FIN-672 Midterm II – Part 1

Total points possible: 100

FIN-672代写 Short Answer/Multiple Choice Questions 1) INDEX MODELS In the Chapter 8 lecture, I argued that the index model is a useful statistical model

Please take time to read these instructions carefully: FIN-672代写

This test is a combination of short answer/multiple choice and Excel-based questions. There are 6 short answer or multiple choice questions (worth a total of 50 points) and 3 Excel questions (worth a total of 50 points). The test is worth 100 points total and each question tells you how many points it’s worth.

At the end of the test, submit your required documents using the link provided. Include your full name in the filenames. The test and the submission link are located in the Midterm II folder on Blackboard.

You may use only your lecture notes and slides, your textbook, and my problem solving solutions or your group’s problem solving solutions. You may NOT use the internet in any way except to access Backboard. Using websites to obtain answers is strictly prohibited. You may not communicate with anyone else during the exam. FIN-672代写

Short Answers:

Type your answers on the test sheet. Please write clearly and concisely. Don’t write everything you know about the topic. Just answer the question directly and accurately. This will typically require only a few sentences.

Multiple Choice Questions: Highlight or bold only one answer.

Excel: Do these problems in an Excel file. Use a separate tab for each question and highlight your answers in yellow. Write your numerical answer in this Word document. If your answer is correct, you will get full credit. However, you must show your work on the Excel spreadsheet to get credit. If you do not get the correct answer, I will look at your Excel file and possibly give you partial credit. Make sure to provide explanations when asked for on this Word document.

Short Answer/Multiple Choice Questions FIN-672代写

1) Index Models

In the Chapter 8 lecture, I argued that the index model is a useful statistical model because it simplifies the amount of calculations required to construct an optimal risky portfolio. I also claimed, however, that it is not a useful model to determine what fair “market equilibrium” expected returns of stocks should be. Explain why this is so. Use only words and no formulas in forming your answer. (9 points)

2) Firm Specific Risk

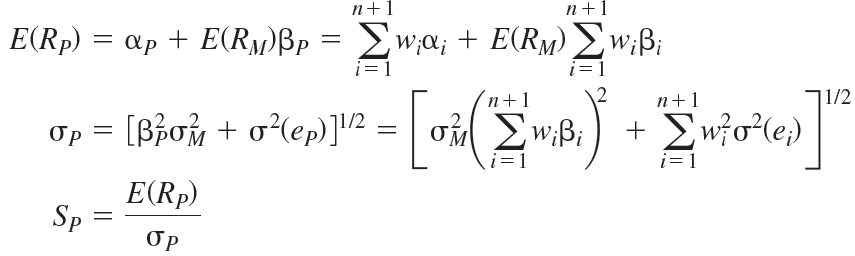

At the end of the Chapter 8 slides, I showed that the optimal risky portfolio could be obtained by maximizing the Sharpe Ratio using the following equations:

In the equation for there is a term which represents firm specific risk. However, I’ve claimed that in very large portfolios, firm specific risk is almost completely diversified away. Does this equation support this claim? Why or why not? (9 points)

3) Beta and the CAPM

In the CAPM model, what does beta represent and why is it a sufficient measure of risk to determine a security’s expected return? Use only words and no formulas in forming your answer. (9 points)

4) Pull to Par

Explain what the pull to par effect in Chapter 15 is and why it occurs. Use only words and no formulas in forming your answer. (9 points) FIN-672代写

5) Yield to Maturity

When a Treasury bond is held to maturity, the IRR the investor achieves is the original yield to maturity of the bond and yield changes over the life of the investment don’t affect tis IRR. Why is this true? Use only words and no formulas in forming your answer. (9 points)

6) Interest Rates

Which of the following is a true statement? (Select only one answer)

a) Spot rate and short rates are known with certainty, but forward rates are not.

b) Forward rates and short rates are known with certainty, but spot rates are not.

c) Forward rates and spot rates are known with certainty, but short rates are not.

d) Spot rates are known with certainty, but forward rates and short rates are not.

(5 points)

FIN-672 Midterm II – Part 2

Total points possible: 100

Excel Questions FIN-672代写

1) Bond Pricing

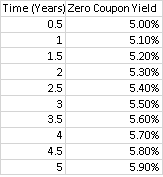

Suppose you are given the following zero coupon yield curve where the yields are expressed in annual units:

Find the price of a 5-year semi-annual pay bond with a coupon of 4.0% (in annual units). What is the bond’s single yield to maturity (again in annual units). Write both your answers to three decimal points. (16 points)

2) Forward Rate Arbitrage

In Chapter 15, we talked about 1-year forward rates. These were rates that could be locked in now for borrowing and lending for a one year period starting at some time in the future. For example, f3 is the rate for borrowing or lending money 2 years from now and paying back the loan or receiving the proceeds 3 years from now. We could also consider a forward rate where we borrow or lend starting 5 years from now and ending 8 years from now and call this f5,8.

Suppose the “fair” value of f5,8 is 3.902% but you are able to obtain a forward rate of 4.000% in the derivatives market. You are given spot yields y5 = 3.1% and y8 = 3.4%. Show all the steps you would undertake to make an arbitrage profit as in problems 3b and 3c of the Chapter 15 problem solving assignment. (Use the Excel solutions I provided as a template). Note you will have to decide what rates to borrow at and what rates to lend at. Write the arbitrage profit here to 3 decimal points: (17 points)

3) Holding Period Return

Consider a 10-year annual pay bond with a coupon of 5.0% You purchase the bond at a yield of 6.0% and sell it 4 years later. At the time of the sale, the bond’s yield has changed to 7.0%. What is the IRR over the 4 year holding period? Write you answer here to 3 decimal points: (17 points)

其他代写:作业加急 北美代写 CS代写 Data Analysis代写 澳大利亚代写 essay代写 assignment代写 analysis代写 homework代写 加拿大代写 英国代写 作业代写 report代写 paper代写 data代写 code代写 algorithm代写