Think-Big Development

decision model and analytics代考 The Van Horne Company manufactures air conditioners that are sold to five large retail customers around the country.

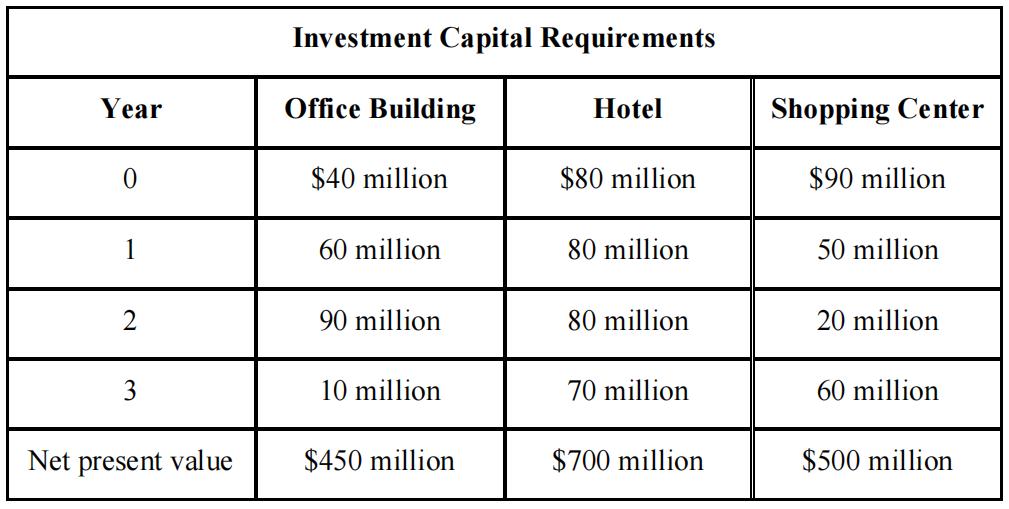

The Think-Big Development Co. is a major investor in commercial real-estate development projects.

It currently has the opportunity to share in three large construction projects: decision model and analytics代考

Project 1: Construct a high-rise office building.

Project 2: Construct a hotel.

Project 3: Construct a shopping center.

Each project requires each partner to make investments at four different points in time: a down payment now, and additional capital after one, two, and three years. Table 1 shows for each project the total amount of investment capital required from all the partners at these four points in time. Thus, a partner taking a certain percentage share of a project is obligated to invest that percentage of each of the amounts shown in the table for the project.

All three projects are expected to be very profitable in the long run. So the management of Think-Big wants to invest as much as possible in some or all of them. Management is willing to commit all the company’s investment capital currently available, as well as all additional investment capital expected become available over the next three years. The objective is to determine the investment mix that will be most profitable, based on current estimates of profitability.

Since it will be several years before each project begins to generate income, which will continue for many years thereafter, we need to take into account the time value of money in evaluating how profitable it might be. This is done by discounting future cash outflows (capital invested) and cash inflows(income), and then adding discounted net cash flows, to calculate a project’s net present value.

Based on current estimates of future cash flows (not included here except for outflows), the estimated net present value for each project is shown in the bottom row of Table 1.

All the investors, including Think-Big, then will split this net present value in proportion to their share of the total investment.

For each project, participation shares are being sold to major investors, such as Think-Big, who become the partners for the project by investing their proportional shares at the four specified points in time. For example, if Think-Big takes a 10 percent share of the office building, it will need to provide $4 million now, and then $6 million, $9 million, and $1 million in 1 year, 2 years, and 3 years, respectively. decision model and analytics代考

The company currently has $25 million available for capital investment. Projections are that another $20 million will become available after one year, $20 million more after two years, and another $15 million after three years. What share should Think-Big take in the respective projects to maximize the total net present value of these investments?

(Note: There are four points in time when Think-Big needs to make payments. Funds not used at one point are available at the next point. For simplicity, we will ignore any interest earned on these funds and any money left over at the end of year 3 will not count towards the overall investment’s net present value.)

