DPBS1140代写: Sample Final Examination Questions

会计Final exam代考 You purchased a machine for $1 million three years ago and have been applying straight-line depreciation to zero for a seven-year life.

Note: Use question 1 as practice for units 1-4 and your final exam will include 10 multiple choice questions on units 1-4 inclusive. You can practice further using the non assessable questions

QUESTION 1: Accounting adjusting entries and financial statements

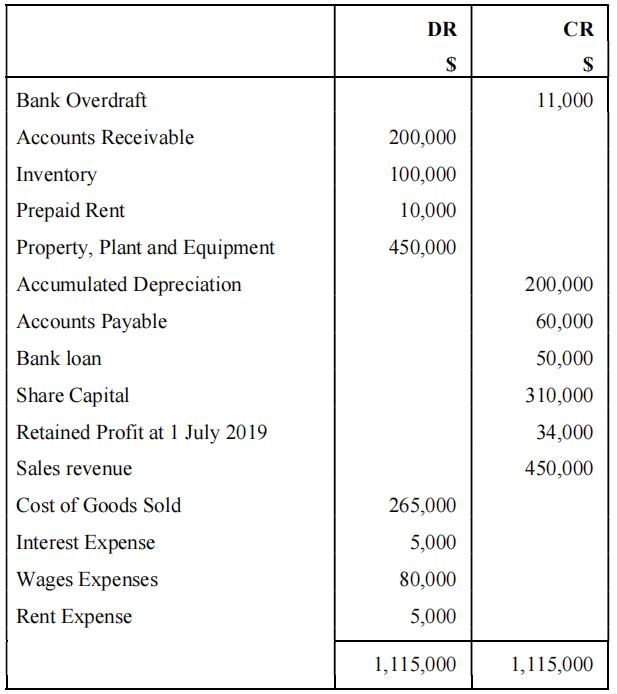

The following is the closing account balances as prepared for Sydney Company as at 30 June 2020 (for the 12 months beginning on 1 July 2019):

The following information is given which may give rise to year-end adjustments. The effect of these transactions is not reflected in the account balances above.

i.Depreciation on Property, Plant and Equipment is $45,000 per annum.

ii.The balance in Prepaid Rent relates to the 12-month period from 1 January 2020 to 31 December 2020.

iii. Insurance worth $18,000 was prepaid on 1 June 2020 for the period 1 June 2020 –30 November 2020. No journal entry had been recorded for this purchase.

iv.On 30 June 2020, the directors declared (payable) a dividend of $5,000,which the shareholders authorised. The dividend is to be paid on 15 September 2022.

v.It is discovered that $10,000 cash received during the year and credited to sales are actually related to services to be delivered in July 2020.

vi.$5,000 of wages relating to June 2020 have not been paid and need to be accrued.

Part A

Prepare journal entries for the necessary end of period adjustments

Part B

Prepare an Income Statement for the year ended 30 June 2020

Sydney Company

Income Statement for the year ended 30 June 2020 会计Final exam代考

Sales revenue

Less: Cost of Goods Sold

= Gross Profit

Less other expenses:

Interest expense

Depreciation expense

Rent expense

Insurance expense

Wages expense

Total other expenses

= Net Profit

Part C

In the Balance Sheet as at 30 June 2020, what would be the closing balance of retained profits? Show all workings

