PART II – Strategy Design(60 points)

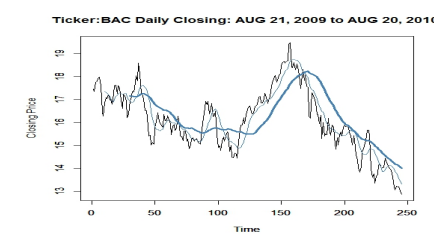

Problem Description: Consider the daily stock price for Back of America (BAC) from August 21, 2009 to August 20, 2010 in the file sp500hst.txt. In this problem, you are given $100,000 capital to invest. Your goal is to max- imize your client’s profitability. But at the same time, you need to measure your investment risk based on your client’s risk utility. Here we assume that your client is risk averse, but she is willing to adjust her risk position, if she can be convinced. You are considering design a trading strategy for BAC stock based on this one year historical data. You need to write a proposal to your client about your strategy, performance and describe your back testing procedure.

|

Year |

S&P 500 Index Annual Return (Wikipedia) |

|

2007 |

5.49% |

|

2008 |

-37.00% |

|

2009 |

26.46% |

|

2010 |

15.06% |

|

2011 |

2.05% |

Note: You will use S&P 500 Index Annual Return as the benchmark rf .

You are to use relative return to calculate ri for each of your trades as:

r = Ending price − Beginning price

r = Ending price − Beginning price

i Ending price

Assignment: You will need to do the following for this assignment:

(1) Assume that you are considering many strategies, but particularly you are testing Moving Average Convergence/Divergence (MACD) at this point. Create a momentum trading strategy based on MACD method to invest $100,000 client’s money. Note that you need to use the fast EMA (12 days) and the slow EMA (26 days), and 9 days for the signalline = ema(M ACDt; 9) for this assignment. Please provide the average return and variance of return for the entire period. (30 points)

(2) To simplify the problem, hedging is not part of your assignment. How- ever, you do need to measure your risk. Suppose you can use S&P 500 Index return during the same period as your risk free rate (annual return rates of S&P 500 Index of the last five years are provided in the table above). Measure your risk adjusted performance using Sharpe ratio:

![]()

![]() RSharpe = E[ri − rf ]/.V ar(ri − rf )

RSharpe = E[ri − rf ]/.V ar(ri − rf )

where rf is the risk-free asset return, ri is return at time i, and V ar(ri − rf ) is the standard deviation of the asset’s excess return at time i. Assume you choose parameter m for the signalline = ema(M ACDt; m) to op- timize your strategy. You need to evaluate the options of m = 7, 9, 11.

Please calculate Sharpe ratios for the three options and choose one best strategy for your client. (30 points) [Hint: calculate exces- sive return for each of your returns (ri − rf ) to the Sharpe ratio, and rf is only different for different years.]

代写CS&Finance|建模|代码|系统|报告|考试

编程类:C++,JAVA ,数据库,WEB,Linux,Nodejs,JSP,Html,Prolog,Python,Haskell,hadoop算法,系统 机器学习

金融类:统计,计量,风险投资,金融工程,R语言,Python语言,Matlab,建立模型,数据分析,数据处理

服务类:Lab/Assignment/Project/Course/Qzui/Midterm/Final/Exam/Test帮助代写代考辅导

天才写手,代写CS,代写finance,代写statistics,考试助攻

E-mail:[email protected] 微信:BadGeniuscs 工作时间:无休息工作日-早上8点到凌晨3点

如果您用的手机请先保存二维码到手机里面,识别图中二维码。如果用电脑,直接掏出手机果断扫描。