Department of Economics

Applied Macroeconomics代考 There are TWO sections. Section A refers to the first part of the course, while Section B refers to the second part of the course.

Level / Year :3

Module Code / Title :EC339 – Applied Macroeconomics

Exam Paper Code: EC3390

Enter your student ID number below:

Enter below (in the student use only boxes) the number of each whole question you have answered.

STUDENT INSTRUCTIONS

1. Read all instructions carefully. We recommend you read through the entire paper at least once before writing. (Please also note, further exam instructions are also available at this link (Examinations Instructions (warwick.ac.uk))

2. Time allowed: 48 hours

3. There are TWO sections. Section A refers to the first part of the course, while Section B refers to the second part of the course. Each question has a word limit. Words beyond this will not be marked. The following are included in the word count: equations (1 equation equals 1 word), footnotes, subtitles, etc. Include your word count at the end of EACH answer. Provide a reference list of the sources cited in Section B, if any. The reference list is not included in the word count.

4. Type your answers. Use Calibri, 12p font, 1.5 space. Applied Macroeconomics代考

5. You should not submit answers to more than the required number of questions. If you do, we will mark the questions in the order that they appear, up to the required number of questions in each section.

6. The number of marks available for a question will be stated at the end of each question.

7. You are advised to save your work as you go. You are also asked to compress the images you upload to the Word document.

Section A: Answer TWO questions

This introduction refers to all questions in section A.

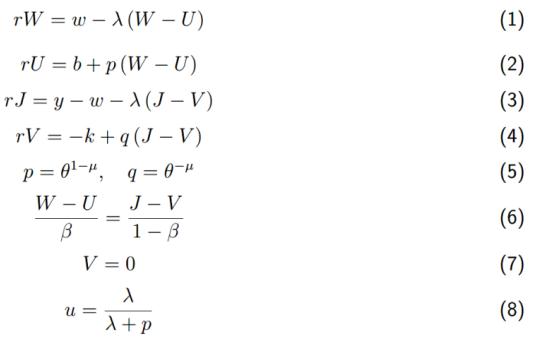

The following equations describe the steady state of the standard Pissarides (1982) search model of the labour market, as considered in our lectures.

The endogenous variables in this model are the value of an employed worker W, the value of anunemployed worker U, the value of a filled job J, the value of an unfilled vacancy V, thejob-finding probability p, the vacancy-filling probability g, the vacancy-unemployment ratio θ, thewage w and the (steady state) unemployment rate u. The parameters are the discount rate r, the separation probability λ, unemployment benefits b, productivity y, vacancy-maintenance costs k,the elasticity of the matching function μ, and workers’ bargaining power β.

1. (wage negotiations) You probably noticed that there have been quite a lot of strikes in theUK recently, and -at least so far- the government is not very proactive in bringing unions andemployer organisations to the negotiation table.

In this question, we try to understand theimplications of this government stance. To do this, we modify the standard model andassume that bargaining is costly: for firm and worker to agree on a wage, the firm needs topay a cost c > 0. By actively facilitating negotiations, the government can lower c.

(a) How should the equations of the standard model be modified to allow for bargainingcosts? Indicate clearly which of the above equations need to be changed and what themodified equations look like, as well as any equations that need to be dropped or added.(100 words, 5 marks)

(b) What is the effect of an active stance by the government, i.e. lower bargaining costs?Which policy-relevant variables are affected and in what way? (100 words, 10 marks) Applied Macroeconomics代考

(c) Explain the intuiton for the result in part b above. lf you could not solve the previouspart, you can still earn partial marks for this part by arguing intuitively what the modelwill predict.(100 words, 10 marks)

2.(government) In the standard model, there are workers and employers (firms), but nogovernment. Applied Macroeconomics代考

The political debate, on the other hand, focuses a lot on the economic andlabour market effects of what the government does: changing taxes, expenditures, andbenefits. Assume that the government raises taxes as a fraction 7 of earnings (both wagesand unemployment benefits), spends some of that money on unemployment benefits 6 (thesame b in the equations above), and uses the rest, denoted by g, for things like infrastructureand civil service wages, which are necessary, but do not directly affect the utility of workersand employers. The government does not borrow or save.

(a) How should the equations of the standard model be modified to incorporate agovernment as described above? lndicate clearly which of the above equations need tobe changed and what the modified equations look like, as well as any equations thatneed to be dropped or added. (100 words, 5 marks)

(b) What is the effect of unemployment benefits on unemployment in this model? How isthe effect different from the standard model? (100 words, 10 marks)

(c) Explain the intuiton for the result in part b above. lf you could not solve the previouspart, you can still earn partial marks for this part by arguing intuitively what the modelwill predict.(100 words, 10 marks)

3. (immigration) Recent history has seen several ‘waves’ of immigrants entering the labourmarket in the UK and other countries.

Whereas the public may be supportive of thisimmigration for humanitarian reasons, many people worry that these immigrants will competewith native workers, putting downward pressure on wages. To better understand this concern,we will use the standard frictional labour market model summarised above. Applied Macroeconomics代考

(a) ln the standard model, how does immigration affect wages? Assume that immigrantsare initially unemployed when they enter the country and the labour market, but areotherwise identical to native workers. Support your argument with reference to theequations and/or derivations thereof. (100 words, 5 marks)

(b) The standard model may not be ideal to analyse this question. lf you were to modify themodel, what would be the first thing you would change and why? Indicate clearly whichof the equations need to be changed and what the modified equations look like, as wellas any equations that need to be dropped or added, and briefly justify your choices inwords. Please number your equations clearly and in order, for reference in part c below.(100 words, 10 marks)

(c) How does the modification proposed in part b above change your answer to part a?Clearly state the differences in the predictions of the model (if any), and derive or arguewhy these differences occur with reference to the equations of the modified model.(100 words, 10 marks)

Section B: Answer Two questions Applied Macroeconomics代考

Please answer the questions as clearly and concisely as possible. lf you think there is a typo or amissing assumption, please state your interpretation or assumptions and this will be taken intoaccount in the marking.

