STA457 Time Series Analysis Assignment 1 (Winter 2019)

Assignment统计学代写 Assignment and solution (Fall 2018)2. Moskowitz et al. (2012), “Time series momentum”, Journal of Financial Economics

Jen-Wen Lin, PhD, CFA Date: February 07, 2019

Please check in Quercus regularly for the update of the assignment.

Background reading: Assignment统计学代写

- Assignment and solution (Fall2018)

- Moskowitz et al. (2012), “Time series momentum”, Journal of FinancialEconomics

General instruction Assignment统计学代写

- Download daily and monthly data of 30 constituents in the Dow Jones (DJ) index from 1999 December to 2018 December. Please seehttps://money.cnn.com/data/dow30/ for the list of DJ constituents.

- Calculate the performance based on a 60-month rolling window and rebalance theportfolio annually at the end of each year.

Questions: Assignment统计学代写

A. Technical trading rule

(1)Find the optimal double moving average (MA) trading rulesfor all 30 DJ constituents (stocks) using monthly data.

Hint: see Assignment (Fall 2018) for more details.

(2)Construct the equally weighted (EW) andrisk-parity (RP) weighted portfolio using all 30 DJ constituents. Summarize the performances of EW and RP portfolios (trading strategies). Assignment统计学代写

Hint: For simplicity, assume the correlations among stocks are zero when constructing the risk-parity portfolio.

B. Time Series Momentum

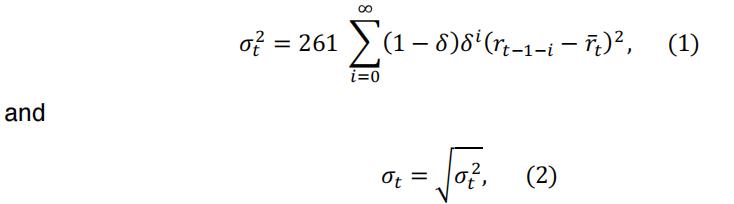

1)Calculate the ex-ante volatility estimateбt for all 30 DJ constituents using the following formula:

where the weights ![]() . add up to one, and

. add up to one, and ![]() average return computed similarly. Assignment统计学代写

average return computed similarly. Assignment统计学代写

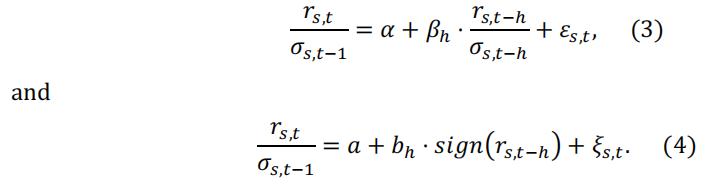

2)Consider the predictive regression that regresses the (excess) return in month t on its return lagged ℎ months,i.e.

whereRs,tdenotes the s-th stock in the DJ constituents and in the prediction regression, returns are scaled by their ex-ante volatilitiesБs,t-1. Determine the optimal ℎ for both predictive regressions for all 30 DJ constituents.

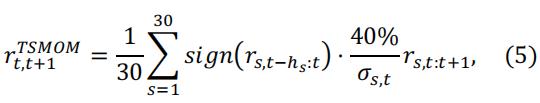

3)Consider a time series momentum trading strategy by constructing thefollowing portfolios:

where Sign(rs,t-hs:t).(40%Бs,t) is our position for the s-th constituent at time t and

Rhs:t-hs:t denote the ℎ:-month lagged returns observed at time t. Summarize the performance of the portfolio.

Hint: For simplicity, assume ℎ: = 12 for all 30 DJ constituents. Assignment统计学代写

C. Dynamic position sizing for technical trading rules

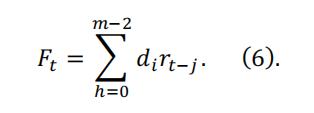

1)Consider a technical indicator Ft, where the technical indicator may be givenby

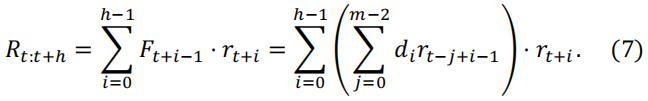

Suppose that our position to the trading rule is determined by the strength (or magnitude) of the signal. The ℎ-period holding period return is then given by

Calculate the expected ℎ-period holding period return, i.e., E(Rt:t+h).

Remark: In this question, we assume that our position changes linearly with the strength of the signal. We can generalize it by replacing Ft+i-1 with g(Ft+i-1) in Equation (7). Assignment统计学代写

2)Find the optimal double MA trading rule for all 30 DJ constituents that maximize the 12-period holding period return.

更多代写:python作业代写 bio生物学网课代考 英国essay代写机构靠谱吗 College level Essay代写 英国term paper代写 留学生实验报告代写