BUSN7031 Exam Practice(1)

管理会计和成本分析代写 The following are practice multiple choice questions and problems for your revision and preparation for the mid-semester exam.

The following are practice multiple choice questions and problems for your revision and preparation for the mid-semester exam. It is not intended to be predictive of the questions that will be in the actual exam.

Multiple Choice

1.

The main purpose for determining the behaviour patterns of costs is to:

a. develop precise mathematical equations

b. assist in making cost predictions

c. correct errors in recording historical costs

d. evaluate actual performance

2.Cost of goods sold is equal to cost of goods manufactured:

a. minus the increase in finished goods inventory

b. minus the decrease in finished goods inventory

c. plus the decrease in work-in-process inventory

d. plus the increase in finished goods inventory

3.A manufacturer has beginning Finished Goods Inventory of $40,000, ending Finished Goods Inventory of $17,000, beginning Work in Process Inventory of $10,000, ending Work in Process Inventory of $22,000, and cost of goods manufactured of $30,000 Given the above information, what is the cost of goods sold?

a. $41,000

b. $18,000

c. $53,000

d. $42,000

4.Given the information in Question 3, what are the total manufacturing costs?

a. $41,000

b. $18,000

c. $53,000

d. $42,000

5. 管理会计和成本分析代写

Profit using variable costing as compared to absorption costing would be higher:

a. when the quantity of beginning inventory equals the quantity of ending inventory

b. when the quantity of beginning inventory is more than the quantity of ending inventory

c. when the quantity of beginning inventory is less than the quantity of ending inventory

d. under no circumstances

6.Christi Manufacturing provided the following information for last month:

Sales $10,000

Variable costs 3,000

Fixed costs 5,000

Operating income $2,000

If sales double next month, what is the projected operating income?

a. $4,000

b. $7,000

c. $9,000

d. $12,000

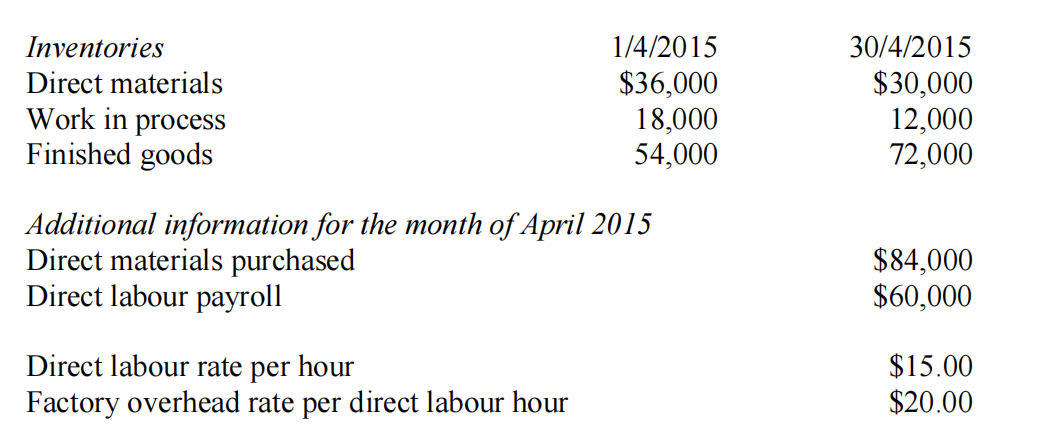

Questions 7 and 8 are based on the following data pertaining to Lam Co’s manufacturing operations:

7.For the month of April 2015, prime cost incurred was:

a. $150,000

b. $138,000

c. $90,000

d. $78,000

8.For the month of April 2015, conversion cost incurred was:

a. $60,000

b. $80,000

c. $140,000

d. $144,000

9. 管理会计和成本分析代写

Which of the following is an example of a budgeted overhead rate?

a. Actual units produced divided by estimated overhead

b. Estimated direct labour dollars divided by estimated overhead

c. Estimated overhead divided by actual direct labour hours

d. Estimated overhead divided by estimated units produced

Questions 10 and 11 are based o n the following data pertaining to Singer Company:

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

Direct materials $ 60

Direct manufacturing labour 10

Variable manufacturing overhead 18

Fixed manufacturing overhead 32

Sales commissions (2% of sales) 4

Administrative salaries 16

Total $140

10.What are the variable costs per unit associated with Product ICT101?

a. $18

b. $22

c. $88

d. $92

11.What are the fixed costs per unit associated with Product ICT101?

a. $102

b. $48

c. $52

d. $32

12. 管理会计和成本分析代写

‘High correlation between two variables means that one is the cause and the other is the effect’ Do you agree? Explain:

a. Yes, high correlation always means the variables have a cause and effect relationship

b. No, high correlation means there is no cause and effect relationship between variables

c. No, there must be a contractual arrangement to have a cause and effect relationship

d. No, you must also consider economic plausibility before determining there is a cause and effect relationship

