Introduction to economic factors

economic factors代写 In this assignment, students will construct factor mimicking portfolios of economic variables for portfolio management

In this assignment, students will construct factor mimicking portfolios of economic variables for portfolio management and hedging purpose. The structure of this assignment is as follows: Section 1 introduce the idea of economic variables in a multifactor asset pricing model, Section 2 discusses how to retrieve signals from given economic time series, Section 3 discusses a method for constructing factor mimicking portfolios, and assignment questions are given in Section 4.economic factors代写

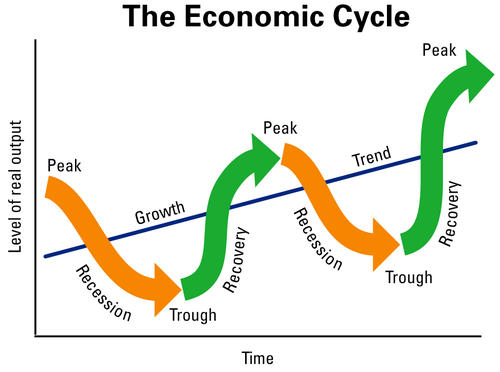

1. Economic variables economic factors代写

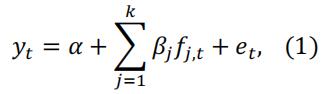

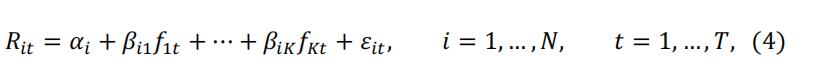

The multifactor structure under ICAPM and APT provides a strong empirical improvement over CAPM. A multifactor model is usually given by

where yt denotes the asset return at time t, f,j,tdenotes the j-th factor return at time t, and et is the error term. However, both theories are vague in defining specific factors to be included in the multifactor model1.

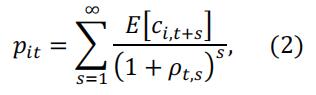

A common way to find suitable factors is to look at the discounted cash flow (DCF) model. Under the DCF model, the present value of the asset i may be calculated as

1 In fact, ICAPM of Merton (1973) did provide some rules for selecting factors—the market return and variables that proxy for the changes of investment opportunity set.

where pt,s is the discount rate at time t for expected cash flows at time t + s. Chen, Roll and Ross (1986, hereafter) note that the common factors in returns must be variables which cause pervasive shocks to expected cash flows E[Ci,t+s] or risk-adjusted discount rate pt,s. Some popular choices of economic variables (but not limited to) are summarized in the table below.

Table 1: Candidates for economic state variables economic factors代写

| Economic variables | Reasons |

| Market return | In an efficient market, new information concerning future real activities should be quickly reflected in the aggregate return of market. |

| Inflation | If the effect of inflation is not perfectly neutralized in the cash

flows and the valuation operator, it will influence the price of a financial asset. |

| Interest rate/term

structure |

Represent opportunity costs and evaluate the impact on discounted cash flows |

| Business cycle risk | 1. Change in the expected real growth rate of the economy

2. A positive realization signals an increase in the expected economic growth (more future cash flows) |

2. Unanticipated shocks (signals)

In theory, only unanticipated shocks to economic variables will contribute to asset pricing. In this section, we introduce how to create unanticipated shocks (or signals) of economic factors in a multifactor model setting.

Specifically, let xt denote the economic variable of interest in period t, and the corresponding signal can be defined as ut=xt− Et_1xt, where Et_1 stands for an expectation operator that uses information up to the end of period t − 1.

Several approaches are found in literature to generate signals (unanticipated shocks) to suitable economic state variables, including the vector autoregressive (VAR) approach,such as Campbell (1996) and Petkova (2006) 2, and the Kalman filter approach3 of Priestley (1996). For simplicity, we only consider the VAR approach in this assignment.economic factors代写

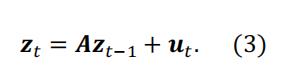

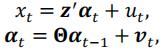

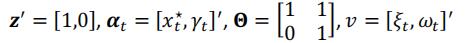

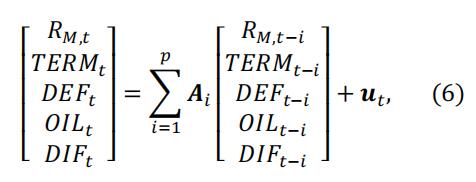

To facilitate our discussion, we briefly introduce the VAR approach below. Let

xk,t, k = 1, … , K and t = 1, … , T deonte the k-th economic state variable in period t, and

zt = 9[x1,t , … , xkt]’. The VAR approach assumes that the demeaned vector zt follows a first- order VAR, as given by

The residuals in the vector ut are the signals for our risk factors since they represent the surprise components of the sate variables that proxy for changes of investment opportunity set.

3. Factor mimicking portfolios economic factors代写

If we would like to apply the aforesaid multifactor model for hedging or portfolio management purposes, we need to convert the factor signals to factor mimicking portfolios, which are portfolios of investible assets. The method of Fama and MachBeth (1973) is one of the approaches commonly used for constructing factor mimicking portfolios.

