Fixed Income Securities

Midterm Exam

固定收益证券代写 You have the entire class period to finish this exam. You are permitted a writing implement, a calculator, the formula sheet that I provide,

You have the entire class period to finish this exam. You are permitted a writing implement, a calculator, the formula sheet that I provide, and no other materials. The exam has 100 points. Partial credit for wrong answers may be given if you show your work.

Always assume that a bond has par value of $100 and pays interest semi-annually unless otherwise stated. Also, use 4 decimal places in each calculation, except when otherwise stated.

(18 points; 2 points each). 1. 固定收益证券代写

True/False. Please mark each statement true or false.

- ____ Fed actions through normal open market operations at their regular meetings generally have a direct effect on the 30 year Treasury Bond YTM.

- ____ The Federal Reserve Board directly sets the discount rate.

- ____ MacCauley duration is interpreted as a percent change in price for a given change in yield.

- ____ When comparing two non-option, semi-annual pay coupon bonds with the same remaining maturity and YTM, the bond with the higher coupon rate will have a higher duration.

- _____ For a non-callable semi-annual pay coupon bond, as its YTM goes down, its price goes up at an increasing rate.

- ____ The haircut required in a repurchase agreement will be generally higher during a financial crisis.

- ____ When the perception in the economy is that credit risk is high, the spread between YTMs on corporate and Treasury bonds will likely narrow.

- ____ When initially issued, a zero coupon bond will typically have a yield to maturity of zero percent.

- _____ Convexity measures the percentage change in a bond’s duration for a given change in yield to maturity.

(12 points) 2. 固定收益证券代写

Rank the following debt obligations in terms of how much value they would lose AS A PERCENT OF THEIR ORIGINAL PRICE if interest rates rise. Assume these bonds have no credit risk, since they are Treasuries. Rank 1 is for the bond that loses the most value; rank 6 is for the bond that loses the least value.

