Problem Set Week 8

Purpose

Try to solve the following set of problems related with contents explored in Week 8. Revisit the learning materials made available during Week 8.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Exercise 1 资产管理课业代做

Consider an investor that is a “passive screener” and follows two criteria from Dodd-Graham (1934):

- Criteria 1– PE ratio of the stock less than the inverse of the yield on AAA Corporate Bonds

- Criteria 2– PE of the stock has to be less than 40% of the average PE over the last 5 years

This investor only acquires stocks that simultaneously fulfill criteria 1 and 2.

Consider an Average AAA Corporate Bond yield of 5% in the market and the following information about a group of stocks the investor is screening:

| Stock | Price (€/share) | EPS (€) 2016 | Average PE last 5 years | ||

| A | 12 | 1,05 | 25 | ||

| B | 24 | 2,3 | 34 | ||

| C | 32 | 1,76 | 25 | ||

| D | 2 | 0,07 | 50 | ||

| E | 17 | 0,8 | 70 | ||

| F | 23 | 1,3 | 21 | ||

| G | 6 | 0,5 | 22 | ||

Question: which stock or stocks will this investor choose?

Exercise 2 资产管理课业代做

A contrarian value investor has the following information about the market performance of a group of stocks during the previous year:

This investor is going to construct a 5 stock portfolio with equal weight for each stock.

2.1 What are the stocks that this contrarian value investor will choose?

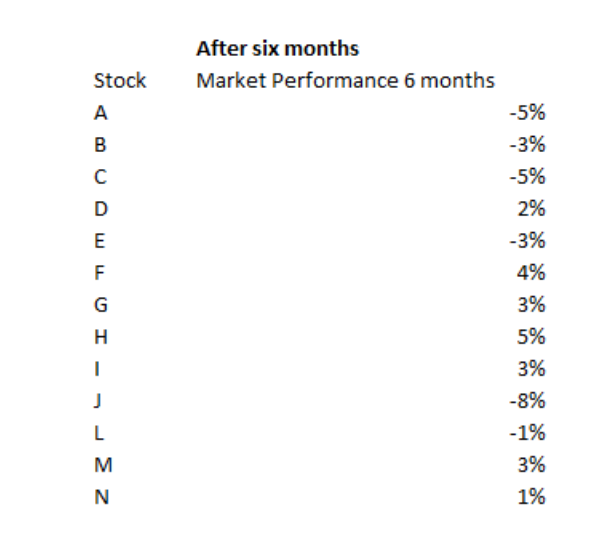

After six months the market performance of stocks was:

2.2 What was the performance of the portfolio of the contrarian value investor during the 6 month period?

2.3 If instead of being a contrarian investor, this investor constructs a 5-stock equal weight portfolio choosing the best past performers what would have been the stocks chosen by the investor and the performance of that portfolio? How this performance compares with that of the contrarian value investor portfolio?

更多代写:cs澳洲靠谱代写 托福作弊 英国环境艺术类网课代修 北美文学论文代写 澳大利亚宏观经济网课代考 资产管理问题代写