Derivates

衍生物课业代写 Question 1. Suppose you manage a mutual fund that specializes in investing in technology stocks. You generally pick a portfolio of technology

Question 1.

Suppose you manage a mutual fund that specializes in investing in technology stocks. You generally pick a portfolio of technology stocks and hedge out some risks using futures contracts on some market index. The total value of your current portfolio is 100 million dollars. Please find in the EXCEL sheet “CrossHedging.xlsx” the monthly data of the futures on the S-index, N-index, and the return on your fund portfolio. You can use either the S-index futures contract or the N-index futures contract to hedge the risk.

Note that the S-index futures contract has a contract unit of 50, or one S-index futures contract has a notional value of 50×S-Index. The N-index futures contract has a contract unit of 20, or one N-index futures contract has a notional value of 20×N-100 Index. The futures price data in the Excel spreadsheet are for indices and do not take the multipliers of 20 and 50 into account. Assume you can take fractions of a futures contract throughout this midterm assignment. When answering the following questions a), b), and c), assume today is the end of July 2019, and use the values given by cells B8 and C8 in the sheet “Data for Q1” when you calculate the number of contracts. 衍生物课业代写

a) Suppose you decide to use the S-index futures to hedge the risk. Should you take long or short positions in the S-index futures contracts? How many S-index futures contracts do you need to go long (or short) in order to minimize the variance of the hedged portfolio?

b) Suppose you decide to use the N-index futures to hedge the risk. Should you take long or short positions in the N-index futures contracts? How many N-index futures contracts do you need to go long (or short) in order to minimize the variance of the hedged portfolio?

c) Which is a better hedge? The S-index futures or the N-index futures? Explain why.

Question 2. 衍生物课业代写

Suppose now you are at the end of July 2019 and want to hedge the risk of your portfolio up until the end of October 2019 (for approximately three months) with the equity index futures you picked in Question 1. In this question, you need to compute the varying margin balance of your futures position throughout the three-month period. For the S-index futures, the maintenance margin is $6000 and the initial margin is $6600. For the N-index futures, the maintenance margin is $7600, and the initial margin is $8360. 衍生物课业代写

a) In the Excel file, you are given both futures contracts’ price series from Aug 1, 2019 to Oct 31, 2019. Suppose you long/short one futures contract that you decided to use in Question 1 (whether you take a long or short position depends on your answer in Q1). Compute the following quantities (for simplicity, omit the interest you earn in your margin account):

i. Daily Gain or Loss: the daily change in the futures price to be reflected on your account

ii. Account Balance: the margin balance after adjusting for the daily gain and loss

iii. Margin Deposit: the amount of new deposit required to meet the margin requirement

iv. New Account Balance: the amount in your margin account after placing the margin deposit

v. Total Deposit: the total amount of capital you use to keep the position open (suppose you never withdraw money from the margin account)

vi. Cumulative Profit or Loss

Question 3. 衍生物课业代写

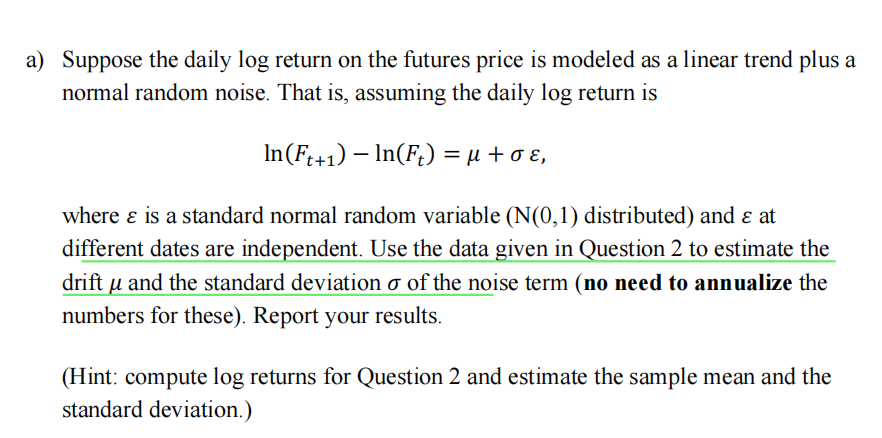

In Question 2, given a particular futures price path from Aug to Oct, you computed the total deposit required to keep your futures positions alive. Let’s call this amount TD. Now we are at the beginning of November and want to hedge our portfolio for the upcoming 90 trading days. In this question, you will simulate 1,000 futures price paths and get a distribution of TD. This computation helps you more precisely estimate the amount of money required for your hedging position. In particular, this exercise allows you to answer questions like “what’s the probability that your futures position keeps alive for up to 90 trading days”. To do this, you first need a model for the dynamics of the futures price.

b) Given your estimated parameters, simulate the daily returns for 90 days, map each return path back to a futures price path, and compute the TD corresponding to this simulated futures price path as you did in Question 2. When doing the simulation, use the latest available futures price in Question 2 as F0. Repeat this step 1,000 times and record the resulting 1,000 values of TD with “Excel What-if Analysis – Data Table”.

(Hint: a brief tutorial for Data Table that may be helpful is included in the Midterm Project folder. For other tutorials for Data Table, there are many online resources.)

c) Now you have a distribution of the TD. You may compute a VaR type of measure of TD, i.e., what is the minimum amount of money you need to have such that you can keep your futures position alive up until the end of Jan 2020 with a 95% chance?