____ 1. A 12-year Treasury bond, semi-annual pay, with a coupon rate of 12%

___ 2. A 12-year Treasury bond with no coupons

____ 3. A 12-year Treasury bond, semi-annual pay, with a coupon rate of 10%

____ 4. A 12-year Treasury bond, semi-annual pay, with a coupon rate of 8%

____ 5. A 30 year zero-coupon Treasury bond

____ 6. A one month Treasury bill

(10 points total) 3. 固定收益证券代写

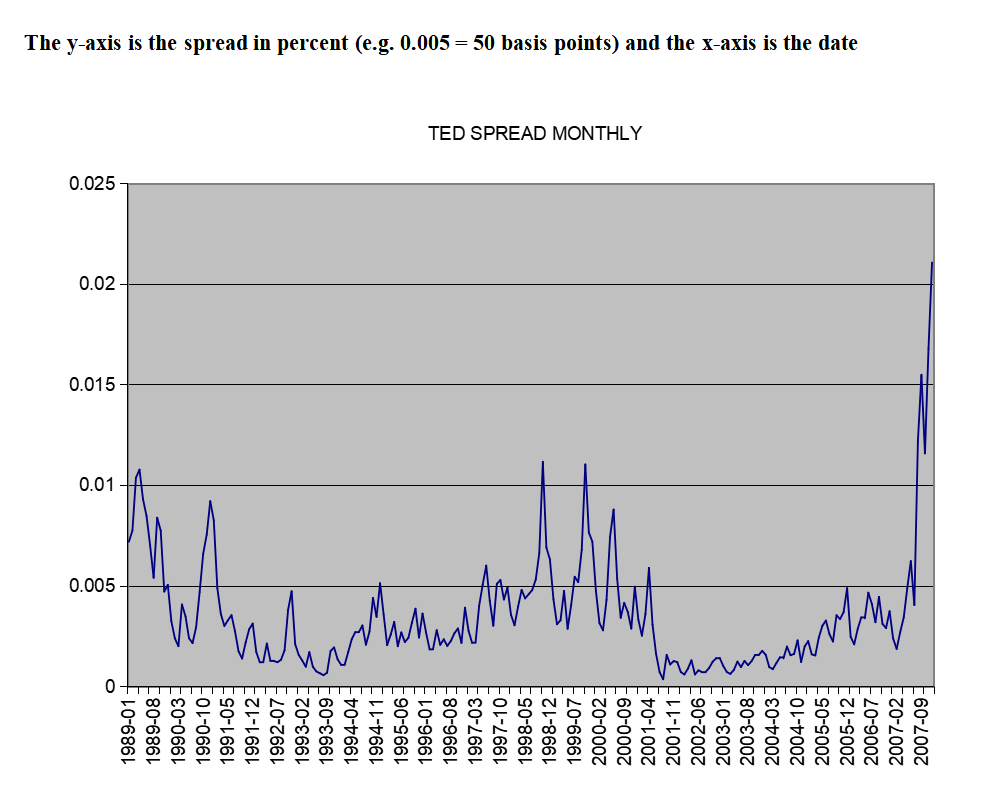

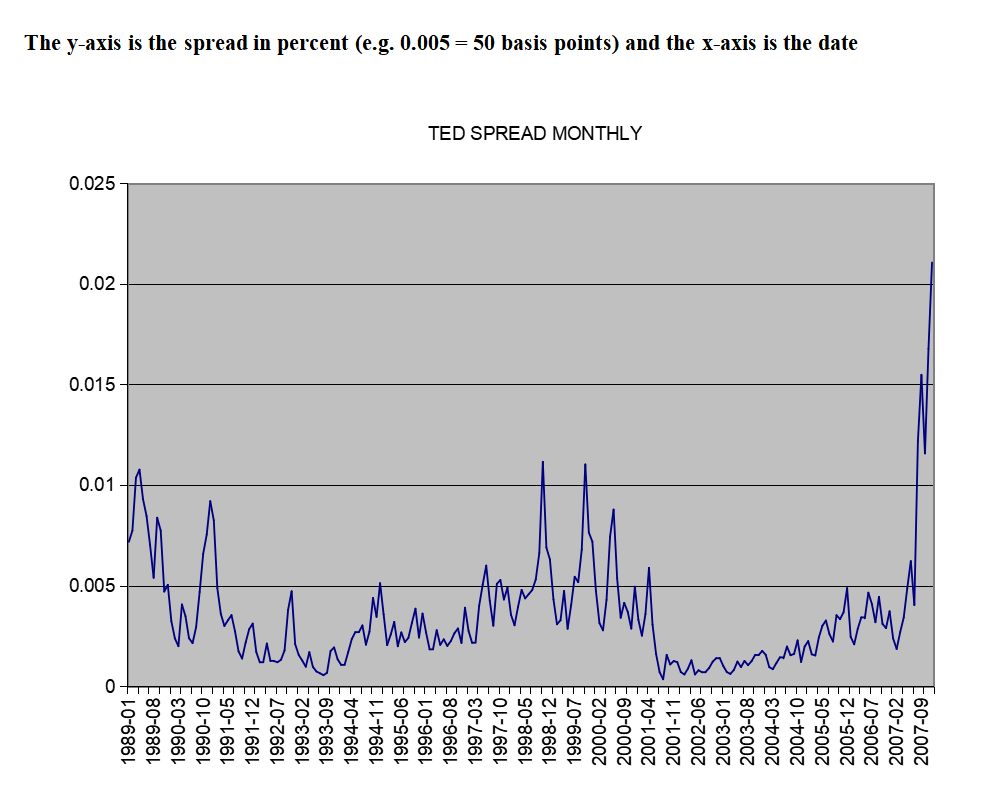

Assume that you want to take a bet on interest rates using a long/short trading strategy. One common trade is called a TED spread trade. The TED spread is the difference in YTMs between 3 month Eurodollar deposits and 3 month Treasury bills. (TED stands for “Treasury EuroDollar.”) 3 month Eurodollar deposits have a rate based on LIBOR, which is the short-term rate at which banks in Europe lend to and borrow from each other.

In general, the spread is positive, because Treasuries do not have credit risk and Eurodollar deposits do have credit risk, albeit small.

Attached is a graph of daily TED spreads since 1990. TED spreads tend to increase when investors are worried about credit risk, in general.

You can see that the TED spread is very high as of 12/31/2007. In 2007, we were in a major credit crisis and investors were worried about credit risk.

In this problem, ignore interest and transaction costs. Also, since the maturity of both Tbills and Eurodollar deposits is so short, you don’t need to use DV01 to implement this strategy.

(5 pts.) 3a. If you believe that this TED spread will decrease/converge to its historical average, what trade could you do to take advantage of this belief? Specifically, which bond would you buy and which bond would you short?

