AcF 301 FINANCIAL ACCOUNTING I – ACCOUNTING FOR COMPLEX ENTITIES

复杂实体会计代写 (2 hours + 15 minutes reading time) The examination consists of two questions. Answer BOTH questions. The use of non-programmable calculators

(2 hours + 15 minutes reading time)

The examination consists of two questions. Answer BOTH questions.

The use of non-programmable calculators is permitted.

This is a CLOSED-BOOK examination.

Question 1 复杂实体会计代写

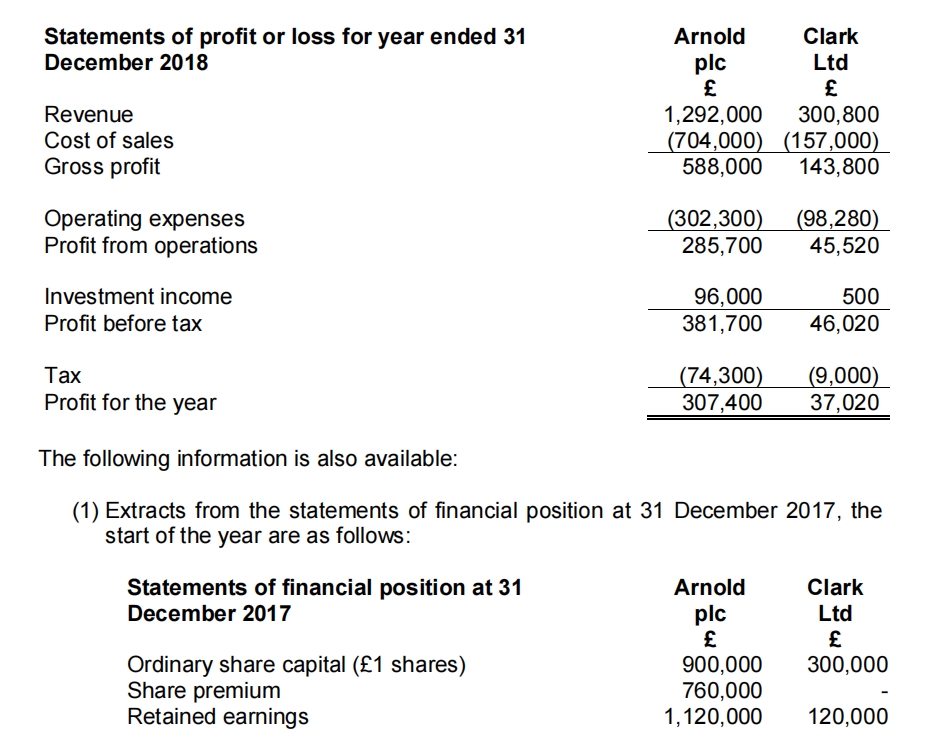

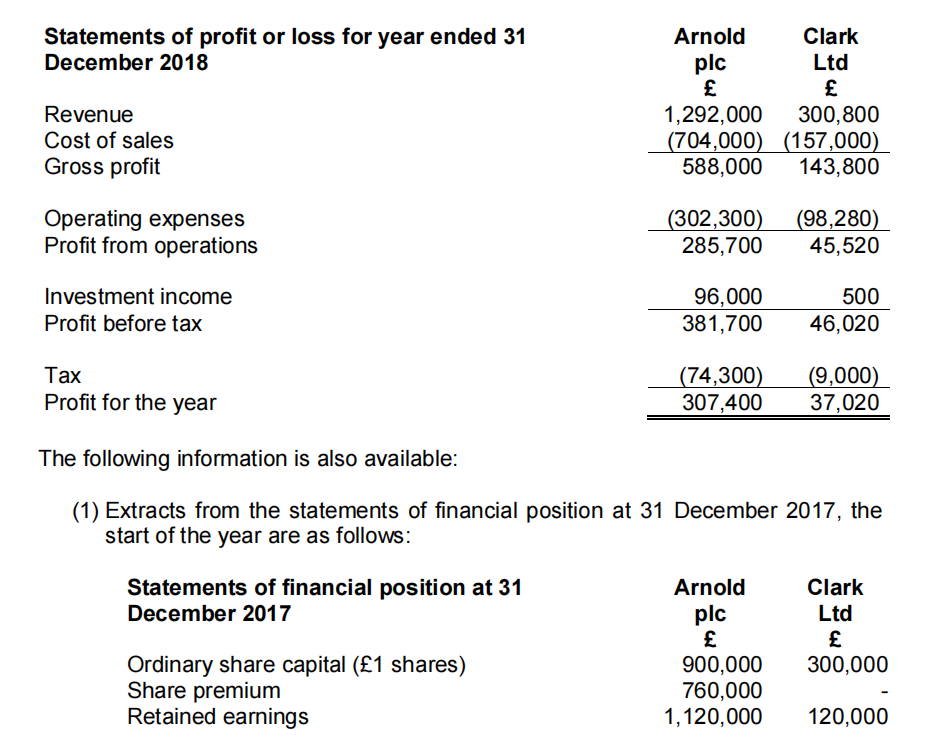

On 1 October 2018, Arnold plc acquired 60% of the ordinary share capital of Clark Ltd. The statements of profit or loss for Arnold plc and Clark Ltd for the years ended 31 December 2018 are set out below. The statement of profit or loss for Arnold plc excludes any results relating to Clark Ltd:

(2)

On 1 October 2018 Arnold plc acquired 60% of the ordinary share capital of Clark Ltd. The consideration consisted of part cash and part share exchange of 2 shares in Arnold plc for every 1 Clark Ltd share acquired. The shares in Arnold plc were issued at a market value of £3 per share. Arnold plc choses to measure the non-controlling interest and goodwill on acquisitions using the proportionate share of net assets method.

The fair values of Clark Ltd’s assets and liabilities at the date of acquisition were the same as their carrying amounts with the exception of a machine, which had a fair value of £8,400 in excess of its carrying amount. The machine had a remaining useful life of seven years at 1 October 2018. Depreciation on machinery is to be recognised as cost of sales.

(3) 复杂实体会计代写

On 1 October 2018 Arnold plc transferred an item of machinery to Clark Ltd for £80,000 cash. This item of machinery is different to the one noted in (2) above. The cost of this asset was £120,000 and accumulated depreciation at the date of transfer was £43,000 (including depreciation for the 9 months to the date of transfer). The remaining useful life of the asset is 5 years from the date of transfer. Depreciation on machinery is to be recognised as cost of sales.

Company policy is to pro-rate depreciation where relevant. Profits or losses on sales of assets are recorded in investment income.

(4)

Clark Ltd’s profits for the year ended 31 December 2018 accrued evenly over the year.

(5)

The management of Arnold plc consider goodwill arising on the acquisition of Clark Ltd to be impaired by £5,000 at 31 December 2018. This has not yet been recorded in the financial statements.

(6)

On 1 November 2018 Clark Ltd sold goods to Arnold plc for £24,000 at a gross profit margin of 20%. At 31 December 2018 half of these goods remain unsold and are included in Arnold plc’s inventory.

(7)

In November 2018 Arnold plc declared and paid a dividend of 20p per share. In December 2018 Clark Ltd declared and paid a dividend of 1p per share.

Required 复杂实体会计代写

(a) Prepare the consolidated statement of profit or loss for the Arnold plc Group for the year ended 31 December 2018. You should clearly show the amounts attributable to the (i) equity holders of the parent and (ii) non-controlling interest. (27 marks)

(b) Explain why intra-group transactions need to be adjusted for within the consolidated statement of profit or loss. You should make reference to two of the pieces of further information (1) – (7) above. You should make specific reference to the information provided and include calculations as part of your answer (6 marks)

(c) Prepare an extract from the consolidated statement of changes in equity showing the share capital, share premium, retained earnings and non-controlling interest.(9 marks)

(d) IFRS 8 Operating Segments requires certain entities to disclose information about their operating segments. Evaluate the extent to which segmental reporting improves the usefulness of financial information of a group and its subsidiary companies (8 marks)

Total for question 1: 50 marks

Question 2 复杂实体会计代写

a)

Young plc owns a number of subsidiary companies. During the year Young plc has undertaken the following transactions which have not yet been accounted for in full:

(1) On 1 July 2018 Young plc purchased 40% of Daquiri Ltd’s ordinary shares for a cash payment of £350,000. This investment gave Young plc significant influence over Daquiri Ltd. Daquiri Ltd made a profit of £126,000 for the year ended 31 December 2018.

The only accounting entries that have been posted are debit investments in the statement of financial position and credit bank. Young plc has not yet accounted for any further entries in relation to Daquiri Ltd in its consolidated financial statements. 复杂实体会计代写

(2) On 1 August 2018 Young plc disposed of a subsidiary company, Singapore Ltd, in which it held a 70% ownership. The only accounting entries that have been posted are debit bank and credit investments in the statement of financial position. The directors of Young plc are unsure how to account for a disposal of a subsidiary company in either the individual company accounts or the consolidated financial statements.

