Corporate Finance

End-Term/Final Exam

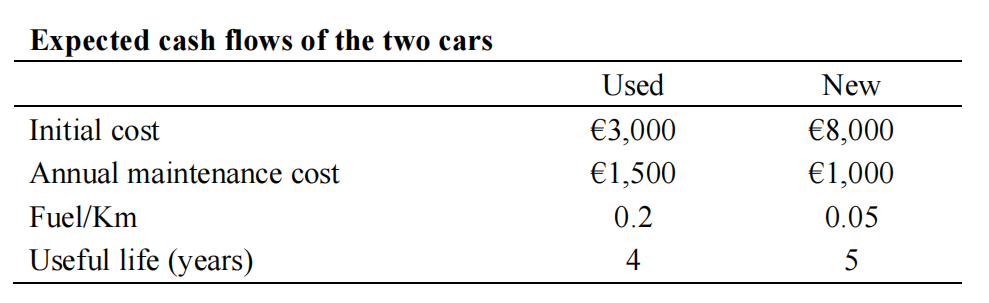

企业融资考试代写 1.Mr. Passos Dias Aguiar, an Uber driver, is facing a decision regarding buying a used car more cheaply, or buying a new car.

Valuation of Real Investments

1.Mr. Passos Dias Aguiar, an Uber driver, is facing a decision regarding buying a used car more cheaply, or buying a new car. The characteristics of the two options are provided in the table below. In addition, we know that Mr. Passos drives 10,000 kilometres per year on average, and the appropriate discount rate is 15%.

a) Which would be the better option for Mr. Passos?

b) What should be the annual maximum mileage such that the two options are equivalent?