Opening Balance Retained Profits ___________

Plus Net Profit for Period _________

Less Dividends declared _________

= Closing Balance _________

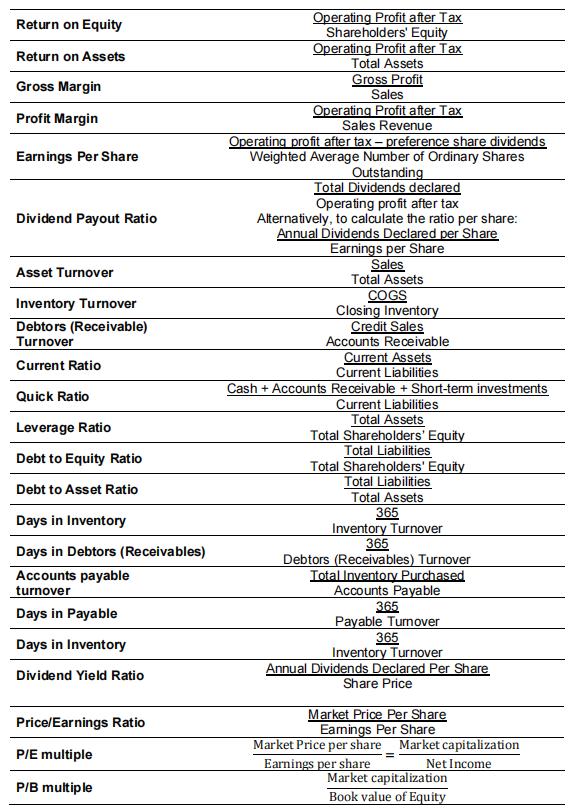

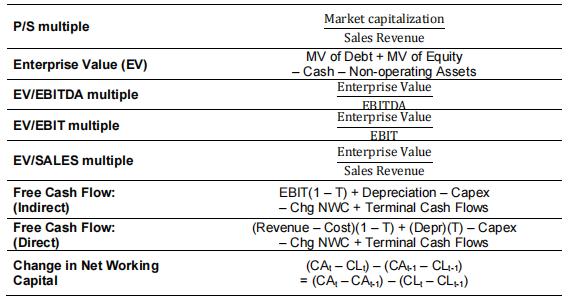

FINANCIAL STATEMENT RATIOS

QUESTION 2: Financial Statement Analysis 会计Final exam代考

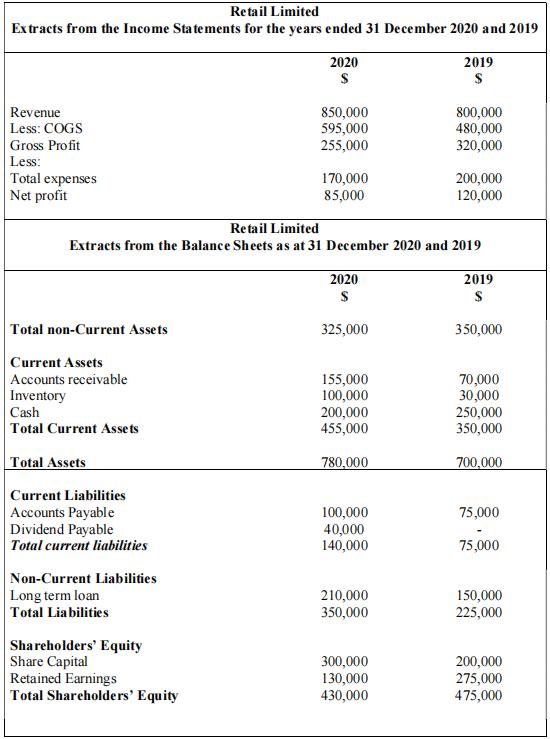

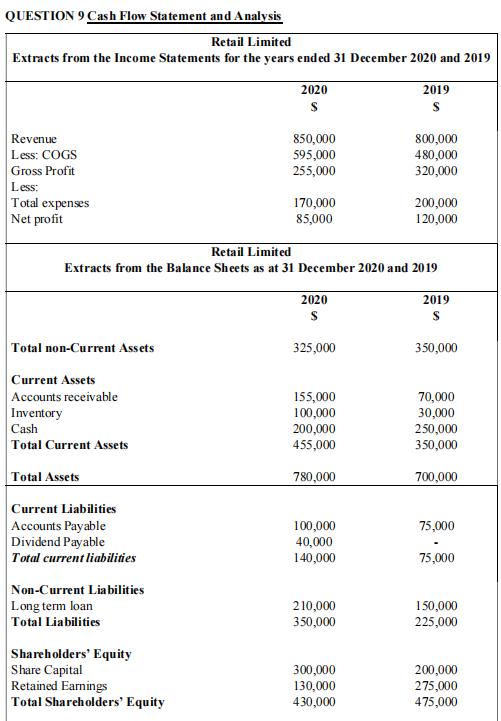

Based on the above extracts from the financial statements of Retail Limited for the years ended 31 December 2020 and 2019, you are required to answer the following:

