Intro to Financial Mathematics

Financial Mathematics1代写 UBMISSION DEADLINE: 5:00 PM on Sunday November 18, 2018 INSTRUCTIONS TO CANDIDATES1.The assignment comprises

1st SEMESTER 2018/19

Group Assignment ONE

SUBMISSION DEADLINE: 5:00 PM on Sunday November 18, 2018 INSTRUCTIONS TO CANDIDATES

- Theassignment comprises 15% weight of the final module mark.

- Writea report about the performance of hedging strategies (details and guidelines attached).

- Thereport must be written in English, associated with the supportive excel files.

- Universitypolicy on late submission will be followed.

IntroductionFinancial Mathematics1代写

This part of the course assessment is worth 15% of the final mark for the course, and consists of a take‐home group course assignment that will be worked on and submitted jointly by the participants with the maximum number of FIVE in the course.

This project aims to practice your skills in hedging market risk by constructing a portfolio involving futures. The relevant information about the securities prices can be founded through Yahoo (http://finance.yahoo.com) or WIND terminal (accessible at Library). In this assignment, you were provided with the following scenario.

SCENARIO:Financial Mathematics1代写

Suppose you are working on a fund of $10 million which invests in a portfolio of the S&P500component stocks, e.g., Apple, HP, BP and etc. This portfolio has been constructed since November 1st, 2017. On May 31, 2018, you were worried about the coming tariff war between US and China and decided to set up a hedging strategy to protect your fund by using the S&P500 index futures for the following four months, e.g., June 1, 2018 to October 12, 2018, and so the trading position in the futures contract would be closed on October 12, 2018.Financial Mathematics1代写

You are required to construct an optimal hedging position in the S&P500 index futures, and analyze its performance during the period from June 1, 2018 to October 12, 2018.

1)All the securities in your portfolio are selected from the component stocks of the S&P500 index, which was constructed on November 1st,2017.

2)The securities are selected from different industries, e.g., bank industry, media industry, and manufacturing industry and etc.Financial Mathematics1代写

3)Thenumber of stocks in your portfolio must be between 6 and 20, g., 6 ≤ n ≤ 20.

4)The daily returns of all the securities in your portfolio are needed, e.g., a time series of daily returns from November 1, 2017 to October 12,2018.

5)Thedaily risk‐free rates (e.g., 1‐month T‐bill rates in US) for the same period are needed.

6)The S&P500 index futures that matures on December 2018 is used for the hedging purposeandthe time series of daily close prices from November 1, 2017 to October 12, 2018 is Note that each futures contract is for delivery of $250 times the index.

7)The dividend yield on the S&P500 index is 1% per annum.

Requirements:Financial Mathematics1代写

I.Given that the securities in your portfolio are only individual stocks (namely, excluding the equity index), you apply the Capital Asset Pricing Model (CAPM) to complete the following tasks(20%):

a)Provide the descriptive statistics of the individual stocks, your portfolio and the marketportfolio(S&P500 index) in terms of excess return, standard deviation and Plot the time series of each of these (daily) returns.

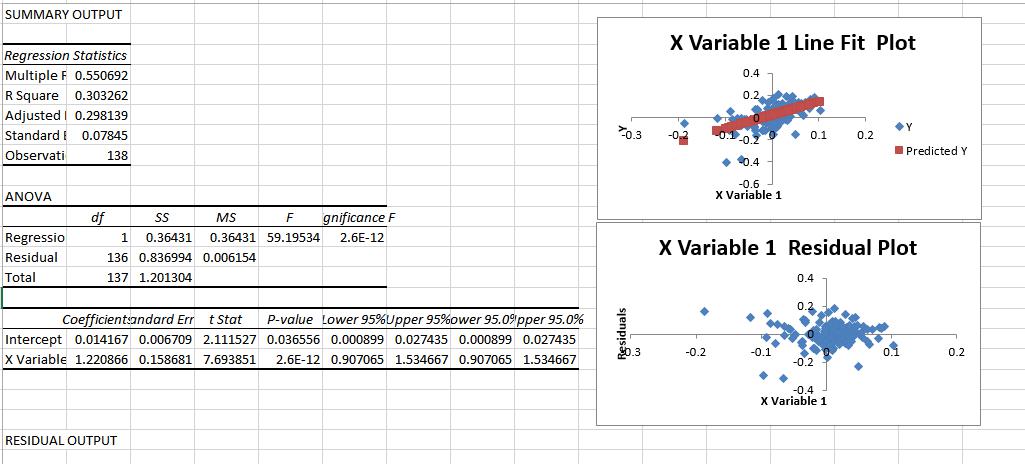

b)Estimate the beta for each individual stock in the portfolio.

c)Estimator the beta for your portfolio.Financial Mathematics1代写

d)Plot all the betas in b) and c) in the space of (X=beta, Y=expected return) to confirm the SecurityMarket Line (SML). Note that the beta of the market portfolio is equal to note.

