The Chinese Economy

Economy代写 Abstract: The interacting and feedback effects between human capital and performance in Chinese publicly listed companies are studied.

ISSN: 1097-1475 (Print) 1558-0954 (Online) Journal homepage: http://www.tandfonline.com/loi/mces20

The Effect of Managerial Education and Firm- Ownership Structure

Vivian Xiaowei Kong & Junxi Zhang

To cite this article: Vivian Xiaowei Kong & Junxi Zhang (2010) The Effect of Managerial Education and Firm-Ownership Structure, The Chinese Economy, 43:6, 34-53

To link to this article: http://dx.doi.org/10.2753/1097-1475430604

Published online: 09 Dec 2014. Submit your article to this journal

Article views: 22

View related articles

Citing articles: 1 View citing articles

Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=mces20

The Chinese economy, vol. 43, no. 6, November–December 2010, pp. 34–53.Economy代写

© 2010 M.E. Sharpe, Inc. All rights reserved. ISSN 1097–1475/2010 $9.50 + 0.00.

DOI 10.2753/1097-1475430604

ViVian Xiaowei Kong and JunXi Zhang

The Effect of Managerial Education and Firm-Ownership Structure Economy代写

Empirical Evidence from Chinese Listed Firms

Abstract: The interacting and feedback effects between human capital and performance in Chinese publicly listed companies are studied. specifically, managerial education attainment is examined to see if it helps to improve firm performance. The effect and efficiency of manage- rial human capital within different firm-ownership structures is investi- gated. it is found that a manager’s educational level generates a positive effect on the firm’s operating and market performance, consistent with classic human capital theory. in addition, research suggests that dominant state control can be detrimental to the contribution margin of managerial human capital. The existence of powerful large minor- ity shareholders, however, exerts a positive effect. other institutional aspects of the Chinese transitional economy and their potential impacts on managerial education effect are also discussed based on empirical findings.

The role of human capital and its effects have been widely studied in many areas in economics—on the micro level, such as productivity and labor economics, and on the macro level, such as economic development

Vivian Xiaowei Kong is an assistant professor at the Finance and Development Institute,

Nankai University, Tianjin; e-mail: [email protected]. Junxi Zhang is an associate professor at the University of Hong Kong; e-mail: jjzhang815@ gmail.com. The idea for this paper originated from V.X. Kong’s Ph.D. dissertation at the University of Hong Kong. The authors thank Chongen Bai, Qiao Liu, and Zhigang Li for helpful comments and suggestions.Economy代写

and growth. While the former concerns the contribution of human capital investment to the individual, the latter concerns the effect of human capital accumulation to aggregate economic growth. Studies derived from the pioneering work of Shultz (1961) and Becker (1962) have significantly enhanced our understanding of the importance of human capital and yielded useful policy implications. There is, however, relatively little research on the effect of human capital in the middle scope, in firms and industries. In particular, its effect on a firm’s performance in the stock market has been largely ignored. This article researches Chinese publicly listed companies to find the answers.Economy代写

The Chinese market is a fast-expanding emerging stock market and has generated rich information and distinctive characteristics that other mature markets lack. Although in existence only seventeen years, China’s stock market has rapidly developed with over 1,400 listed companies and over RMB9.8 trillion in capitalization. Its size may not be large com- pared with that of the Chinese economy as a whole, and many structural problems remain, but there is undoubtedly room for great improvement as the Chinese stock market recovers quickly from the global financial crisis. This article will investigate the role human capital plays in Chinese firms and in the capital market. How the process of ownership transition and restructuring influences human capital efficiency in Chinese publicly listed companies will also be examined.

One obvious difficulty is the measurement issue.

To measure the contribution of human capital to a firm, the conventional measuring tool by Mincer (1974) needs to be modified. Mincer only evaluated the individual return to labor education, taking wages as the measure of the human capital margin. Instead, this article will study firm value and performance as an alternative to individual income, and study the effects of education on firm senior managers, and how they are affected by insti- tutional factors, especially corporate governance and financial structures. In other words, our research explores the interacting and feedback effects of managerial human capital and firm performance.Economy代写

The existing literature utilizes the average managerial education level as a proxy for the general education status of the firm. In addition to the conventional arguments, there are three more reasons to justify our endeavor. First, the management team is highly human-capital intensive in a company, which spends a significant amount of resources to attract and invest in senior managers. Second, the managerial team should be responsible for daily operations or business decisions, and exert vital

influence on the planning of long-term corporate strategies, including the policy of future human resource management. Third, due to the obvious problems of information asymmetry, senior managers have a clear comparative advantage in information collection and accuracy, important to firm performance. This is especially important for Chinese publicly listed companies, where senior mangers are often accused of providing inaccurate or false information.

The Effects of Managerial Human Capital and Its Testing Hypotheses Economy代写

The significance of managerial human capital has long been recognized by economists, as in the work of Prescott and Visscher (1980). They use the concept “organizational capital” to define intangible capital and suggest considering it when estimating or computing the total-factor productivity rates. Gort and Lee (2003) provided some empirical support by showing that the managerial efficiency variation has changed the input- to-output ratio and furthered the existence ratio for enterprises. It is clear that managerial human capital affects a firm’s market value according to institutional circumstances and corporate governance structures. Still, the transmission mechanisms are unknown.

