AcF 302 ACCOUNTING AND FINANCE

CORPORATE FINANCE (End-of-term test: Section B)

会计和财务代写 Section B consists of 4 questions for a total of 80 marks. Answer ALL questions. Question 1 Tian Industries is considering a new project.

Section B consists of 4 questions for a total of 80 marks. Answer ALL questions.

Question 1

Tian Industries is considering a new project. The project is expected to increase Tian’s free cash flow by £11.5 million the first year, and this cash flow is expected to decline at a rate of 1% per year from then on. The project will cost £125 million. Tian currently maintains a constant equity-to-debt ratio of 1.5, its corporate tax rate is 36%, its cost of debt is 4%, and its cost of equity is 10.5%.

REQUIRED: 会计和财务代写

i) How much equity does Tian need to issue to finance the project? (9 marks)

ii) Does the value of existing equity change? (3 marks)

iii) Suppose that the cost of the project was £50 million instead of £125 million. Calculate the dividend that could be paid to shareholders as a result of the project. (3 marks)

iv) Calculate the free cash flow to equity of the project in year 3. (9 marks)

(Total 24 marks)

Question 2 会计和财务代写

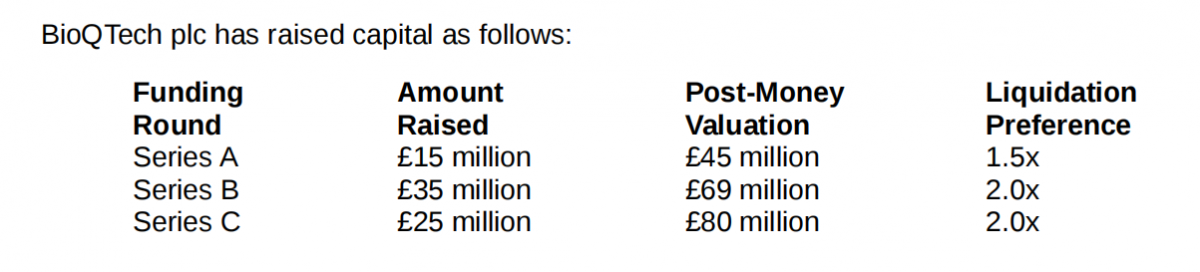

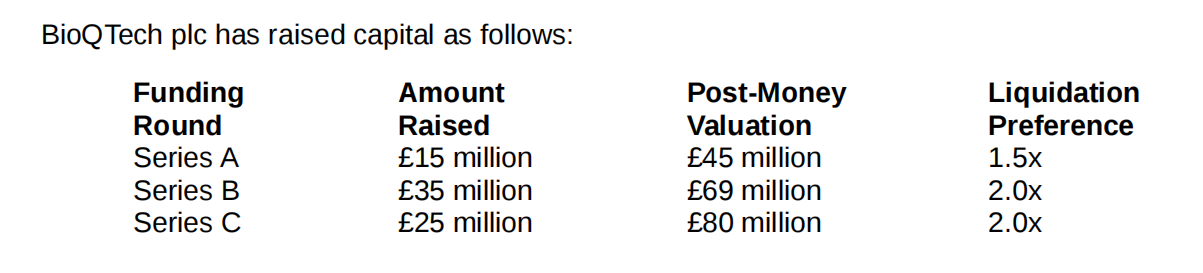

BioQTech plc has raised capital as follows:

The table above shows the capital raised and post-money valuations in each funding round and the liquidation preference of investors in each round. Series C investors have the highest seniority followed by Series B then Series A and then common shareholders. None of the funding rounds offered investors participation rights.

REQUIRED:

i) What will Series A, Series B, Series C, and common shareholders receive if the company is sold for £100 million? (8 marks)

ii) What will Series A, Series B, Series C, and common shareholders receive if the company is sold for £250 million? (8 marks)

(Total 16 marks)

Question 3 会计和财务代写

i) Goldsboro Industries has an average accounts payable balance of £680,000. Its annual cost of goods sold is £4,500,000, and it receives terms of 1/10, net 40 from its suppliers. Goldsboro chooses to forgo this discount. Is Goldsboro managing its accounts payables well? Explain why or why not. (7 marks)

ii) Goldsboro Industries wants to borrow £1 million for two months. Using its inventory as collateral, it can obtain a 10% (APR) loan (compounded monthly). The lender requires that a warehouse arrangement be used. The warehouse fee is £10,000, payable at the end of the two months. Calculate the effective annual rate of this loan for Goldsboro Industries. (7 marks)

(Total 14 marks)

Question 4 会计和财务代写

SuperFood needs a lorry to improve their food delivery service to supermarkets and retailers. They have contacted a lorry manufacturer who quotes a purchase price of £250,000. The manufacturer can lease or sell the lorry.

i) If SuperFood decided to lease the lorry, which type of lease would this be? (5 marks)

ii) Assume that the lorry’s residual value in 5 years is £50,000, capital markets are perfect and the risk-free interest rate is 3% APR (with monthly compounding). Calculate the monthly lease payments for a 5 year lease of the lorry. (7 marks) 会计和财务代写

iii) As an alternative, SuperFood is offered a five year fixed price lease that allows the lessee to buy the lorry at the end of the lease for £40000. Assume that capital markets are perfect and the risk-free interest rate is 1% APR (with monthly compounding). Calculate the monthly lease payments for a 5 year lease of the lorry. (7 marks)

iv) If Superfood decided to buy the lorry outright by borrowing the amount needed to purchase it using a 5 year annuity loan with a 2.5% APR with monthly compounding, calculate the monthly loan payments of a five year loan to purchase the lorry. (7 marks)

(Total 26 marks)

更多代写:monash代码查重 gre代考2021 英国心理学代写推荐 西浦essay代写 戏剧论文代写 留学商科类ps代写