Problem Set Week 6

Purpose

Try to solve the following set of problems related with contents explored in Week 6. Revisit the learning materials made available during Week 6.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Exercise 1 资产管理问题代写

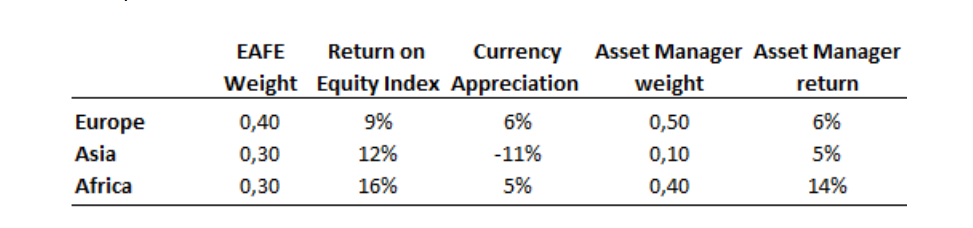

Consider data disclosed in the Table below, with respect to the performance of an U.S. active asset manager internationally diversified. EAFE Index is the international benchmark index. (give your answers with one decimal. For example, 1.65% is rounded to 1.7%)

a)Compute the total performance of the Asset Manager.

b)Compute the Benchmark performance. How did the Asset Manager performed versus the Benchmark?

c)Decompose total performance of the Asset Manager in three factors: currency selection, country selection and stock selection.

d)How do you justify the relative performance of the Asset Manager versus the International Benchmark?

Exercise 2 资产管理问题代写

An asset manager has implemented a 6-month carry trade strategy between currency U and currency T. Interest rates of currencies U and T are 1% and 6% respectively. The amount invested in this carry trade strategy was 2.000.000 in terms of currency U.

a)What is the design of the carry trade strategy that this asset manager would have implemented?

Exchange rate between currency U and T was 44 at the inception of the trading strategy and during the six month period currency T depreciated 20% versus currency U. (use one decimal)

b)What is the final result of this carry trade strategy for the asset manager?