Education of senior management is also found to be related to a firm’s research and development (R&D) expenditures.

However, the effect is ambiguous, as there is both positive and negative evidence. Hitt and Tyler (1991) and Wally and Baum (1994) suggest that better-educated execu- tives have greater cognitive complexity to absorb and accept new ideas, and therefore stronger tendencies to increase R&D input. Furthermore, Tyler and Steensma (1998) conclude that CEOs with extensive science and engineering training tend to be more inclined to invest in R&D programs. The R&D expenditure is positively related to a firm’s market value, measured by the Value Added Intellectual Coefficient (VAIC).1 However, the Barker and Mueller study (2002) regarding R&D spending and CEO characteristics fails to find a significant association between education and R&D. The explanation may be that well-educated managers are more risk-averse. As a result, some riskier but more profitable projects are sacrificed.Economy代写

Culling the above effects, our position is that the positive effects of managerial human capital surpass the negative effects. That is, managerial education improvement leads to higher R&D expenditures and specific

organizational capital through VAIC and other operational or innovation capability improvements. This results in better market performance of the firm. Three hypotheses can be formulated.

Hypothesis 1:

There is a positive net effect between average managerial educational level and a firm’s performance.

Recent empirical findings have shown that the market value of Chinese publicly listed firms could be affected by the status of corporate gover- nance and corporate finance. This includes financial structure, capital concentration, minority shareholder power, and internal control capability (Bai, Liu, Lu, Song, and Zhang 2004). Bolton and Xu (1999), examin- ing the relationship between firm financial structure and local manager market demands, developed a model emphasizing that capital structure can influence a manager’s incentives and behavior if material capital and human capital are not perfectly complementary. The character traits of the manager or CEO, including his or her educational level, play an important role in transmitting the effects on firm performance. In other words, managerial educational level is a channel through which corporate governance affects firm performance.Economy代写

To do a similar analysis of Chinese firms,

a series of proper measures for corporate governance factors affecting managerial human capital efficiency need to be selected. Although many listed firms have undergone urban enterprise reforms in recent years, they still have an unbalanced and twisted ownership structure because the state remains the dominant shareholder with decisive power over a firm’s real operations. Official authority influence is difficult to restrict or weaken in many internal institutional and organizational arrangements, especially in the area of management team selection and performance evaluation. It is a tough challenge to construct a modern corporate governance framework in Chinese enterprise reform. Economy代写

The government, whether local or central, is the largest shareholder and often makes important appointments based on political considerations rather than professional concerns. Managers appointed by state-owned shareholders are usually officials who need to gain work experience in large firms to advance in their political careers. Hence, two distinct types of managers exist: conservative ones who prefer to avoid risk as much as possible, and aggressive ones who are more likely to abuse power when making decisions that may jeopardize the safety of assets and investments.

There is an obvious conflict of interest for firm managers appointed by

government authorities. Therefore, it can be stated that the human capital effect is negatively affected by state-controlled ownership.

Hypothesis 2: Economy代写

The efficiency of managerial human capital is negatively affected if the state is the largest shareholder.

Due to its short history and many institutional factors in the Chinese capital market, such as the existence of a huge amount of nontradable shares and the particular financing policy of debt-to-equity swap, there are assorted large groups of minority shareholders invested in Chinese listed firms, necessitating different utility functions and behavioral patterns.2 For the noncontrolling shareholders who want to protect their own benefits, it is essential to maintain strong influence over the nomination and final appointment of senior managers.

It is well known that tunneling behavior is rather popular in an unbalanced ownership structure. This is so because the large-minority shareholders sitting on the board of directors lack the power to effectively participate in decisions about significant strategies, as well as to deflect conspiracies between the controlling shareholders and the managers. On the contrary, the existence of strong noncontrolling minority shareholders is more likely to generate a positive effect, for managerial expectations are adjusted under the monitoring pressure to avoid excessively high risks. Managerial human capital efficiency is largely influenced by the various individual utility functions.

Hypothesis 3:

The existence of large groups of strong minority shareholders has a positive effect on managerial human capital efficiency.

Chinese data will be used to test the validity of the above three hypotheses.

Data Description and Variable Definition

Data Sample Economy代写

Our data sample covers all listed firms in the Chinese capital market from 1999 to 2003. Data on education, age, managerial terms, boards of directors, and supervisors are collected from a database provided by WIND Ltd. Financial, and trade data are from China Stock Market and Accounting Research Database (CSMAR). After filtering missing observations, a sample was obtained containing 5,337 observations, in-

cluding 905 from 1999, 1,017 from 2000, 1,117 from 2001, 1,003 from

2002, and 1,189 from 2003.

Explanation and Descriptive Statistics of the Variables

Firm Performance

There are two groups of firm-performance indicators: accounting performance and market performance. The former group includes return on asset (ROA), return on equity (ROE), return on investment (ROI), and other corporate finance measures. The latter group contains Tobin’s q, book/market ratio, economic value added (EVA), and market value added (MVA).