13.Two journal entries are generally made when

a. goods are transferred out of Work in Process and into Finished Goods

b. finished goods are sold.

c. overhead is applied to production.

d. materials are requisitioned for production

14.When factory overhead is allocated to production, the proper journal entry is a debit to:

a. work in Process Inventory and a credit to Factory Overhead Allocated.

b. Factory Overhead Allocated and a credit to Work in Process Inventory.

c. Work in Process Inventory and a credit to Factory Overhead Control.

d. Factory Overhead Control and a credit to Factory Overhead Allocated.

15. 管理会计和成本分析代写

The cost of materials purchased flows through all of the following manufacturing accounts except:

a. Finished Goods Inventory.

b. Factory Payroll.

c. Cost of Goods Sold.

d. Work in Process Inventory.

16.When using the high-low method, the two observations used are the high and low observations of the:

a. cost driver

b. dependent variables

c. slope coefficient

d. residual term

17.In a normal costing system, the Manufacturing Overhead Control account:

a. is increased by allocated manufacturing overhead

b. is credited with amounts transferred to Work-in-Process

c. is decreased by allocated manufacturing overhead

d. is debited with actual overhead costs

18. 管理会计和成本分析代写

When a job is complete:

a. Work-in-Process Control is debited

b. Finished Goods Control is credited

c. the cost of the job is transferred to Manufacturing Overhead Control

d. actual direct materials, actual direct manufacturing labour, and allocated manufacturing overhead will comprise the total cost of the job

19.In a process-costing system, the calculation of equivalent units is used for calculating:

a. the dollar amount of ending inventory

b. the dollar amount of the cost of goods sold for the accounting period

c. the dollar cost of a particular job

d. Both a and b are correct.

20.When a bakery transfers goods from the Baking Department to the Decorating Department, the accounting entry is

a. Work in Process — Baking Department

Work in Process — Decorating Department

b. Work in Process — Decorating Department

Accounts Payable

c. Work in Process — Decorating Department

Work in Process — Baking Department

d. Work in Process — Baking Department

Accounts Payable

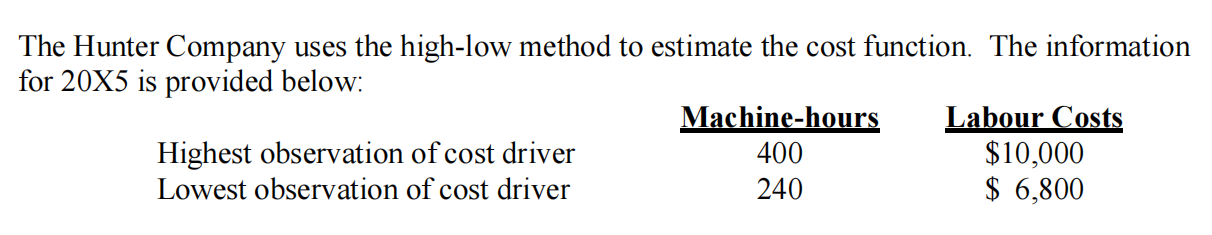

The following information applies to questions 21 and 22:

21.What is the slope coefficient per machine-hour?

a. $28.33

b. $0.05

c. $20.00

d. $25.00

22.What is the constant for the estimating cost equation?

a. $2,000

b. $6,800

c. $8,000

d. $10,000

23.The difference between operating incomes under variable costing and absorption costing centers on how to account for:

a. direct materials costs

b. fixed manufacturing costs

c. variable manufacturing costs

d. Both b and c are correct.

24. 管理会计和成本分析代写

The Tessmer Company has fixed costs of $400,000 and variable costs are 75% of the selling price. To realize profits of $100,000 from sales of 500,000 units, the selling price per unit:

a. must be $1.00

b. must be $1.33

c. must be $4.00

d. is indeterminable

25.Trailhound Company operates on a contribution margin of 30% and currently has fixed costs of $200,000. Next year, sales are projected to be $1,000,000. An advertising campaign is being evaluated that costs an additional $30,000. How much would sales have to increase to justify the additional expenditure?

a. $60,000

b. $90,000

c. $100,000

d. $300,0006

26.Which of the following is NOT an issue that restricts the adoption of outwardly organised systems?

a. The transaction costs involved in executing a transaction

b. The need for agreement on account standardisation

c. The level of interaction that is to occur through the system

d. The feasibility of small businesses meeting the costs of inter-organisational coordination

27. 管理会计和成本分析代写

Which of the following statement is true?

