Risk Management 25878

Assignment

Spring 2019

Risk Management25878代写 Variance/Covariance method: use delta-normal/delta-gamma approximation method for non-linear positions.

i.Determine the Value-at-Risk (VaR), denominated in Australian dollars, for the portfolios provided belowusing

- Variance/covariance (Delta-Normal/Delta Gamma for non-linear positions)

- HistoricalSimulation

- Monte CarloSimulation

ii.Determine the Expected Tail Loss (ETL), denominated in Australian dollars, for the portfolios provided below using the resultsfrom

- HistoricalSimulation

- Monte CarloSimulation

For each of the methods above, calculate the VaR and ETL (where applicable) for the following parameter sets:

| Confidence Level (%) |

95 |

99 |

95 |

99 |

| Holding Period (days) |

1 |

1 |

10 |

10 |

| Individual Portfolios | Portfolio 1 |

| Portfolio 2 | |

| Portfolio 3 Risk Management25878代写 | |

| Portfolio 4 | |

| Portfolio 5 | |

| Combinations

(Compute diversified and undiversified VaR for these combinations) |

Portfolio 2 and Portfolio 3 Risk Management25878代写 |

|

Portfolio 1 and Portfolio 4 (Physical Shares Only) |

Assumptions: Risk Management25878代写

Valuation Date: August 2, 2019

Variance/Covariance method: use delta-normal/delta-gamma approximation method for non-linear positions.

Monte Carlo simulation: Geometric Brownian motion acceptable (but you may choose to use another process if you wish). Zero drift may also be assumed. For the option positions, consider only risk due to the change in the value of the underlying asset. Risk Management25878代写

Mark-to-Market of positions: standard valuation methods assumed. All options are assumed to be of European style.

All data required for mark-to-market valuation can be found in the data files (Valuation date: 2/08/2019).

For the option positions assume that the standard deviations provided are constant over the holding period for the purpose of VaR.

Outline of Steps: Risk Management25878代写

- Determine the risk factors affecting each portfolio. (Note: the set of interest rate data provided consists of many more zero-coupon rates than needed for the portfolios.)

- Determine the valuation formulae to be used for the positions. Some positions may need to be decomposed into simpler instruments (e.g bonds can be decomposed into equivalent zero couponbonds). Risk Management25878代写

- Determine the mark-to-market value of the portfolios on the valuationdate.

- Determine a method for estimating the change in the underlying risk factor (e.g. log(change), discrete change(%))

- Determine the variance/covariance and correlation matrices for thevarious portfolios.

- Proceed with VaR estimation.

See UTSOnline for

- Cholesky Factorisation

- Notes on VaR for bondportfolios

- Data for assignment

Task 1: Due on September 20, 2019 (worth 35% of assignment) Risk Management25878代写

You are required to submit the results for the following:

- Mark-to-market value of the all portfolios.

- Value–at–Risk using Variance/covariance methodology for theportfolios

using the parameter values below:

| Confidence Level (%) |

95 |

99 |

95 |

99 |

| Holding Period (days) |

1 |

1 |

10 |

10 |

(You will need to submit the actual results and the code for producing the results.)

Task 2: Due on October 26, 2019 (worth 65% of assignment) Final Submission of Assignment: Risk Management25878代写

The final results of the assignment should be submitted should be in the form of

- Written reportconsisting of :

- A brief description of the methods used in calculating VaR.

- Any additional assumptions made for each VaR method including the method used to measure the changes in risk factors, the technique usedto determine the 10-day VaR for each method. Risk Management25878代写

- Full documentation of the VaR results for all individual portfolios and the specified combinationsusing the various methods as required for the assignment. (See table on page 1 of Assignment)

- A brief analysis and explanation of the variability in the VaRestimates determined using the different methods.

- A brief analysis of the diversified vs. undiversified risk for the combined portfolios.

- Computer programs/spreadsheets developed and used for theassignment.

References: Risk Management25878代写

- Jorion, P., Value-at-Risk, McGraw-Hill, 3rd ,2006

- Risk Management Lecture Notes, 2019.

- Crouhy, M., Galai, D. and Mark, R., Essentials of Risk Management, McGraw-Hill,2014

- Lecture Notes from Financial Markets Instruments. (May be useful for valuationformulae)

- Hull, J., Futures, Options and Other Derivative Securities, 9th , McGraw- Hill, 2015.

- Hull, J., Risk Management and Financial Institutions, 4th , Wiley Finance Series,2015.

- RiskMetrics Technical Document, 4th (1996)