The use of Tobin’s q as a measure of market performance runs into a problem because a large proportion of the shares of the listed firms in China cannot be freely traded. As a result, their market prices do not exist and must be estimated. It is generally agreed that the nontradable state-owned shares and legal-person shares in China have a significant discount, ranging from 70 percent to 80 percent when traded on the informal market. Bai et al. (2004) use these figures to compile a corporate governance G index in their study. In this article, both 70 percent and 80 percent discounts are adapted to the illiquid value by using variables Q_30 and Q_20.Economy代写

management Team’s human Capital

It is well known that there is no good measurement of human capital. In this article, managerial human capital will be considered. Although the process of building human capital includes education, on-the-job training, and learning by doing, it is difficult to construct an index measuring the success of any of these components. In labor economics, the return on education is taken as a main proxy of human capital return. Because school education is highly correlated to other human capital factors, it is reasonable to take the average educational level as a measurement of general managerial human capital. The equation used to determine the managerial educational index is:

where n is the numbers of senior managers of firm i at the end of each year; ei is the educational level of a manager at firm i; ei = 0 if his/her highest educational level is junior middle school or below; ei = 1 if high school or the equivalent; ei = 2 if community college or the equivalent; ei

= 3 if college graduate or equivalent; ei = 4 if postgraduate with a master’s

degree, ei = 5 if postgraduate with a Ph.D. degree and above.

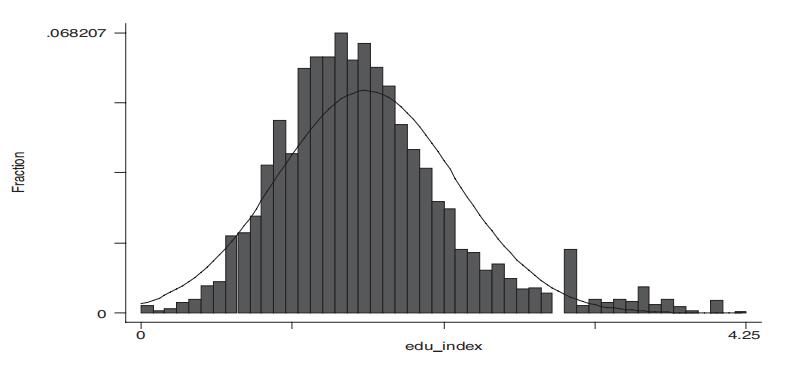

Figure 1 depicts the distribution of the managerial educational index of

the listed firms in the sample. The average educational level ranges from the minimum 0.2 to the maximum 5. The sample mean value is 2.66, a relatively low figure below college level. Also, the sample mean (2.66) is very close to the median value (2.67), pointing out an approximately symmetric distribution. A visual observation suggests that the education index distribution is close to a normal distribution.

ownership structure

Two variables are chosen to describe ownership structure. The dummy variable, so_1, indicates whether the first large shareholder is state-owned or not. Variable so_1 is equal to 1 if the firm is state-controlled and 0 if not. The other ownership structure factor is the power of large minor- ity shareholders, defined as the concentration of noncontrolling large shareholders. Following the definition as in Bai et al. (2004), we use an index with the natural logarithm of the sum of squares of the second to the tenth largest shareholder share-ratios. The higher the concentration of shares in the hands of large shareholders, the stronger the role the larger minority shareholders will play. We introduce this variable into the regression to test the impact of the noncontrolling shareholders on the efficiency of the managerial human capital.

other Controlled variables Economy代写

Following Mincer’s (1974) education return model, we add the average age and the square of the age of the management team to the equation. In theory the average age of a firm’s managers should have a positive effect on firm performance, implying that experience helps to improve human capital efficiency. There is, however, an obvious limit to the age variable in playing a positive role. Thus, we expect an inverse U-shaped curve of this variable.

In our regressions below, we also use other control dummy variables, such as firm size, leverage ratio, industry, and year. Since these measures are standard, to preserve space, they are not discussed here.

Figure 1. Distribution of Managerial Education Index of Chinese Listed Firms

note: Figure 1 illustrates sample distribution of the managerial education index. The average educational level is dispersed from minimum 0.2 to maximum 5. Mean value is 2.66, revealing a relatively low average educational level below college. In addition, the mean value (2.66) is very close to the median value (2.67), showing an approxi- mately symmetric distribution.