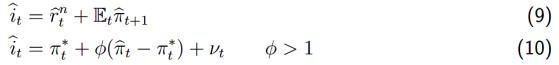

4.Consider the following simple flexible-price model

The first equation is the lS curve (Fisher equation). Here ![]() are respectively thenominal interest rate, the natural interest rate (real interest rate under flexible prices), andinflation. The natural interest rate is an exogenous variable. Et, is the expectation operatorconditional on time t. The second equation is a monetary policy rule. Here π*t is the centrabank’s inflation target at time t. The term vt represents an exogenous shock to the nominainterest rate.

are respectively thenominal interest rate, the natural interest rate (real interest rate under flexible prices), andinflation. The natural interest rate is an exogenous variable. Et, is the expectation operatorconditional on time t. The second equation is a monetary policy rule. Here π*t is the centrabank’s inflation target at time t. The term vt represents an exogenous shock to the nominainterest rate.

(a) What is the condition on Ø for the uniqueness of stationary rational expectations equilibrium? lf you can, provide a derivation. (100 words, 6 marks)

(b) Suppose ![]() for all t and this is credible. Compute equilibrium inflation

for all t and this is credible. Compute equilibrium inflation ![]() underthe condition you derived in (a). Suppose the central bank wishes to achieve

underthe condition you derived in (a). Suppose the central bank wishes to achieve ![]() forall t. Then which path of vtshould the bank choose? (100 words, 6 marks)

forall t. Then which path of vtshould the bank choose? (100 words, 6 marks)

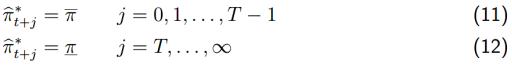

(c) Now suppose that at time t, the bank announces disinflation that will take place at time t + T. More specifically, ![]() is given by

is given by

and ![]() Assume that this policy is credible. Compute

Assume that this policy is credible. Compute ![]() and compare with youranswer to (b). Discuss how

and compare with youranswer to (b). Discuss how ![]() depends on T and Ø. Give intuitions for your answer(100 words,6 marks)

depends on T and Ø. Give intuitions for your answer(100 words,6 marks)

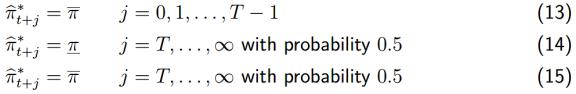

d)Consider again the same disinflation policy in (c), but now assume that this policy is notfully credible. Assume that the private agents believe that disinflation at time T will beimplemented only with probability 0.5. That is:

Compute ![]() under this non-credible policy. (100 words, 7 marks)

under this non-credible policy. (100 words, 7 marks)

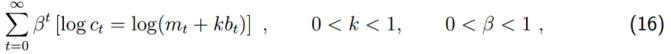

5.Consider the following deterministic money-in-utility function model in which both money andnominal government bonds provide liquidity services. Applied Macroeconomics代考

The preference of the representativehousehold is given by

Here ct: consumption; mt = Mt/Pt: real money holdings; bt = Bt/Pt: real government bondholdings. Mt, and Bt, respectively represent nominal money and government bond holdings atthe end of period t. Pt is the price level. The assumption that 0 < k < 1 captures the fact that Bt: provides less liquidity services compared with money.

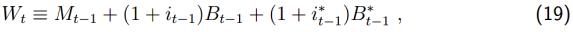

Assume that there is another kind of bond, denoted by B, , that does not provide anyliquidity services. The budget constraint of the representative household is given by

![]()

where it: nominal interest rate of the government bond;it*: nominal interest rate of the otherbond; yt: exogenous income; Tt: nominal lump-sum tax. Assume that the initial nominalwealth is given by Wo. The household chooses {ct, Mt, Bt, Bt* in order to maximise (16),subject to (17).

The government does not purchase goods, and chooses taxes, supply of money andgovernment bond according to its budget constraint

Mt + Bt = (1 +it-1)Bt-1+ Mt-1 –Tt (18)

The goods market clearing implies that ct = Yt. The net supply of B; is equal to zero.

(a) Derive the intertemporal budget constraint (BC) of the representative household.

Whatare the opportunity costs of holding money and the government bond, respectively?Hint: You may want to re-write the flow budget constraint in terms of

to then derive the IBC.(100 words, 6 marks)

(b) Derive the first-order conditions for consumption (Euler equation), money andgovernment bonds. Using these equations, provide an expression for the demandfunction for ‘broad money’, mt + kb.. What is the liquidity premium defined as it/it*?(100 words, 6 marks) Applied Macroeconomics代考

c)Consider the steady state in which mt, bt, it*, it, ct, real tax τt = Tt/P are all constantand inflation is equal to Pt/Pt-1 = at all times. Assume μ > β. Here inflation rate pand real tax τt in the steady state are chosen by the government as exogenous variables Normalise yt = 1. Compute the steady state values of i and i*. Discuss how broadmoney, m + kb, is affected by μ. (100 words, 6 marks)

d) In the steady state considered in (c), show how b/m is affected by u.(100 words, 7 marks)

6.Discuss why macroeconomic models may need nominal rigidities to describe the effects ofmonetary policy. Using formulae and diagrams, discuss how different views about the sourcesof incomplete nominal adjustment – prices or wages – and the characteristics of labor andgoods markets have different implications for unemployment, the real wage, and the markup.(600 words,25 marks)