Simulation Methods for Finance EXAM

金融模拟方法代考 Let Xi, i = 1, 2,. . ., be independent and identically distributed Poisson random varpiables with parameter λ > 0.

1.(a)[5 marks] Let X be a Poisson random variable with parameter L > 0. 金融模拟方法代考

Assume one knows how to generate standard uniform Design an algorithm to generate random variable X.

(b)[10marks] Let Xi, i = 1, 2,. . ., be independent and identically distributed Poisson random varpiables with parameter λ > 0. Define Sn = X1 + · · + Xn and Zn =(Sn — nλ)/ nλ. Find the characteristic function of Zn and its limit as n tends to ∞,then conclude that Zn converges in distribution to a standard normal random variable.

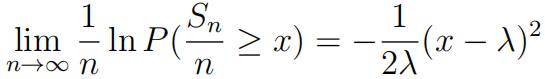

(c)[10 marks] Continue (b). Prove that

for x > λ. (Hint. You may use the following fact without proof that limx!1 xØ(—x) = 1, where 0(x) is the cumulative distribution function of a standard normal variable and Ø(x) = Φ0(x).)

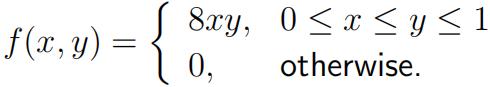

2.(a)[7 marks] Assume that random variables X and Y have a joint probability density function

Let U = X/Y and V = Y . Prove that U and V are independent random variables and find their probability density functions. Furthermore, let U1 and U2 be two independent samples from standard uniform distribution U[0, 1]. Use U1 and U2 to construct X and Y such that (X, Y ) is a sample with pdf f. 金融模拟方法代考

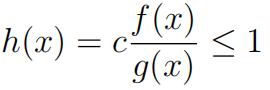

(b)[9marks] Let X be a nonnegative random variable with ![]()

Let Y be a standard exponential variable with pdf g(x) = exp(—x). Find the maximum

c such that

for all x ≤ 0 and design an acceptance-rejection algorithm to generate variate X by using variate Y . Explain why we want to choose c as large as possible.

(c)[9marks] Let X be a Poisson random variable with parameter λ. Find the cumulant generating function of X, defined by Γ(θ) = ln E[eθX], and its Fenchel-Legendretransform, defined by F*(x) = supθ2R(θx — Γ(θ)). Furthermore, show Γ*(x) is strictly positive for all x except at one point and find that point.

3.Let(Ω, F,P) be a probability space, equipped with a filtration (Ft)t≤0. 金融模拟方法代考

Let (Wt)t≤0 be astandard Brownian motion and (Nt)t≤0 be a Poisson process with intensity L, both W and N are adapted to the filtration (Ft)t≤0 and are independent of each other.

(a)[3marks] Let X satisfy stochastic di↵erential equation (SDE)

dXt = adt + bXtdWt, 0 t T, (1)

with X0 = x, where a, b are constants. Assume the Euler scheme is used to solve SDE (1)Write out the correspondingalgorithm.

(b)[5 marks] Continue (a). Solve SDE (1) and find the solutionX.

(c)[3marks] Find the quadratic variation of the process Wt + Nt for t ≤ 0.

(d)[4marks] Assume one knows how to generate independent standard uniform Explain how to generate a sample path of (Nt)t≤0.

(e)[6marks] Prove that Nt tends to L almost surely as t tends to 1.

(f)[4marks] Prove that process (Nt — Lt)2 — Lt, t ≤ 0, is a martingale.

4.Let(Ω, F,P) be a probability space, equipped with a filtration (Ft)t≤0. 金融模拟方法代考

Let (Wt)t≤0 be a standard Brownian motion, adapted to the filtration (Ft)t≤0. Assume the risky asset S satisfies the SDE

dSt = rStdt + oStdWt, t ≤ 0

with S0 = S, where r > 0 is the riskless interest rate and o > 0 is the volatility. Assume one can generate independent standard normal variables.

(a)[8marks] The payo↵ of an Asian put option at time T is given by (K — AT)+, where

K > 0 is a constant and ![]() is the average of asset prices St with ti = ih,i = 1, 2,. .., m, and h = T/m. The Asian put price at time 0 is given by

is the average of asset prices St with ti = ih,i = 1, 2,. .., m, and h = T/m. The Asian put price at time 0 is given by

V (S) = E[e—rT(K — AT)+]. 金融模拟方法代考

Describe the simulation method to compute the value V (S) and the pathwise derivative method to compute its delta V ‘(S).

(b)[8marks] The payo↵ of a digital option at time T is given by AT = 1ST ≤K, where K > 0 is a constant, ST is the asset price at time T , and 1B is an indicator that equals 1 if the event B happens and 0 The digital option price at time 0 is given by

V (S) = E[e—rTAT].

Describe the simulation method to compute the value V (S) and the likelihood ratio method to compute its delta V ‘(S).

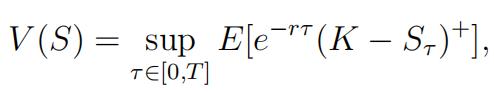

(c)[9marks] The value of an American put option at time 0 with expiry time T and strike price K is given by

where Τ is any stopping time in the time interval [0,T]. Describe the Longstaff and Schwartz regression method to compute V (S) with basis functions 1, x, x2, x3.

更多代写:Statistics统计学代写 多邻国代考 Psychology心理学代写 Statement of Purpose代写 Results代写 代写代考安全吗