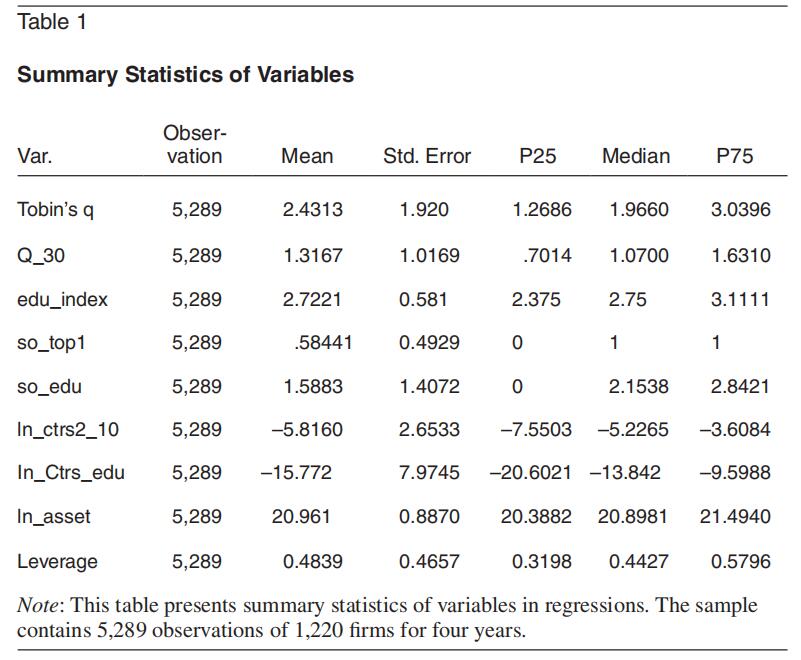

Summary Statistics

The sample covers listed firms from the Shanghai and Shenzhen exchanges. Table 1 reports the summary statistics for nine variables. Notably, the firm value variables, Q, Q_20, and Q_30, have higher mean values than median values, indicating they have left-skewed distribu- tions. The education index, however, is close to being symmetric, and it suggests that the average educational level of management in the listed firms is between high school and college. The mean of variable so_top1 is more than 0.584, meaning that more than 58 percent of the listed firms have a state-owned controlling shareholder.

Regression Models

Basic Model with OLS Regressions

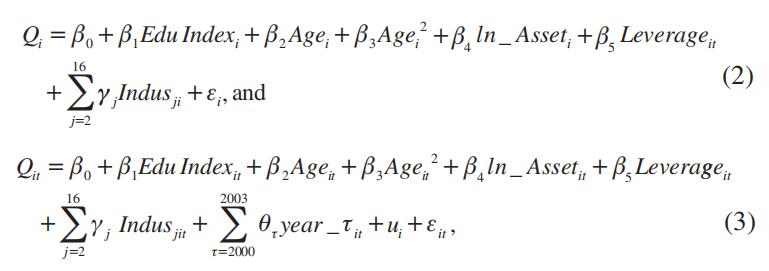

To test the educational effect on firm performance, OLS regressions were run respectively to the cross-sectional data for each year from 1999 to 2003, and then the random effect was investigated using the panel dataset. Equations (2) and (3) can be regarded, to some extent, as variant forms of Mincer’s (1974) classic regression of education earnings, with the dependent variable replaced by the firm performance variable of Tobin’s q.

Specifically, we run two types of regressions: cross-sectional OLS regression and cross-sectional and time-series regression. They are:

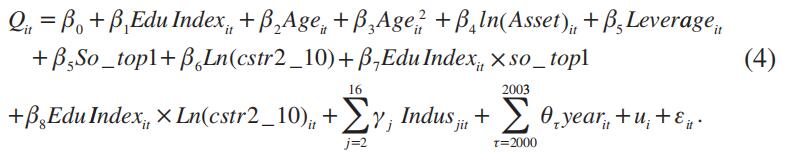

where Qi is the Tobin’s q of Firm i; edu_index is the managerial education level, as in Equation (1); Age is the average age of the senior managers; ln_Asset is the logarithm of total assets; Leverage is the financial lever- age ratio; the industry dummy represents the controls for sixteen official catalogue-listed industries.

Modified Model: Regressions with Ownership Structure Interaction Items

To test the impact of ownership structure on managerial education efficiency, we construct two interaction items and apply them to the regression Equation (3): the product of education index and the top shareholder dummy variable (Edu_index × so_top1), and the interaction of education and the concentration ratio of shareholding from the second to the tenth largest shareholders (Edu_index × ln cstr_2–10).

In the modified model, we run random-effect and fixed-effect regres- sions separately. The fixed-effect model is more applicable to control potential biases generated from endogeneity. We follow the standard procedure to run random-effect (RE) regression in a large sample as shown in a later section.