(5 pts.) 3b. If in 6 months, YTMs on both 3 month Treasuries and Eurodollar deposits have increased, but that Treasury rates have increased less than Eurodollar deposit rates, did your trade make money? Explain.

(14 points total) 4. 固定收益证券代写

Assume the following details about a corporate bond:

Rotech Healthcare Inc. coupon of 9.5%, maturity date: 4/01/2022, Rating CCC

Settlement date: 6/29/15

YTM: 8.455

Clean price: $104

Assume TODAY is 6/29/15, the settlement date, and answer all questions relative to this assumption.

(2 pts.) 4a. What was the most recent coupon date for this bond, assuming today is 6/29/15?

(2 pt.) 4b. What is the next coupon date for this bond, assuming today is 6/29/15?

(8 pts.) 4c. Calculate the “time” exponent you would use to discount the first cash flow when you price this bond. (use 6 decimal places) Please show the details of this calculation so that I can check your day-counting.

(2 pts). 4d. Calculate the present value of this bond’s first cash flow (to be received on the bond’s next coupon date).

(16 pts.) 5. 固定收益证券代写

Assume you have short-sold a bond with the following characteristics:

Coupon 7%, YTM 5%, maturity 10 years, par value $100

You are worried about rates changing. You are going to hedge using a bond with the following characteristics:

Coupon 9%, YTM 5%, maturity 10 years, par value $100

(6 pts.) a. Calculate the DV01 of each bond. Round to 4 digits. To be consistent, assume that the YTM goes UP for each bond to calculate the DV01.

(4 pts.) b. Calculate the hedge ratio.

(6 pts) c. If the YTM of the bond you are protecting goes down in the next couple of weeks, are you happy or sad that you hedged? Why?

(20 points) 6. 固定收益证券代写

You observe the following Treasury yield curve. Rates are stated as BEYs (Bond Equivalent Yields)

| Time in Years | Time in Periods | Coupon Rate | YTM | Price | Discount Factor | Sum of current and prior period discount factors |

| 0.5 | 1 | 0.00% | 5.25% | 0.97442 | 0.974421 | |

| 1 | 2 | 0.00% | 5.50% | 0.94719 | 1.921610 | |

| 1.5 | 3 | 6.00% | 6.00% | $100.00 | 0.91490 | 2.836514 |

| 2 | 4 | 6.50% | 6.50% | $100.00 | 0.87924 | 3.715752 |

| 2.5 | 5 | 7.00% | 7.00% | $100.00 | 0.84053 | 4.556282 |

| 3 | 6 | 7.50% | 7.50% | $100.00 | 0.79917 | 5.355453 |

| 3.5 | 7 | 8.00% | 8.00% | $100.00 | ||

| 4 | 8 | 8.50% | 8.50% | $100.00 |

For this problem, use 6 decimal places for all calculations

(4 pts.) 6a. Calculate the discount factors for period 7 (year 3.5).

(4 pts.) 6b. Calculate the spot rate for the 1.5 year hypothetical zero-coupon bond and state as a BEY.

(4 pts.) 6c. Calculate the the expected 6 month rate 6 months from now (this is a forward rate)

(4 pts.) 6d. If you were to strip the third cash flow from a 5-year Treasury bond (assume it has a YTM of 9.5%) to sell it separately in the STRIPS market, what rate would you use to discount this cash flow? (Please fill in the actual rate; state as an annual rate).

(4 pts) 6e. If instead you sold the third cash flow at the bond’s YTM, would you be overpricing or underpricing this cash flow? (simply answer “overpricing” or “underpricing”)

(10 pts) 7. 固定收益证券代写

Assume that Bank ONE is going to enter into a repurchase agreement with Bank TWO. Bank ONE will sell Bank TWO a Treasury Bond with a face value of $50,000,000. The haircut is 25 bp. The loan term is overnight. The repo rate is 0.15%. Assume 360 days per year, as is conventional in repo transactions.

(4 pts) a. Calculate the total dollar amount that Bank TWO will pay to Bank ONE for the Treasury Bond, rounding to the nearest dollar.

(2 pt) b. At expiration, Bank ONE will buy the bond back from Bank TWO. What is the price that Bank ONE will pay?

(4 pt) c. This transaction can be considered a collateralized loan from Bank ______ to Bank _______. (Fill in ONE and TWO in the appropriate positions)