Enterprise Valuation 企业融资考试代写

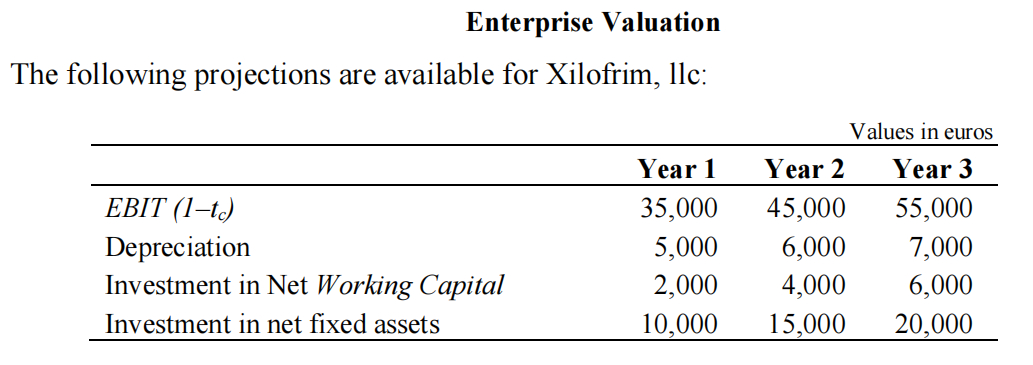

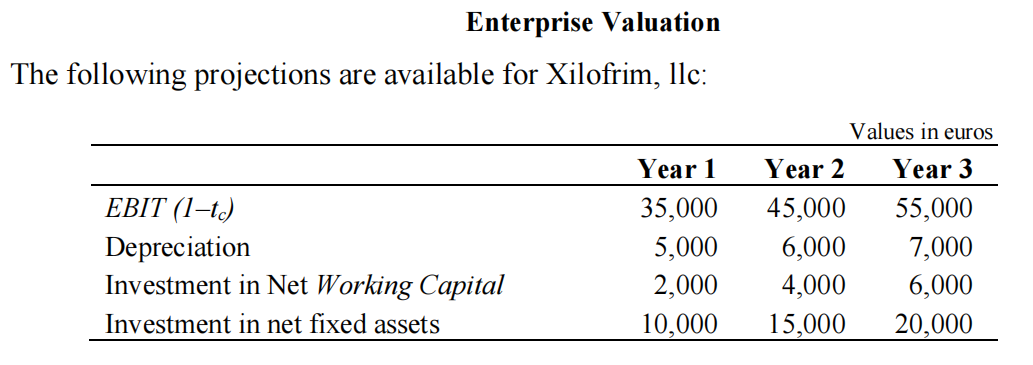

From year 3 on (inclusive) the growth rate is 2%. Currently, the book value of the company’s debt is 300,000 euros, and it is quoted at 104.5% in the market, providing a yield of 5%. The book value of equity is 435,000 euros. Regarding non-operating assets, the consists of shares purchased 5 years ago with a price-to-book ratio of 1.2. The target debt-to-equity ratio of the firm, in market value, is 0.5, and, given the company’s risk, the shareholders require a return of 8.75%. At the end of year 0, the invested capital is 600,000 euros. The effective corporate tax rate is 30%.

a) Determine the equity value of Xilofrim, llc by using the EVA

b) What is the implicit equity value in an Enterprise Value/EBITDA multiple with an average value of 14.1 in the sector? What can you conclude regarding the perpetual 2% growth rate assumed in the projections?

Calculate EBITDA1 = 35,000/(1 – 0.3) + 5,000 = 55,000

Calculate EV implicit in the sector multiple (year 0) = 55,000 ´ 14.1 = 775,500

Equity value implicit in the multiple (year 0) = 775,500 + 162,000 – 313,500 = 624,500

Since the equity value is greater than the one obtained in the previous part, it means that the growth rate should be greater than 2%, at least if the remaining projections are maintained.

c) Comment the following statement: “The valuation of companies by the DCF method by using dividends as relevant cash flows is perfectly acceptable”.

Long-Term Financing and Cash and Credit Management 企业融资考试代写

1.(Only Final Exam).

A firm received a proposal on a bank loan in euros for 2 years and with an all-in cost of 5.1%. Alternatively, the firm could also take a loan in USD. Assume that the effective corporate tax rate is 30%, and consider the following characteristics for the USD loan:

USD loan

- Nominal value 1,000,000 EUR (=1,000,000 USD)

- Maturity: 2 years

- Annual interest rate: 4% (fixed)

- Interest payment: annual

- Repayment: 50% at the end of each year

- Average annual depreciation rate of EUR/USD: 2%

- Tax on interest and commission: 4%

- Commission: 0.5%

- Tax on opening the credit line: 0.5%

Calculate the all-in cost for the USD loan and make a suggestion to the company regarding which option it should choose.

2.

Eject, llc is considering a financing for 90 days from Bank A which proposes an interest rate of Euribor 1M+2%, being the actual Euribor 1M at 5% (actual/360), augmented with a tax on opening the credit line of 0.05% and a 4% interest tax. Alternatively, the company could offer a cash discount to its clients, who typically pay in 45 days, if they pay within 15 days. What is the maximum cash discount offered to the clients such that it is preferable to the bank loan?

3.(Only End-Term Exam).

In managing the current assets, the companies must take into account a set of factors and define an optimal level of current assets. Which are these factors and how can you characterise them?

Capital Structure and Project Valuation with Debt 企业融资考试代写

1.

Consider a perpetual project which the firm wants to finance entirely by equity, with an initial investment of €2.5 million (useful lifetime of 5 years) and NPV equal to €– 100,000. The corporate tax rate is 30%.

a) Calculate the EBIT of the project, knowing that the cost of (unlevered) equity is 10%.

b) Meanwhile the company decided to take a perpetual loan at 8.5% to finance €200,000 from the initial cost of the project. Under these conditions should the company accept the project?

c) Continuing the previous part, what is the minimum value of state subsidy, repaid in 5 years, that makes the APV equal to 0 and, under these conditions, what is the equity-to-asset ratio of the firm? (if you did not solve the previous part, consider an APV equal to €–80,000).

d) (End-term exam). Considering the assumptions of part (a), what should be the unlevered cost of equity that would allow and NPV of €500,000?

2.

Comment the following statement. “In a world of corporate taxes the argument of homemade leverage developed by M&M about the capital structure of companies does not make sense anymore.”

3.

Comment the following statement. “A profitable company is not always attractive to investors.”

更多代写:留学生计算机代写 文科Online exam代考 英国essay代写机构 英文Essay学生论文代写 新西兰留学文书代写 开放经济宏观经济学代写