Midterm Exam

中级财务会计代写 Question 1 Gruffalo Inc’s 2021 financial statements include a number of unverifiable disclosures about the company’s financial position and

Question 1

Gruffalo Inc’s 2021 financial statements include a number of unverifiable disclosures about the company’s financial position and economic performance. If Gruffalo hires an external auditor to perform a financial statement audit of the company’s 2021 year end financial statements what is Gruffalo doing?

Choose the option that BEST describes what this illustrates.

- Other (answer is not shown)

- Prospectivelyadjusting

- Creatingmoral hazard

- Signalling

- Cheap talk

Question 2

Which of the following options best describes the impact of overstating an accrued expense during the 2021 fiscal year?

- There is no effect onnet income for 2021.

- Net income for 2021 will be

- Current liabilities for 2021 will be understated.

- Ending retained earnings for 2021 will be understated.

Question 3 中级财务会计代写

During fiscal year 2021, Management decided to change the method of depreciation for a machine that was purchased January 1, 2020 from the double-declining balance method to the straight-line method. The depreciation expense for this machine under each of these methods for 2020 was determined to be as follows:

- Double-declining balance method depreciation = $57,000

- Straight-line method depreciation = $32,000

Assume that net income before tax (NIBT) was $125,000 for fiscal 2020, What is the appropriate adjustment type and revised NIBT value for fiscal 2020 given this accounting change?

- Prospective treatment with no adjustment necessary for fiscal

- Other (none of the other options are correct))

- Retrospective adjustment and revised 2020 NIBT of $150,000

- Retrospective adjustment and revised 2020 NIBT of $182,000

- Retrospective adjustment and revised 2020 NIBT of $100,000

Question 4 中级财务会计代写

Early in 2021, Forest Ltd. signed a contract to construct a warehouse. At that time, Forest’s management estimated the gross profit on the contract to be as follows:

| Contract Price | $1,150,000 |

| Estimated total costs | 883,200 |

| Estimated gross profit | 236,800 |

At the end of 2021, the status of the work on the contract was as follows:

| Costs incurred to date | $432,000 |

| Estimated costs to complete | 528,000 |

How much revenue can be recognized on this contract for 2021, assuming that Forest uses the percentage-of-completion basis for long-term construction contracts and the cost-to-cost approach (round to nearest dollar)?

- $106,560

- $547,826

- $504,000

- $916,364

Question 5

Silver’s Fitness Centre opened for business on April 1, 2021. For revenue recognition purposes, all memberships are assumed to be issued and commence at the beginning of the month. Membership pricing is as follows:

- One-year memberships are priced at $600

- Two-year memberships are priced at $960

During April, Silver’s Fitness Centre sold 32 one-year memberships and 25 two-year memberships. Silver’s Fitness Centre prepares monthly financial statements.

Which of the following statements is correct?

- Deferred revenue at April 30 would be $43,200.

- Other (none of the other options are correct))

- Revenue to be recognized as earned for the month of April is $3,600.

- Revenue to be recognized as earned for the month of April is $43,200.

- Revenue to be recognized as earned for the month of April is $2,600.

Question 6 中级财务会计代写

Diamond Head Ltd has a December 31 year end and uses the aging of accounts method to estimate the allowance for doubtful accounts for the year.

At December 31, 2020, the balance in the allowance account was $50,000. The company had the following transactions during the current year ending December 31, 2021:

- A $5,000 receivable that had previously been included in the allowance was written off.

- A $3,000 receivable that had previously been written off as uncollectible earlier in the year was collected.

At December 31, 2021, the aging schedule indicated that the balance of the allowance for doubtful accounts should be $64,000.

What is the bad debt expense for the year ended December 31, 2021?

- Other (none of the other options are correct))

- $16,000

- $66,000

- $69,000$19,000

Question 7 中级财务会计代写

On June 15 Charlie Co sold merchandise on credit to Jasper Co, the invoiced amount was $8,000 and the terms of the invoice were 2/10 net 30. The balance was paid by Jasper Co on June 30.

Assuming Charlie Co uses the net method to record receivables, what is the journal entry required to settle Jasper Co’s account when payment is received?

- AR $8,000, Cr. Cash $7,840, Cr. Interest revenue $160

- Cash $8,000, Cr. AR $7,840, Cr. Interest revenue $160

- Cash $8,000, Cr. AR $8,000

- Cash $7,840, Dr. Cash Discounts $160, Cr AR $8,000

- Other (none of the other options are correct))

Question 8

In 2021, Coffee & Cream Co initially reported net income of $245,000. You have since been made aware of the following errors in inventory:

- 2020 ending inventory was overstated by $12,000

- 2021 ending inventory is understated by $11,000.

