FINANCIAL ACCOUNTING II

MsC in MANAGEMET / FINANCE AND ACCOUNTING

财务会计代写 Multiple Choice Questions From a financial accounting standpoint, only one of the answers to each of the ten questions below is possible.

INFORMATION

- The duration of the exam is 2 hours.

- The exam must be performed individually.

- Only calculators with simple arithmetic are permitted.

- Mobile phones and other smart telecommunication devices are not allowed.

- Students cannot leave the class room during the exam.

- IFRS framework and standards and the chart of accounts are allowed references for consultation purposes during the exam.

- Fill in the appropriate fields with your name and student’s number.

- At the end, the complete set of the exam must be returned without being detached.

- When signing the attendance list, you are required to copy your order number in the attendance list and post it to this exam on the appropriate field located at the bottom, right hand side, of this page.

- You should answer the questions in the answering sheets provided.

- Regarding – Part I, multiple choice questions, with estimated time for resolution of 15 minutes, only one answer is correct. Each correct answer is worth 0,6 point. Total points for 10 questions, is 6.0 points. Wrong questions are penalized with 0.15 point.

- Part IIis worth 10.0 points with an estimated time for resolution of 80 minutes;

- Part IIIis worth 4.0 points with an estimated time for resolution of 20 minutes.

- Whenever you find convenient you can present, assumptions, auxiliary calculations and explanations. These can be done in the blank sheets provided or in the back page of the answering sheets.

PART I 财务会计代写

Multiple Choice Questions (6.0 points)

From a financial accounting standpoint, only one of the answers to each of the ten questions below is possible.

1.A soundly developed conceptual framework enables the International Accounting Standards Board (IASB) to

I. Issue more useful and consistent pronouncements over time.

II. More quickly solve new and emerging practical problems by referencing basic theory.

a. I only.

b. II only.

c. Both I and II.

d. Neither I nor II.

e. None of the above.

2.Numerous errors may exist even though the trial balance columns agree. Which of the following is not one of these types of errors?

a. A transaction is not journalized.

b. Transposition error in the amount posted as a debit.

c. A journal entry is posted twice.

d. A journal entry to purchase $100 worth of equipment is posted as a $1,000 purchase.

e. None of the above.

3.Which of the following is an example of an accrued expense?

a. Office supplies purchased at the beginning of the year and debited to an expense account.

b. Property taxes incurred during the year, to be paid in the first quarter of the subsequent year.

c. Depreciation expense.

d. Rent earned during the period, to be received at the end of the year.

e. None of the above.

4.The failure to properly record an adjusting entry to accrue a revenue item will result in an 财务会计代写

a. understatement of revenues and an understatement of liabilities.

b. overstatement of revenues and an overstatement of liabilities.

c. overstatement of revenues and an overstatement of assets.

d. understatement of revenues and an understatement of assets.

e. None of the above.

5.Recording the adjusting entry for depreciation has the same effect as recording the adjusting entry for:

a. an unearned revenue.

b. a prepaid expense.

c. an accrued revenue.

d. an accrued expense.

e. None of the above.

6.If, during an accounting period, an expense item has been incurred and consumed but not yet paid for or recorded, then the end-of-period adjusting entry would involve:

a. a liability account and an asset account.

b. an asset or contra asset account and an expense account.

c. a liability account and an expense account.

d. a receivable account and a revenue account.

e. None of the above.

7.Which of the following would not be a correct form for an adjusting entry?

a. A debit to a revenue and a credit to a liability

b. A debit to an expense and a credit to a liability

c. A debit to a liability and a credit to a revenue

d. A debit to an asset and a credit to a liability

e. None of the above.

8.Year-end net assets would be overstated and current expenses would be understated as a result of failure to record which of the following adjusting entries? 财务会计代写

a. Expiration of prepaid insurance

b. Depreciation of fixed assets

c. Accrued wages payable

d. All of these answers are correct.

e. None of the above.