a. ERP systems capture the accounting information for all business processes

b. ERP systems capture a wide range of information for all key business events

c. ERP systems recognise that business functions are separate and unrelated

d. ERP systems divide a business based on either manufacturing or accounting

28.Schulz Corporation applies overhead based upon machine-hours. Budgeted factory overhead was $266,400 and budgeted machine-hours were 18,500. Actual factory overhead was $287,920 and actual machine-hours were 19,050. Before disposition of under/overallocated overhead, the cost of goods sold was $560,000 and ending inventories were as follows:

Direct materials $ 60,000

WIP 190,000

Finished goods 250,000

Total $500,000

Required:

a. Determine the budgeted factory overhead rate per machine-hour.

b. Compute the over/underallocated overhead.

c. Prepare the journal entry to dispose of the over/underallocated overhead using the write-off to cost of goods sold approach.

d. Prepare the journal entry to dispose of the over/underallocated overhead using the proration based on ending balances approach.

29. 管理会计和成本分析代写

Bruster Company sells its products for $66 each. The current production level is 25,000 units, although only 20,000 units are anticipated to be sold.

Unit manufacturing costs are:

Direct materials $12.00

Direct manufacturing labour $18.00

Variable manufacturing costs $9.00

Total fixed manufacturing costs $180,000

Marketing expenses $6.00 per unit, plus $60,000 per year

Required:

a. Prepare an income statement using absorption costing.

b. Prepare an income statement using variable costing.

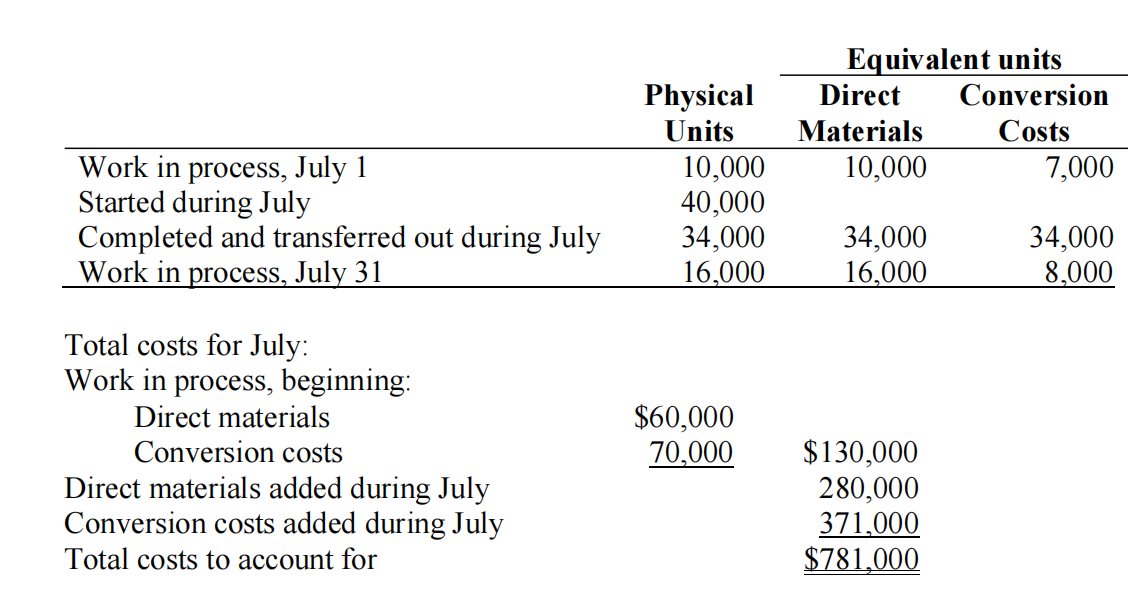

30.The Chatham Company makes a water-treatment chemical in a single processing department. Direct materials are added at the start of the process. Conversion costs are added evenly during the processes. Chatham uses the weighted-average method of process costing:

Required:

a. Calculate cost per equivalent unit for direct materials and conversion costs.

b. Summarize total costs to account for, and assign total costs to units completed (and transferred our) and to units in ending work in proc