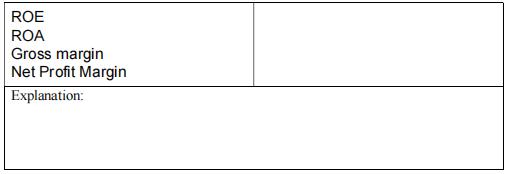

1.Drawing on any two profitability ratios, comment on the financial performance of the company (3 marks)

2.Drawing on any two relevant pieces of evidence from the balance sheet, explain whether the company’s liquidity improved or worsened during year 2020 (3 marks)

3.Drawing on any two relevant ratios, explain whether the company’s solvency improved or worsened during the year (3 marks)

4.Evaluate the Investment potential of the business in the short term ie 1 year? (1 mark)

QUESTION 3: Financial Statement Analysis

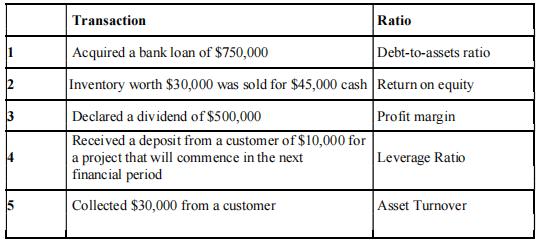

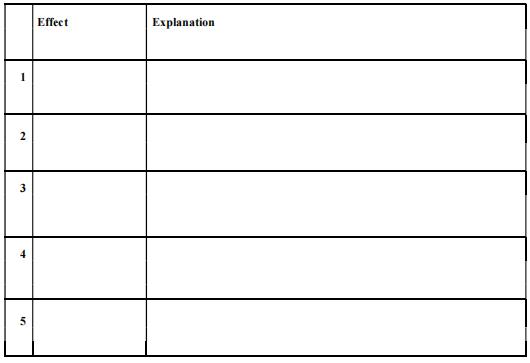

You are required to indicate the effect of the transactions listed below on the ratio listed opposite it. For each transaction, state whether the ratio would increase, decrease, or have no effect. You are also required to provide a brief explanation for your answer.

Note:

- Treat each transaction independently.

- The current ratio for the period was 2.4.

- The debt-to-asset ratio was 0.67.

- The return on equity ratio was 4%.

- All other ratios were positive.

QUESTION 4: Audit Independence Threats 会计Final exam代考

QUESTION 4: Audit Independence Threats 会计Final exam代考

Describe and explain what type of independence threat each of the following situation provides:

1.The client of an audit firm asked the audit partner to promote their shares for a stock exchange listing. (2 marks)

2.The husband of an auditor holds $23,000 worth of shares in the audit client. (2 marks)

3.The client manger engaging has a dominant personality and seeks to influence the decision making of junior staff. (2 marks)

4.Due to a recent audit controversy, the audit firm has lost several clients. This means AZ Bank represents 25% of the audit firm’s earnings. (2 marks)

QUESTION 5: Audit Opinions

A.Describe the role of an external auditor (2 marks)

B.What type of audit opinion would be offered in the following situation? (4 marks)

A problem with the client’s IT systems has meant that the audit team are unable to review important sales receipts to confirm the recording of revenue and expense receipts to confirm all expenditures. This means that the audit team were unable to determine whether proper books of account had been kept.

