MT4551 Financial Mathematics

Problem Sheet 1

金融数学代做 1.If interest payments are compounded m times per year, an initial sum invested for 1 year will grow by (1 + r/m)m where r is the annual rate of

1.

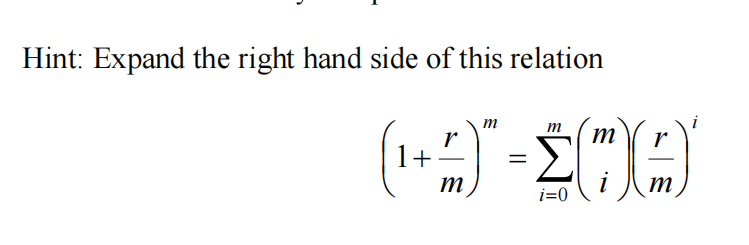

If interest payments are compounded m times per year, an initial sum invested for 1 year will grow by (1 + r/m)mwhere r is the annual rate of interest. Show that this reduces to continuously compounded interest under the limit m → ∞.

2. 金融数学代做

A risk free bond costing 98p now matures in 6 months and pays back 100p. A second bond matures in 1 year, at which time it pays 105p, and currently costs 100p. What should you pay for a bond paying 4p interest in 6 months then 104p at maturity in one year?

3.

A share that pays no dividend has a spot price of £60 and the annual risk-free interest rate is 5%. Determine the forward contract price to buy the share in 1yr, under the assumption that no arbitrage may occur. Present the arbitrage opportunities that will arise if the forward price of the share is incorrectly priced at £58 or £67. For each case determine the profit that can be made.

4. 金融数学代做

A risk free investment in sterling held over one year pays 1.5% interest. A similar investment in Euros pays 3%. What amount in sterling should you agree to pay (neglecting charges) to buy 100,000 Euros in one year’s time if the current exchange rate is £1=€1.2?

5.

A risk free investment in sterling held over one year pays 7% interest. A similar investment in Euros pays 5%. What amount in sterling should you agree to pay (neglecting charges) to buy 1,000,000 Euros in one year’s time if the current exchange rate is €1.0 = £0.62 ? Discuss the arbitrage opportunities if the price is set at £700,000 or £600,000.

6. 金融数学代做

An investor takes a long position on a share (value So). Draw the payoff diagram for the position after 6 months if the share price is now ST. Determine whichcombination of options will produce the same payoff as the long share position.