Empirical Findings Economy代写

Managerial Human Capital Efficiency: Result of OLS Regressions

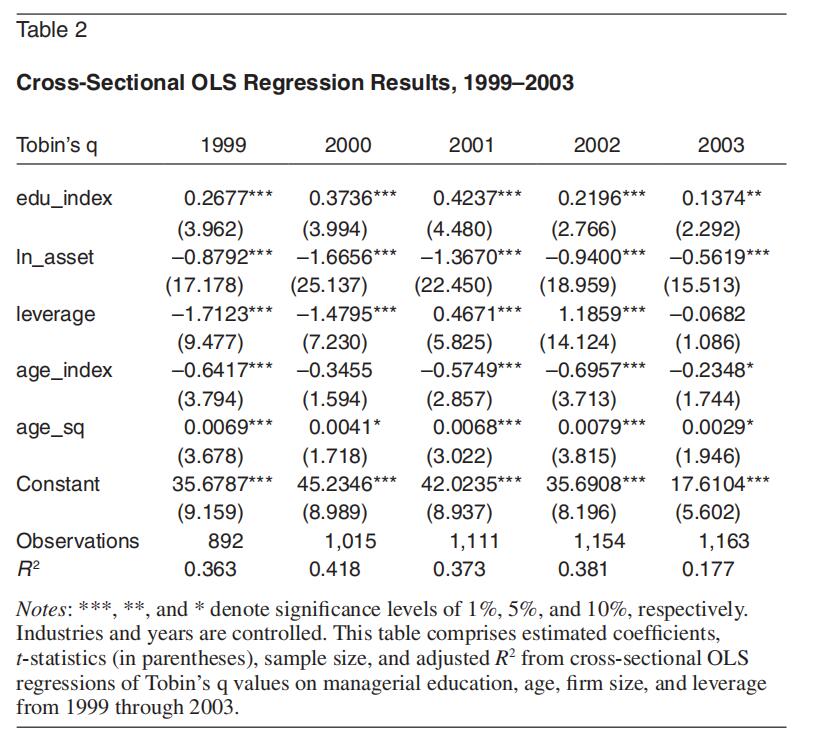

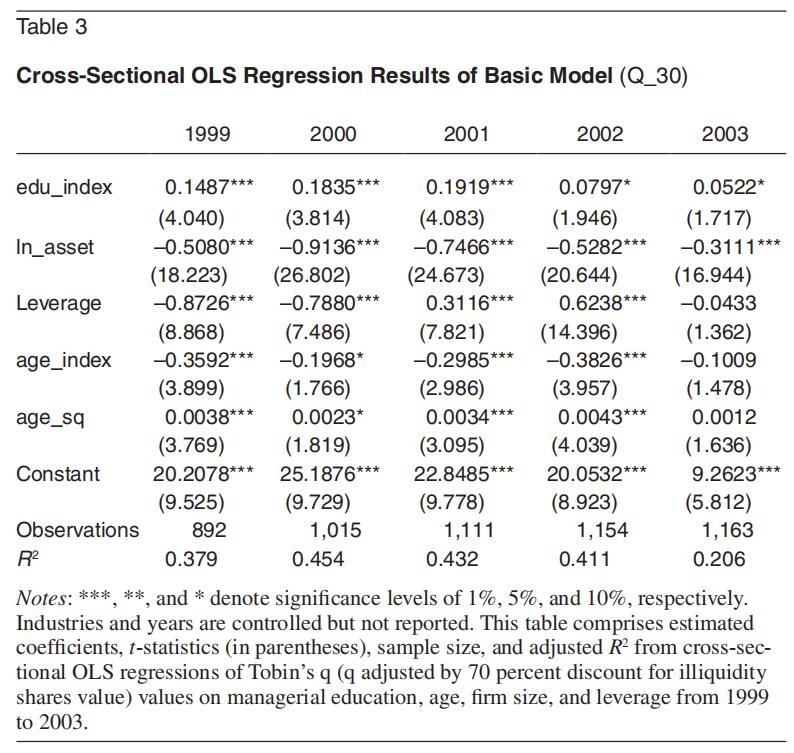

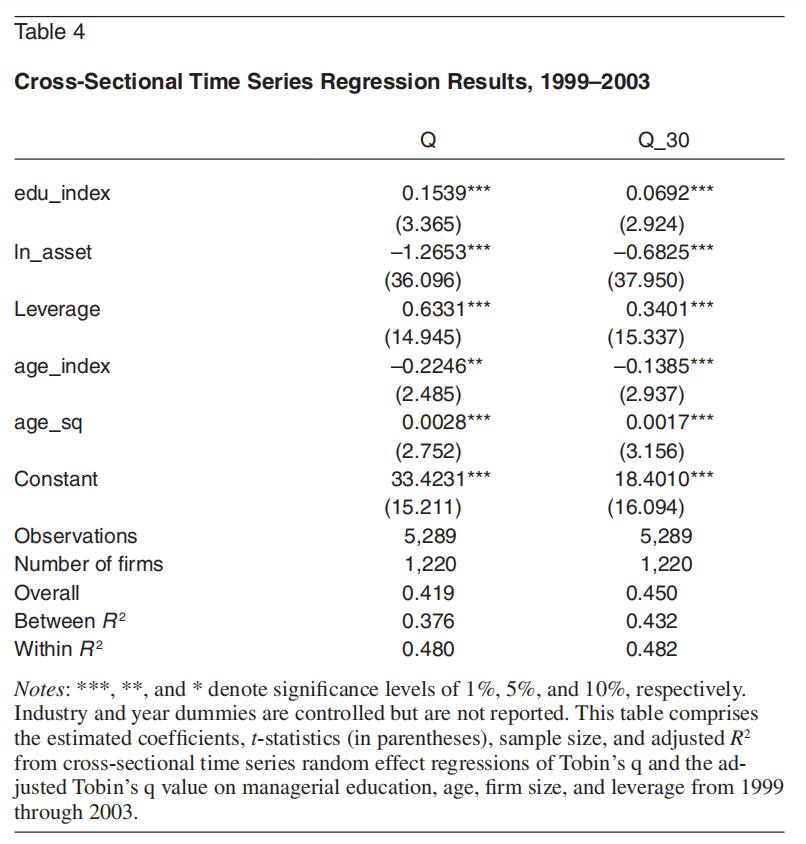

A positive and significant effect of education on management is found in both the cross-sectional OLS regressions and the RE regressions applied to the panel data. Tables 2 and 3 report the results of cross-sectional re- gressions. In the five columns of Table 2, which reports the OLS regres- sion results from 1999 to 2003, the coefficients of the education index are all positive and significant. The coefficients vary with a minimum of 0.1498 and a maximum reaching 0.3381, implying quite a high economic contribution margin.

