,可能需要一些时间才能填满所有公寓,因此考虑到公寓有望偿还所借的抵押贷款,在财务上可能并不谨慎。另一方面,三居室公寓的年收益率较低,收回借入资金需要更多时间。因此,两居室公寓是战略上和财务上的最佳选择。

Conclusion and Recommendation

In conclusion, the proposed investment project is a viable project to undertake. This is mainly because there is no doubt about the possibility of consistent returns from the project. The houses will certainly be filled given the location as well as the set rent rates. In addition, capital returns are certain since the current research on the area as well as in the whole London suggests that rents rates are projected to rise in the foreseeable future. The demand for housing is certainly not met and this state is expected to prevail over the projected holding period.

In addition, the location chosen is undergoing significant changes.

Such significant changes are intended to strategically transform East London and specifically Stratford into a city on its own. As such, it is inevitable that there will be a high influx of new residents as more jobs are created. The local authority projects that 1800 new work places will be built in the wider Stratford locality. This will see an estimated 46,000 new jobs created with the next ten years. The council also projects that there will be over 200 new homes which are likely to be integrated into the already existing ones. Sound financial analysis on the locality suggests a positive signal of value addition to capital investments in this part of London. With such positive expectations on the proposed locality, investors are certainly assured of good returns on long term capital investments. 房地产学paper代写

In assessing the suitability of the project in financial terms, the net present value method adopted is more realistic in valuation of the cash flows. This is because any future cash inflow is not equal to an inflow today. This means that the time value of money is taken into account in evaluating future cash inflows. In this particular investment, the net present value assumption gives a positive return which means that the expected cash inflows fully compensate the costs incurred. According to this method therefore, it is viable to invest in the project since the returns are certain and quite impressive.

Equity reversion is basically the expected lump sum benefit to an investor at the end of an investment holding period.

This amount is based on the reversion value less all the transaction costs and the outstanding debt amount (Manigart, 1997). Transaction costs include tax, any deposition costs and outstanding mortgage debt. This means that the time value of money is not taken into account in this case. This is an unrealistic assumption since the value of receivables in future cannot be equated to present value.

However, the method tries to give a rough idea on the possible trend of the proposed investment after the holding period. Though not a realistic figure, the result obtained gives an indication given the projected cash flows on possible loss on resale value at the end of the period. In the case of the proposed investment, the equity reversion method gives a positive figure at the end of the holding period. This suggests that the project proposed is a viable investment worth undertaking. Since both approaches have a positive indication regarding the project, it is certainly worth to invest in. finally, it is financially prudent to hold the apartments for the ten years analyzed and more since the returns on the investment tend to be increasing given the surge on prices in the London property market which is expected to continue in the foreseeable future.

译文:

结论和建议 房地产学paper代写

总之,拟议的投资项目是一个可行的项目。这主要是因为项目的持续回报的可能性是毋庸置疑的。考虑到位置和设定的租金,这些房屋肯定会被填满。此外,资本回报是确定的,因为目前对该地区以及整个伦敦的研究表明,在可预见的未来,租金率预计会上升。对住房的需求肯定没有得到满足,预计这种状态将在预计的持有期内盛行。

此外,所选择的地点正在发生重大变化。

如此重大的变化旨在战略性地将东伦敦,特别是斯特拉特福转变为一个独立的城市。因此,随着更多就业机会的创造,不可避免地会有大量新居民涌入。地方当局预计将在更广泛的斯特拉特福地区新建 1800 个工作场所。这将在未来十年内创造约 46,000 个新工作岗位。市议会还预计,将有超过 200 套新房屋可能并入现有房屋中。对该地区的良好财务分析表明,伦敦这一地区的资本投资有增值的积极信号。由于对拟建地点的预期如此积极,投资者当然可以保证长期资本投资的良好回报。

在从财务角度评估项目的适用性时,采用的净现值法在现金流量估值方面更为现实。这是因为任何未来的现金流入都不等于今天的流入。这意味着在评估未来现金流入时会考虑货币的时间价值。在这项特定投资中,净现值假设给出了正回报,这意味着预期现金流入完全补偿了发生的成本。因此,根据这种方法,投资该项目是可行的,因为回报是确定的并且相当可观。

股票逆转基本上是投资者在投资持有期结束时的预期一次性收益。

该金额是基于回归价值减去所有交易成本和未偿债务金额(Manigart,1997 年)。交易成本包括税收、任何存款成本和未偿还的抵押贷款债务。这意味着在这种情况下不考虑货币的时间价值。这是一个不切实际的假设,因为未来的应收账款价值不能等同于现值。

然而,该方法试图对持有期后拟议投资的可能趋势给出一个粗略的概念。尽管不是一个现实的数字,但所获得的结果表明了期末转售价值可能损失的预计现金流量。在拟议投资的情况下,权益回归法在持有期结束时给出正数。这表明所提议的项目是一项值得进行的可行投资。由于这两种方法对项目都有积极的迹象,当然值得投资。 最后,在分析的十年以上持有公寓在财务上是谨慎的,因为投资的回报往往会随着房价的激增而增加预计在可预见的未来,伦敦房地产市场的价格将继续上涨。

Bibliography 房地产学paper代写

Baum, A. and Hartzell, D., 2011. Global Property Investment: Strategies, Structures, Decisions, Oxford: Wiley-Blackwell.

Baum, A. E., & Crosby, N.,2007. Property investment appraisal. Boston, Blackwell Pub.

Brueggeman, W. and Fisher, J.,2010. Real Estate Finance and Investments, 14thEdition, Boston: McGraw-Hill Internationa

Dembinski, P.H. et al., 2003. The Ethical Foundations of Responsible Investment. Journal of Business Ethics, 48(2), p.203-213. Available at: http://www.springerlink.com/openurl.asp?id=doi:10.1023/B:BUSI.0000004598.89426.d8

Geltner, D., Miller,N.,Clayton, J. and Eichholtz, P.,2007. Commercial Real Estate Analysis and Investments, 2ndEdition, Mason OH: Thompson-South-Western.

Glynn, J. J.,2008. Accounting for managers. London, Cengage Learning.

Hutchison , N.E., 1998. Housing as an Investment?: A Comparison of Returns from Housing with Other Types of Investment. Journal of Property Finance, 5(2), p.47-61.

Jenkins, G.P., 1999. The Appraisal of Investment Projects: A Teaching Approach. Journal of International Development, 6, p.115-122. Available at: http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=18328830&site=bsi-live.

Manigart, S. et al., 1997. Venture Capitalitstsʼ Appraisal of Investment Projects: An Empirical European Study. Entrepreneurship: Theory & Practice, 21(4), p.29. Available at: http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=730752&site=ehost-live

Savills Research Reports,2012, p 1-18. Available at: www.savills.co.uk

APPENDIX 房地产学paper代写

INTERIOR

http://atlasblp.com/landing/

NEW HOUSES

http://www.propertywire.com/news/europe/prime-central-london-property-201311118442.html

EXCEL SHEETS ON THE PROPOSED INVESTMENT

更多代写:Stata代写 代考网课exam 工程专业essay代写 高中代写essay 工业工程代写论文 美国大学网课代修