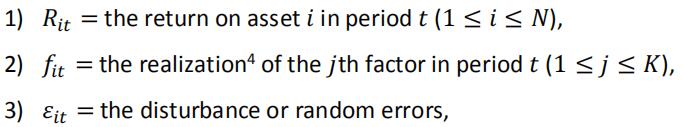

Let’s first define notation to facilitate our discussion of the Fama-MacBeth (FM hereafter) method. First, assume that asset returns are governed by a multifactor model:

where

2 Petkova (2006), “Do the Fama–French Factors Proxy for Innovations in Predictive Variables?”, Journal of Finance, Volume 61, Issue 2.

3 Priestley (1996) suggests using the residuals of a dynamic linear model on variables of interest as our estimate of innovations. Priestley claimed that this approach would avoid the concern about Lucas critique on the change of optimal decisions of economic agents due to changes of polices. For example, we may consider

where

with xt⋆ representing our expectation. Note that dynamic linear models can be easily estimated using Kalman

filter.

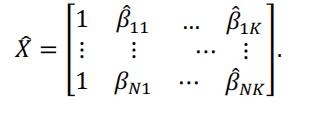

and T is the number of time series observations5.

The FM method consists of a two-pass procedure. In the first stage of the two-pass procedure, we use OLS regression to estimate (β1, … , βk) in eqn. (4) for each asset. Letβ1 = (β1, … , βk) be the resulting N × K matrix of OLS (ordinary least squares) slope estimates6.

In the second stage, we regress asset returns Rt = (R1t, … , Rnt)Pon X= [1N, β]

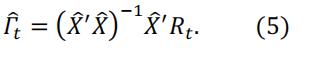

using OLS (for each period t). The corresponding regression coefficient can be given by

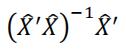

Ft represents the factor mimicking portfolio in period t, where  represents the weights allocating to each security at period t.

represents the weights allocating to each security at period t.

Remark 1: The X matrix is given by

Remark 2: Some practitioners create factors without conducting the second stage of the FM method. Specifically, they first sort the values of betas (from the first stage) for each factor. They then construct the factor mimicking portfolios of a specific factor by longing the assets with bigger betas (with respect to the factor) and shorting the assets with smaller betas (with respect to the factor).economic factors代写

4 In our case, they are the signals or unanticipated shocks discussed in the last section.

5 For simplicity, in this assignment, we assume that that the disturbances are independent over time and jointly distributed each period with mean zero and a nonsingular residual covariance matrix Σ, conditional on the factors. The factors are assumed to be independent and identically distributed (iid) over time.

![]()

4. Questions

Data retrieval:

- Retrieve data from the followingresources:

- Louis Fed website(https://fred.stlouisfed.org)

- the Fama-French data library (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html).

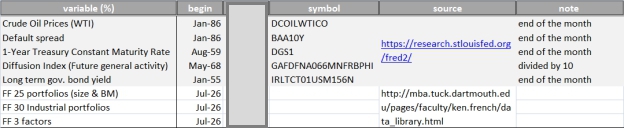

- Use the following macroeconomic variables for yourassignment:

- OIL: the change rate on the crude oil price(WTI);

- TERM: the difference between the long-term government bond yield and the 1-Year constant maturity rate (termspread);economic factors代写

- DEF: Moody’s Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity (defaultspread);

- Rm,t: excess market return from the Fama-French (FF) dataset;

- DIF: Current General Activity (Diffusion Index for FRB – Philadelphia District). The description of the data is summarized in the above

Table 2: Data description and sources

Estimation of unanticipated shocks

Use the VAR approach to construct unanticipated shocks (innovations). Specifically, consider

where ut represents a vector of innovations for each element in the state vector.

1)Use the methods taught in class to select the optimal lags for Equation (4), including model selection criteria and adequacy

2)Orthogonalize the innovations to excess market returns as suggested by Petvoka (2006).7

Construction of (economic) factor mimicking portfolioseconomic factors代写

Use the constructed signals from the above question and Fama-French industry portfolios to construct the factor mimicking portfolios. Use 60 months rolling-window to construct the portfolios and different re-calibration times, say ONE month, ONE quarter, or ONE year.

1)Discuss the performance of constructed mimicking portfolios (using Sharpe ratio, mean and standard deviation, and maximumdraw-down).

2)Select the optimal re-calibration time based on Sharpe

Construct the factor momentum portfolio as discussed Question B) in Assignment 1.

Answer this question based on your analysis in the above question.

1)Constructthe equally weighted (EW) and risk-parity (RP) portfolio for the constructed factor mimicking portfolios. Discuss the performance of both portfolios (using Sharpe ratio, mean and standard deviation, and maximum draw-down).

2)Re-do Question B.3) in assignment 1 for the factor mimicking portfolios. Specifically, use ℎ = 12 and Equation (5) in assignment 2. (For simplicity, use the samplestandard deviation for this )

3)Report the performance the time series momentum portfolio (using Sharpe ratio, mean and standard deviation, and maximumdraw-down).economic factors代写

7 Doing so, the coefficient in front of the market factor in the multiple time series regression will be equal to the simple market beta computed in a univariate time-series regression. This provides a convenient way to assess whether the innovations to the state variables add explanatory power to the simple CAPM model.