Econ454

学生经济作业代写 The maker of kitchen classics like Pyrex and CorningWare is adding a new culinary darling, the Instant Pot, to its cupboard.

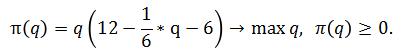

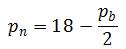

1.(a) In this case M is the monopolist on the market. Thus, it solves 学生经济作业代写

Which gives optimal q= 18, p= 9, CS= (12-9) *18/2= 27, , TS= CS +81

(b) In equilibrium, competition in price ensures that p = =6 (otherwise firms can profitably deviate) which by assumption means that everything is purchased from E; q= 36, CS= (12-6)*36/2= 108,

(c)![]()

(d)![]()

Note that as in notes, for there is a welfare loss from existence of entry barriers.

2, (a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

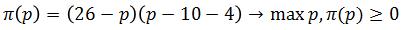

3, (a)![]()

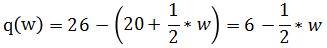

(b) Maximizing to p, we find

![]()

(c)

(d)

![]()

(e) Maximizing we find w= 8, p= 24, q=2

(f)

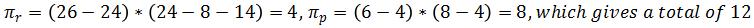

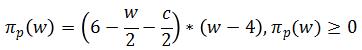

(g) The monopolist problem is then

![]()

This yields p=22<24, q= 4>2, = 4*4=16>12

(h) Double marginalization problem: if producer decreases w to increase sales, only half of this decrease is passed through to customers because of existence of the retailer (because ![]() △w ).Thus dereasing price in presence of rtailer is not as pofitable in terms of ihcrease in sales than without one.

△w ).Thus dereasing price in presence of rtailer is not as pofitable in terms of ihcrease in sales than without one.

(i) From (d), we can get w as a function of increase c: w=8+c/2; from (b), we know p as a function of c; p(w) =20+(w+c/2)/2=20+w/2+c/4 which means that a half of the increase is passed through to the trailer and a quarter to the consumer.

(j) From (a), we can get p as a function of an increase of unit retail cost from 14 to 14+c:p(w)= 20+w/2+c/2; this change affects the quantity sold, so now producer`s profit becomes

Maximizing this w.r. to w, we obtain w8-c/2. Thus, $1 increase in the unit retail cost results in $0.5 decrease in the wholesale price. Plugging this into p(w), we finally get the effect of the increase on the retail price: p=20+4-c/4+c/2=24+c/4. This is, $1 increase in the unit retail cost result $0.25 increase in retail price.

(k) The price with become

P(w)=20+(w+R)/2

(i) q= 6-(w+R)/2 ![]() when W+r>8 the profit of retailers drops on the down slop of revenue curve

when W+r>8 the profit of retailers drops on the down slop of revenue curve

(m) when the total cost is between 8 and 12, both producer and retailers are still profit and the total benefit will be more than producer itself.

(n) A nonlinear price schedule is a menu of different-sized bundles at different prices, from which the consumer makes his selection. In such schedules, the larger bundle generally sells for a higher total price but a lower per-unit price than a smaller bundle.

4, (a) Each producer solves 学生经济作业代写

π;(PnPb) = (26-Pn-)(Pi一pb)→maxPi, Ti(Pn,Pb)≥0,i = n,b.

This system yields

![]()

And the equilibrium is ![]()

(b) Now there is one firm that solves

This system yields p=20<Pn + po=22,q=6,π=36> 32

(c) Similarly, with the previous problem, when one producer decreases the other producer decreases only by half of the decrease in (we can see this from price functions in (a)). Thus decreasing price in presence of another firm producing the complementary good is not as profitable in terms of increase in sales than with merged firm producing the bundled good.

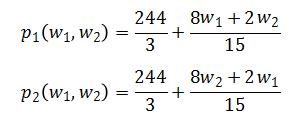

5, (a) Each retailer solves

![]()

(b)This system yields

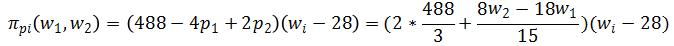

(c) plug to into the demand system (3), then each producer solves

(d) This system above yield w1 = W2 =118

(e) The retail price will be P1 = P2 = 160

(f) Quality sold q1 =q2 = 488- 2* 160= 168

(g) retailer profits 168*(160-118)=7056

(h) producer profits 168*(118-28)=15120

(i)πp;(w1,W2)= (488- 4p1 + 2p2)(Pi – 28)

This system yields p1 = P2 = 100,91 = 92 =288,π1 =π2 = 288* (100- 28) = 20736

(j) The franchise fee for each producer should give retailer a positive profit while keep producer`s profit on a level higher than without a retailer 20736-15120=5616franchise fee < 7056

6, 学生经济作业代写

(1)

McDonald’s Corp said on Monday it would buy Israel’s Dynamic Yield, whose technology helps marketers personalize customer interactions.

Even this transaction is not horizontal acquisition but it faces huge political risk. Per the tense relationship with US and Israel, this trade may be unable to complete.

(2)

Deutsche Bank and Commerzbank, Germany’s two largest lenders, said on Sunday that they had begun merger discussions, in what analysts see as a last-ditch effort to create a national champion that can compete with the giant American investment banks.

For Berlin, combining the two would create a new national champion lender that could support the country’s huge export industry and compete for international business with the giant Wall Street banks. For the lenders, it offers the opportunity to gain financial scale, cut costs and combine technology. 学生经济作业代写

But analysts have questioned whether fusing two beleaguered banks would simply create an even bigger problem. Commerzbank and Deutsche Bank are among the least profitable banks of their size, primarily because they are too large and unwieldy in relation to the revenue they generate.

(3)

The maker of kitchen classics like Pyrex and CorningWare is adding a new culinary darling, the Instant Pot, to its cupboard.

Corelle Brands, which owns Pyrex and other brands, said on Monday that it planned to merge with Instant Brands, the Canadian producer of electric multicookers that have taken the public, and the internet, by storm.

Although Instant Brands has already expanded its product lineup (its website lists 30 multicooker models, an immersion circulator for cooking food using the sous-vide method and a blender that also cooks), combining with Corelle will give it the ability to expand internationally, Mr. Wang said in a statement.

更多代写:统计学online exam代考 雅思代考台湾 网课Online Quiz代考 网课代考 quiz代考 网课代考推荐 英国论文网站