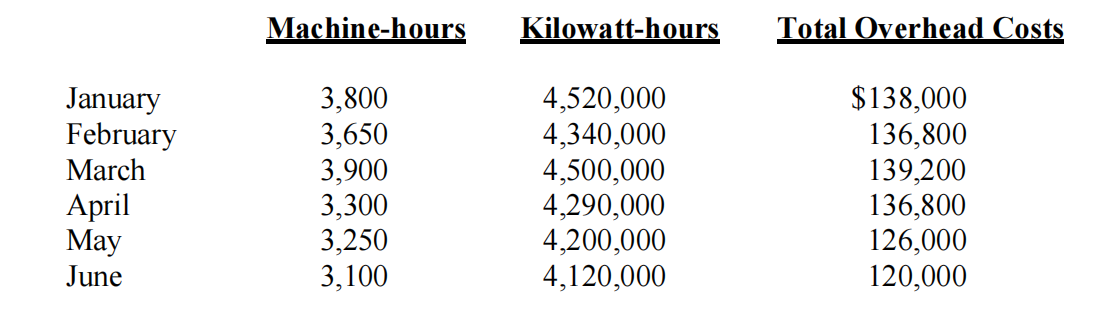

31. 管理会计和成本分析代写

Tessmer Manufacturing Company produces inventory in a highly automated assembly plant in Olathe, Kansas. The automated system is in its first year of operation and management is still unsure of the best way to estimate the overhead costs of operations for budgetary purposes. For the first six months of operations, the following data were collected:

Required:

a. Use the high-low method to determine the cost function with machine-hours as the cost driver.

b. Use the high-low method to determine the cost function with kilowatt-hours as the cost driver.

c. For July, the company ran the machines for 3,000 hours and used 4,000,000 kilowatt-hours of power. The overhead costs totalled $114,000. Which cost driver was the best predictor for July

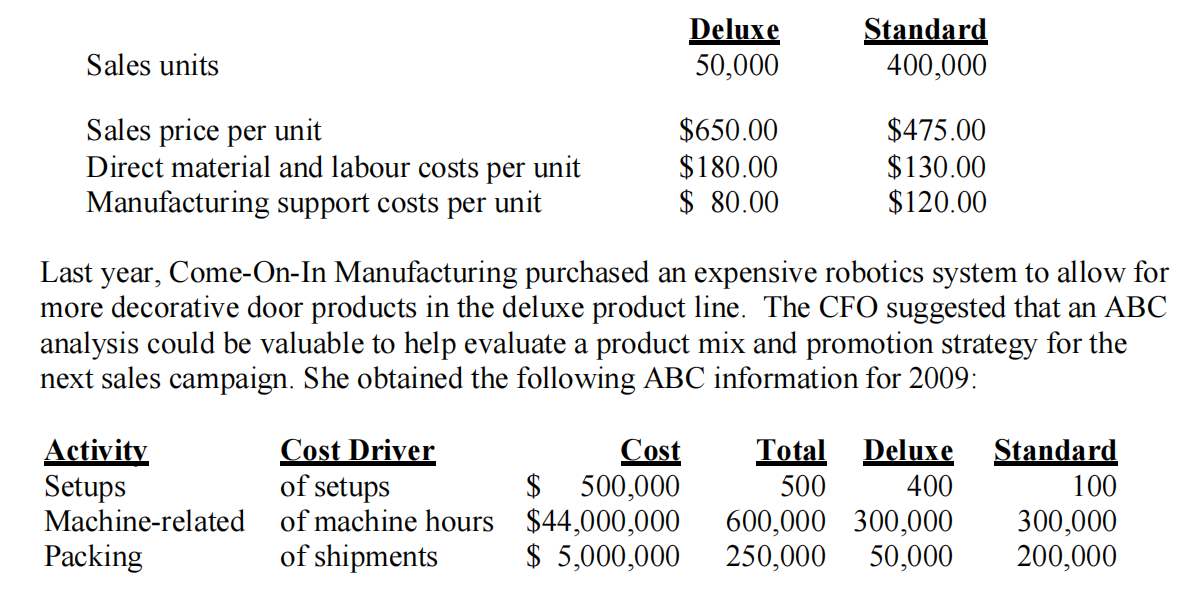

32.Come-On-In Manufacturing produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs has been direct labour dollars. For 2009, Come-On-In compiled the following data for the two products:

Required:

a. Using the current system, what is the estimated

1.total cost of manufacturing one unit for each type of door?

2.profit per unit for each type of door?

b. Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit) than the standard door ($120 per unit). What is a likely explanation for this?

c. Review the machine-related costs above. What is a likely explanation for machine-related costs being so high? What might explain why total machining hours for the deluxe doors (300,000 hours) are the same as for the standard doors (300,000 hours)?

d. Using the activity-based costing data presented above,

1.compute the cost-driver rate for each overhead activity.

2.compute the revised manufacturing overhead cost per unit for each type of entry door.

3.compute the revised total cost to manufacture one unit of each type of entry door.

e. Is the deluxe door as profitable as the original data estimated? Why or why not?

更多代写:CS美国澳大利亚代考 雅思替考 英国商科网课代写 美国哥伦比亚essay代写 美国会计paper代写 essay常用词汇