Exercises – Lecture 09

This question below is from Chapter Twenty-one and is meant as background to exercise 1.

According to SEC Rule 15C 3-1, what adjustments must securities firms make in the calculation of the book value of net worth? (The information is taken form the ebook pp.342-343)

Specifically, broker-dealers must maintain aggregate indebtedness to net capital of no more than 1500 percent. Aggregate indebtedness consists of the total liabilities arising from any transaction. This includes, among other things, money borrowed, money payable against securities lent, the market value of securities borrowed, customers’ and non-customers’ free credit balances, credit balances in customers’ and non-customers’ accounts having short positions in securities, equities in customers’ and non-customers’ future commodities accounts, and credit balances in customers’ and non-customers’ commodities accounts. Net capital is the net worth adjusted for unrealized profit or loss, deferred tax provisions, and certain liabilities.

In addition to this capital ratio, the 2013 amendment introduced an additional ‘net capital rule’ that is a net liquid assets test. Broker-dealers must calculate the market value for their highly liquid assets on a day-to-day basis and ensure that the market value of these assets exceed the value of their liabilities. This standard is designed to allow a broker-dealer the flexibility to engage in activities that are part of conducting a securities business (e.g., taking securities into inventory), but in a manner that places the firm in the position of holding more than one dollar of highly liquid assets for each dollar of unsubordinated liabilities (e.g., money owed to customers, counterparties, and creditors) at all times.

The rule does not permit most unsecured receivables to count as allowable net capital. 投资证券练习题代写

This aspect of the rule severely limits the ability of broker-dealers to engage in activities that generate unsecured receivables (e.g., lending money without obtaining collateral). The rule also does not permit fixed assets or other illiquid assets to count as allowable net capital. This creates disincentives for broker-dealers to own real estate and other fixed assets that cannot be readily converted into cash. For these reasons, Rule 15c3-1 incentivizes broker-dealers to confine their business activities and devote capital to activities such as underwriting, market making, and advising on and facilitating customer securities transactions.

“Data to support the SEC Rule 15c3-1 net capital calculation and reporting requirements is typically dispersed across multiple systems and internal processes. Although firms are trying to automate their net capital reporting process, there is a lack of available technology vendors that provide a comprehensive, turn-key and end-to-end broker-dealer reporting solution. Instead, current technology vendors provide niche computations that contribute to sub-components of the reporting process with a workflow overlay that bolts into other systems such as reconciliation engines.

Firms leverage internally developed solutions coupled with vendor tools to support reporting requirements. 投资证券练习题代写

However, heavy reliance is placed on the broker-dealer reporting teams to manually aggregate the data using internal and vendor solutions supplemented by spreadsheets to support the remainder of the reporting process. Regulators continue to find suboptimal processes and controls that have led to inaccurate suspense or aged fail charge calculations due to human error and limited spreadsheet controls.

Due to the manual nature of the net capital reporting process across institutions and lack of an automated solution for sourcing data from a single golden source, complete real-time data is unrealistic. Therefore, firms tend to hold excess net capital buffer based on historic trends. In addition, firms are obtaining intraday data for transactions that could cause material fluctuations based on specified thresholds to maintain moment-to-moment net capital requirements.”

“EY Federal Reserve regulatory reporting survey conducted in 2018”

Exercise 1 is related to Chapter Twenty-One 投资证券练习题代写

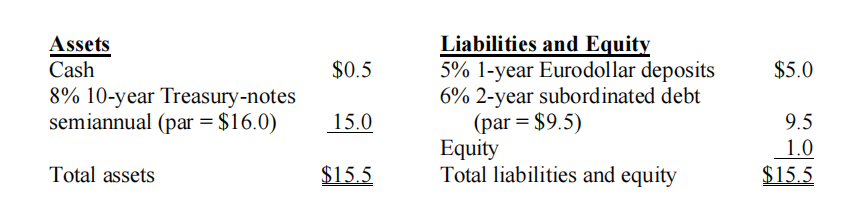

1.An investment bank specializing in fixed-income assets has the following balance sheet (in millions). Amounts are in market values and all interest rates are annual unless indicated otherwise.

a. Does the investment bank have sufficient liquid assets per the net capital rule? Is the investment bank in compliance with SEC Rule 15C 3-1?

b. Assume that the rates on all assets rise 15 basis points and on all liabilities rise 25 basis points (per year). Will the FI be in compliance with SEC Rule 15C 3-1?

c. How does the net capital rule for investment banks differ from the capital requirements imposed on commercial banks and other depository institutions?

Exercise 2 is from Chapter Twenty-Six 投资证券练习题代写

2.A bank has made a four-year $10 million loan that pays annual interest of 9 percent. The principal is due at the end of the third year.

a. The bank is willing to sell this loan with recourse at an interest rate of 9.5 percent. What price should it receive for this loan?

b. The bank has the option to sell this loan without recourse at a discount rate of 9.75 percent. What price should it receive for this loan?

c. If the bank expects a 0.5 of a percent probability of default on this loan, is it better to sell this loan with or without recourse? It expects to receive no interest payments or principal if the loan is defaulted.

Exercise 3 is from Chapter Twenty-Six 投资证券练习题代写

3.City Bank has made a 10-year, $2 million loan that pays annual interest of 10 percent.

The principal is expected to be paid at maturity.

a. What should City Bank expect to receive from the sale of this loan if the current market interest rate on loans of this risk is 12 percent?

b. The price of loans of this risk is currently being quoted in the secondary market at bid-offer prices of 88-89 cents (on each dollar). Translate these quotes into actual prices for the above loan.

c. Do these prices reflect a distressed or non-distressed loan? Explain.

Exercise 4 is from Chapter Twenty-Six

4.An FI is planning the purchase of a $5 million loan to raise the existing average duration of its assets from 3.5 years to 5 years. It currently has total assets worth $20 million, $5 million in cash (0 duration) and $15 million in loans. The FI’s liabilities have an average duration of 5 years. All the loans are fairly priced.

a. Assuming it uses the cash to purchase the loan, should the FI purchase the loan if its duration is seven years?

b. What asset duration loans should the FI purchase in order to raise its average duration to five years?

更多代写:cs澳洲课程代写 gre代考2021 英国宏观经济代上网课 北美论文润色 澳大利亚数学Midterm代考 投资证券代写