What is Coffee & Cream’s corrected net income for 2021?

- $222,000

- Other (none of theother options are correct))

- $246,000

- $268,000

- $244,000

Question 9 中级财务会计代写

Hydro Co has 3 inventory items in stock at year end. The costs to sell are commissions of 10%. Based on the following information, determine the amount (if any) of the inventory write-down required at year end.

| Item | Cost per unit | Units | Selling price per unit | Selling price per unit – net of commission |

| A | $100 | 100 | $150 | $135.00 |

| B | $120 | 125 | $130 | $117.00 |

| C | $50 | 100 | $45 | $10.50 |

- $6,250

- $0

- Other (none of the other options are correct))

- $1,325

- $500

Question 10

Outdoor Apparel Co. uses a standard markup of 100% on invoiced cost. At the year end, 400 out of 10,000 products had been discounted by 40% of retail price.

What is the cost as a percentage of retail price for the discounted products?

- 83%

- 120%

- Other (none of the other options are correct))

- 60%

- 40%

Question 11 中级财务会计代写

Rouge Inc reports under IFRS and has total fixed production overhead costs of $20,000. Rouge has a normal production level of 2,000 units per year. If the actual production level in 2021 is 3,200 units, how much fixed overhead would be allocated per unit and what is the total amount of fixed overhead included in inventory for 2021?

- FOH per unit = $10.00; FOH included in inventory = $32,000

- FOH per unit = $6.25; FOH included in inventory = $20,000

- FOH per unit = $10.00; FOH included in inventory = $20,000

- Other (none of the other options are correct))

- FOH per unit = $6.25; FOH included in inventory = $12,500

Question 12

Fast and Fancy Inc. (FFI) sold a used car for $76,800 cash in Year 1. The company will also provide 4 oil changes per year for 5 years and an extended service-type warranty for 5 years. This is the first time that FFI has offered an extended warranty. They intend to offer it to customers on a stand-alone basis but have not yet established a sales price.

The observable selling prices of the car and oil changes follow:

Car $72,000

Oil change $90 each oil change

How much revenue can FFI recognize in year 1?

- $72,000

- Other (none of the other options are correct))

- $72,960

- 76,800

- $72,360

Question 13 中级财务会计代写

YumYum Yogurt (YumYum) signed a franchise agreement to allow a franchisee to operate in Kelowna for a 10-year period. The franchise agreement had the following terms:

- the franchisee is required to pay a $100,000 initial fee to YumYum.

- the franchisee will pay a royalty of 3% on all sales revenue

YumYum.If Year 1 sales at this franchise location are $5 million and management has made the following estimates:

- The value of services rendered to this franchisee—such as location and demographic analysis, initial staffing, and training—totalled $20,000 at the start of year 1.

- The remainder of the initial fee (i.e., $80,000) relates to services to be provided evenly over each of the 10 years (including year 1).

How much revenue should YumYum recognize in year 1?

- $178,000

- $128,000

- Other (correct answer not shown)

- $250,000

- $170,000

- $150,000

Question 14 中级财务会计代写

Which of the following statements is correct about transactions with multiple performance obligations (ie. multiple deliverables)?

- Revenue must be allocated to the performance obligations evenly over

- the life of the contract.

- The revenue must be recognized evenly over the life of the contract

- Applying the revenue recognition criteria to each performance obligation

- separately increases representational faithfulness

- The revenue recognition criteria no longer apply to these transactions.

- Other (none of the other options are correct))

Question 15

Select the option that best completes the following statement. Changes in accounting estimates

- are applied to current and future reporting periods

- are applied to current and past reporting periods

- Other (none of the other options are correct))

- reduce the relevance and reliability of financial reporting

- are accounted for in the same manner as changes in accounting policies

Question 16 中级财务会计代写

Tick Tock Ltd has a December 31 year end. The “Deferred Revenue” balance showing on Tick Tock’s 2021 year end trial balance relates to a special order placed by one of their biggest customers who requested a line of custom clocks. The order price was $24,000 and full payment was needed upfront because this is a custom order.

We received and recorded the full payment as deferred revenue on December 20, 2021. Production on this order will commence January 15, 2022 with completion expected in February 2022.

What journal entry, if any, is required to adjust the December 31, 2021 trial balance?

- Deferred Revenue $24,000, Cr. Revenue $24,000

- no entry required.

- Other (none of the other options are correct))

- Deferred Revenue $24,000, Credit Cash $24,000

- Dr COS $24,000, Cr. Inventory $24,000

Question 17 中级财务会计代写

Indigo Inc. reported credit sales of $600,000, cash sales of $100,000 and cash collections of $450,000 for the year ended December 31, 2021. The ending balance in accounts receivable was $800,000. Bad debt expense is estimated at 1% of credit sales. The allowance for doubtful accounts had a balance of $80,000 at the beginning of the year.