9.A prepaid expense can best be described as an amount:

a. paid and currently matched with revenues.

b. paid and not currently matched with revenues.

c. not paid and currently matched with revenues.

d. not paid and not currently matched with revenues.

e. None of the above.

10.Which of the following adjustments would require decreasing the liabilities reported on the statement of financial position?

a. A company uses $400 worth of supplies during the year.

b. A company records $400 worth of depreciation on equipment.

c. A company has earned $400 of revenue collected at the beginning of the year.

d. A company records $400 of wages earned by employees that will be paid next year.

e. None of the above.

PART II (10.0 points) 财务会计代写

Question 1 (2.0 points)

El Dog Corporation includes one coupon in each bag of dog food it sells. In return for 4 coupons, customers receive a dog toy that the company purchases for $1.20 each. El Dog’s experience indicates that 60 percent of the coupons will be redeemed. During 20X4, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 40,000 coupons were redeemed. During 2X15, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed.

Required:

Determine the premium expense to be reported in the income statement and the premium liability on the statement of financial position for 20X4 and 20X5.

Question 2 (2.5 points)

Piggy Builders contracted to build a high-rise for $28,000,000. Construction began in 20X5 and is expected to be completed in 20X8. Piggy uses the percentage-of-completion method. Data for 20X5 and 20X6 are:

Required:

(a) How much gross profit should be reported for 20X5? Show your computation.

(b) How much gross profit should be reported for 20X6?

(c) Make the journal entry to record the revenue and gross profit for 20X6.

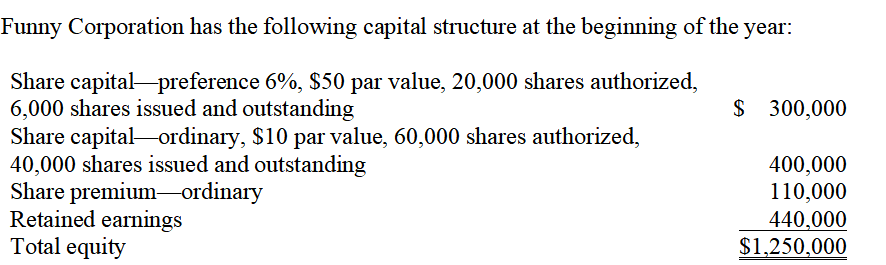

Question 3 (2.5 points) 财务会计代写

Required:

(a) Record the following transactions which occurred consecutively (show all calculations).

1.A total cash dividend of $90,000 was declared and payable to shareholders of record. Record dividends payable on ordinary and preference shares in separate accounts.

2.A 10% ordinary share dividend was declared. The average fair value of the ordinary shares is $18 a share.

3.Assume that net income for the year was $150,000 (record the closing entry) and the board of directors appropriated $70,000 of retained earnings for plant expansion.

(b) Construct the equity section incorporating all the above information.