Table 4 reports the results of the random effect of the panel data. After we control the effects of firm, industry, and year, the results accord well with the results from the cross-sectional data, supporting Hypothesis 1. According to the human capital theory, the motivation to invest in education is to pursue higher marginal productivity, which in

turn is rewarded by extra profit (Becker 1962). Education is not only the major resource for human capital formation, but also provides a signal demonstrating the capability, potential, and attitude of the prospective employee (Psacharopoulos and Layard 1979). Stevens (1993) points out that educational investment tends to produce larger positive externality or spillover effects. This effect is even more pronounced in compara- tively noncompetitive markets.

People who attain a higher educational level have a better ability to master skills faster and have more incen- tives as well as opportunities to take advantage of on-the-job training (Foster 1987; Kremer and Thomson 1998; McMahon 1987). In addition, education is of particular importance to the management team. Higher education is found to help improve managerial capabilities and discre- tion in analyzing information, and in optimally organizing information (Fleming 1970; Welch 1970). Our results from the two basic regressions are consistent with the existing literature.Economy代写

Results of the Modified Model Regressions Economy代写

In the modified model of managerial education effect, two interaction variables have been introduced into the regression. One is the product of the managerial education index variable (edu_index) and the dummy variable symbolizing whether the largest shareholder is stated-owned or not (so_top1). The other is the product of the education index and the concentration variable of large minority shareholding, expressed by the logarithm of the sum of squares of the percentage points of shareholding by the second to the tenth largest shareholders.

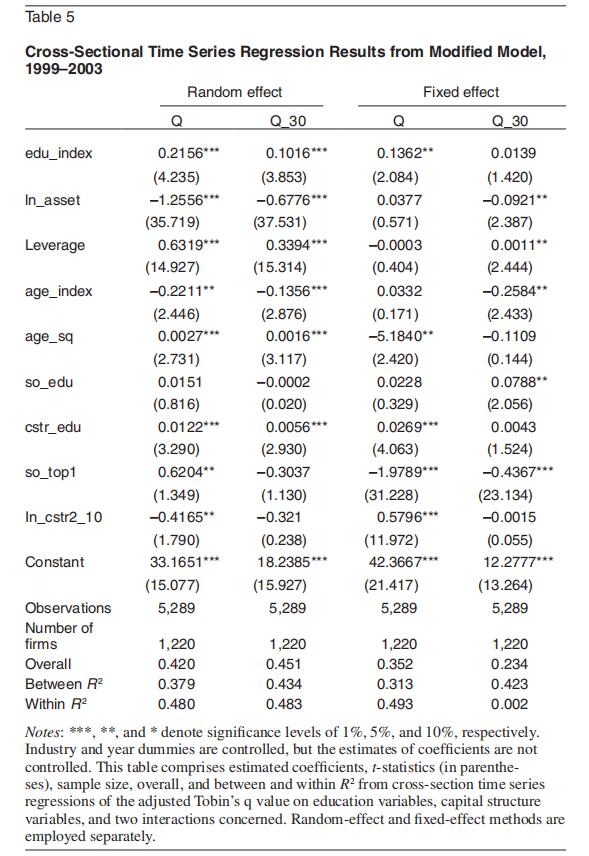

As in the basic model, we repeat OLS regressions to the cross-sectional data and panel data, respectively. Only the results for the panel data are reported in Table 5.

As shown in Table 5,

the coefficient of the education index remains positive and significant at the 5 percent level, supporting our Hypothesis

- The variable of education interacting with the state-owned first shareholder dummy variable is found to have a negative coefficient. This implies that the state-owned largest shareholder exerts a negative effect on managerial human capital efficiency in Chinese listed firms. This is consistent with our Hypothesis 2. The second interaction item, managerialeducation and the large minority shareholding concentration from the second to the tenth, has a positive This indicates the strong monitoring gains from the noncontrolling shareholders’ contribu- tion to human capital efficiency. Therefore, Hypothesis 3 is supported by our empirical findings, consistent with other findings in the existing literature.

Our results concerning the impact of capital structure on managerial Economy代写

human capital efficiency are intuitive. The standard principal-agent literature suggests that the existence of asymmetric information might lead to the moral hazard of the managers taking advantage of sharehold- ers, due to the impartibility of human capital investment. Moreover, realizing the intrinsic characteristics of human capital, we find it is simultaneously highly organized as well as highly specialized. To some extent this explains why the efficiency of human capital is affected by ownership or corporate governance factors.Economy代写

As a type of highly organized capital, human capital formation, generating an economic surplus of positive external effects, is complex and systematic, and requires strict control and accurate evaluation. However, on the other hand, human capital investment in a certain firm leads to “firm-specific” human capital with less liquidity in the general labor market. Managers have less incen- tive to take the illiquidity risk, bearing the time and other costs for this firm-specific human capital, unless they are guaranteed attractive career expectations in their current firm.

For the capital structure variables we consider the state-owned control- ling shareholders and the noncontrolling large shareholders concentration.

The state-owned controlling shareholders face a severe asymmetric in- formation problem but have little incentive to solve it because they are unable to evaluate and price human capital, whether general or specific, in the proper and accurate way.

