FIN 450

风险管理assignment代写 You work in risk management for an airline. You want to hedge the airline’s exposure to fluctuations in the price of jet fuel

Spring 2019 HW1

1)Cross-hedging 风险管理assignment代写

You work in risk management for an airline. You want to hedge the airline’s exposure to fluctuations in the price of jet fuel, but the company’s bylaws restrict you to using exchange-

traded futures for hedging, and there is not a liquid market for jet fuel futures contracts. Suppose you choose to hedge using futures in a closely-related asset, heating oil.

a)Download the followingdata: 风险管理assignment代写

1)Monthly NYMEX futures prices for heating oil (No. 2 heating oil, NYHarbor,

Contract 1), 1990-2018, from www.eia.gov

2)Monthly spot prices for jet fuel, 1990-2019, fromeia.gov risk management1代写

Combine your data in Excel, aligning by date. Use the data from 1990 to 2000 to calculate the minimum-variance hedge ratio (MVHR), ℎ∗. Look up the contract size for heating oil futures contracts on the CME Group web site, also called Heating Oil USLD (www.cmegroup.com), and determine the optimal number of heating oil futures contracts to use for hedging (round to the nearest whole number). Specify whether your futures hedge position is long or short. (5 points)

b)Use the optimal number of heating oil futures contracts you found in (a) to calculate monthly changes in the value of a hedged position over the period from 2001 to 2010. Calculatethe volatility of these changes. Repeat these steps using values of ℎ and 2ℎ∗ to test whether a hedge using ℎ∗ produces the minimum volatility in the changes in value of the position. (3 points) 风险管理assignment代写

c)Explain why the MVHR for an equity portfolio being hedged by stock index futures is given by the portfolio’s CAPM beta. (1point)

2)Forward exchange rates underno-arbitrage

a)Find the five-year forward AUD/JPY exchange rate under no-arbitrage if the spot exchange rate is 80 yen per Australian dollar, and the five-year risk-free interest rates in Australia and Japan are 4% and 6% per annum, respectively. (1point)

b)Choose a forward exchange rate that is greater than the no-arbitrage exchange rate you found in (a), and describe the arbitrage strategy you would use to exploit this situation. Calculate your profits from arbitrage, assuming you’re able to borrow 1,000 units of any given currency. (1point)

c)Choose a forward exchange rate that is lower than the no-arbitrage exchange rateyou found in (a), and repeat the steps in (b). (1 point)

d)Forwards and futures exist on cryptocurrencies like Bitcoin. Would you calculate forward prices on these contracts as if Bitcoin was a stock, or forward exchange rates (as if Bitcoin was a currency)? Why? Can you support your answer with research? (2points)

3)Forward prices and convergence 风险管理assignment代写

a)Show that, at time t = F,Ft=T must be equal to St=T under no-arbitrage forward prices for a non-dividend-paying stock. (1 point)

b)Assume that F1and F2 are the futures prices of two contracts on the same consumption commodity, with times to maturity t1and t2, t2 > t1. Show that F2 ≤ F1er(t2−t1).

(1 point)

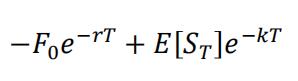

c)At time t = 0, a speculator takes a long position in a futures contract that will expire at time T. The present value of this contract to the speculator is givenby:

Where r is the risk-free rate, and k is the investor’s required rate of return on the investment. Assume no-arbitrage pricing. Show analytically that if the return from the underlying is positively correlated with the overall return on the stock market, then the futures market must be in backwardation. (2 points) 风险管理assignment代写

d)Download the following dataseries:

(1)Monthly NYMEX futures prices for crude oil (light-sweet, Cushing, OK, Contract 1), 1983-2018, fromeia.gov

(2)Monthly spot prices for crude oil (WTI – Cushing, OK), 1986-2019, fromeia.gov

(3)1-month treasury bill rates (“1-Month Treasury Constant Maturity Rate”), monthly average, Jan. 2010 to Dec. 2018, fromfred.stlouisfed.org

Combine the data series in a spreadsheet (make sure dates are aligned) for the years 2010 to 2018. Assume that futures prices are determined under no-arbitrage, and that storage costs are negligible. Derive an estimate for the monthly convenience yield, and generate a scatter plot showing these estimates over time. (Label your axes and include a title.) 风险管理assignment代写

Based on your scatter plot, from the end of 2014 to the end of 2017, was the crude oil market in contango or in backwardation? How do you know? (6 points)

Additional question for FIN 550 students only:

4)Returning to question 1, let’s say you want to hedge your airline’s exposure tofluctuations in jet fuel prices with futures market hedges in two contracts: heating oil and propane. How might you calculate the number of contracts required for each asset in the two-asset case? 风险管理assignment代写

(Hint: consider how the one-asset MVHR is derived — can you extend this to multiple assets?) Describe your methodology, and then repeat the exercise in question 1: download data for propane futures prices from 1993 to 2009, estimate the hedge ratios for heating oil and propane futures (again using jet fuel spot prices) using the data from 1994 to 2000, and interpret your results in the context of the standard deviations of the assets’ price movements and the correlations between them. Next, calculate the changes in the value of your hedged portfolio at monthly intervals from 2001 to 2008. How does the volatility of this hedged portfolio compare to the volatility of the portfolio that you hedged using only heating oil futures? Why do you think this is? What do you think would happen if you extended this exercise to three (or more) assets? (10 points)

其他代写:algorithm代写 analysis代写 app代写 assembly代写 assignment代写 C++代写 C/C++代写 code代写 course代写 dataset代写 finance代写 java代写 source code代写 java代写 web代写 北美作业代写 数据分析代写 编程代写 考试助攻 北美作业代写