ECMT5001: Mid-semester Examination (2021s2)

Econometrics期中代考 What is the probability that there are at least one day with big market movement out of two consecutive days?

Time allowed: 1.5 hours

The total score of this exam is 40 marks. Attempt all questions.

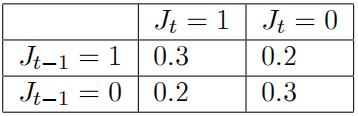

1.Let Jt be the indicator that a big movement occurs in the stock market on day t (i.e.,Jt= 1 if there is a big move; Jt= 0 otherwise).

The joint probability distribution of Jt-1 and Jt is given in the table below:

(a) [2 marks] What is the probability that there are at least one day with big market movement out of two consecutive days? Econometrics期中代考

(b) [3 marks] Given that there is a big market movement today, what is the probability that there was a big market movement yesterday?

(c) [3 marks] Are Jt-1 and Jt independent? Explain.

(d) [2 marks] Compute E(Jt).

(e) [3 marks] Compute V ar(Jt).

(f) [4 marks] Compute Corr(Jt-1,Jt).

2.There are two major blue-chip stocks in the stock market: Apple (AAPL) and Berry(BRRY). Econometrics期中代考

Let A and B denote, respectively, the annual returns of a share of AAPL and BRRY. It is known that A has mean 0.1 and standard deviation 0.4, and B has mean 0.05 and standard deviation 0.2.

Carol decided to form a portfolio by investing in 50% of AAPL and 50% of BRRY.

(a) [3 marks] Find the expected annual return of Carolís portfolio.

(b) [5 marks] It is also known that the correlation between A and B is -0.25. Find the standard deviation of the annual return of Carolís portfolio.

3.The stocks in the technology sector performed quite well in 2020. Their annual returns follow a normal distribution with mean 0.2 and standard deviation 0.5. Econometrics期中代考

Little Bob formed a mutual fund by randomly picking 25 stocks with equal weights from the technology sector.

(a) [5 marks] What is the probability that the annual return of little Bobís mutual fund was negative in 2020?

(b) [6 marks] Little Bobís mutual fund achieved an average annual return of 0.35 in 2020.Test at the 5% significance level that little Bobís mutual fund outperformed the technology sector of the stock market with a higher average annual return. Show all your steps. A complete response should include:

i.setting up the null and alternative hypotheses;

ii.defining an appropriate test statistic;

iii. stating the distribution of your test statistic under the null hypothesis; Econometrics期中代考

iv.computing the test statistic based on the sampled data;

v.making a decision using a correct method (e.g., critical value approach or p-value approach); and

vi.drawing a conclusion.

(c) [4 marks] Simon formed his own mutual fund by randomly picking 100 stocks with equal weights from the technology sector. He also achieved an average annual return of 0.35 in 2020. Do you think Simonís mutual fund outperforms the technology sector of the stock market at the 5% signiÖcance level? Explain your answer.

更多代写:台湾留学生代写 雅思远程代考 宏观经济Midterm代考 会计Essay代写论文 国际商务论文代写 Principles of Econometrics代写