What is the bad debt expense for the year ended December 31, 2021?

- $6,000

- Other (none of the other options are correct))

- $7,000

- $86,000

- $8,000

Question 18

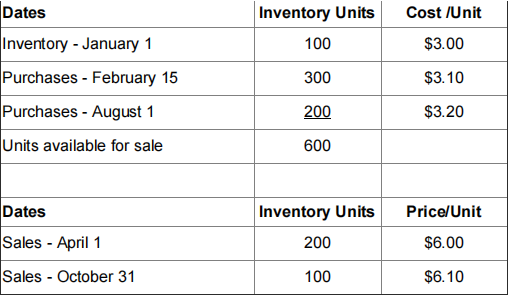

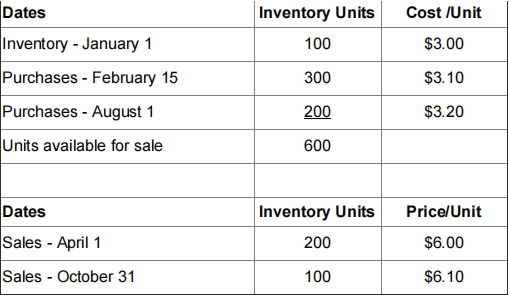

The following purchase and sales data was taken from the inventory records of Spooky Co.

What would the cost of goods sold be for the year assuming that the FIFO method is used and that Spooky Co uses a periodic inventory system?

- $940

- Other (none of the other options are correct))

- $950

- $920

- $930

Question 19

Which statement is correct about multiple performance obligation arrangements?

- The residual method must normally be used.

- The percentage completion method must be used.

- There is no specific method that must be used.

- The relative stand-alone selling price method is the preferred method when available.

- Other (none of the other options are correct))

Question 20 中级财务会计代写

Blue Ltd has a December 31 year end. In January 2022, during the subsequent events period, a major client that had a material receivable balance outstanding as at December 31, 2021 filed for bankruptcy. It is determined that Blue Ltd will only be able to collect 20% of the value of their account receivable as full and final settlement.

Which of the following statements best describes the accounting treatment of this event.

- This is an adjusting event and a reduction to the receivables balance should be recorded in the December 31, 2022 financial statements.

- This is a non adjusting event but requires note disclosure in the December 31, 2021 financial statements.

- This requires neither adjustment to recognized amounts nor disclosure in the December 31, 2021 financial statements.

- This is an adjusting event and a reduction to the receivables balance should be recorded in the December 31, 2021 financial statements.

- Other (none of the other options are correct))

Question 21 中级财务会计代写

At the start of 2019, Brick and Mortar Ltd. entered into a $5,400,000 contract with the city of North Vancouver to construct a wharf at the Lonsdale Quay. Construction commenced in February 2019 and completed in November of 2021.

During contract negotiations, the costs were estimated to be $4,500,000.

Brick and Mortar Ltd report under IFRS and use the percentage of completion method of revenue recognition and the cost-to-cost method of estimating the percentage complete.

The following information is available for each year of the project:

| 2019 | 2020 | 2021 | |

| Costs incurred each year | $450,000 | $3,150,000 | $2,100,000 |

| Estimated costs to complete | $4,050,000 | $2,400,000 | 0 |

| Billings | $2,700,000 | $1,800,000 | $900,000 |

| Collections | $2,400,000 | $1,800,000 | $1,200,000 |

(Hint: only the information provided in the 2019 column was known in 2019, similarly the information provided in the 2021 column was not known in 2020)

REQUIRED:

Part 1: Identify each of the 5 steps for revenue recognition and explain how they apply to this scenario.

Part 2: Calculate the amount of profit/loss to be recognized in each of 2019, 2020 and 2021.

Be sure to show your work in your response file. It is strongly recommended that you take the table approach to ensure you are receiving full marks.

In the space provided below enter the amount of profit/loss for each of 2019, 2020, and 2021.

Upload your supporting calculation response file (either in excel, word or as a scanned pdf of your written work) to thedropbox provided after you have completed the timed exam.

