ECON3006/4437/8037: Financial Economics

Practice Exam covering Week 1-5

金融经济学代考 Take the economy from part/question 1 but now with S = {1, 2}, and P(1) == P(2) (“it turned out state 3, 4 are no longer possible”)

1.[4+2+2=8 points] Consider a two agent economy with S = {1, 2, 3, 4} and P = ( 1 4 , 1 4 , 4 1 , 1 4 ), utility 金融经济学代考

U1(X) = E P [X]

U2(X) = E P [ln X]

and endowments

ω1 = (2, 2, 2, 2) ω2 = (1, 1, 1, 4)

(a) Determine the Arrow-Debreu Equilibrium

(x1, x2, p) ∈ R 4+× R 4+× R4+

(b) Explain the equilibrium outcome (risk sharing) based on risk prefer-ences and initial endowments. 金融经济学代考

(c) Why can’t there be full insurance for both agents in equilibrium?

2.[2+2=4 points] Take the economy from part/question 1 but now with S = {1, 2}, and P(1) =![]() = P(2) (“it turned out state 3, 4 are no longer possible”)

= P(2) (“it turned out state 3, 4 are no longer possible”)

(a) Draw an Edgeworth box (indifffference curves, initial endowment, equi-librium price from (b))

(b) Specify via the Edgeworth box the resulting Arrow-Debreu economy and the new equilibrium.

3.[2+1=3 points] Take the equilibrium state price p from part 1. 金融经济学代考

(If 1. is not solved then take any p ∈ R4 ++)

(a) Determine the risk-neutral probabilities from part 1.

(b) What is the price of the aggregate endowment, when priced under risk-neutral probabilities from (a)?

4.[4=(1+1)x2 points] Risk preferences:

Compute the certainty equivalents of agent 1 and 2 from part 1 at their initial endowment. What are their risk premia? 金融经济学代考

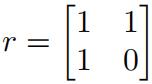

5.[4 points] Find by computation a price q for the risky assets that are induced by the return matrix

such that an equilibrium price p from part 2. is the (unique up positive scalars) arbitrage free state prices.

(If 2. is not solved then take any p ∈ R2 ++on the 45o -degree line.)