Nonlinear econometrics for finance HOMEWORK 2

(C-CAPM and GMM)

非线性计量经济学作业代写 In this homework you will evaluate the Consumption CAPM model using two different utility functions and asset returns data.

In this homework you will evaluate the Consumption CAPM model using two different utility functions and asset returns data. Each should submit:

- Theanswers to the questions in a pdf file.

- TheMatlab code(s) used for You should combine answers and code in a single file.

Please note: it will be useful for you to read the 2014 paper by John Campbell (under Lecture Notes in Blackboard) before you tackle the assignment.

Problem 1 (50 points) 非线性计量经济学作业代写

Consider, as we did in class, a representative investor who lives for two peri- ods (t and t + 1) and has income et in period t and et+1 in period t + 1. The utility function of the representative investor is:

U (ct, ct+1) = u(ct) + βEt[u(ct+1].

The investor can invest in an asset by buying ϑ shares at the unit price pt. The asset’s payoff xt+1 in the second period is uncertain. The investor chooses how many units (ϑ) of the asset to buy in order to maximize her/his utility function:

max u(ct) + βEt[u(ct+1],ϑ

subject to the income/wealth constraints 非线性计量经济学作业代写

ct = et − ϑpt,

ct+1 = et+1 + ϑxt+1.

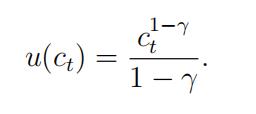

1.(2point) Assume the investor has a CRRA utility:

Derive the economy’s pricing equations both in terms of prices and in terms of returns. Use the return equation to derive estimable moment conditions.

- Use the quarterly data on 15 portfolios provided in class to estimate the parameters of the CCAPM using the GMM estimator. Use the consumption data provided in class. Let N denote the number of as- sets/portfolios and let d be the number of parameters to estimate.非线性计量经济学作业代写

- (6points) Compute first-stage GMM estimates of the d model parame- ters using the weight matrix WT = IN . For this step, assume that your data are an i.i.d.

- (10points) Second Using the first-stage estimates, re-estimate the parameters using the optimal weight matrix. Assume, again, that your data are i.i.d.

- (10points) Next, use the HAC estimator to compute the optimal weight matrix in the second stage as well as the variance-covariance matrix of the GMM In this case you are assuming that your data are stationary but not i.i.d. Provide some justification for your choice of the number of lags (k in our notation in class) in the construction of the HAC estimator. How do your estimates change?

- (4points) Interpret your estimation results in economic What do you learn about the representative investor?非线性计量经济学作业代写

- (6 points) Test whether γ =1.

- (6 points) Test whether γ = 1 and β = 0.95 jointly.

- (6 points) Test for over-identifying restrictions.

Problem 2 (50 Points) 非线性计量经济学作业代写

Consider, again, the Consumption-CAPM model used in Problem 1. Let the preferences of the representative investor be given by the log-utility

u(ct) = ln(ct).

Using the same data you used for Problem 1, please answer the following questions:

- (2point) Derive the economy’s pricing equations both in terms of prices and in terms of returns. Use the return equation to derive estimable moment conditions.

- (6 points) Provide first-stage GMM estimates of the model parame- ter(s) using WT= IN . For this step, assume your data are an i.i.d. sample.非线性计量经济学作业代写

- (10points) Second Using the first-stage estimates, re-estimate the parameters using the optimal weight matrix. Assume, again, that your data are i.i.d.

- (14points) Compute standard errors for the estimate(s) and test β =1.

Note: for this question you need to compute the gradient by hand. In other words, you can not use the command “gradi- ent” in Matlab 非线性计量经济学作业代写

5.(10points) Next, use the HAC estimator to compute the optimal weight matrix in the second stage as well as the variance-covariance matrix of the GMM In this case you are assuming that your data are stationary but not i.i.d. Provide some justification for your choice of the number of lags (k in our notation in class) in the construction of the HAC estimator. How do your estimates change? Note: for this question you need to compute the gradient by hand. In other words, you can not use the command “gradient” in Matlab.

6.(4points) Interpret your estimation results in economic What do you learn about the representative investor?

7.(4 points) Test for over-identifying restrictions.

其他代写:program代写 cs作业代写 app代写 Programming代写 homework代写 source code代写 考试助攻 finance代写 代写CS C++代写 finance代写 java代写 金融经济统计代写 assignment代写 matlab代写