Besides encouraging corruption and low efficiency, the unbalanced ownership structure also prevents fur- ther organization and specification of human capital. The weak voice of noncontrolling large shareholders causes lack of necessary monitoring and enforcement of discipline on the largest shareholder and high- level executives, encouraging tunneling behavior. It especially prevents achieving the optimal distribution of human capital, for example, to select the best candidates to obtain further training and other opportunities, and to decrease the possibility of nepotistic behavior.Economy代写

Two-Stage-Least-Squared Regressions (2SLS) and Robustness Checks

We will use instrumental variables to deal with the potential endogeneity problem and consider a number of instrumental variables. The reason for doing so is that the issue of our interest is quite vulnerable to the endogeneity problem. It is known that a well-educated management team helps to improve the firm’s market performance. Firms with outstanding

performance and good value have more opportunities to absorb high- quality managerial human capital. There are bidirectional causalities in the system where the problem of endogeneity might arise.Economy代写

We are able to find a special instrument connected to the realities of corporate governance in most Chinese listed firms. As is prescribed in the general provisions of Chinese Company Law, each corporation registered in China is required to set up a board of supervisors. The supervisory board, as an institutional arrangement, is designed to implement internal monitoring and checking. The board of supervisors does not have any responsibility directly correlated to company profit or performance. Strong support from the supervisor board helps to reduce internal risk and benefits the firm’s performance in the long run. But in practice, the board of supervisors fails to function as expected. Zhang, Tenev, and Brefort (2002) reported that boards of supervisors fail to monitor directors and managers with any significant effect.

Supervisors obtain operational and financial information mainly

by attending board meetings as nonvoting delegates and receiving periodic working reports from the board chairperson and the executive managers.

In a Chinese state-owned enterprise (SOE) or an ex-SOE, before the enterprise administration reform, supervisors usually came from the nonperforming and less efficient parts of the enterprise, such as “worker unions” controlled by the political authority.Economy代写

There are few working financial or auditing experts on the supervisor board. Moreover, few supervisors possess the necessary professional knowledge or capability. To make things worse, the Corporation Law does not clearly require the board of directors and the senior managers to submit regular reports to the supervisors. In addition, the board of supervisors has no legal rights to intervene with the nomination and election of members of the board of directors or executive managers. These institutional arrangements constrain supervisor activity, and obviously impair internal monitoring and discipline.

Since the supervisors in the current corporate governance arrangements are ineffective, we regard the body of the supervisor board as uncor- related to a firm’s market performance. The only way the board of supervisors influences firm performance is through its monitoring func- tion of management according to some laws or rules, if there are any. However, even this function has been severely weakened in the Chinese corporate governance mechanism. We can therefore assume that the board of supervisors is uncorrelated with effective endogenous factors

that affect firm performance; in other words, they have gained some kind of exogeneity.

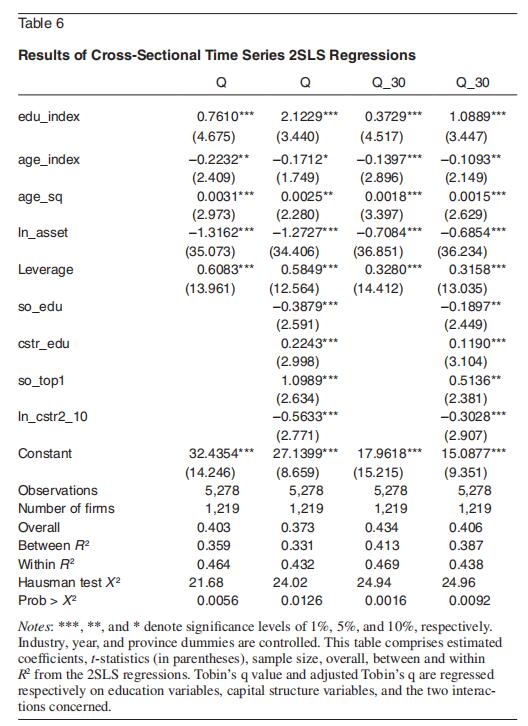

Table 6 reports the results of 2SLS regression using the education index of the board of supervisors as an instrumental variable. The coefficients

of the managerial education variable, the interaction items of education and capital structure indicators, are again positive and significant. The 2SLS regression results are consistent with our previous findings and support our arguments.

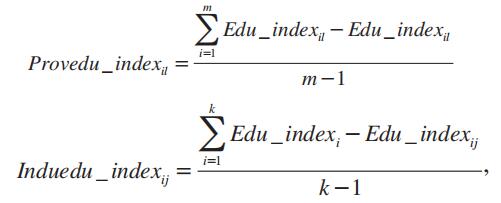

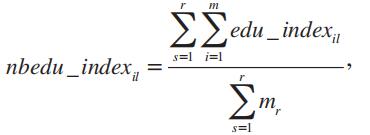

Besides the education index of the board of supervisors discussed above, several other instruments can also be found and employed with the 2SLS regressions. They are, respectively, the provincial (industry) firm education index,3 the average city firm education index, the average firm educational level of the neighboring province,4 and the number of colleges and universi- ties in the area. For lack of space, the empirical results are omitted here. In addition, we also ran two tests to check the robustness of our findings: the Hausman test and the overidentifying restrictions test. In short, our main findings remain valid, indicating the robustness of our results.