C.Briefly describe any other type of audit opinion (2 marks) 会计Final exam代考

QUESTION 6: Audit Opinions

“John is a recent graduate from UNSW and has successfully applied for a job in a medium sized accountancy firm, Thompson & Smith, as a junior auditor. John is part of the team that audits the annual financial statements of XYZ Limited. The audit for XYZ Limited is nearing its completion and the audit team are considering what type ofaudit opinion can be issued. The audit partner has held some difficult meetings with the management team of XYZ Limited, disagreeing with how management have calculated depreciation of buildings.

The audit partner believes that the manner in which depreciation has been calculated is incorrect and represents a material misstatement to the financial statement. The audit partner has also told John that all other areas of XYZ Limited’s financial statements are correctly prepared. Unfortunately, XYZ Limited’s management are unwilling to follow the audit partner’s advice and won’t change how they have calculated deprecation for buildings. The audit partner has asked John to think about how this will affect the audit opinion.”

Based on the above information, please answer the following questions:

1.Explain the purpose of an external audit? (2 marks)

2.Justify the type of audit opinion that would likely be issued in the above situation? (4 marks)

3.Outline any two other types of audit opinions that auditors provide? (2 marks)

QUESTION 7: Internal Controls 会计Final exam代考

For each of the following situations, evaluate the segregation of duties implemented by the company and indicate the following:

1.Any deficiency in the segregation of duties described. Indicate “None” if no deficiency is present.

2.The potential financial statement misstatements that might occur because of the inadequate segregation of duties.

3.Additional controls that might mitigate potential misstatements.

Situation A (4 marks):

Nick’s is a small family-owned restaurant in a northern resort area whose employees are trusted. When the restaurant is very busy, any of the servers have the ability to operate the cash register and collect the amounts due from the customer. All orders are tabulated on “tickets.”Although each ticket has a place to indicate the server, most do not bother to do so, nor does management reconcile the ticket numbers and amounts with total cash receipts for the day. 会计Final exam代考

Situation B (4 marks):

A sporting goods store takes customer orders via a toll-free phone number. The order taker sits at a terminal and has complete access to the customer’s previous credit history and a list of inventory available for sale. The order clerk has the ability to input all the customer’s requests and generate a sales invoice and shipment with no additional supervisory review or approval.

QUESTION 8: Cash Flow Statement and Analysis

1.Describe what information the cash flow statement adds above and beyond the accrual-based financial statements

2.Mention two items that are accounted for in the income statement, but not the cash flow statement;

Also mention two items that are accounted for in the cash flow statement, but not in the income statement

3.Assume that a company has positive cash flow from operations and financing, but negative cash flow from investing. What does this cash flow pattern indicate?

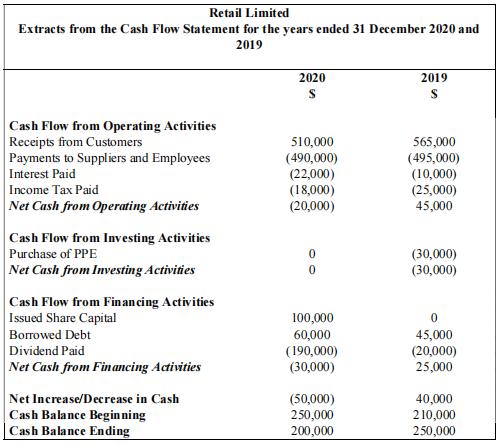

QUESTION 9 Cash Flow Statement and Analysis

Based on the above extracts from the financial statements of Retail Limited for the years ended 31 December 2020 and 2019, you are required to answer the following:

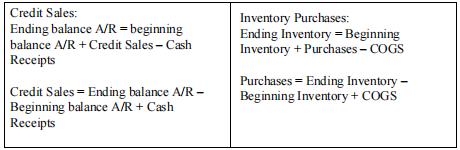

1.Based on the financial statement information above, calculate

a.the amount of credit sales of Retail Limited in 2020.

b.the inventory purchases of Retail Limited in 2020.

