ECOM137 China and Global Financial Markets

Problem Set 2

1.How expensive is early retirement? 中国与全球金融市场作业代写

Suppose you are 40 years old today and you are considering retiring this year. Assume that you are going to live to be exactly 90 years old and have a lifestyle that costs £100,000 a year, which you wish to maintain after retirement. You don’t have any other retirement plan and hence won’t have any social security payments after retirement. Suppose you can guarantee a rate of return on your investment of an annual rate of 4%. How many pounds do you need to have today in order to afford the early retirement?

2.How fast do you pay off your credit card debt? 中国与全球金融市场作业代写

You have a balance of £3,000 on your credit card debt. Suppose you start paying back your debt next month and you can afford to pay as least £50 per month. Consider three options: paying £50, £60 or £75 per month. How many months, from next month on, does it take for you to repay your credit card debt (assuming no new debts) if your credit card company charges 12% annual interest rate? 18% annual interest rate?

3.Who benefits from a lower inflation rate?

Suppose two parties agree that the expected inflation rate for the next year is 3%. Based on this, they enter into a loan agreement where the nominal interest rate to be charged is 7%. If the inflation rate for the year turns out to be 2%, who gains and who loses?

4.What’s the effect of leverage on risk? 中国与全球金融市场作业代写

Consider an investment project of £1,000 with the following payoffs: with probability 0.5, the investment pays off £700 (i.e. bad outcome); with probability 0.5, it pays off £1,500 (i.e. good outcome). What is the expected rate of return? What is the standard deviation of the rate of return?

Now suppose you borrow £1,000 in addition to your own £1,000 capital and invest a total of £2,000 in this project. Let’s suppose you must repay the lender £1,050 regardless of the outcome from your investment. What is the expected rate of return now? What is the standard deviation of the rate of return?

5.How to measure the riskiness of a bond? 中国与全球金融市场作业代写

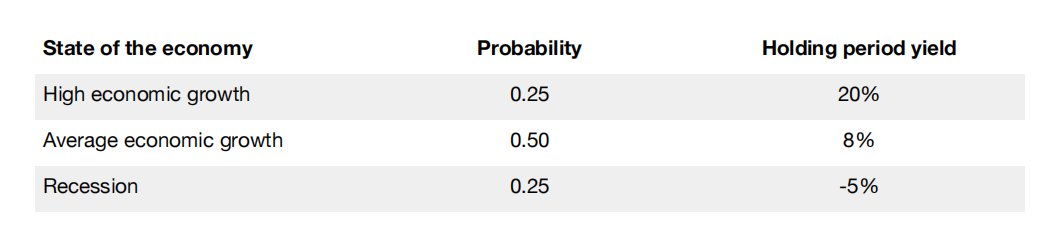

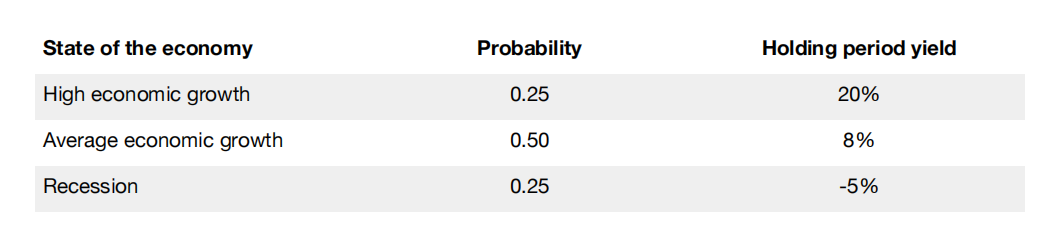

Suppose you buy a long-term bond, planning to hold it for one year. Over the course of that year, the bond’s return depends on how the economy evolves. Suppose that the holding period yield (i.e. the rate of return from holding the bond for the year) has the following probability distribution:

(1) If you pay £1,000 for this bond, what is the expected value in terms of pounds and in terms of percentage gains or losses?

(2) Compute the standard deviation in terms of the percentage return.

(3) If the risk-free rate is 3%, what is the risk premium on this bond?

更多代写:cs澳洲网课代上机构 ap考试代考 英国会计online quiz代考 管理学essay代写 澳大利亚数学代考推荐 中国与全球金融市场代写