(3) On 1 January 2018 Young purchased 70% of Star GmbH (a company operating in Germany). The directors of Young plc are unsure how to account for the investment in Star GmbH. The only accounting entries that have been made in relation to this acquisition are debit investments in the statement of financial position and credit bank. In particular the directors of Young plc do not know how to account for:

- Statement of profit or loss items

- Statement of financial position items

- Goodwill

Required

Explain the required IFRS financial reporting treatment of (1) to (3) above in relation to the consolidated financial statements of Young plc for the year ended 31 December 2018. Include all relevant calculations. You should also explain why the specific treatment you identify is appropriate. (15 marks)

b) 复杂实体会计代写

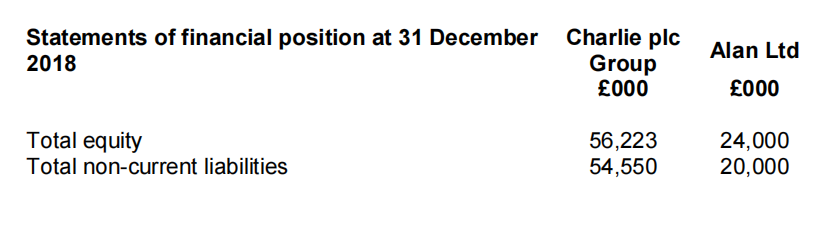

On 1 January 2018 Charlie plc acquired 40% of the ordinary share capital of Alan Ltd. As part of the purchase agreement, the management of Alan Ltd will continue to have responsibility for the day to day running of Alan Ltd. However all major investing and financing activities of Alan Ltd require agreement from Charlie plc.Additionally, Charlie plc was granted an option to purchase a further 20% of the share capital of Alan Ltd at a price of £2 per share on 30 June 2019. The current market price of the shares in Alan Ltd is £3.

Charlie plc have appointed 4 out of the 9 directors to the Board of Directors of Alan Ltd. The directors appointed by Charlie plc have specialist knowledge, which has meant that the Board of Directors have deferred to the 4 directors appointed by Charlie plc for all major decisions since acquisition.

Charlie plc has a loan covenant in place that requires the gearing ratio (defined as Debt / (Debt + Equity) x 100) to remain below 50% of the total financing of the group. The following are summary extracts from the statements of financial position:

Required

(i) Evaluate whether Charlie plc has control over Alan Ltd. Explain any

assumptions that you have made.(11 marks)

(ii) Analyse why the management of Charlie plc might prefer to account for Alan Ltd as an associate rather than a subsidiary. You should use figures to illustrate your answer. (4 marks)

c)

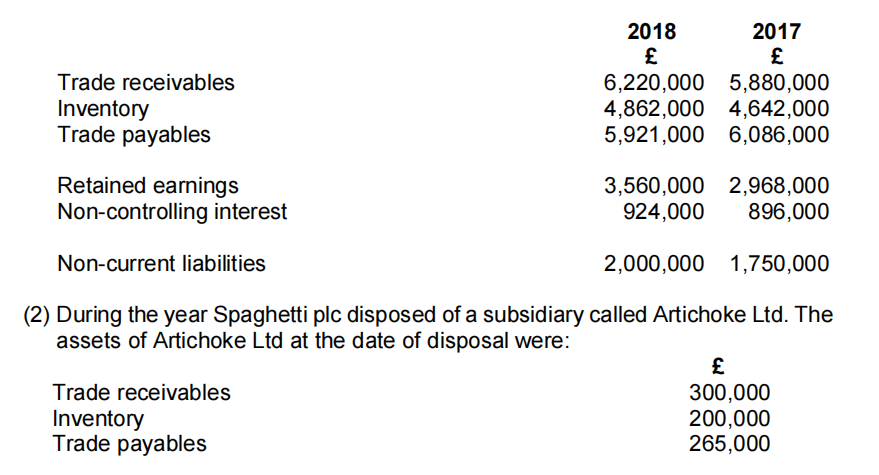

You are a financial accountant for Spaghetti plc, a listed group. The financial

controller has asked you to produce the consolidated statement of cash flows for the year ended 31 December 2018 and has provided the following information:

(1) Extracts from Spaghetti plc’s statement of financial position as at 31 December:

Non-controlling interest is valued using the fair value method and at the date of disposal was valued at £120,000.

(3) During the year ended 31 December 2018 Spaghetti plc:

- made a profit for the year of £1,035,000, of which £200,000 was attributable to the non-controlling interest

- paid ordinary dividends

- sold a machine for £829,000. The cost at acquisition was £1,600,000 and accumulated depreciation £700,000

- charged depreciation of £314,000

Required 复杂实体会计代写

(i) As far as the information provided allows, prepare the following extracts from Spaghetti plc’s Consolidated Statement of Cash Flows:

- Cash generated from operations

- Cash flows from financing activities

(15 marks)

You should ignore tax for the purposes of this question.

(ii)Explain why it is necessary to produce a consolidated statement of cash flows in addition to the consolidated statement of financial position and consolidated statement of profit or loss (5 marks)

Total for question 2: 50 marks

更多代写:matlab作业代做 gre考试作弊 英国医学网课代上 北美essay代写 毕业论文Results代写 UIUC大学申请范文代写