Empirical Finance and Financial Econometrics

Sample Final Examination

实证金融代写 Instructions: You have 120 minutes to complete the exams. Please, write legibly. Succinct, clear, and accurate responses will get maximum points.

Instructions: You have 120 minutes to complete the exams. Please, write legibly. Succinct, clear, and accurate responses will get maximum points. The time and points allocated for each question are shown in parentheses. Don’t spend too much time on any given question. Good luck!

Problem 1 实证金融代写

Answer by “True” or “False” and provide a short explanation for your answer.

1.The GARCH(1,1) is a simple and elegant model of volatility and its insample and out-of-sample performance are difficult to beat by other, more complicated models(3 minutes/points)

2.Stock returns at 5-minute, daily, weekly, and monthly frequency are equallyserially uncorrelated.(3 minutes/points)

3.A Variance Ratio test provides a less general way of testing for serial correlation in returns than if we were to fit an AR(1) model.(3 minutes/points)

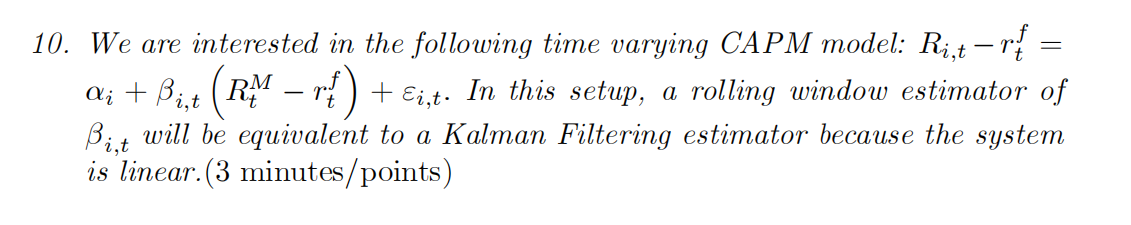

4.The CAPM is a useful benchmark because it explains a great deal of thecross-sectional variation in returns.(3 minutes/points)

5.A 3-factor Fama-French model can be estimated using only time-series regressions. In fact, any 3-factor model can be estimated using only one time-series regression.(3 minutes/points)

6.In a linear model, the GMM and ML (maximum likelihood) estimators are always the same.(3 minutes/points)

7.Event studies are particularly prone to small sample biases.(3 minutes/points)

8.The difference between a bootstrap and a simulation is that in the latter we need to make distributional assumptions about the data while in the former we do not. (3 minutes/points)

9.A non-linear model with more parameters will always do a better job at forecasting out-of-sample than a simpler linear odel with fewer parameters.(3 minutes/points)

Problem 2

Answer the following questions:

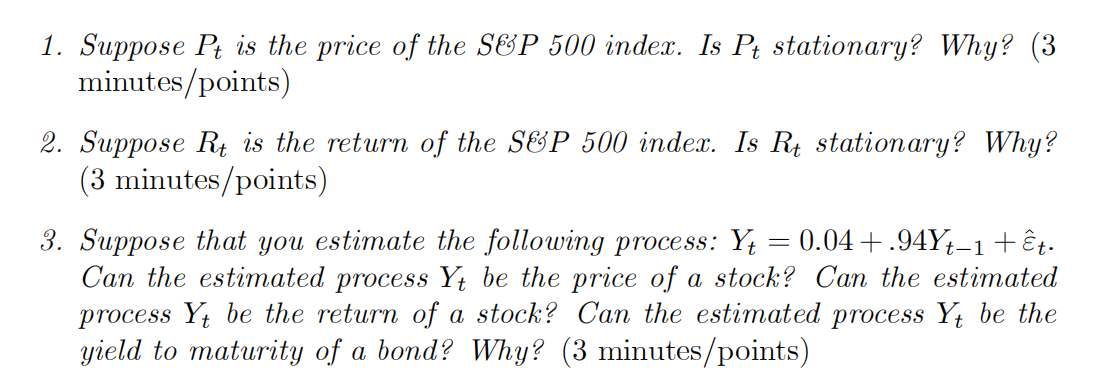

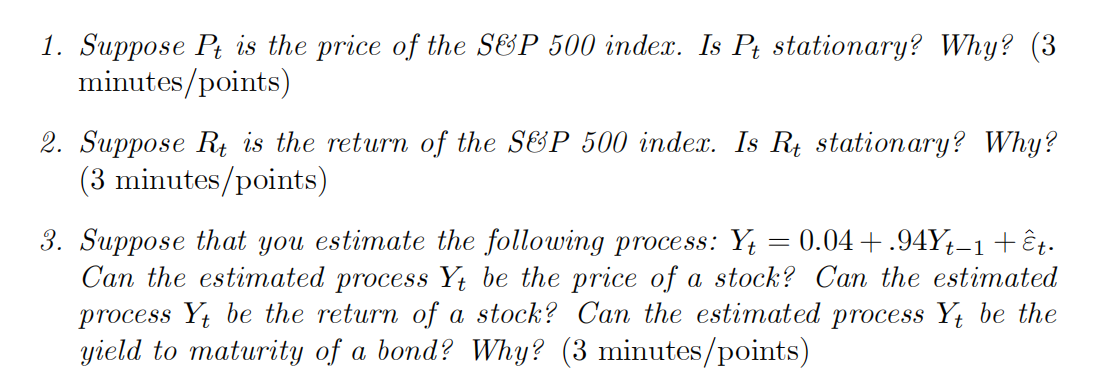

4.Provide a definition of a stationary process, Xt 。(3 minutes/points)

5.Why do we prefer to work with stationary time series in empirical work? Be as precise as possible. (4 minutes/points)

6.What would you do if you had to run a regression of Yt on Xt and you found out that Xt is nonstationary? Be as precise as possible. (4 minutes/points)

Problem 3 实证金融代写

Suppose you want to estimate the conditional mean and the conditional variance of the stock market return. More specifically, you want to use information from the options market to help you get better estimates of the conditional mean and variance of the stock market. What information from the options market do you think will be useful to do that? Explain how you would go about gathering the data, and how you would transform it so that it be useful for further empirical analysis. Clear, succinct and exhaustive answers will get maximum points. (10 minutes/points)

1.Suppose that the variables from the options market that you specified in part 8 are collected in a vector xi,t−1 Given these variables, how would you go aboutestimating the conditional mean μt|t−1 How would you compare the estimate of the conditional mean to the unconditional estimate, obtained in part3. Discuss in-sample and out-of-sample comparisons. (10 minutes/points)

2.Explain why is it not a good idea to run the regressions

Ri,t = ηi + δiRi,t + ui,t

(Hint: Would you be able to obtain a consistent estimate of δi ?) (10 minutes/points)

Problem 4 实证金融代写

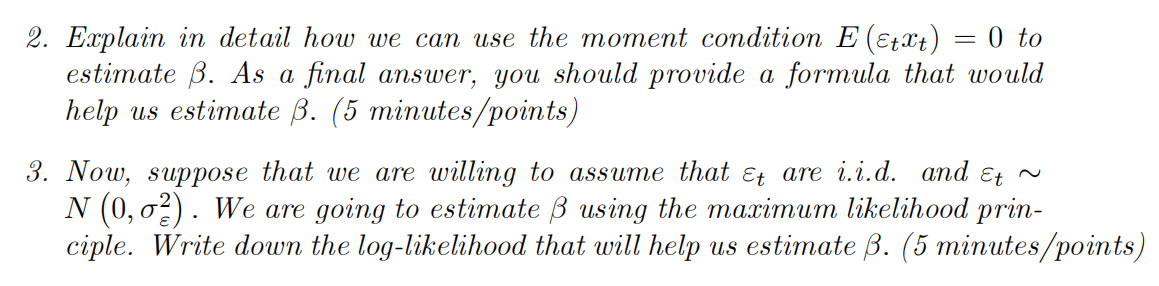

We want to estimate the linear model yt = βxt + εt , where all the processes are assumed to be stationary and we assume E(εt|xt)=0:

1.First, we want to construct an estimator without making any assumptions about the distributions of the processes. Show that the condition E(εt|xt)=0implies that E(εt|xt)=0 where the variables εt and xt have well defined joint, conditional, and marginal distributions. (3 minutes/points)

4.Using the log-likelihood function, write down the maximization problem that we have to solve in order to find β (3 minutes/points)

5.Find the first order necessary and sufficient conditions for the above problem. What estimate of β do you obtain? As a final answer, you should provide a formula that would help us estimate β (7 minutes/points)

6.Compare the estimates obtained in parts 2 and 5. Which one would be more efficient and under what conditions? (2 minutes/points)

更多代写:Python网课exam代修 考试助攻 英国统计代上网课价格 土木工程论文代写 统计report作业代写 代写国外报告