E4700 Financial engineering

160 points total

金融工程考试代写 You can make use only of your lecture notes but no other sources of information or help in completing this exam.

You can make use only of your lecture notes but no other sources of information or help in completing this exam. You may use only a hand-held calculator. No Excel or any computer math programs are allowed.

Problem 1. [25 points]

A financial institution entered into an interest rate swap with company X two years ago to receive 10% fixed rate and pay 6-month LIBOR on a principal of $10 million ending in three years. Thus, the remaining life of the contract today is 1 year. The payments are made semiannually and the rates are quoted with semiannual compounding:

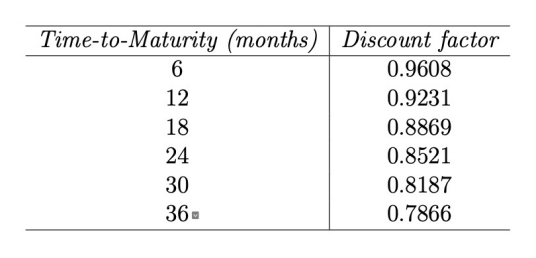

The following were the discount factors two years ago when the swap was entered:

How much did the financial institute pay to or receive from company X two years ago to enter into the swap?

____________________________________________________

Problem 2 [15 points] 金融工程考试代写

A company uses delta hedging to hedge a portfolio of long positions in put and call options on a currency. Which of the following would give the most favorable result for their profit?

(a) A virtually constant exchange rate

(b) Wild movements in exchange rate

Explain your answer.

__________________________________________________

Problem 3. [35 points]

A stock has a current price $100 and will pay a dividend $2 at the end of second month. The volatility of the stock is 30%, and the interest rate is 6%. Use a four-period binomial tree to model the stock price dynamics over the next four months by breaking up the stock into a riskless and a risky part. Display the risky part of the stock price tree and the actual stock price tree.

Problem 4. [20 points] 金融工程考试代写

Consider three European call options with strikes all at the same expiration time T.

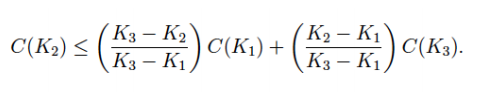

Show that the absence of arbitrage at all earlier times t implies that

__________________________________________________________

Problem 5. [30 points] 金融工程考试代写

Consider a 3-month European put option on a non-dividend-paying stock with a current price $50.

The strike price is $48. The current interest rate is 5%, compounded continuously. Assume the stock price evolves according to a three-period CRR binomial tree with volatility 33%.

(a) Find the option price. Show all the trees. [15 points]

(b) Suppose you write one put option. Find the number of shares of stock needed to replicate the short put with stock at each step from the beginning if the stock price goes up in the 1st period and goes down in the second period. [15 points]

________________________________________

Problem 6 [20 points] 金融工程考试代写

A stock price is currently $25. It is known that at the end of two months it will be either $23 or $27. The risk-free interest rate is 10% per annum with continuous compounding. Suppose is the stock price at the end of two months. What is the current value of a derivative that pays off at this time?

_______________________________________________________

Problem 7. [15 points]

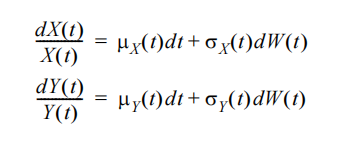

Consider two Ito processes X and Y that take the form

where W(t) is a Brownian processes.

Show that the process is a geometric Brownian motion.