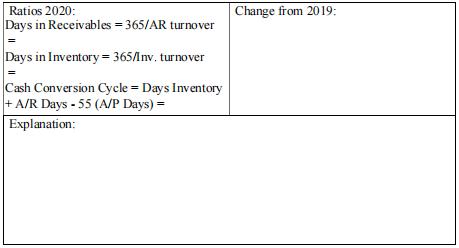

2.Retail Limited’s management is concerned about its cash flow from operations in 2020.In 2019, the number of days to convert investments in inventory into cash flows from sales was 71. Calculate the number of days it took Retail Limited to convert its investments in inventory into cash flows from sales in 2020. Assume that accounts payable days were 55 in 2020. Comment on the change and provide two possible reasons for this change. Suggest two ways through which Retail Limited could improve cash generation.

Hint: you can use information that you calculated in question 2 above.

3.Comment on how the company is financing its operating and investing activities in 2020 and 2019. 会计Final exam代考

4.Assume that Retail Limited had the following additional transactions in 2020:

1) bought shares on the stock market for an amount of $15,000.

2) Received a dividend for the investment over $300

Answer the following questions:

a.How would these transaction be categorized on the cash flow statement?(1 marks)

b.How would these transaction in combination change the 2020 net change in cash and the cash balance? (2 marks)

QUESTION 10: Responsible Financial Management

1.Outline the difference between economic disclosures, social disclosures and environmental disclosures, as defined by the Global Reporting Initiative (GRI)? (3 marks)

2.Name two social disclosures and two environmental disclosures that are likely to be included in UNSW’s sustainability report? (4 marks)

3.Describe and explain three challenges auditors experience in providing assurance of Sustainability Reports. (3 marks)

QUESTION 11 会计Final exam代考

a) You notice that Cisco Computer Systems has a share price of $30.72 and earnings per share of $0.52. Its competitor Hewlett-Packard has earnings per share of $0.36. What is one estimate of the value of Hewlett- Packard shares?

Since Cisco Computer Systems and Hewlett-Packard are in the same industry, one estimate for the value of Hewlett-Packard is that it should have the same P/E ratio = Market Price Per Share/Earnings

Per Share

Cisco P/E =

Using Cisco’s P/E to value HP’s earnings: HP Price =

b) CSH has EBITDA of $5 million. You feel that an appropriate enterprise value/EBITDA ratio for CSH is 9. CSH has $10 million in debt, $2 million in cash and 0.8m shares outstanding. What is your estimate of CSH’s share price?

EV/EBITDA ratio Enterprise Value/EBITDA to estimate the enterprise value and calculate the price per share based on that estimate.

QUESTION 12 会计Final exam代考

a) You purchased a machine for $1 million three years ago and have been applying straight-line depreciation to zero for a seven-year life. Your tax rate is 30%. If you sell the machine right now (after three years of depreciation) for $700,000,what is your incremental (after-tax salvage) cash flow from selling the machine?

Hint: You need to know the book value of the machine at the time of the sale. Only the part of the selling price above or below book value will have a tax effect. The book value is the purchase price minus accumulated depreciation.

b) Castle View Games would like to invest in a division to develop software for a soon to-be-released video game console. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following estimates (in millions of dollars). 会计Final exam代考

If Castle View currently does not have any initial working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

QUESTION 12

c) This year, The Boring Company, has an EBIT of $100m, interest expenses of $40m,depreciation expenses of $15m and capital expenditures of $30 million, and has increased its net working capital by $5m. Its tax rate is 35%. Compute earnings/Net Income (NI) and free cash flow (FCF).

Earnings = NI = (EBIT – Interest)*(1 – Tax Rate)

FCF = EBIT x (1 – Tax Rate) + Depreciation – Change in NWC – Capex + Terminal cash flows

更多代写:代写assignment作业 gre proctoru代考 代写网课加拿大 电影report代写 大学论文代写 劳动经济学代写