II.Suppose that on May 31, 2018, you develop a hedging strategy for your portfolio constructed in I) by using the S&P500 index futures that matures on December 2018, and close your futures trading position on October 12, 2018. You then apply the optimal‐hedging‐ratio approach to complete the following tasks(60%):

e)Develop the hedging strategy with the minimal variance hedging ratio which is estimatedbasedon the time series of price changes between the portfolio and the index futures.

f)Develop the hedging strategy with the optimal hedging ratio which is estimated using the CAPMmodel;

g)Suppose that the S&P500 index and the close price of the December index futures are 2705.25 and 2715.25 on May 31, 2018, respectively. Analyze the total value ofhedgingposition on October 12, 2018 by following the strategies in e) and f), including the gain/loss on the hedge when the S&P500 index and index futures fall into the following scenarios:Financial Mathematics1代写

| Value of S&P Index on Oct 12, 2018 | 2667.13 | 2717.13 | 2767.13 | 2817.13 | 2867.13 |

| Value of Index futures on Oct 12, 2018 | 2672.25 | 2722.25 | 2772.25 | 2822.25 | 2872.25 |

h)Analyze the dynamics of the gains/losses of your trading positions in the index futures by following the strategies in e) and f) during the period from June 1, 2018 to October 12, 2018, given the real market data you have collected.

i)Analyzethe dynamics of the total value of hedging position by following the strategies in e) and f) during the period from June from June 1, 2018 to October 12, 2018, given the real market data you have collected.Financial Mathematics1代写

Assessthe advantages and disadvantages of the optimal hedging strategies developed in II).

III.For example, you may compare the statistics of both the profits/losses generated by these two strategies and the dynamics of the total value of the hedged portfolio (e.g., your stock portfolio plus the hedging position in the index futures) in II). You may further analyze the potential risks when they are used in various market conditions (bullish markets vs bearish markets) (with the maximum of 600 words). (20%)

Group Assignment GuidelineFinancial Mathematics1代写

This group assignment assesses Learning Outcome A‐C.

Note that you need:

1)Showall the results with comprehensive interpretations in a report (with the maximum 15 pages);

2)Showother relevant and supportive results in in Excel, g., plots in I) and the construction process of the required hedging strategies in II).Financial Mathematics1代写

As the outcome from your group project, you are expected to submit a report, associatedwith the excel files. Please disclose the detailed process/results as much as possible (e.g., the statistics of those portfolios and the data sets to support your plots). The deadline of the assignment submission to ICE is at 5pm on November 18, 2017 (Week 9). You may download all the required financial information via https://finance.yahoo.com/ or WIND terminal at Library.

Your analysis has to be your own, demonstrating your own ideas and independent and critical thinking (and not those of somebody else).Financial Mathematics1代写

However, your report must include:Financial Mathematics1代写

1)A brief description of theproject

In the first section, your work should contain a formal introductory section that provides an overview of the project, including the title of the project, the data collection and preparation, securities selection and the main goals that this project aims to achieve.

2) Process of the optimal hedging strategies and performance analysis

After preparing all the required financial data, you are ready to complete the tasks in I) and II) Financial Mathematics1代写 which can be presented in two separated sections. It is suggested that you describe the process of portfolio construction in detail and report their statistics accordingly, and then provide the details about the development of the optimal hedging strategies. Also, please clearly explain how you obtain the required results, supported by your models in excel files.

Note 1: the lecture and tutorial in Week 5 will demonstrate the strategy how to complete these tasks in a simplified case.

Note 2: the procedure how to run regression in Excel is attached in Appendix C

3) Comments on results

In the final section, you need evaluate the performance of the optimal hedging strategies against distinctive market scenarios in the asset management process. It is very important for you to understand the advantages/disadvantages of each method in specific market conditions,which will help to improve your skills in investment management in practice.

APPENDIX A Financial Mathematics1代写

MTH202 Group Assignment Individual Contribution Form

REPORT GROUP NO.: ………………………………………………………………………..