Designing a Supply Chain decision model and analytics代考

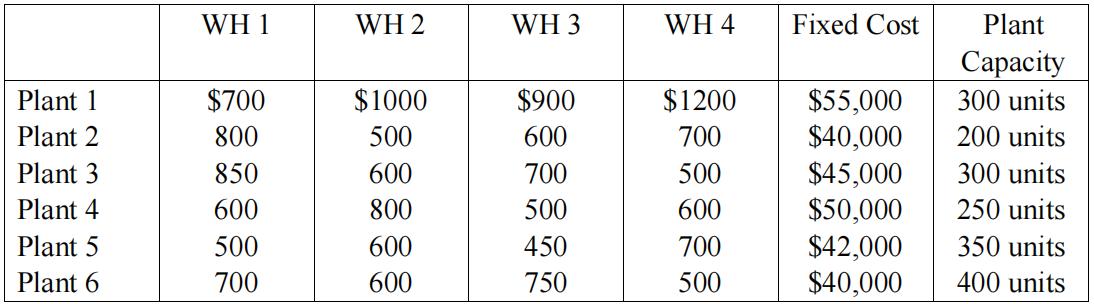

The Van Horne Company manufactures air conditioners that are sold to five large retail customers around the country. Van Horne is evaluating its manufacturing and logistics strategy to ensure that it is operating as efficiently as possible. The company can produce air conditioners at six plants and stock these units in any of four different warehouses. The cost of manufacturing and shipping a unit between each plant and warehouse is summarized in the following table alone with the fixed operating cost and monthly capacity for operating each plant.

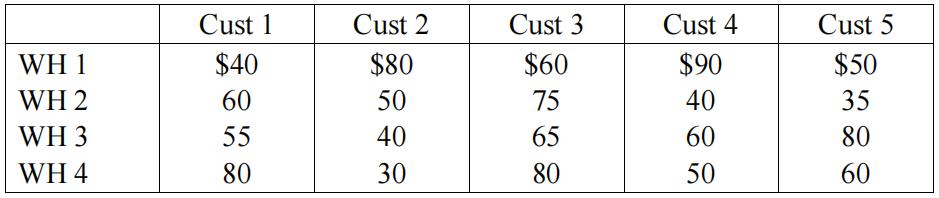

Per-unit cost of shipping units from each warehouse to each customer is given in the following table:

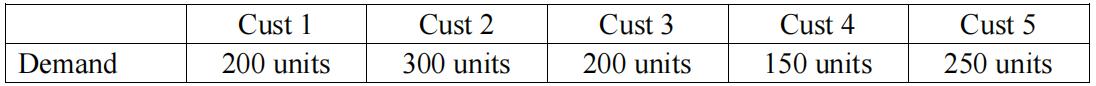

The monthly demand from each customer is summarized as follows

Consider all of the costs and demands tabulated above, what is the minimum monthly operating cost for Van Horne’s supply chain? Which plants should Van Horne operate to meet demand in the most costeffective manner?

Project Management

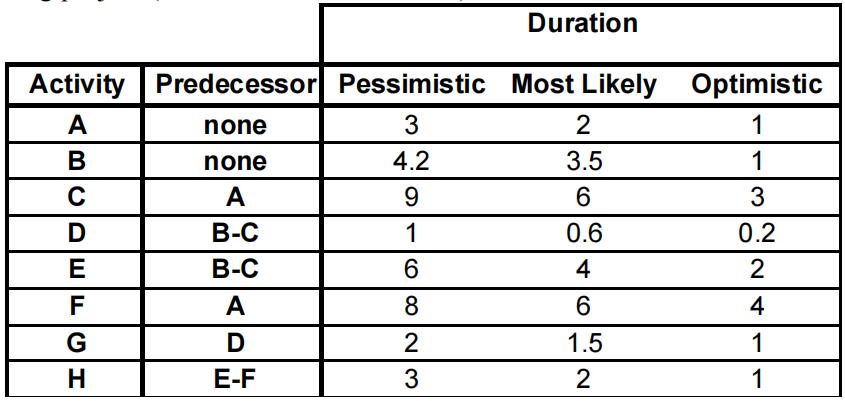

Consider the following project (all durations are in weeks).

a) Draw the network

b) What is the probability that the project duration exceeds 16 weeks?

The cost of developing this project is equal $3000. On the other hand, the revenue you can make out of this project depends on the time you (as project manager) promise to complete it. More specifically,you know that the revenues are given by

Revenues = 30000-1000×(Project duration (in weeks) that you quote) decision model and analytics代考

However, if the duration of the project ends up being larger than the duration that you quote then there is a fixed penalty of $8000 that you will need to pay.

For example, if you quote a duration of 12 weeks and the project takes 12 or less weeks then your net profits are $18000 on revenues minus $3000 on fixed costs (that is, $15000). However, if the duration exceeds 12 weeks then your profits are $18000 on revenues minus $3000 on fixed costs minus $8000 on penalty ($7000).

c) What is the optimal duration that you should quote?

更多代写:北美bio生物学代考 gre网考代考 法学留学生代写 北美essay作业代写 北美论文范文 paraphrase技巧