Problem Set Week 5

Purpose

Try to solve the following set of problems related with contents explored in Week 5. Revisit the learning materials made available during Week 5.

Duration

Try to solve this set of problems in 50 minutes, maximum.

Exercise 1 资产管理作业代写

1.

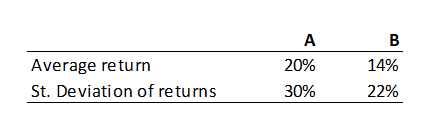

Consider the following information about the performance of two mutual funds (A and B) for a certain period of time:

The average T-Bill rate during the period was 4%.

Compute the Sharpe Ratio of Funds A and B. Using this performance measure, which Fund performs better? Give a brief intuition about the information Sharpe ratio is giving.

2.

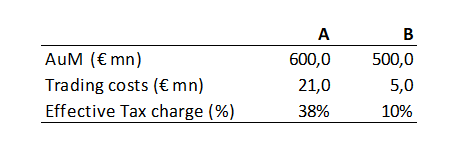

For both funds, consider the additional information about the Assets under Management (AuM) at the beginning of the period at which returns respect to, total trading costs incurred during the period under analysis and the effective tax charge (measured as a % of the AuM above mentioned).

2.1 Compute the adjusted returns of both funds, A and B, after considering the trading costs and the tax costs.

2.2 Recalculate the Sharpe ratios of both portfolios. Does your conclusion obtained in question 1 change? If yes, how?

3.

Considering empirical evidence about different impact from trading costs and tax burden across different trading strategies, and based on results from previous two questions, can you give a candidate strategy for Fund B (vs Fund A)?

Exercise 2 资产管理作业代写

As an asset manager you receive in your office managing directors of two funds (P and Q): part of the information with respect to the performance of both funds and the market benchmark over the last 5 months is summarized in the following table:

| Month | Actively Managed Fund P | Actively Managed Fund Q | Market M |

| 1 | 20% | 37% | 8% |

| 2 | 22% | 24% | 10% |

| 3 | 15% | 18% | 7% |

| 4 | 11% | 13% | 6% |

| 5 | 13% | 8% | 9% |

- For each of the actively managed funds (P and Q) as well as for the Market benchmark, compute:

a. Average monthly return in the period;

b. Standard deviation of monthly returns;

c. Considering exclusively the above information, the beta.

2.Additionally, assume the tracking error of P and Q are 15% and 25%, respectively. Assume also that average T-bill rate during last 5 months was 4%. Compute for P, Q and the Market the following performance measures:

a. Sharpe Ratio;

b. Jensen’s alpha;

c. Treynor ratio;

d. Information ratio;

e. M2.

3.Considering each of the performance measures compute in previous question how do you compare (i) each of the actively managed funds vs the market benchmark and (ii) actively managed funds between them?

4.Which of the measures should deserve more attention in the following scenarios?

a. P and Q represents the entire investment fund;

b. P and Q compete as one of the possible subportfolios;

c. P and Q to be mixed with the index portfolio.

更多代写:cs澳洲Midterm 代考推荐 雅思作弊 英国环境科学代写 北美留学生论文代写范例 澳大利亚数学网课代考 资产管理课业代写