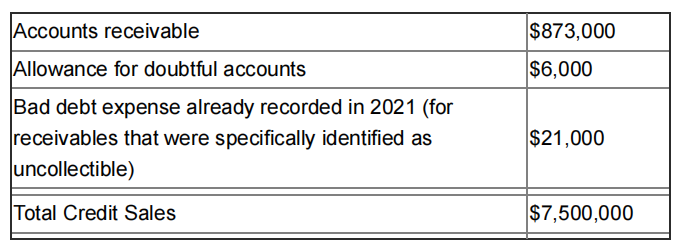

Question 22

Banditt Inc. accounts show the following balances on the December 31, 2021 unadjusted year end trial balance:

Note 1: In 2021 there were $10,000 in accounts that had previously been allowed for that were identified as being uncollectible. It was determined that the customers have gone bankrupt and the amounts will not be collectible. In 2021 Baditt also collected $5,000 on a receivable that had previously been written off. These amounts have

not yet been recorded in the unadjusted trial balance.

As at December 31, 2021, the company estimates that the following amounts of accounts receivable will not be collectible:

| Days outstanding | 0-30 | 31–75 | 76-120 | 120+ | Total |

| Amount | 320,000 | 267,000 | 234,000 | 52,000 | 873,000 |

| % not collectible | 4% | 8% | 15% | 30% | — |

For Required 1, 2 and 3 assume that Banditt estimates ADA based on the AR aging schedule.

REQUIRED 1:

Prepare the journal entry to adjust for the uncollectible accounts receivable (bankrupt customers) in 2021 and the collection of the account previously written off described in Note 1.

REQUIRED 2:

Prepare the journal entry to adjust the allowance for doubtful accounts (AFDA) in 2021:

REQUIRED 3:

What should be the amount of bad debt expense for the year ended December 31, 2021?

Enter the amount of bad debt expense for the year ended December 31, 2021 (identify as Required 3) in the space provided below

REQUIRED 4:

Independent of Required’s 1-3, now assume that the company estimates bad debts as 1.5% of credit sales, what would be the journal entry to adjust the allowance for doubtful accounts on December 31, 2021.

REQUIRED 5

Similar to required 4 above, assume that the company estimates bad debts as 1.5% of credit sales, what should be the amount of bad debt expense for the year ended December 31, 2021?

Enter the amount of bad debt expense for the year ended December 31, 2021 (Identify as Required 5) in the space provided below

Upload your response file (either in excel document or as a pdf of your written work) to the dropbox provided after you have completed the quiz.

Question 23 中级财务会计代写

Ambiance Ltd. sells essential oil blends and diffusers, its best-selling diffuser model is the Aroma-home which is perfect for infusing large spaces within the home with refreshing aromas. The following information pertains to the Aroma-home inventory for August 2021:

| Units | Unit Cost | |

| Opening inventory – August 1 | 2,000 | $25 |

| Purchase 1 – August 7 | 1,200 | $20 |

| Sale 1 – August 12 | 900 | |

| Purchase 2 – August 14 | 2,200 | $27 |

| Sale 2 – August 26 | 2,400 |

REQUIRED 1:

Assume that Ambiance uses the weighted-average cost method under a periodic inventory system, what would be the cost of goods sold for August 31, 2021?

Enter the amount of cost of goods sold for August 31, 2021 for Required 1 in the space provided below

REQUIRED 2:

If Ambiance uses the weighted-average cost method under a perpetual inventory system, what would be the cost of ending inventory for August 31, 2021?

Enter the amount of cost of goods sold for August 31, 2021 for

Required 2 in the space provided below

REQUIRED 3:

If Ambiance used the FIFO cost method under a periodic inventory system, what would be the total cost of goods sold for the month of August?

Enter the amount of cost of goods sold for August 31, 2021 for Required 3 in the space provided below

Upload your response file (either in excel document or as a pdf of your written work) to the dropbox provided after you have completed the quiz.

Question 24 中级财务会计代写

Ambiance Ltd. sells essential oil blends and diffusers. Ambiance’s controller has provided you with the following information related to the essential oil blends inventory:

| Essential Oil Blend | Units on hand | Cost per unit | Selling price per unit |

| Fresh and calm

A blend of lavender and peppermint oils |

400 | $ 13.00 | $ 12.50 |

| Peppy mint

A blend of lemon and peppermint oils

|

650 | $ 15.00 | $19.00 |

| Into the woods

A blend of pine and sandalwood oils

|

300 | $ 13.50 | $ 21.00 |

| Festive

A blend of cinnamon, clove and orange oil |

400 | $ 16.00 | $ 13.00 |

| Harmony

A blend of grapefruit and clary sage |

300 | $ 14.50 | $15.00 |

Ambiance estimates selling costs, such as commissions to be 5% of the selling price.

Required:

Determine the amount of inventory write-down required – if any.

Enter the write-down amount in the space provided below

Upload your response file (either in excel document or as a pdf of your written work) to the dropbox provided after you have completed the quiz.