You are required to evaluate the general effort that was put in by your group members to reach the final result of your team work. From your own point of view, please rank your colleagues (not including yourself) according to their contribution towards this report.

| Rank | Strength & weakness |

| e.g. Ocean’s Eleven | |

| No. 2: Brad Pitt | Average contribution |

| No. 3: Matt Damon | Did not show up in group discussions |

| No. 1: | |

| No. 2: | Financial Mathematics1代写 |

| No. 3: | |

| No. 4: | |

| No. 5: |

Notes:

- Every group member needs to fill in a separate review report. The review result may be used to differentiate students in the same group: the student with an important role may receivea higher group assignment mark than the remaining students in the same

- The review result isconfidential.

- Each rank can only be given to one group

- If students do not submit any peer review reports, it is normally assumed that group members contributed to the workequally.Financial Mathematics1代写

- If any group member is identified as a free‐rider, i.e. has 0% contribution of the group assignment,then he/she will be awarded 0% for the group

Signed:_ Date:

APPENDIX BFinancial Mathematics1代写

Assessment Form for MTH202 Group Assignment

Group ID

Student’s ID and Name Financial Mathematics1代写

| Max Points | Examiner (100%)** | |

| A. Final Report and Excel Modeling (Group) | 75 | |

| Academic Content | ||

| 1. A brief description of the project. | 5 | |

| 2. Construction of portfolios * | 5 | |

| 3. Estimation of the CAPMA model * | 10 | |

| 4. Construction of the optimal hedging strategies * | 20 | |

| 5. Analysis on the hedging performance* | 20 | |

| 6. Comments | 10 | |

| Written Presentation | ||

| 7. Presentation of report (including writing style, grammar, use of graphics and tables) |

2.5 |

|

| 8. Appropriate use of the results in excel to support the analysis of report |

2.5 |

|

| B. Contribution to this group | 25 | |

| Reduction for Late Submission (Group) | ||

| Total Marks for Final Report | 100 |

* Items 2‐5 will be evaluated using the following:

I.Quality and usefulness of data and informationgathered;

II.Use and application of relevant methods and techniques;

III.Clarity and feasibility of assumptions in the

** The final individual mark should be adjusted according to the comments from the “peer review” part (Part B).Financial Mathematics1代写

APPENDIX CFinancial Mathematics1代写

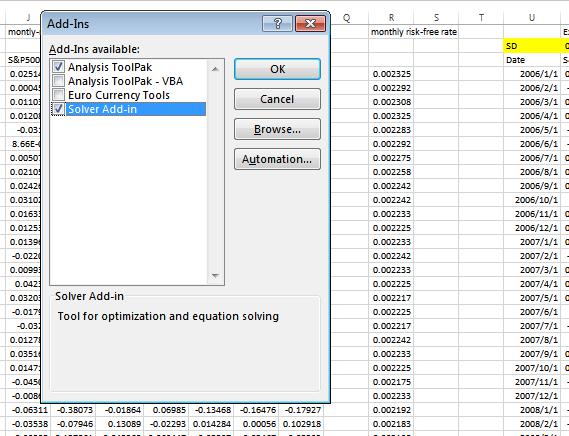

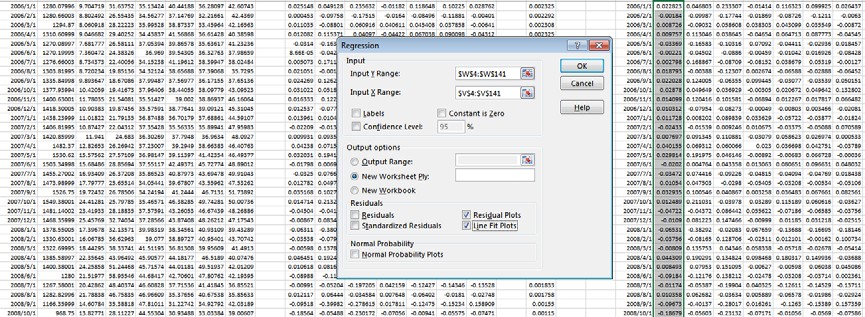

Instruction on Procedure of Regression in EXCEL

Step 1. Prepare your data

Step 2. Choose File‐> Options‐> Add‐Ins and click “GO” button to install Regression Add‐In package

Step 3 Click “OK” to install “Analysis Toolpak” and “Solver Add‐in” Step 4 Choose Data‐>Data Analysis to activate the tool box

Step 5 Fill in all required inputs, e.g., Ys and Xs

Step 6 Obtain the regression results in a new worksheet

========================== END =================================

更多其他:C++代写 考试助攻 计算机代写 report代写 project代写 java代写 algorithm代写 代写CS 代码代写 function代写 作业代写 course代写 金融经济统计代写 app代写 数学代写