Conclusion Economy代写

This article has studied an important issue in economics: the interacting and feedback effects between human capital and firm performance. We used data from Chinese publicly listed companies to conduct our analysis and examined whether managerial educational attainment improves firm performance. The effect and efficiency of managerial human capital within different firm-ownership structures was also investigated. The empirical findings about human capital efficiency support a gener- ally positive effect of managerial education. Moreover, this effect is dramatically affected by the firm’s ownership structure and corporate governance factors. The existence of a state-owned largest shareholder negatively influences managerial human capital efficiency, however, while the concentration of other large shareholders is found to possess a positive influence.

The findings about the educational effect agree with classical human capital theory,

while the capital structure effects provide empirical evidence for recent discussions in firm theory, corporate governance, and human resource management.Economy代写

Studies that attempt to link human capital to capital market generate interesting academic value and useful policy implications. In academia, it is well known that managerial incentives are important in improving firm performance. Our findings suggest that this view should include managerial educational attainment because of its importance. The findings also show that the efficiency of managerial

education is greatly affected by ownership structure. In practice, the level of managerial education attained has been ignored, especially in state-owned companies in China. Given that the Chinese government is launching reforms in corporate governance, in particular by introducing managerial incentives, it is necessary to emphasize the creation of a corporate culture with adequately educated and open-minded managers. Indeed, reforms of ownership structures also help to improve managerial efficiency and therefore firm performance. Finally, our research points out that the human capital contribution to a firm, within the modern corporate finance and governance framework, deserves more attention in the overlapping fields of labor economics, human capital theory, and modern firm theory.

Notes Economy代写

- VAIC is a popular measure for the efficiency of value added by corporate intellectual ability. The major components of VAIC come from a firm’s resource base—physical capital, human capital, and structural capital. In some recent ap- plications of VAIC, R&D is found to exert a stronger effect on firm economic and financial performance (Chen, Cheng, and Hwang2005).

- Starting in 2005, the reform of nontradable shares was launched in major Chinese Portions of the state-owned shares have been sold to the public. The ratio of nontradable shares has decrease sharply since then.

- We define themas

where m is the number of firms in province 1, and k is the number of firms in industry j.

- The index is definedas

where r is the number of neighboring provinces of province 1, and mr is the number of firms in r of province 1.

References Economy代写

Bai, C.; Q. Liu; J. Lu; F. Song; and J. Zhang. 2004. “Corporate Governance and Market Valuation in China.” Journal of Comparative economics 32, no. 4: 519– 616.

Barker, V., and G. Mueller. 2002. “CEO Characteristics and Firm R&D Spending.”

management science, no. 48: 782–801.

Becker, G. 1962. “Investments in Human Capital: A Theoretical Analysis.” Journal of Political economy 70: 9–14.

Bolton, P., and C. Xu. 1999. “Ownership and Managerial Competition: Employee, Customer, and Outside Ownership.” Center for International Development at Harvard University, working paper no. 20.

Fleming, M. 1970. “Inter-Firm Differences in Productivity and Their Relation to Occupational Structure and Size of Firm.” manchester school 38, no. 3: 223–45.

Foster, P.J. 1987. “The Contribution of Education to Development.” economics of education research and studies: 93–100.

Gort, M., and S.H. Lee. 2003. “Managerial Efficiency, Organizational Capital and Productivity.” Economic Studies 03–08, U.S. Census Working Paper no. 20, Center for International Development, Harvard University.

Hitt, M., and B. Tyler. 1991. “Strategic Decision Models: Integrating Different Perspectives.” strategic management Journal, no. 12: 327–51.

Kremer, M., and J. Thomson. 1998. “Why Isn’t Convergence Instantaneous? Young Workers, Old Workers, and Gradual Adjustment.” Journal of economic Growth 3: 5–28.

McMahon, W. 1987. “Consumption and Other Benefits of Education.” In economics of education: research and studies, ed. G. Psacharopoulos, 129–33. Oxford: Pergamon Press.

Mincer, J. 1974. schooling, experience, and earnings. New York: NBER Press.

Prescott, E.C., and M. Visscher. 1980. “Organization Capital.” Journal of Political economy 88, no. 3: 446–61.

Psacharopoulos, G., and R. Layard. 1979. “Human Capital and Earnings: British Evidence and a Critique.” review of economic studies 56, no. 3: 485–503.

Schultz, W.T. 1961. “Investment in Human Capital.” American economic review

51, no. 1: 1–17.

Stevens, M. 1993. “Some Issues in the Economics of Training.” Ph.D. diss. (microfilm), Nuffield College, Oxford University.

Tyler, B., and H. Steensma. 1998. “The Effects of Executives’ Experiences and Perceptions on Their Assessment of Potential Technological Alliances.” strategic management Journal, no. 19: 939–65.

Wally, S., and J. Baum. 1994. “Personal and Structural Determinants of the Space of Strategic Decision Making.” Academy of management Journal, no. 37: 932–56. Welch, F. 1970. “Education in Production.” Journal of Political economy 78: 35–

59.

Zhang, C.; S. Tenev; and L. Brefort. 2002. Corporate Governance and enterprise reform in China: building the institutions of modern markets. Washington, DC: World Bank and International Finance Corporation.

To order reprints, call 1-800-352-2210; outside the United states, call 717-632-3535.

其他代写: java代写 function代写 web代写 编程代写 report代写 数学代写 algorithm代写 python代写 java代写 code代写 project代写 dataset代写 analysis代写 C++代写 代写CS 金融经济统计代写 essay代写 assembly代写