- Smithson, C.W., Managing Financial Risk, 3rd Edn, McGraw-Hill,

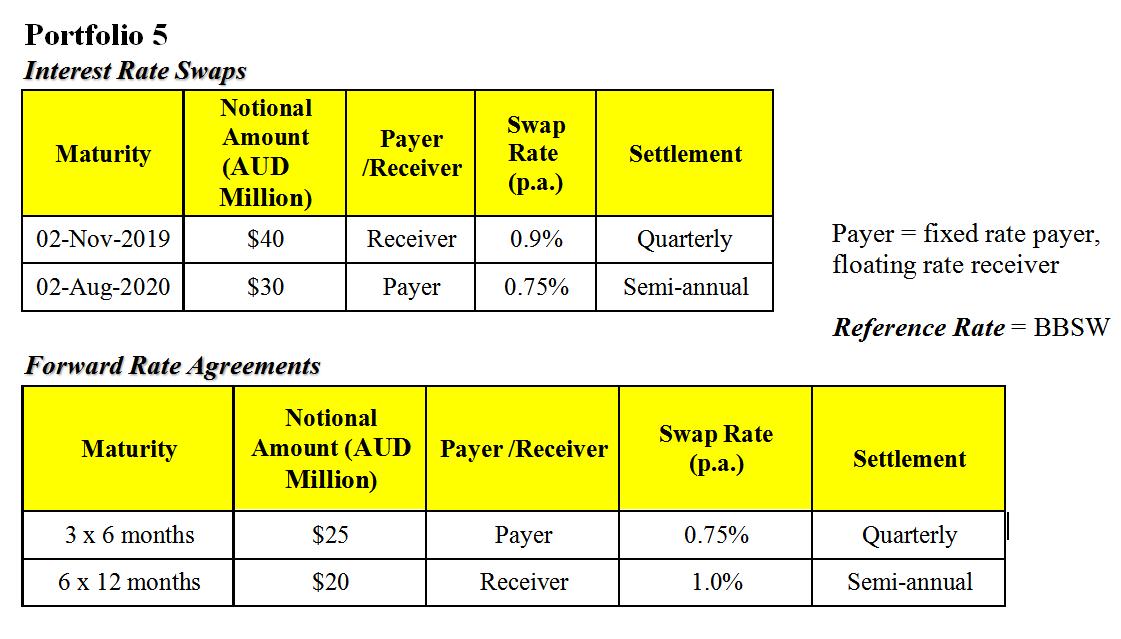

Portfolios for Risk Management Assignment Risk Management25878代写

Portfolio 1

| Issuer | Coupon rate p.a | Maturity | Next Coupon Date | Face Value (Millions) |

| Com G | 4.50% | 15-Apr-2020 | 15-Oct-2019 | 5 |

| Com G | 5.75% | 15-May-2021 | 15-Nov-2019 | 6 |

| Com G | 5.75% | 15-Jul-2022 | 15-Jan-2020 | 4 |

| Com G | 2.25% | 21-Nov-2022 | 21-May-2020 | 5 |

| Com G | 5.50% | 21-Apr-2023 | 21-Oct-2019 | 6 |

Assume: coupon paid semi-annually. Risk Management25878代写

Portfolio 2

| Currency | Currency Description

Risk Management25878代写 |

AUD

Million Equivalents |

| USD | US $ | 20 |

| GBP | UK £ | -15 |

| EUR | Euro | 25 |

| JPY | Japanese yen | -30 |

| NZD | New Zealand $ | 25 |

| MYR | Malaysian

Ringgit |

-20 |

Negative amount implies short position.

Portfolio 3

|

Expiration Date |

Put/Call |

Bought/ Sold |

Underlying Asset |

Amount |

AUD Amount (Millions) |

Strike |

| 12-Jun-20 | Put | Sold | Euro | 130 | 196.9697 | 0.61 |

| 2-May-20 | Call | Bought | Euro | 140 | 222.2222 | 0.64 |

| 2-Oct-19 | Put | Bought | USD | 120 | 157.8947 | 0.65 |

| 2-Dec-19 | Call | Bough | USD | 110 | 150.6849 | 0.70 |

| 5-Feb-20 | Call | Sold | JPY | 10000 | 115.088 | 72.05 |

Strike rate expressed as 1AUD = xx CCY. Option exercise style is European.

You may use historical data to estimate s to use in the pricing the options (unless you have access to implied volatilities). Assume that the computed s is constant over the holding period for the purpose of VaR calculations. Risk Management25878代写

Forward Foreign Exchange Contracts

|

Expiry |

Buy Currency | Buy

Amount (Millions) |

Sell Currency |

Sell Amount (Millions) | Contracted Forward Rate (K) |

| 3-Dec-19 | USD | 25 | AUD | 37.31343 | 0.67 |

| 5-Apr-20 | EUR | 20 | AUD | 32.25806 | 0.62 |

| 4-May-20 | JPY | 900 | AUD | 10.94891 | 82.2 |

| 10-Aug-20 | CHF | 35 | AUD | 47.2973 | 0.74 |

Forward rate expressed as 1AUD = xx CCY.

Portfolio 4 Risk Management25878代写

| Issuer | Number of Shares | Bought/Sold |

| BHP | 5,000 | Bought |

| RIO | 3,000 | Bought |

| CBA | 4,000 | Bought |

| WES | 10,000 | Sold |

| WPL | 5000 | Bought |

| NAB | 15000 | Sold |

| TLS | 30000 | Sold |

Share Options (Exchange Traded)

|

Maturity |

Underlying |

Put/Call |

Bought/Sold |

Number of Shares |

Strike |

s (% p.a) |

| 9-Dec-19 | BHP | Call | Bought | 20,000 | $39.00 | 26.00% |

| 8-Mar-20 | CBA | Put | Bought | 15,000 | $75.00 | 27.98% |

| 12-Apr-20 | CBA | Call | Bought | 15,000 | $75.00 | 27.98% |

| 4-May-20 | WES | Put | Bought | 25,000 | $38.10 | 30.56% |

| 7-Aug-20 | WES | Call | Bought | 20,000 | $39.00 | 32.98% |

| 6-Nov-20 | WPL | Call | Sold | 10,000 | $35.00 | 28.45% |

| 6-Dec-20 | WPL | Put | Bought | 15,000 | $33.00 | 27.00% |

Assume: Options are European style Risk Management25878代写

其他代写:代写CS C++代写 java代写 matlab代写 web代写 app代写 作业代写 物理代写 数学代写 考试助攻 金融经济统计代写 作业加急