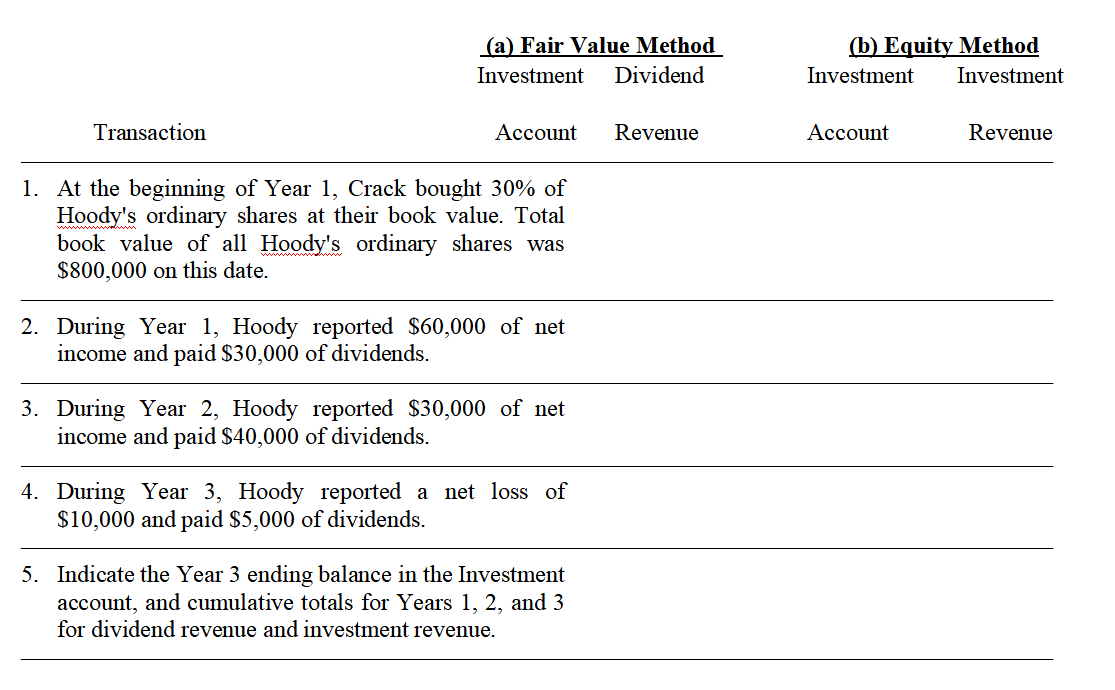

Question 4 (3.0 points)

Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Crack Company uses (a) the fair value method and (b) the equity method for accounting for its investments in Hoody Company.

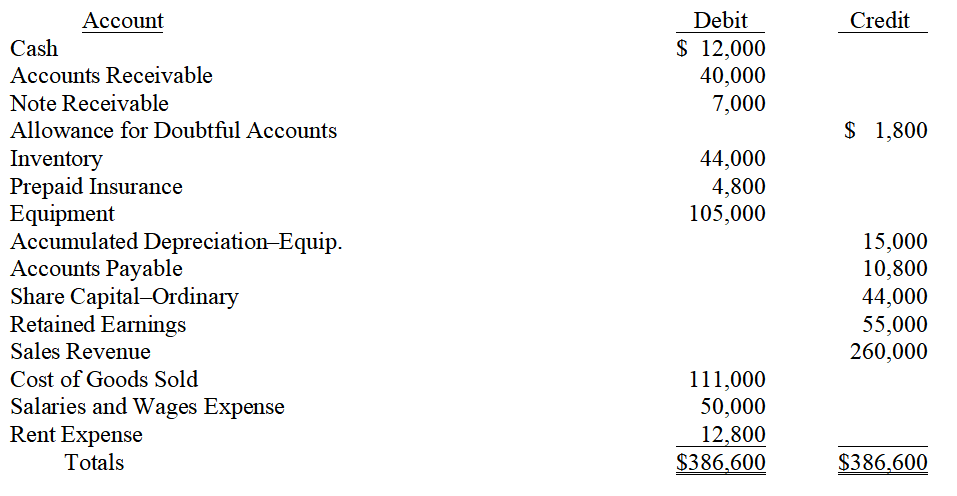

PART III (4.0 points) 财务会计代写

The following trial balance was taken from the books of First Corporation on December 31, 20X5.

At year end, the following items have not yet been recorded.

a. Insurance expired during the year, $2,000.

b. Estimated bad debts, 1% of gross sales.

c. Depreciation on equipment, 10% per year.

d. Interest at 5% is receivable on the note for one full year.

e. Rent paid in advance at December 31, $5,400 (originally charged to expense).

f. Accrued salaries and wages at December 31, $5,800.

Required:

(a) Prepare the necessary adjusting entries.

(b) Prepare the necessary closing entries for the Income Summary (Profit/Loss for the period) and the transfer of it to Retained Earnings.

更多代写:Multi-threading代写 新加坡经济学代考 英国论文apa格式代写 文书类Essay代写 文学书评代写 摄影学报告代写