Empirical Finance Spring II 2021 Assignment 1

Empirical Finance作业代写 They say that “success begets success,” but in the case of The Buzz, success seems to beget feature requests.

* indicates that partial credits are allowed. Make sure you double check your answers.

Data are from the Center for Research in Security Prices (CRSP). The two monthly series from CRSP are the value-weighted with-, RNt, and without-dividend nominal returns, RXt, of CRSP stock market indexes (NYSE/AMEX/NASDAQ/ARCA). The sample period is from 1946:M1 to 2020:M12. The monthly nominal dividend series are constructed as follows.Empirical Finance作业代写

- A normalized nominal value-weighted price series is produced by initializing P0= 1 and recursively setting Pt = (1 + RXt)Pt−1,

- Anormalized nominal dividend series, Dt, is obtained by recognizing that Dt = (RNt −RXt)Pt−1.Empirical Finance作业代写

You will find “dividends.xlsx” that explains how to construct Pt (Price) and Dt (Div).

Q1. (70pts) Constructing dividend growth rates and log pd ratio

- (10pts)Compute log dividend growth rates, ∆dt = ln(Dt/Dt−1), and plot ∆dt.

- (10pts) Compute the sample average and standard deviation of ∆dtin the range be- tween 1947:M1 and 2020:M12.Empirical Finance作业代写

- (20pts*) Discuss the time series properties of ∆dtand explain how to deal with the issue. (Hint: read Schorfheide, Song and Yaron, 2018).

- (10pts)Aggregate the monthly dividends Da = Σ11 Dt−i. It is important to under-stand that for each December, we are aggregating the 12-months of dividends. Thus, τ runs in annual frequency (i.e., December of each year) while t runs in monthly fre-quency. Compute the annual log growth rates ∆da= ln(Da/Da) and provide its sample average and standard deviation.Empirical Finance作业代写

- (10pts*)Plot the time series of ∆da and compare with ∆dt (you could evenly distribute ∆da over the 12 months). Discuss the sample standard deviation of the two series.

- (10pts) Consider the December value of price Ptas P a. Therefore, the length of time series of P a matches that of Da. Construct the log pd ratio pdτ = ln(P a/Da) and compute its sample average and standard deviation in the range of 1948 to 2020.

Q2. (60pts) Predictability Empirical Finance作业代写

- (20pts) Run the following OLSregression

∆dτ+h = αh + βhpdτ + sτ+h (1)

for h ∈ {1, 2, 3, 4, 5} using the most available sample. For example, ∆dτ+5 is availablefrom 1953 to 2020 whereas pdτ is available from 1948 to 2015. Report the estimate of βh and the implied R2 value for each h.

- (10pts) Run the following VARregression

yτ+1 = Φ0 + Φ1yτ + ετ+1, ετ+1 ∼ N (0, Σ) (2)

where yτ = [∆dτ , pdτ ]j. Report the estimates of Φ1 and Σ. Note that Σ = 1 Σ εˆjτ +j εˆτ+j (sum of squared residuals) where k is the number of regressors (including a constant).

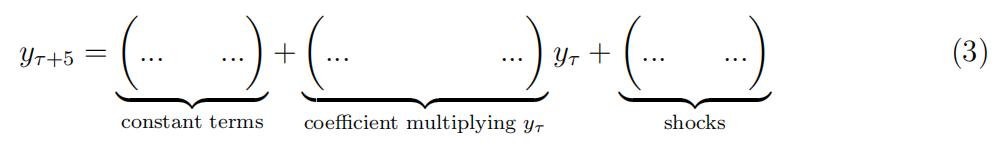

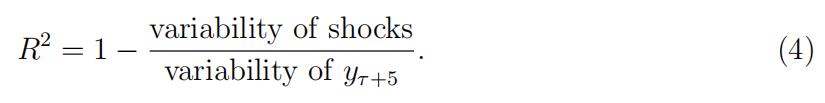

- (10pts) Fill out theblanks

- (10pts*) Based on your previous answers on (3), explain how you wouldcompute

- (10pts*)Read Section 3 of Bansal, Kiku, and Yaron (2012) and discuss very briefly how you can increase the dividend growth predictability.

Q3. (20pts) Reading on dividend/return predictability Empirical Finance作业代写

Read Binsbergen and Koijen (2010) and summarize the paper. The summary should be not more than two paragraphs.

Q4. (50pts) Correlation between stock and bond returns Empirical Finance作业代写

You will find ”returns.mat” that includes two daily series of stock returns and bond returns (of maturity 1-year) which range from 1971 to 2020.

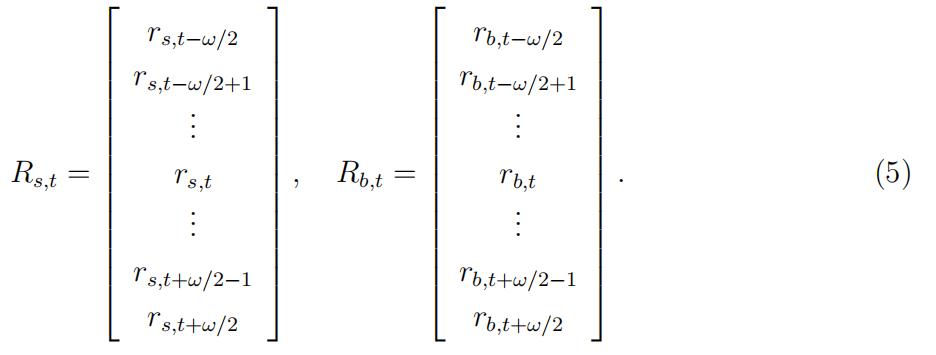

- (20pts) Compute the rolling correlation between stock returns and bond returnsby setting window interval to ω. That is, you are to compute corr(Rs,t, Rb,t) for each t

where ω + 1 ≤ t ≤ T − ω

Plot the time series of rolling correlation for ω = 60 and ω = 900.

- (30pts*)Describe the correlation pattern and provide potential (Hint: feel free to search online). The explanation should be not more than two paragraphs.

其他代写:代写CS C++代写 java代写 r代写 金融经济统计代写 matlab代写 web代写 app代写 作业代写 物理代写 数学代写 考试助攻 algorithm代写