Homework Assignment 1 (Due: Monday, September 28)

Econometrics作业代写 The manager collects data on NPS, personality types, and certificates for 120 sales reps. Refer to the NPSdata to answer

-

A human resources manager at a software development firm would like to analyze the net promoter score (NPS) of sales reps at the company. Econometrics作业代写

The NPS is a key indicator of customer satisfaction and loyalty, measuring how likely a customer would recommend a product or company to others on a scale of 0 (unlikely) to 10 (very likely). The manager believes that NPS is linked with the sales rep’s personality type (Analyst, Diplomat, Explorer, and Sentinel) and the number of professional certifications (Certificates) he/she has earned. The manager collects data on NPS, personality types, and certificates for 120 sales reps. Refer to the NPSdata to answer the following questions. Econometrics作业代写

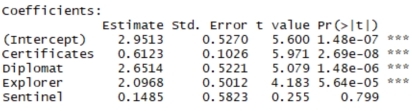

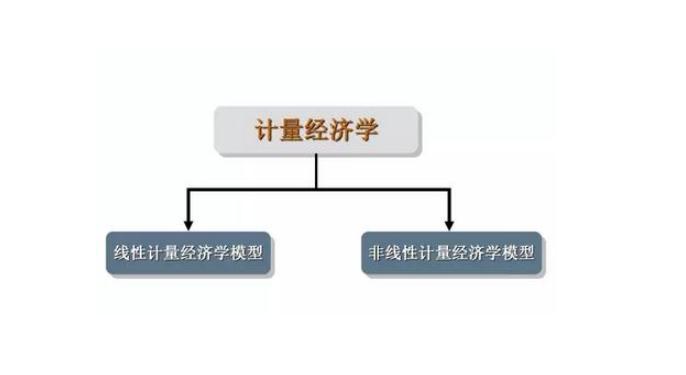

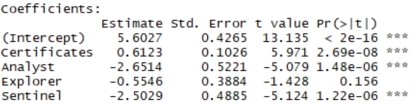

- Estimate a linear regression model using NPS as the dependent variable. The explanatory variables include the number of certificates along with the appropriate dummy variables for personality type. (1 point)

-

Construct and interpret the 95% confidence and prediction intervals for a diplomat and an analyst with three certificates. (1 points) Econometrics作业代写

Diplomat:

![]()

![]()

Analyst:

![]()

![]()

- As expected, the prediction intervals are wider because they also account for the variability caused by the random error term.

- Test if NPS differs between diplomats and analysts at the 5% significance level. (2 points)

; p-value = 1.48e-06; reject the null; NPS differs between diplomats and analysts at the 5% significance level. Econometrics作业代写

- Test if NPS differs between diplomats and explorers at the 5% significance level. (2 points)

; p-value = 0.156; do not reject the null; cannot conclude that NPS differs between diplomats and explorers at the 5% significance level.

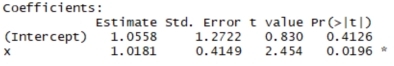

- Go to https:// HYPERLINK “https://finance.yahoo.com/”finance.yahoo.com HYPERLINK “https://finance.yahoo.com/”/and click on Apple Inc (APPL). Click on historical data; apply time period Jan 1, 2016 – December 31, 2018. Download adjusted close price, data and compute monthly return as for 35 months. Compute where (monthly risk-free rate). Similarly extract historical data on S&P 500 (^GSPC), compute returns and . Run a simple linear regression (CAPM) of y on x to estimate alpha and the beta.

- At the 5% significance level, is the Apple stock not as risky as the market?(3 points)

p-value = 0.9655 (2*pt(0.0436, 33, lower.tail = FALSE))

Do not reject the null

We cannot conclude at the 5% significance level that Apple stock not as risky as the market. Econometrics作业代写

- At the 5% significance level, are there abnormal returns? (1 point)

; p-value = 0.4126

Do not reject the null

We cannot conclude at the 5% significance level that there are abnormal returns.